DEF 14A: Definitive proxy statements

Published on April 24, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to

Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

One Vanderbilt Avenue 48th Floor New York, New York 10017 |

Notice of Annual Meeting of Stockholders

Date:

June 6, 2023

Time:

2:00 p.m. ET

Place:

Virtual Internet

Your Vote

is Important

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. It is extremely important that your shares be represented and voted at the Annual Meeting.

To Our Stockholders

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of MFA Financial, Inc., a Maryland corporation (“MFA,” “we” or “our”), on Tuesday, June 6, 2023, at 2:00 p.m. Eastern Time. This year the Annual Meeting is being held for the following purposes:

|

To consider and vote on the election of the two (2) nominees named in the proxy statement to serve on MFA’s Board of Directors (the “Board”) until our 2026 Annual Meeting of Stockholders and until their successors are duly elected and qualify; |

|

To consider and vote upon the ratification of the appointment of KPMG LLP as MFA’s independent registered public accounting firm for the fiscal year ending December 31, 2023; |

|

To consider and vote upon an advisory (non-binding) resolution to approve MFA’s executive compensation as disclosed in the proxy statement; |

|

To consider and vote upon an amendment and restatement of the MFA Financial, Inc. Equity Compensation Plan, which, if approved at the Annual Meeting, will, among other things, increase the number of shares of common stock available for grant by MFA so that the number of shares available for issuance on or after the date of the Annual Meeting will be 8,468,548; |

|

To consider and vote upon an advisory (non-binding) vote on the frequency of executive compensation advisory votes; and |

|

To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

This year’s Annual Meeting will once again be a virtual meeting that will be held over the Internet. We believe the use of the Internet to host the Annual Meeting enables expanded stockholder participation. You will be able to attend the Annual Meeting, submit your questions and, if you are a record holder of our common stock or proxy for a record holder, vote your shares during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/MFA2023 and entering your 16-digit control number.

The close of business on April 10, 2023, has been fixed by the Board as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof.

Whether or not you plan to virtually attend the Annual Meeting, in order to assure proper representation of your shares at the Annual Meeting, we urge you to submit your proxy voting instructions to MFA by using our dedicated Internet voting website, our toll-free telephone number or, if you prefer, the mail. By submitting your proxy voting instructions promptly, either by

Internet, telephone or mail, you can help MFA avoid the expense of follow-up mailings and ensure the presence of a quorum at the Annual Meeting. If you virtually attend the Annual Meeting, you may, if so desired, revoke your prior proxy voting instructions given in advance of the meeting and vote your shares over the Internet at the virtual meeting.

In order to submit proxy voting instructions prior to the Annual Meeting, you have the option of authorizing your proxy (a) through the Internet at www.proxyvote.com and following the instructions described on the notice and access card previously mailed to you or on your proxy card, (b) by toll-free telephone at 1-800-690-6903 and following the prompts on the automated voting system or (c) by completing, signing and dating your proxy card and returning it promptly in the postage-prepaid envelope provided.

Your proxy is being solicited by the Board.

By Order of the Board

/s/ Harold E.

Schwartz

Harold E. Schwartz

Secretary

New York, New York

April 24, 2023

Table of Contents

Proxy Statement for the 2023 Annual Meeting of Stockholders

General Information

This Proxy Statement is being furnished to stockholders in connection with the solicitation of proxies by and on behalf of the Board of Directors (the “Board”) of MFA Financial, Inc., a Maryland corporation (“MFA,” the “Company,” “we,” “our” or “us”), for exercise at MFA’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, June 6, 2023, at 2:00 p.m. Eastern Time, or at any postponement or adjournment thereof.

If a proxy is properly authorized, submitted without specifying any instructions thereon and not revoked prior to the Annual Meeting, the shares of our common stock, par value $0.01 per share (the “Common Stock”), represented by such proxy will be voted (i) FOR the election of the two (2) nominees for director named in this Proxy Statement to serve on the Board until our 2026 Annual Meeting of Stockholders and until their successors are duly elected and qualify, (ii) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023, (iii) FOR the advisory (non-binding) resolution to approve our executive compensation as disclosed in this Proxy Statement (“Say-on-Pay”), (iv) FOR the approval of the MFA Financial, Inc. Equity Compensation Plan, as amended and restated (the “Amended Plan”), which amends and restates our existing Equity Compensation Plan (which was last amended and restated, and most recently approved by our stockholders, in 2020) (the “Existing Plan”), and which, if approved at the Annual Meeting, will increase the number of shares of Common Stock available for grant by us so that the number of shares available for issuance on or after the date of the Annual Meeting will be 8,468,548 (which includes 3,240,238 shares of Common Stock subject to outstanding grants under the Existing Plan) and make certain other changes as described in this Proxy Statement and (v) ONE (1) YEAR on the advisory (non-binding) vote on the frequency of executive compensation advisory votes. As to any other business that may properly come before the Annual Meeting or any postponement or adjournment thereof, the persons named as proxy holders on your proxy card will vote the shares of Common Stock represented by properly submitted proxies in their discretion.

This Proxy Statement, the Notice of Annual Meeting of Stockholders and the related proxy card are first being sent and made available to stockholders on or about April 24, 2023.

Attending and Participating in the Annual Meeting

This year’s Annual Meeting will once again be a virtual meeting that will be held over the Internet. We believe the use of the Internet to host the Annual Meeting enables expanded stockholder participation, reduces costs for both the Company and our stockholders and provides the same rights to participate as stockholders would have at an in-person meeting.

You may attend the virtual Annual Meeting if you are a stockholder of record, hold a proxy for a stockholder of record or are a beneficial owner of our Common Stock with evidence of ownership. You may participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/MFA2023 and entering the 16-digit control number included on your proxy card or your voting instruction form. You will be able to submit questions and, if you are a stockholder of record of our Common Stock or a proxy for a stockholder of record, vote your shares during the Annual Meeting.

Stockholders eligible to vote may submit questions after logging into the virtual meeting platform as described above by typing a question in the field below the caption “Ask a Question”, and clicking “Submit.” We will attempt to respond to as many questions

| MFA Financial, Inc. | 1 |

2023 Proxy Statement |

that are pertinent to the Company as time allows. Questions that are substantially similar may be grouped and answered once to avoid repetition.

Additional information regarding the rules and procedures for participating in the Annual Meeting will be provided in our rules of conduct for the Annual Meeting, which stockholders can view once they have checked in and during the Annual Meeting on the meeting website.

Technical Assistance. The Annual Meeting will begin promptly at 2:00 p.m. Eastern Time. We encourage you to access the Annual Meeting prior to the start time. Online access will begin at approximately 1:45 p.m. Eastern Time. The virtual Annual Meeting platform is fully supported across most browsers (Firefox, Chrome and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to participate in the Annual Meeting. Participants should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

If you encounter any difficulties while accessing the virtual Annual Meeting during the check-in or meeting time, a technical assistance phone number will be made available on the Annual Meeting registration page approximately 15 minutes prior to the start time of the meeting through the conclusion of the Annual Meeting.

Annual Report

This Proxy Statement is accompanied by our Annual Report to Stockholders for the year ended December 31, 2022 (the “2022 Annual Report to Stockholders”), which includes financial statements audited by KPMG LLP, our independent registered public accounting firm, and their report thereon, dated February 23, 2023.

