EX-99.1

Published on May 8, 2013

Exhibit 99.1

|

|

May 2013 |

|

|

When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as will, believe, expect, anticipate, estimate, plan, continue, intend, should, may or similar expressions, are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions. Statements regarding the following subjects, among others, may be forward-looking: changes in interest rates and the market value of MFAs MBS; changes in the prepayment rates on the mortgage loans securing MFAs MBS; changes in the default rates and managements assumptions regarding default rates on the mortgage loans securing MFAs Non-Agency MBS; MFAs ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowing; implementation of or changes in government regulations or programs affecting MFAs business; MFAs estimates regarding taxable income and the timing and amount of distributions to stockholders; MFAs ability to maintain its qualification as a REIT for federal income tax purposes; MFAs ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended (or the Investment Company Act), including statements regarding the Concept Release issued by the SEC relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are in engaged in the business of acquiring mortgages and mortgage-related interests; and risks associated with investing in real estate assets, including changes in business conditions and the general economy. These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the Securities and Exchange Commission, could cause MFAs actual results to differ materially from those projected in any forward-looking statements it makes. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA. Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statements 2 |

|

|

MFA is an internally managed REIT that seeks to deliver shareholder value through both the generation of distributable income and through asset performance linked to improvement in residential mortgage credit fundamentals. MFA Financial, Inc. 3 |

|

|

Non-Agency MBS selection is driven by credit analysis and expected return. Agency MBS selection is driven by analysis of interest rate sensitivity, prepayment exposure and expected return. Book value per common share was $8.84 as of March 31, 2013, compared to $8.99 at December 31, 2012. Excluding the impact of the $0.50 per share special dividend declared March 4, 2013, book value would have increased in the quarter due primarily to continued appreciation within the Non-Agency MBS portfolio. Our Strategy is to Identify the Best Investment Opportunities Throughout the Residential MBS Universe 4 |

|

|

MFA has a Long Track Record of Delivering Attractive Shareholder Returns* Source: Bloomberg *Through March 31, 2013. Includes reinvestment of dividends. 17.3 % Annual Return since January 2000 727.8% Total Stockholder Return since January 2000 5 |

|

|

MFA Asset Allocation Strategy Investment in Residential MBS Including both Agency MBS and Non-Agency MBS 6 (1) Information presented with respect to Non-Agency MBS and related financings (which includes repurchase agreements) and resulting totals are presented on a non-GAAP basis. Includes $46.6 million of Non-Agency MBS and $34.1 million of repurchase agreements underlying Linked Transactions, which, for GAAP financial reporting purposes, are evaluated on a combined basis and presented net as Linked Transactions on the companys consolidated balance sheet. (2) Financings include repurchase agreements, securitized debt and senior notes. (3) Represents sum of financings (and with respect to the Total column, also the obligation to return securities obtained as collateral of $408.6 million) as a multiple of net equity allocated. (4) Average cost of funds includes interest on repurchase agreements, including the cost of swaps, and securitized debt. At March 31, 2013 Agency MBS Non Agency MBS (1) Cash Other, net Total ($ in Thousands) Market Value $ 7,153,905 $ 5,434,860 606,587 $ (200,762) $ 12,994,590 Less Financings (2) (6,338,378) (3,240,149) - (100,000) (9,678,527) Equity Allocated 815,527 2,194,711 606,587 (300,762) 3,316,063 Less Swaps at Market Value - - - (50,515) (50,515) Net Equity Allocated $ 815,527 $ 2,194,711 606,587 $ (351,277) $ 3,265,548 Debt/Net Equity Ratio (3) 7.77 x 1.48 x - - 3.09 x Yield on Average Interest Earning Assets 2.42% 6.80% 0.03% - 4.02% Less Average Cost of Funds (4) (1.24) (2.45) - - (1.63) Senior Notes - - - (8.03) % (8.03) Net Interest Rate Spread 1.18% 4.35% 0.03% (8.03) % 2.32% For the Quarter Ended March 31, 2013 |

