Compensation Committee of the Board oversees our compensation programs to ensure that they do not encourage unnecessary or excessive risk taking. The principal goal of these processes is to achieve thoughtful Board-level attention to (i) our risk management process and framework, (ii) the nature of the material risks we face, (iii) the adequacy of our risk management process and framework designed to identify, respond to and mitigate these risks and (iv) as necessary or appropriate, possible changes to our risk management process and framework to react to a fluid business environment.

Director Independence

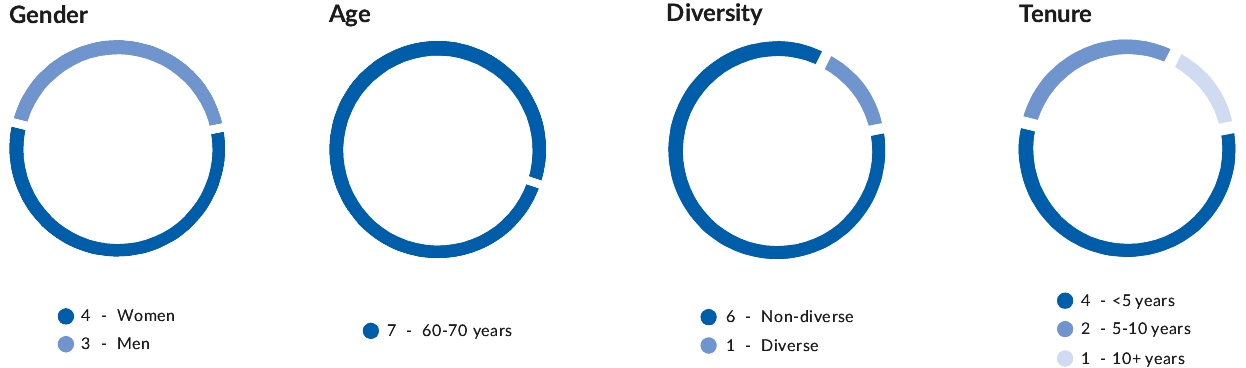

MFA’s Corporate Governance Guidelines (the “Governance Guidelines”), which have been adopted and are periodically reviewed by the Board, provide that a majority of the directors serving on the Board must be independent as affirmatively determined by the Board in accordance with the rules and standards established by the NYSE. In addition, as permitted under the Governance Guidelines, the Board has also adopted certain additional categorical standards (the “Independence Standards”) to assist it in making determinations with respect to the independence of directors. Based upon its review of all relevant facts and circumstances, the Board has affirmatively determined that six of our seven current directors, Laurie S. Goodman, Robin Josephs, Francis J. Oelerich III, Lisa Polsky, Sheila A. Stamps and Richard C. Wald, qualify as independent directors under the NYSE listing standards and the Independence Standards. Craig L. Knutson, by virtue of his position as our CEO and President, is not an independent director.

The Independence Standards can be found on our website at www.mfafinancial.com.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to our directors, officers and employees. The Code of Conduct was designed to assist directors, officers and employees in complying with the law, in resolving certain moral and ethical issues that may arise in the performance of their duties and in complying with our policies and procedures. Among the areas addressed by the Code of Conduct are compliance with applicable laws, conflicts of interest, use and protection of our assets, confidentiality, communications with the public, internal accounting controls, improper influence on the conduct of audits, records retention, fair dealing, discrimination and harassment, and health and safety. The Board’s Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Code of Conduct and will recommend, as appropriate, proposed changes to the Code of Conduct to the Board.

The Code of Conduct can be found on our website at www.mfafinancial.com. We will also provide the Code of Conduct, free of charge, to stockholders who request it. Requests should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017.

Corporate Governance Guidelines

General. The Board has adopted the Governance Guidelines, which address significant issues of corporate governance and set forth procedures by which the Board carries out its responsibilities. Among the areas addressed by the Governance Guidelines are Board composition, Board functions and responsibilities, Board committees, director qualification standards, director resignations, director retirements, access to management and independent advisors, director compensation, management succession, director orientation and continuing education and Board and committee performance evaluations. The Board’s Nominating and Corporate Governance Committee is responsible for assessing and periodically reviewing the adequacy of the Governance Guidelines and will recommend to the Board, as appropriate, proposed changes to the Governance Guidelines.

The Governance Guidelines can be found on our website at www.mfafinancial.com. We will also provide the Governance Guidelines, free of charge, to stockholders who request them. Requests should be directed to the attention of our Secretary at MFA Financial, Inc., One Vanderbilt Avenue, 48th Floor, New York, New York 10017.