Voting Information

Record Date and Outstanding Shares

Stockholders will be entitled to one vote for each share of Common Stock held of record at the close of business on April 10, 2023 (the “Record Date”), with respect to (i) the election of the two (2) directors named in this Proxy Statement to serve on the Board until our 2026 Annual Meeting of Stockholders and until their successors are duly elected and qualify, (ii) the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023, (iii) the advisory (non-binding) Say-on-Pay vote, (iv) the approval of the Amended Plan, (v) the advisory (non-binding) vote on the frequency of executive compensation advisory votes (“Say-on-Frequency”) and (vi) any other proposal for stockholder action that may properly come before the Annual Meeting or any postponement or adjournment thereof.

As of the Record Date, we had issued and outstanding 101,912,357 shares of Common Stock.

Ownership of Shares

Stockholders may own shares of Common Stock in one or more of the following ways: (i) directly in their name as the stockholder of record, (ii) indirectly through a broker, bank or other intermediary in “street name” or (iii) indirectly through the Company’s 401(k) Savings Plan (the “401(k) Plan”).

If shares of Common Stock are registered directly in the stockholder’s name, we are sending proxy materials directly to the stockholder. As the holder of record, the stockholder has the right to give their proxy directly to our tabulating agent or to vote electronically during the virtual Annual Meeting via webcast. If the stockholder holds their shares in street name, the stockholder’s broker, bank or other intermediary is sending proxy materials to them, and the stockholder may direct the intermediary how to vote on their behalf by completing the voting instruction form that accompanies the proxy materials or following the instructions in the notice they received. If the stockholder holds shares through the Company’s 401(k) Plan, the proxy includes shares of Common Stock that the 401(k) Plan has credited to the participant’s account.

| MFA Financial, Inc. | 2 |

2023 Proxy Statement |

Internet Availability of Proxy Materials

We utilize a “notice and access” model rather than mailing full sets of proxy materials to all of our stockholders, as we believe, among other things, that the Company benefits from the reduced costs associated with this method of delivery, and it is friendlier to the environment. Thus, pursuant to rules of the Securities and Exchange Commission (“SEC”), we are making our proxy materials available to our stockholders electronically over the Internet rather than mailing the proxy materials to all our stockholders. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials to our stockholders. All stockholders will have the ability to access the proxy materials, including this Proxy Statement and our 2022 Annual Report to Stockholders, on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed set of such materials can be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

How to Vote

In order to submit proxy voting instructions prior to the Annual Meeting, stockholders have the option to authorize their proxy by Internet, telephone or mail. Stockholders are requested to authorize a proxy to vote their shares of our Common Stock during the virtual Annual Meeting via webcast by using the dedicated Internet voting website or toll-free telephone number provided for this purpose. Specific instructions regarding the Internet and telephone voting options are described in the Notice Regarding the Availability of Proxy Materials previously mailed to you and/or on your proxy card. Alternatively, stockholders may authorize their proxy by completing, signing and dating their proxy card and returning it in the postage-prepaid envelope provided. Stockholders who authorize their proxy by using the Internet or telephone voting options do not need to also return a proxy card.

Internet and telephone voting are available through 11:59 p.m. Eastern Time on Monday, June 5, 2023, for all shares other than shares held through the 401(k) Plan. To allow sufficient time for the 401(k) Plan trustee to vote, the trustee must receive voting instructions for shares of Common Stock held through the plan by 11:59 p.m. New York City time on Thursday, June 1, 2023. If the trustee does not receive voting instructions from the 401(k) Plan participant by that date, the trustee will not vote the participant’s shares. Accordingly, Internet and telephone voting are available through 11:59 p.m. Eastern Time on Thursday, June 1, 2023, for shares held in the 401(k) Plan.

Shares of Common Stock represented by properly submitted proxies received by us prior to the Annual Meeting will be voted according to the instructions specified on such proxies. Any stockholder submitting a proxy retains the power to revoke such proxy at any time prior to its exercise at the Annual Meeting by (i) delivering prior to the Annual Meeting a written notice of revocation to the

attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017, (ii) authorizing a later proxy by Internet or telephone or submitting a later-dated proxy card or (iii) voting electronically during the Annual Meeting via webcast. Attending the virtual Annual Meeting via webcast will not automatically revoke a stockholder’s previously submitted proxy unless such stockholder votes electronically during the Annual Meeting.

Quorum and Required Vote

The presence, in person or by proxy, of holders of Common Stock entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting shall constitute a quorum.

Assuming a quorum is present, the business scheduled to come before the Annual Meeting will require the following affirmative votes:

|

1. |

with respect to the election of directors, a majority of the total votes cast for and against the election of each nominee; |

|

|

2. |

with respect to the ratification of the appointment of our independent registered public accounting firm, a majority of the votes cast on the proposal; |

|

|

3. |

with respect to the advisory (non-binding) Say-on-Pay vote, a majority of the votes cast on the proposal; |

|

|

4. |

with respect to the approval of the Amended Plan, a majority of the votes cast on the proposal; and |

|

|

5. |

with respect to the advisory (non-binding) Say-on-Frequency vote, the option receiving a majority of the votes cast on the proposal, provided that if no option receives a majority of votes cast, we will consider the option that receives the most votes to be the option recommended by stockholders. |

| MFA Financial, Inc. | 3 |

2023 Proxy Statement |

Abstentions and Broker Non-Votes

Abstentions and broker non-votes are each included in the determination of the number of shares present at the Annual Meeting for the purpose of determining whether a quorum is present.

An abstention is the voluntary act of directing your proxy to abstain or attending the meeting in person (via webcast over the Internet) and marking a ballot to abstain.

A broker non-vote occurs when a nominee (i.e., a broker) holding shares for a beneficial owner has not received instructions from the beneficial owner on a particular proposal for which the nominee is not permitted to exercise discretionary voting power under New York Stock Exchange (the “NYSE”) rules, and therefore, the nominee does not cast a vote on the proposal.

Under NYSE rules, brokers are not permitted to vote shares held in their clients’ accounts on elections of directors, the non-binding Say-on-Pay vote, the vote on the Amended Plan or the non-binding Say-on-Frequency vote (each of which is considered a non-routine matter), unless, in each case, the client (as beneficial owner) has provided voting instructions to the broker. The ratification of the appointment of our independent registered public accounting firm is, however, a proposal for which brokers do have discretionary voting authority (although they may choose not to exercise such authority). If you hold your shares in “street name” (i.e., through a broker or other nominee), your broker or nominee will not vote your shares on non-routine matters unless you provide instructions on how to vote your shares. You can instruct your broker or nominee how to vote your shares by following the voting procedures provided by your broker or nominee.

Abstentions do not count as votes cast on any of the election of directors, the ratification of the appointment of KPMG LLP, the advisory (non-binding) Say-on-Pay vote, the proposal to approve the Amended Plan or the advisory (non-binding) Say-on-Frequency vote and will have no effect on the results of such proposals.