|

|

MFA Strategy - Agency MBS Lower Duration Assets that Either Reset or are Fixed for 15 Years or Less 63% Hybrid 37% 15-Year Fixed Low Premium Exposure Agency Portfolio average amortized cost of 103.4% Runoff of High Cost Funding During 2013, approximately $960 million notional amount of existing swaps with a weighted average fixed pay rate of 2.76% will expire. 7 MFA is maintaining an Agency MBS portfolio in excess of $7 billion due to attractive carry with limited interest rate risk. |

|

|

MFA owns approximately $5.4 billion market value ($6.3 billion face amount) of Non-Agency MBS, with an average amortized cost of 73% of par. In the first quarter, these assets generated a loss-adjusted yield of 6.80% on an unlevered basis. We have lowered our estimate of future losses within MFAs Non-Agency MBS portfolio due to a combination of both home price appreciation and mortgage amortization. Over the last nine (9) months, $170 million has been transferred from credit reserve to accretable discount. This increase in accretable discount will be realized in income over the life of the Non-Agency MBS. *Information presented as of March 31, 2013. MFA Strategy - Non-Agency MBS Significant Investment in Non-Agency MBS* 8 |

|

|

Non-Agency MBS universe continues to shrink providing technical support for existing assets MFA Strategy - Non-Agency MBS * Source: CoreLogic, 1010Data 9 |