Broker non-votes, if any, do not count as votes cast on the election of directors, the ratification of the appointment of KPMG LLP, the advisory (non-binding) Say-on-Pay vote, the vote on the Amended Plan, the advisory (non-binding) Say-on-Frequency vote and will have no effect on the results of such proposals.

| MFA Financial, Inc. | 4 |

2023 Proxy Statement |

Corporate Governance

Role of the Board

Pursuant to our Charter and Bylaws and the Maryland General Corporation Law, our business and affairs are managed under the direction of the Board. The Board is responsible for establishing broad corporate policies and for our overall performance and direction, but is not involved in our day-to-day operations. Members of the Board keep informed of our business by participating in meetings of the Board and its committees, by, among other things, reviewing analyses, reports and other materials provided to them and through discussions with our chief executive officer (“CEO”) and other executive officers.

Board Leadership Structure

We currently separate the roles of the Chairman of the Board (the “Board Chair”) and CEO, with the Board Chair held by a non-executive independent director. Under our Bylaws, the Board Chair does not automatically serve as CEO, and the Board Chair may be an executive or non-executive of the Company. At present, our Board believes that the separation of roles, while not required, fosters clear accountability and enhances the Board’s oversight of and independence from management, as well as assisting the Board’s ability to carry out its roles and responsibilities on behalf of stockholders. The Board also believes that the current leadership structure fosters effective decision making and alignment on corporate strategy. In addition, the Board believes that separation of the Board Chair and CEO roles strengthens risk management and allows our CEO to focus more of his time and energy on day-to-day management and operations of the business.

Role of the Non-Executive Board Chair

Laurie S. Goodman, an independent director, currently serves as our Board Chair. Among other things, the Board Chair: (1) presides at all meetings of the Board; (2) has the authority to call, and will lead, meetings and executive sessions of our independent and non-management directors; (3) consults with the CEO and the Board committee chairs in establishing the agenda for Board and Board committee meetings; (4) helps facilitate communication between the CEO and the Board; (5) acts as a liaison between the Board and management; (6) confirms the Board has a process of periodically assessing the effectiveness of the Board, its committees and individual directors and management; and (7) performs such other functions as may be designated from time to time. The Board Chair is elected annually by a majority of the directors then serving on the Board at the first meeting of the Board following the annual meeting of stockholders.

Board’s Role in Risk Oversight

The Board is responsible for the oversight of MFA’s risk management. The Board oversees and monitors MFA’s risk management framework and reviews risks that may be material to us. As part of this oversight process, the Board periodically receives reports from management on areas of material risk to MFA, including operational, financial, interest rate, liquidity, credit, market, legal and regulatory, accounting, strategic, cyber (i.e., data protection and information security) and personnel risks. The Board receives these reports from the appropriate sources within MFA to enable it to understand our risk identification, risk management and risk mitigation strategies. To the extent applicable, the Board and its committees coordinate their risk oversight roles. As part of its written charter, the Audit Committee of the Board periodically discusses guidelines and policies to govern the process by which risk assessment and risk management, including major financial risk exposures, are undertaken by MFA and its management, and the

| MFA Financial, Inc. | 5 |

2023 Proxy Statement |

Compensation Committee of the Board oversees our compensation programs to ensure that they do not encourage unnecessary or excessive risk taking. The principal goal of these processes is to achieve thoughtful Board-level attention to (i) our risk management process and framework, (ii) the nature of the material risks we face, (iii) the adequacy of our risk management process and framework designed to identify, respond to and mitigate these risks and (iv) as necessary or appropriate, possible changes to our risk management process and framework to react to a fluid business environment.

Director Independence

MFA’s Corporate Governance Guidelines (the “Governance Guidelines”), which have been adopted and are periodically reviewed by the Board, provide that a majority of the directors serving on the Board must be independent as affirmatively determined by the Board in accordance with the rules and standards established by the NYSE. In addition, as permitted under the Governance Guidelines, the Board has also adopted certain additional categorical standards (the “Independence Standards”) to assist it in making determinations with respect to the independence of directors. Based upon its review of all relevant facts and circumstances, the Board has affirmatively determined that six of our seven current directors, Laurie S. Goodman, Robin Josephs, Francis J. Oelerich III, Lisa Polsky, Sheila A. Stamps and Richard C. Wald, qualify as independent directors under the NYSE listing standards and the Independence Standards. Craig L. Knutson, by virtue of his position as our CEO and President, is not an independent director.

The Independence Standards can be found on our website at www.mfafinancial.com.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to our directors, officers and employees. The Code of Conduct was designed to assist directors, officers and employees in complying with the law, in resolving certain moral and ethical issues that may arise in the performance of their duties and in complying with our policies and procedures. Among the areas addressed by the Code of Conduct are compliance with applicable laws, conflicts of interest, use and protection of our assets, confidentiality, communications with the public, internal accounting controls, improper influence on the conduct of audits, records retention, fair dealing, discrimination and harassment, and health and safety. The Board’s Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Code of Conduct and will recommend, as appropriate, proposed changes to the Code of Conduct to the Board.

The Code of Conduct can be found on our website at www.mfafinancial.com. We will also provide the Code of Conduct, free of charge, to stockholders who request it. Requests should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017.

Corporate Governance Guidelines

General. The Board has adopted the Governance Guidelines, which address significant issues of corporate governance and set forth procedures by which the Board carries out its responsibilities. Among the areas addressed by the Governance Guidelines are Board composition, Board functions and responsibilities, Board committees, director qualification standards, director resignations, director retirements, access to management and independent advisors, director compensation, management succession, director orientation and continuing education and Board and committee performance evaluations. The Board’s Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Governance Guidelines and will recommend to the Board, as appropriate, proposed changes to the Governance Guidelines.

The Governance Guidelines can be found on our website at www.mfafinancial.com. We will also provide the Governance Guidelines, free of charge, to stockholders who request them. Requests should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017.

| MFA Financial, Inc. | 6 |

2023 Proxy Statement |

Majority Voting

for Directors/Director Resignation Policy. Our Bylaws provide that a nominee for director will be elected by receiving the affirmative vote of a majority of the total votes cast for and against the election of such nominee in a non-contested

election

(i.e., where the number of nominees is the same as the number of directors to be elected).

Under the terms of our Governance Guidelines, if a nominee for director who is an incumbent director is not elected by the vote required in our Bylaws, the director is required to promptly tender to the Board his or her offer to resign from the Board. Upon recommendation of the Nominating and Corporate Governance Committee, the Board, will decide whether or not to accept such offer to resign, and thereafter, it will promptly and publicly disclose its decision. The nominee may address the Board, but may not be present during deliberations or voting on whether to accept the nominee’s resignation. If the Board determines not to accept the director’s offer to resign, the director will continue to serve on the Board until the next annual meeting of stockholders and until the director’s successor is duly elected and qualified or until the director’s earlier resignation or removal. The Board may consider any factors it deems relevant in deciding whether to accept a director’s resignation.

In a contested election, the director nominees who receive a plurality of votes cast are elected as directors. Under the plurality standard, the number of individuals equal to the number of directorships to be filled who receive more votes than other nominees are elected to the board, regardless of whether they receive a majority of votes cast.

Director Retirement Policy. The Governance Guidelines provide that no person who has reached the age of 75 at the time of their election or appointment may be elected or appointed as a director.

Review and Approval of Transactions with Related Persons

The Board has adopted written policies and procedures for review, approval and monitoring of transactions involving the Company and “related persons” (directors and executive officers, stockholders beneficially owning greater than 5% of our outstanding capital stock or immediate family members of any of the foregoing). The policy covers any related person transaction that meets the minimum threshold for disclosure in the Proxy Statement under the relevant rules of the SEC (generally, transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest). A summary of these policies and procedures is set forth below:

Policies

|

● |

Any covered related party transaction must be approved by the Board or by a committee of the Board consisting solely of disinterested directors. In considering the transaction, the Board or committee will consider all relevant factors, including, as applicable, (i) our business rationale for entering into the transaction; (ii) the available alternatives; (iii) whether the transaction is on terms comparable to those available to or from third parties; (iv) the potential for the transaction to lead to an actual or apparent conflict of interest; and (v) the overall fairness of the transaction to the Company. |

|

|

● |

On at least an annual basis, the Board or committee will monitor the transaction to assess whether it is advisable for the Company to amend or terminate the transaction. |

Procedures

|

● |

Management or the affected director or executive officer will bring the matter to the attention of the Chair of the Audit Committee or, if the Chair of the Audit Committee is the affected director, to the attention of the Chair of the Nominating and Corporate Governance Committee. |

|

|

● |

The appropriate committee Chair shall determine whether the matter should be considered by the Board or by a committee of the Board consisting solely of disinterested directors. |

|

|

● |

If a director is involved in the transaction, he or she will be recused from all discussions and decisions about the transaction. |

|

|

● |

The transaction must be approved in advance whenever practicable and, if not practicable, must be ratified as promptly as practicable. |

|

|

● |

If a transaction that has been entered into without prior approval is not ratified, the Board or committee may consider additional action, in consultation with counsel, including, but not limited to, with respect to transactions that are pending |

| MFA Financial, Inc. | 7 |

2023 Proxy Statement |

|

or ongoing, termination of the transaction on a prospective basis or modification of the transaction in a manner that would permit it to be ratified by the Board or committee, and with respect to transactions that are completed, rescission of such transaction and/or disciplinary action. |

Identification of Director Candidates

In accordance with the Governance Guidelines and its charter, the Nominating and Corporate Governance Committee is responsible for identifying and evaluating director candidates for the Board and for recommending director candidates to the Board for consideration as nominees to stand for election at our annual meetings of stockholders. Director candidates are nominated to stand for election to the Board in accordance with the procedures set forth in the written charter of the Nominating and Corporate Governance Committee.

We seek highly-qualified director candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The Nominating and Corporate Governance Committee periodically reviews the appropriate skills and characteristics required of our directors in the context of the current composition of the Board, our operating requirements and the interests of the Company. In accordance with the Governance Guidelines, director candidates should have experience in positions with a high degree of responsibility and decision making, be able to exercise good business judgment, be able to provide practical wisdom and mature judgment and be leaders in the companies or institutions with which they are affiliated. The Nominating and Corporate Governance Committee reviews director candidates with the objective of assembling a slate of directors that can best fulfill and promote our goals, and recommends director candidates based upon contributions they can make to the Board and management and their ability to represent MFA’s long-term interests and those of its stockholders.

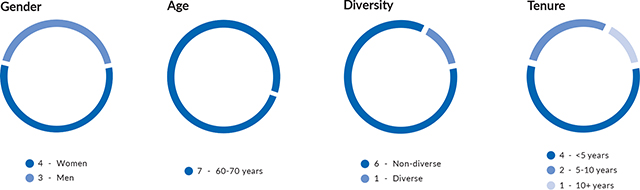

Although we do not have a formal written diversity policy, the Nominating and Corporate Governance Committee considers diversity of race, ethnicity, gender, age, cultural background, professional experiences, expertise and education in evaluating director candidates for Board membership. We believe that director diversity is, and will continue to be, an important component relating to the Board’s composition, as multiple and varied backgrounds and points of view contribute to a more informed and effective decision-making process.

Upon determining the need for additional or replacement Board members, the Nominating and Corporate Governance Committee identifies director candidates and assesses such director candidates based upon information it receives in connection with the recommendation or which it otherwise possesses, which may be supplemented by certain inquiries. In conducting this assessment, the Nominating and Corporate Governance Committee considers knowledge, experience, skills, diversity and such other factors as it deems appropriate in light of our then current needs and those of the Board. If the Nominating and Corporate Governance Committee determines, in consultation with other directors, that a more comprehensive evaluation is warranted, the Nominating and Corporate Governance Committee may then obtain additional information about a director candidate’s background and experience, including by means of personal interviews. The Nominating and Corporate Governance Committee will then re-evaluate the director candidate using its evaluation criteria. The Nominating and Corporate Governance Committee receives input on such director candidates from other directors, and recommends director candidates to the Board for nomination. The Nominating and Corporate Governance Committee may, in its sole discretion, engage one or more search firms and/or other consultants, experts or professionals to assist in, among other things, identifying director candidates or gathering information regarding the background and experience of director candidates. If the Nominating and Corporate Governance Committee engages any such third party, the Nominating and Corporate Governance Committee will have sole authority to approve any fees or terms of retention relating to these services.

The Nominating and Corporate Governance Committee accepts stockholder recommendations of director candidates and applies the same standards in considering director candidates submitted by stockholders as it does in evaluating director candidates recommended by members of the Board or management. Stockholders may make recommendations at any time,

| MFA Financial, Inc. | 8 |

2023 Proxy Statement |

but recommendations of director candidates for consideration as director nominees at our next annual meeting of stockholders must be received not less than 120 days before the first anniversary of the date of the proxy statement for the prior year’s annual meeting of stockholders. Accordingly, to submit a director candidate for consideration for nomination at our 2024 Annual Meeting of Stockholders, stockholders must submit the recommendation, in writing, by no later than the close of regular business hours on December 26, 2023. The written notice must demonstrate that it is being submitted by a stockholder of MFA and include information about each proposed director candidate, including name, age, business address, principal occupation, principal qualifications and other relevant biographical information. In addition, the stockholder must provide confirmation of each recommended director candidate’s consent to serve as a director and contact information for each director candidate so that his or her interest can be verified and, if necessary, to gather further information.

Communications with the Board

The Board has established a process by which stockholders and/or other interested parties may communicate in writing with our directors, a committee of the Board, the Board’s non-employee directors as a group or the Board generally. Any such communications may be sent to the Board by U.S. mail or overnight delivery and should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017, who will forward them to the intended recipient(s). Any such communications may be made anonymously. Unsolicited advertisements, invitations to conferences or promotional materials, in the discretion of our Secretary, are not required, however, to be forwarded to the directors. The Board has approved this communication process.

Executive Sessions of Independent Directors

The independent directors serving on the Board meet in executive session at least four times per year at regularly scheduled meetings of the Board. These executive sessions of the independent directors are presided over by Laurie S. Goodman, in her capacity as the non-executive Chair of the Board.

Corporate Responsibility: Social and Environmental Considerations

MFA understands the importance of incorporating environmental and social considerations into its business and day-to-day operations, and we appreciate the increased interest of our stockholders in these matters. We consider the interests of all our stakeholders — our stockholders, employees, lenders and other counterparties, vendors and community — in pursuing the long-term success and best interests of our business.

Social Considerations

MFA’s primary social considerations and impacts relate to our investment activity and human capital management, both of which are critical to our success as an organization.

Investment Activity

As a provider of private capital to the U.S. housing market through our investments in residential mortgages, our business enhances liquidity in the residential real estate mortgage markets and, in turn, facilitates homeownership in the United States. As of December 31, 2022, MFA had approximately $7.9 billion in aggregate mortgage and mortgage-related investments.