|

|

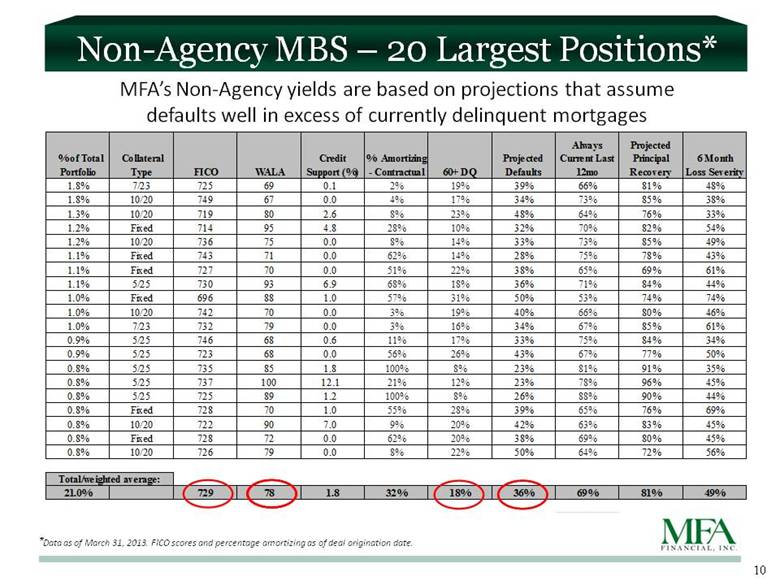

*Data as of March 31, 2013. FICO scores and percentage amortizing as of deal origination date. Non-Agency MBS 20 Largest Positions* MFAs Non-Agency yields are based on projections that assume defaults well in excess of currently delinquent mortgages 10 % of Total Portfolio Collateral Type FICO WALA Credit Support (%) % Amortizing - Contractual 60+ DQ Projected Defaults Always Current Last 12mo Projected Principal Recovery 6 Month Loss Severity 1.8% 7/23 725 69 0.1 2% 19% 39% 66% 81% 48% 1.8% 10/20 749 67 0.0 4% 17% 34% 73% 85% 38% 1.3% 10/20 719 80 2.6 8% 23% 48% 64% 76% 33% 1.2% Fixed 714 95 4.8 28% 10% 32% 70% 82% 54% 1.2% 10/20 736 75 0.0 8% 14% 33% 73% 85% 49% 1.1% Fixed 743 71 0.0 62% 14% 28% 75% 78% 43% 1.1% Fixed 727 70 0.0 51% 22% 38% 65% 69% 61% 1.1% 5/25 730 93 6.9 68% 18% 36% 71% 84% 44% 1.0% Fixed 696 88 1.0 57% 31% 50% 53% 74% 74% 1.0% 10/20 742 70 0.0 3% 19% 40% 66% 80% 46% 1.0% 7/23 732 79 0.0 3% 16% 34% 67% 85% 61% 0.9% 5/25 746 68 0.6 11% 17% 33% 75% 84% 34% 0.9% 5/25 723 68 0.0 56% 26% 43% 67% 77% 50% 0.8% 5/25 735 85 1.8 100% 8% 23% 81% 91% 35% 0.8% 5/25 737 100 12.1 21% 12% 23% 78% 96% 45% 0.8% 5/25 725 89 1.2 100% 8% 26% 88% 90% 44% 0.8% Fixed 728 70 1.0 55% 28% 39% 65% 76% 69% 0.8% 10/20 722 90 7.0 9% 20% 42% 63% 83% 45% 0.8% Fixed 728 72 0.0 62% 20% 38% 69% 80% 45% 0.8% 10/20 726 79 0.0 8% 22% 50% 64% 72% 56% 21.0% 729 78 1.8 32% 18% 36% 69% 81% 49% Total/weighted average: |

|

|

11 A combination of low mortgage rates, rising multifamily rents, limited housing supply, capital flows into own-to-rent purchases and demographic driven U.S. household formation, has led to price appreciation on a nationwide basis. MFA Strategy Non-Agency MBS *includes distressed sales Source: CoreLogic, 1010Data |

|

|

MFA Strategy Non-Agency MBS 12 10.8% of portfolio 5.8% of portfolio 4.8% of portfolio 3.3% of portfolio 2.3% of portfolio Source: CoreLogic, 1010 data HPA=Home Price Appreciation Data as of February 2013 MFA Portfolio Top 5 California County Concentrations County % of MFA Non-Agency Portfolio 12 Month Home Price Appreciation Los Angeles 10.8% + 15.9% Orange 5.8% + 14.6% San Diego 4.8% + 12.5% Santa Clara 3.3% + 15.1% Alameda 2.3% + 16.8% While housing fundamental trends remain uncertain, there have been increasing signs of home price stabilization 46.1% of the underlying loans in the Non-Agency portfolio are in California 12MO HPA > 5% 2 - 5% 0 - 2% -2 - 0% -5 - -2% < -5% No Data |

|

|

13 0.9% of portfolio 0.5% of portfolio 0.5% of portfolio 1.1% of portfolio 1.2% of portfolio MFA Portfolio Top 5 Florida County Concentrations County % of MFA Non-Agency Portfolio 12 Month Home Price Appreciation Miami-Dade 1.2% + 10.5% Broward 1.1% + 9.8% Palm Beach 0.9% + 10.9% Orange 0.5% + 12.3% Hillsborough 0.5% + 8.7% MFA Strategy Non-Agency MBS Florida makes up MFAs second largest Non-Agency geographic concentration with 7.9% of the portfolio Source: CoreLogic, 1010 data HPA=Home Price Appreciation Data as of February 2013 12MO HPA > 5% 2 - 5% 0 - 2% -2 - 0% -5 - -2% < -5% No Data |

|

|

MFA Strategy Non-Agency MBS 14 Non-Agency Portfolio As of March 31, 2013 Current Face $6,313.1 We maintain a substantial credit reserve of $1.3 Billion. Credit assumption changes would impact earnings over time. Dollars in Millions |

|

|

MFA Financial, Inc. Strategy is to identify the best investment opportunities within the Residential MBS universe. Internally managed. 17.3% annual return and 727.8% total return since 2000 (including reinvestment of dividends). Significant $5.4 billion market value investment in Non-Agency MBS sector which generated a 6.80% loss-adjusted unlevered yield in the first quarter. A combination of low mortgage rates, rising multifamily rents, limited housing supply, capital flows into own-to-rent purchases and demographic driven U.S. household formation, has led to price appreciation on a nationwide basis. 15 |