Human Capital Management

As an employer, we have a responsibility to our most important asset, our employees. We recognize the importance of ongoing communication and engagement with our employees through direct channels, facilitated by our relatively small employee base. We are committed to providing our employees an engaging, supportive and inclusive atmosphere in which to grow professionally and contribute. We are also committed to promoting equality and further increasing diversity within our workforce. In this regard, we are proud to have been one of 483 companies across a variety of business sectors in 45 countries and regions that was included in the 2023 Bloomberg Gender-Equality Index, which recognizes companies committed to transparency in gender reporting and

| MFA Financial, Inc. | 9 |

2023 Proxy Statement |

advancing gender equality. 2023 was the fourth consecutive year in which MFA received this accolade. In addition, during 2022 MFA was certified as a Great Place to Work™ by Great Place to Work® Institute for the third consecutive year based on the results of an anonymous survey of our employees. We have also been recognized and included in the 50/50 Women on Boards Gender Diversity and Directory Index since 2019, and women comprise more than half the number of directors on our Board.

Finally, we pride ourselves on providing a wide selection of resources to protect our employees’ health, well-being, financial security and safety, and work-life balance, including:

|

Compensation, Retirement and Income Protection |

● Competitive base salary and bonus potential ● Equity compensation plan ● 401(k) plan with company matching contribution ● Company-paid short-term and long-term disability insurance ● Company-paid group term life and accidental death & dismemberment insurance ● Student loan repayment assistance program ● Child care reimbursement program |

| Health, Wellness and Community |

● Company-subsidized medical insurance ● Company-paid dental and vision insurance ● Flexible spending accounts for health, dependent care, commuting and parking expenses ● Paid parental leave ● Paid vacation, personal and sick days and Federal holidays ● Gym reimbursement program ● Employee assistance program ● Charitable contribution matching program ● W@M — Women at MFA employee network ● Paid time off for participation in volunteer activities ● Eldercare reimbursement ● Headquarters located in WELL-certified building ● Participation in Toys for Tots holiday toy drive with company match of all donations ● Financial support for the following: ○ Samuel Waxman Cancer Research Foundation ○ WIN (Women in Need), which provides family shelter and supportive housing in New York City ○ Kiva, which supports women-owned businesses in impoverished countries |

| Professional Education and Development |

● Tuition reimbursement for career-related college and continuing education courses ● Reimbursement of costs for pursuing and maintaining job-related professional licenses, including prep course and exam fees ● Reimbursement for membership in career-related professional organizations and associations |

| Business Continuity and Disaster Recovery |

● Active business continuity and disaster recovery program to identify and remediate threats to our operations and employees ● Company maintains a dedicated and fully functional co-location facility usable in the event our principal office is unusable ● Annual company-wide disaster recovery drill |

| MFA Financial, Inc. | 10 |

2023 Proxy Statement |

Environmental Considerations

As a specialty finance company that invests in and finances residential mortgage assets, including originating and servicing business purpose mortgage loans, our business operations have a relatively modest impact on the environment. Nonetheless, we strive to use resources efficiently and responsibly.

Our efforts to reduce our environmental impact include:

|

● |

Headquarters building has earned the highest LEED, WELL and Wired Certifications |

|

|

● |

Headquarters building incorporates a 90,000 gallon rainwater collection system that reduces demand for cooling tower water by one million gallons of water annually |

|

|

● |

Office cleaning and pest control conducted with specific green products |

|

|

● |

Street-to-desk touchless entry experience |

|

|

● |

Headquarters location has a walkability score of 99 and facilitates the use of public transportation for nearly all employees |

|

|

● |

Bike room within headquarters building |

|

|

● |

Mandated recycling program for glass, metal, paper and plastic products |

|

|

● |

Individual recycling containers in all common areas |

|

|

● |

Commuter benefit program enables employees to use a pre-tax benefit account to pay for public transportation |

|

|

● |

Cloud computing to reduce electricity footprint |

|

|

● |

Recycling of electronic equipment and ink cartridges |

|

|

● |

Energy Star® printers, monitors and other electronics |

|

|

● |

Motion sensor control LED lighting |

|

|

● |

Motion sensor faucets and toilets |

|

|

● |

Filled water dispensers |

|

|

● |

Compostable and recycled kitchen products |

| MFA Financial, Inc. | 11 |

2023 Proxy Statement |

Board and Committee Matters

Board of Directors

The Board is responsible for directing the management of our business and affairs. The Board conducts its business through meetings and actions taken by unanimous written consent in lieu of meetings. During the year ended December 31, 2022, the Board held six meetings and acted 13 times by unanimous consent in lieu of a meeting. Each of our directors then serving on the Board attended at least 75% of the meetings of the Board (and of the Board’s committees on which they then served) that were held in 2022. All directors then serving on the Board attended our 2022 Annual Meeting of Stockholders. The Board’s policy, as set forth in our Governance Guidelines, is to encourage and promote the attendance by each director at all scheduled meetings of the Board and all meetings of our stockholders.

Committees of the Board

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Audit Committee. Francis J. Oelerich III (Chair), Laurie S. Goodman, Robin Josephs and Lisa Polsky are currently the members of the Audit Committee. The Board has determined that all of the members of the Audit Committee are independent as required by the NYSE listing standards, SEC rules governing the qualifications of audit committee members, the Governance Guidelines, the Independence Standards, the written charter of the Audit Committee and our Bylaws. The Board has also determined, based upon its qualitative assessment of their relevant levels of knowledge and business experience (see “Election of Directors” beginning on page 19 of this Proxy Statement for a description of their respective backgrounds and experience), that each of Mr. Oelerich, Ms. Goodman, Ms. Josephs and Ms. Polsky qualifies as an “audit committee financial expert” for purposes of, and as defined by, SEC rules and has the requisite accounting or related financial management expertise required by the NYSE listing standards. In addition, the Board has determined that all of the members of the Audit Committee are financially literate as required by the NYSE listing standards. During 2022, the Audit Committee met eight times.

The Audit Committee is responsible for, among other things, engaging our independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of their audit engagement, approving professional services to be provided by the independent registered public accounting firm, reviewing the independence of the auditors, considering the range of audit and non-audit fees, reviewing the adequacy of our internal controls, accounting and reporting practices and assessing the quality and integrity of our consolidated financial statements. In accordance with its charter, the Audit Committee has a policy requiring that the terms of all auditing and non-auditing services to be provided by our independent registered public accounting firm be pre-approved by the Audit Committee. The Audit Committee also reviews and evaluates the scope of all non-auditing services to be provided by our independent registered public accounting firm in order to confirm that such services are permitted by the rules and/or regulations of the NYSE, the SEC, the Financial Accounting Standards Board or other similar governing bodies. The specific responsibilities of the Audit Committee are set forth in its charter, which can be found on our website at www.mfafinancial.com.

Compensation Committee. Robin Josephs (Chair), Francis J. Oelerich III, Sheila A. Stamps and Richard C. Wald are currently the members of the Compensation Committee. The Board has determined that all of the members of the Compensation

| MFA Financial, Inc. | 12 |

2023 Proxy Statement |

Committee are independent as required by the NYSE listing standards, the Governance Guidelines, the Independence Standards, the written charter of the Compensation Committee and our Bylaws. During 2022, the Compensation Committee met seven times and acted five times by unanimous consent in lieu of a meeting.

The Compensation Committee is responsible for, among other things, overseeing the design, approval, administration and evaluation of MFA’s compensation plans, policies and programs and reviewing and establishing the compensation of our directors and executive officers. The specific responsibilities of the Compensation Committee are set forth in its charter, which can be found on our website at www.mfafinancial.com.

Compensation Committee Interlocks and Insider Participation. There are no compensation committee interlocks and no insider participation in compensation decisions that are required to be reported under the rules and regulations of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Nominating and Corporate Governance Committee. Lisa Polsky (Chair), Laurie S. Goodman, Sheila A. Stamps and Richard C. Wald are currently the members of the Nominating and Corporate Governance Committee. The Board has determined that all of the members of the Nominating and Corporate Governance Committee are independent as required by the NYSE listing standards, the Governance Guidelines, the Independence Standards, the written charter of the Nominating and Corporate Governance Committee and our Bylaws. During 2022, the Nominating and Corporate Governance Committee met five times and acted once by unanimous consent in lieu of meeting.

The Nominating and Corporate Governance Committee is responsible for, among other things, assisting the Board in identifying individuals qualified to become Board members, recommending to the Board the director nominees to stand for election by our stockholders, recommending to the Board the directors to serve on each of the Board’s committees, developing and recommending to the Board the corporate governance principles and guidelines applicable to the Company and directing the Board in an annual review of its performance. The specific responsibilities of the Nominating and Corporate Governance Committee are set forth in its charter, which can be found on our website at www.mfafinancial.com.

We will provide the charter of any of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, free of charge, to stockholders who request them. Requests should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017.

Report of the Audit Committee

The Audit Committee of the Board is responsible for monitoring, on behalf of the Board, the integrity of MFA’s consolidated financial statements, the Company’s system of internal controls, the performance, qualifications and independence of its independent registered public accounting firm and its compliance with related legal and regulatory requirements. The Audit Committee has the sole authority and responsibility to select, determine the compensation of, evaluate the performance of and, when appropriate, replace MFA’s independent registered public accounting firm. The Audit Committee operates under a written charter adopted by the Board.

Management has the primary responsibility for the Company’s financial reporting process, including the system of internal controls, for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States and for the report on the Company’s internal control over financial reporting. KPMG LLP, the Company’s independent registered public accounting firm, is responsible for performing an independent audit of (i) the Company’s annual consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States and (ii) the effectiveness of the Company’s internal control over financial reporting and expressing an opinion with respect thereto. The Audit Committee’s responsibility is to oversee and review the financial reporting process and to review and discuss management’s report on the Company’s internal control over financial reporting. The Audit Committee is not, however, professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance as to such financial

| MFA Financial, Inc. | 13 |

2023 Proxy Statement |

statements concerning compliance with laws, regulations or accounting principles generally accepted in the United States or as to auditor independence. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by the Company’s management and our independent registered public accounting firm.

During 2022, the Audit Committee held eight meetings. The meetings were designed, among other things, to facilitate and encourage communication among the Audit Committee, management, KPMG LLP, the Company’s independent registered public accounting firm, and Grant Thornton LLP, the Company’s internal auditing firm.

The Audit Committee reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2022, and the related report prepared by KPMG LLP, with management and KPMG LLP. The Audit Committee discussed with KPMG LLP and Grant Thornton LLP the overall scope and plans for their respective audits, including internal control testing under Section 404 of the Sarbanes-Oxley Act of 2002. The Audit Committee also reviewed and discussed with management, KPMG LLP and Grant Thornton LLP management’s annual report on MFA’s internal control over financial reporting and the report prepared by KPMG LLP with respect to its audit of MFA’s internal control over financial reporting. The Audit Committee met with KPMG LLP and Grant Thornton LLP, with and without management present, to discuss the results of their examinations, their evaluations of MFA’s internal control environment and the overall quality of MFA’s financial reporting.

The Audit Committee reviewed and discussed with KPMG LLP its audit plan for MFA and their proposed implementation of this plan. The Audit Committee also discussed with KPMG LLP matters that independent accounting firms are required to communicate to audit committees under the rules of the SEC, generally accepted auditing standards and standards of the Public Company Accounting Oversight Board (“PCAOB”), including, among other things, matters related to the conduct of the audit of MFA’s consolidated financial statements and the matters required to be discussed by Auditing Standard No. 16, as adopted by the PCAOB, which included a discussion of KPMG LLP’s judgments about the quality (not just the acceptability) of MFA’s accounting principles as applied to financial reporting.

The Audit Committee also discussed with KPMG LLP its independence from the Company. KPMG LLP provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and represented that it is independent from MFA. When considering the independence of KPMG LLP, the Audit Committee considered whether services provided by KPMG LLP, beyond those rendered in connection with its audit of MFA’s consolidated financial statements, its reviews of MFA’s interim condensed consolidated financial statements included in MFA’s quarterly reports on Form 10-Q and its audit of the effectiveness of MFA’s internal control over financial reporting, were compatible with maintaining its independence. The Audit Committee reviewed and approved the audit and other professional services performed by, and the amount of fees paid for such services to, KPMG LLP.

The Audit Committee has adopted policies and procedures for the pre-approval of auditing and non-auditing services for the purpose of maintaining the independence of MFA’s independent registered public accounting firm. The Audit Committee received periodic updates on the amount of fees and scope of audit and other professional services provided.

Based on the Audit Committee’s review and the outcome of these meetings, discussions and reports, and subject to the limitations on the Audit Committee’s role and responsibilities referred to above and in its written charter, the Audit Committee recommended to the Board, and the Board has approved, that MFA’s audited consolidated financial statements for the fiscal year ended December 31, 2022, be included in the Company’s Annual Report on Form 10-K filed with the SEC and 2022 Annual Report to Stockholders. The Audit Committee has also selected and appointed KPMG LLP as MFA’s independent registered public accounting firm for the fiscal year ending December 31, 2023, and is presenting this appointment to the Company’s stockholders for ratification.

| MFA Financial, Inc. | 14 |

2023 Proxy Statement |

Audit Committee

Francis J. Oelerich III, Chair

Robin Josephs

Laurie S. Goodman

Lisa Polsky

The foregoing Report of the Audit Committee shall not be deemed under the Securities Act of 1933, as amended, or the Exchange Act to be (i) “soliciting material” or “filed” or (ii) incorporated by reference by any general statement into any filing made by us with the SEC, except to the extent that we specifically incorporate such report by reference.

| MFA Financial, Inc. | 15 |

2023 Proxy Statement |

Compensation of Non-Employee Directors

Pursuant to the terms of its charter, the Compensation Committee is responsible for reviewing and making recommendations to the Board with respect to the compensation of the non-employee directors (the “Non-Employee Directors”) on the Board.

At present, we have the following compensation program for Non-Employee Directors:

|

● |

an annual cash retainer of $100,000, which retainer is payable in equal quarterly installments in arrears. |

|

|

● |

an annual grant to each director under the Company’s Equity Compensation Plan of fully-vested shares of our Common Stock or fully-vested stock units (“RSUs”) with a grant value of $150,000. |

|

|

● |

an annual cash retainer for service on one or more committees of the Board pursuant to which each member of the Board’s (i) Audit Committee (other than the Audit Committee Chair) receives $15,000 per year, (ii) Compensation Committee (other than the Compensation Committee Chair) receives $15,000 per year and (iii) Nominating and Corporate Governance Committee (other than the Nominating and Corporate Governance Committee Chair) receives $5,000 per year. These fees are payable in equal quarterly installments in arrears. |

|

|

● |

an annual cash fee of (i) $35,000 per year paid to the Chair of the Board’s Audit Committee, (ii) $35,000 per year paid to the Chair of the Board’s Compensation Committee and (iii) $15,000 per year paid to the Chair of the Board’s Nominating and Corporate Governance Committee, which fees are payable in equal quarterly installments in arrears. |

|

|

● |

an additional annual grant to the non-executive Chair of the Board of fully-vested shares of our Common Stock or fully-vested RSUs with a grant date value of $115,000. |

Our Non-Employee Directors may also participate in our Fourth Amended and Restated 2003 Non-Employee Directors’ Deferred Compensation Plan (the “Non-Employee Directors Plan”), which allows participants to elect to defer receipt of 50% or 100% of their annual cash fees and to elect whether to receive their equity-based compensation in the form of fully-vested shares of our Common Stock or fully-vested RSUs. Under the Non-Employee Directors Plan, cash amounts that are deferred are deemed to be converted into hypothetical “stock units,” which do not represent our capital stock, but rather the right to receive a cash payment equal to the fair market value of an equivalent number of shares of Common Stock. Deferred amounts (and the resultant hypothetical stock units), together with any dividend equivalents credited to outstanding stock units, increase or decrease in value as would an equivalent number of shares of Common Stock and are settled in cash at the termination of the deferral period, based on the value of the stock units at that time. Cash amounts deferred are generally subject to an initial five-year deferral period, which may be extended for an additional five years if the Non-Employee Director so elects. To the extent a Non-Employee Director elects to take their equity compensation in the form of RSUs, such RSUs will settle, in shares of Common Stock on a one-for-one basis after an initial five-year deferral period (subject to an additional five year deferral if the director so elects).

| MFA Financial, Inc. | 16 |

2023 Proxy Statement |

The following table summarizes the compensation of our Non-Employee Directors for the year ended December 31, 2022.

2022 Non-Employee Director Compensation

|

Name |

Fees Earned or Paid in Cash $(1) |

Stock/RSU Awards $(2) |

Total $(3) |

|

James A. Brodsky(4) |

60,000 |

— |

60,000 |

|

Laurie S. Goodman |

120,000 |

265,000 |

385,000 |

|

Robin Josephs |

150,000 |

150,000 |

300,000 |

|

Francis J. Oelerich III |

150,000 |

150,000 |

300,000 |

|

Lisa Polsky |

130,000 |

150,000 |

280,000 |

|

Sheila A. Stamps |

120,000 |

150,000 |

270,000 |

|

Richard C. Wald |

120,000 |

150,000 |

270,000 |

|

1. |

Amounts in this column represent, as applicable, the annual board retainer fees, annual committee chair fees and committee membership fees earned or paid to Non-Employee Directors for service in 2022. For Ms. Goodman and Mr. Wald, amount includes cash fees that the director elected to defer under the Non-Employee Directors Plan. |

|

2. |

Amounts in this column represent the aggregate grant date fair value of such stock or RSU awards computed in accordance with FASB ASC Topic 718. During 2022, each non-employee director (except Mr. Brodsky) was granted 10,973 fully-vested RSUs on June 8, 2022 (based on a price per share of $13.67, which was the closing price of the Common Stock on such day). In addition, Ms. Goodman, our non-executive Board Chair, was granted an additional 8,413 fully-vested RSUs on June 8, 2022 (based on the same price). The right to receive dividend equivalents was factored into the grant date fair value of the fully-vested RSUs reported in this column. A discussion of the assumptions underlying the calculation of RSU values may be found in Note 12 to our Consolidated Financial Statements on pages 125 to 129 of our 2022 Annual Report on Form 10-K. |

|

3. |

Total compensation for Non-Employee Directors does not include dividend equivalents (which consist of a cash distribution equal to the cash dividend paid on a share of Common Stock) paid during 2022 in respect of the fully-vested RSUs granted to Ms. Goodman, Ms. Josephs, Mr. Oelerich, Ms. Polsky, Ms. Stamps and Mr. Wald. |

|

4. |

Mr. Brodsky retired from the Board effective June 7, 2022. |

The following table summarizes certain additional information regarding cash amounts deferred by our Non-Employee Directors participating in the Non-Employee Directors Plan as of December 31, 2022.

|

Name |

Fair Market Value of Deferred Amounts at Jan. 1, 2022(1) $ |

Cash Distribution Jan. 15, 2022 $ |

Remaining Deferred Amount after Jan. 15, 2022 Distribution(2) $ |

Fair Market Value of Deferred Amounts at Dec. 31, 2022(3) $ |

|

James A. Brodsky |

855,222 |

— |

855,222 |

543,800 |

|

Laurie S. Goodman |

817,371 |

— |

817,371 |

572,627 |

|

Robin Josephs |

655,511 |

— |

655,511 |

403,181 |

|

Lisa Polsky |

320,676 |

— |

320,676 |

216,501 |

|

Richard C. Wald |

187,645 |

— |

187,645 |

216,803 |

|

1. |

Amounts in this column represent the value of compensation deferred by the director (including dividend equivalents credited to hypothetical stock units) from the inception of the individual director’s elected participation in the Non-Employee Directors Plan, less cash distributions, if any, made at the termination of any elected deferral and payment period before the effect of any distributions made during 2022. Amounts in this column represent the fair market value of stock units in the director’s deferred compensation account (including dividend equivalents credited to hypothetical stock units) based on the closing price of the Common Stock of $18.24 per share as reported on the NYSE on December 31, 2021 (as adjusted to reflect our 1-for-4 reverse stock split effected on April 4, 2022). |

|

2. |

Amounts in this column represent the value of the director’s deferred compensation account under the Non-Employee Directors Plan following the distributions, if any, made on January 15, 2022. |

|

3. |

Amounts in this column represent the fair market value at December 31, 2022, of hypothetical stock units in the director’s deferred compensation account (including dividend equivalents credited to outstanding stock units) (based upon the closing price of the Common Stock of $9.85 per share reported on the NYSE on December 30, 2022 (the last trading day of the year), under the Non-Employee Directors Plan. |

| MFA Financial, Inc. | 17 |

2023 Proxy Statement |

The Non-Employee Directors are subject to a share retention/alignment requirement pursuant to which each Non-Employee Director is required to hold and maintain equity in MFA, which could include Common Stock and/or RSUs under the Non-Employee Directors Plan (collectively, the “Equivalent Shares”), in an amount equal to no less than three times (3x) the annual cash retainer (currently $100,000 per year) payable to Non-Employee Directors. Generally, this retention requirement must be met within five years after becoming a director. As of the Record Date (April 10, 2023), all of our directors (other than Ms. Stamps, who was elected to the Board in December 2021) have met this retention requirement.

The following table summarizes information regarding the number of Equivalent Shares owned by each of our current Non-Employee Directors as of the Record Date.

|

Name |

Shares of Common Stock Beneficially Owned # |

Fully-Vested RSUs Owned # |

Total Number of Equivalent Shares Owned # |

|

Laurie S. Goodman |

2,854 |

70,807 |

73,661 |

|

Robin Josephs |

28,828 |

56,277 |

85,105 |

|

Francis J. Oelerich III |

4,924 |

40,267 |

45,191 |

|

Lisa Polsky |

-0- |

35,116 |

35,116 |

|

Sheila A. Stamps |

-0- |

10,973 |

10,973 |

|

Richard C. Wald |

-0- |

35,116 |

35,116 |

Non-employee directors are also eligible to receive other grants of Common Stock and phantom shares, as well as grants of stock options, under the Company’s Equity Compensation Plan. We also reimburse all Non-Employee Directors for reasonable travel and other expenses incurred in connection with attending Board, committee and stockholder meetings and other Company-sponsored events and/or other activities in which they engage or participate on our behalf. In addition, we provide all non-employee directors with up to $500,000 of accidental death and dismemberment insurance while traveling to or attending Board, committee and stockholder meetings and other Company-sponsored events. Directors who are employees of the Company (currently, only Mr. Knutson) are not entitled to receive additional compensation for serving on the Board.

| MFA Financial, Inc. | 18 |

2023 Proxy Statement |

Proposal 1. Election of Directors

Board of Directors

In accordance with our Charter and Bylaws, the Board is currently comprised of seven (7) directors, Laurie S. Goodman, Robin Josephs, Craig L. Knutson, Francis J. Oelerich III, Lisa Polsky, Sheila A. Stamps and Richard C. Wald, and it is divided into three classes.

One class of directors is elected at each annual meeting of our stockholders for a term of three (3) years. Each director holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal. The term of the Board’s Class I directors expires at the Annual Meeting. The terms of the other two classes of directors expire at MFA’s 2024 Annual Meeting of Stockholders (Class II directors) and MFA’s 2025 Annual Meeting of Stockholders (Class III directors).

Upon the recommendation of the Nominating and Corporate Governance Committee of the Board, Ms. Goodman and Mr. Wald have been nominated by the Board to stand for election as Class I directors by the stockholders at the Annual Meeting to serve a term until our 2026 Annual Meeting of Stockholders and until their respective successors are duly elected and qualify. Ms. Goodman and Mr. Wald are currently directors of MFA, and each has consented to stand for election at the Annual Meeting.

If the candidacy of Ms. Goodman or Mr. Wald should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidate or candidates (if any) as shall be nominated by the Board or the Board may determine to reduce its size.

The Board has no reason to believe that Ms. Goodman or Mr. Wald would be unable or unwilling to serve as Class I directors.

Set forth below is a summary of self-identified diversity characteristics for each of our directors, including Ms. Goodman and Mr. Wald, the nominees for election at the Annual Meeting. We also provide the same for our continuing Class II and Class III directors. The Board has determined that all of our current directors are qualified to serve as directors of the Company. The biographies of each of the Board’s nominees standing for election or re-election and of our continuing directors, which follow below, contain information regarding each person’s service as a director, business experience and education, director positions held currently or at any time during the last five years and the experience, qualifications, attributes or skills that caused the Board and the Nominating and Corporate Governance Committee to determine that the person should serve as a director.

In addition to the specific information set forth in their respective biographies, we believe that each of our directors also possesses the tangible and intangible attributes and skills that are important to being an effective director on the Board, including experience in areas of expertise relevant and beneficial to our business and industry, a willingness and commitment to assume the responsibilities required of a director of the Company and the character and integrity we expect of directors of the Company.

| MFA Financial, Inc. | 19 |

2023 Proxy Statement |

Diversity of the Board

|

L. S. Goodman |

R. Josephs |

C. L. Knutson |

F. J. Oelerich III |

L. Polsky |

S. A. Stamps |

R. C. Wald |

|

|

Gender |

|||||||

|

Female |

● |

● |

● |

● |

|||

|

Male |

● |

● |

● |

||||

|

Ethnicity or Race |

|||||||

|

Black or African American |

● |

||||||

|

White/ |

● |

● |

● |

● |

● |

● |

| MFA Financial, Inc. | 20 |

2023 Proxy Statement |

Class I Director Nominees

The following information is furnished regarding the nominees for election as our Class I directors by the holders of Common Stock.

|

Laurie S. Goodman Age: 67 |

Ms. Goodman is currently an Institute Fellow at the Housing Finance Policy Center at the Urban Institute, a Washington, D.C.-based nonprofit organization dedicated to elevating the debate on social and economic policy. Ms. Goodman founded the Housing Finance Policy Center in 2013, and served as its director or co-director from 2013 through 2021. Prior to joining the Urban Institute, she was with Amherst Securities Group, L.P., a boutique broker dealer specializing in securitized products, where she had been a Senior Managing Director since late 2008 leading a group known for its analysis of housing policy issues. Prior to her tenure at Amherst Securities, Ms. Goodman was head of Global Fixed Income Research and Manager of U.S. Securitized Products Research at UBS and its predecessor firms from July 1993 through November 2008. Prior to her tenure with UBS, Ms. Goodman spent ten years in senior fixed income research positions at Citicorp, Goldman Sachs, and Merrill Lynch. She was also a mortgage portfolio manager at Eastbridge Capital and a Senior Economist at the Federal Reserve Bank of New York. Ms Goodman also serves as a director of Arch Capital Group Ltd., a Bermuda-based insurance company, where she serves on its audit, underwriting oversight and nominating and governance committees, and Homepoint Capital Inc., a residential mortgage originator and servicer, where she serves as a member of its Audit Committee and Chair of its Nominating and Corporate Governance Committee. Ms. Goodman is also a member of the Consumer Financial Protection Bureau’s Consumer Advisory Board. Ms. Goodman has an A.M. and Ph.D. in economics from Stanford University and a B.A. in mathematics from the University of Pennsylvania. She has published more than 200 articles in professional and academic journals and co-authored and co-edited five books. Ms. Goodman was inducted into the Fixed Income Analysts Hall of Fame in 2009. We believe that Ms. Goodman’s qualifications to serve on the Board include her extensive knowledge of mortgage finance, housing policy issues, the fixed income capital markets and, in particular, the mortgage-backed securities markets. |

|

|

Richard C. Wald Age: 63 |

Mr. Wald has served as Vice Chairman and a management (non-voting) member of the Board of Directors of Emigrant Bank, a privately held financial institution based in New York City, and its Vice Chairman, since 2012. In addition, Mr. Wald has served as Chief Regulatory Officer of Emigrant Bank since 2009 and Chairman and Chief Executive Officer of each of Emigrant Mortgage Company, and Emigrant Funding Corporation since 2011. Mr. Wald has also been an Adjunct Professor of Law at the Zicklin School of Business of Baruch College since 2013. Mr. Wald was an associate with the law firm of Fried, Frank, Harris, Shriver and Jacobson from 1986 to 1992 and was an Honors Program Attorney with the Federal Deposit Insurance Corporation from 1984 to 1986. Mr. Wald received a J.D. from the Boston University School of Law and a B.A. from the State University of New York at Stony Brook. We believe that MR. Wald’s qualifications to serve on the Board include his extensive experience in mortgage banking and his extensive knowledge of legal, reguLATORY and compliance matters in the mortgage banking industry. |

| MFA Financial, Inc. | 21 |

2023 Proxy Statement |

Vote

The Board recommends a vote “For” the election of each of Ms. Goodman and Mr. Wald as Class I Directors.

Continuing Class II Directors