EX-99.2

Published on November 4, 2013

Exhibit 99.2

|

|

Third Quarter 2013 Earnings Call |

|

|

When used in this press release or other written or oral communications, statements which are not historical in nature, including those containing words such as will, believe, expect, anticipate, estimate, plan, continue, intend, should, may or similar expressions, are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions. Statements regarding the following subjects, among others, may be forward-looking: changes in interest rates and the market value of MFAs MBS; changes in the prepayment rates on the mortgage loans securing MFAs MBS; changes in the default rates and managements assumptions regarding default rates on the mortgage loans securing MFAs Non-Agency MBS; MFAs ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowing; implementation of or changes in government regulations or programs affecting MFAs business; MFA's estimates regarding taxable income the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by the Company to accrete the market discount on Non-Agency MBS and the extent of prepayments, realized losses and changes in the composition of MFA's Agency MBS and Non-Agency MBS portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA's Board of Directors and will depend on, among other things, MFA's taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as the Board deems relevant; MFAs ability to maintain its qualification as a REIT for federal income tax purposes; MFAs ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended (or the Investment Company Act), including statements regarding the Concept Release issued by the SEC relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are in engaged in the business of acquiring mortgages and mortgage-related interests; and risks associated with investing in real estate assets, including changes in business conditions and the general economy. These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the Securities and Exchange Commission, could cause MFAs actual results to differ materially from those projected in any forward-looking statements it makes. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA. Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statements 2 |

|

|

Third Quarter 2013 Earnings and Dividends 3 Net Income Per Common Share $0.19 Core Earnings Per Common Share $0.18(1) Estimated Taxable Income Per Common Share $0.23 Third Quarter Dividend $0.22 Special Cash Dividend $0.28 Total Dividend $0.50 Estimated Undistributed Taxable Income Per Common Share as of September 30, 2013 $0.17 (1) See Annex 1 for reconciliation to GAAP EPS |

|

|

Despite Changing Interest Rates and Prepayment Speeds, MFAs Key Metrics Have Remained Consistent Over the Last Year Fourth Quarter 2012 First Quarter 2013 Second Quarter 2013 Third Quarter 2013 Yield on Interest Earning Assets 4.10% 4.02% 4.01% 4.05% Net Interest Rate Spread 2.33% 2.32% 2.38% 2.24% Debt Equity Ratio 3.04x 3.09x 3.14x 3.07x 4 |

|

|

Core EPS has Declined Due Primarily to the Special Dividends Paid to Shareholders of $0.78 per Share 5 Fourth Quarter 2012 First Quarter 2013 Second Quarter 2013 Third Quarter 2013 EPS $0.19 $0.21 $0.19 $0.19 Core EPS $0.20 $0.20 $0.19 $0.18(1) Assuming MFA had retained the $0.78 of equity per share and earned its average third quarter ROE of 9% on this equity, Core EPS for the third quarter would have been approximately $0.02 higher, or $0.20 per share. (1) See Annex 1 for reconciliation to GAAP EPS |

|

|

The Change in Book Value was Due Primarily to the Special Dividend In Addition, the Third Quarter Dividend Exceeded Net Income so as to More Closely Track REIT Taxable Income 6 Book Value per common share as of 6/30/13 $ 8.19 Net Income 0.19 Regular Q3 Common Dividend declared during the quarter (0.22) Special Dividend declared and paid during the quarter (0.28) Preferred Dividend declared and paid during the quarter (0.01) Net change in value of Agency MBS 0.04 Net change in value of Non-Agency MBS - Net change in value of hedging and other derivative instruments (0.05) Other (0.01) Book Value per common share as of 9/30/13 $ 7.85 |

|

|

REIT Taxable Income Update 7 MFA has now distributed to stockholders an amount equal to all taxable income for years prior to 2013. We currently estimate that for the first nine (9) months of 2013, MFAs REIT taxable income was approximately $297 million, while distributions not attributed to prior years was approximately $236 million. MFA has until the filing of its 2013 tax return (due not later than September 15, 2014), to declare the distribution of any 2013 REIT taxable income not previously distributed. |

|

|

Interest Rate Strategy MFAs estimated effective duration has been reduced from approximately 1.70 as of June 30, 2013 to approximately 0.65 as of September 30, 2013. MFA added new longer term swaps: While shorter term, higher cost swaps expired: 8 Notional Amount Term Weighted Average Fixed-Pay Rate $1,750,000 5-10 years 2.13% Notional Amount Term Weighted Average Fixed-Pay Rate $358,000 Expired 4.16% *Duration is the measure of price sensitivity to changes in interest rates Dollars in thousands |

|

|

MFAs Interest Rate Sensitivity 9 Assets Market Value Average Coupon Duration Non-Agency ARMs (12 months or less MTR) $2,934 3.07% 0.5 Non-Agency Hybrid (12-48 MTR) $644 5.17% 1.1 Non-Agency Fixed Rate $1,501 5.81% 3.5 Agency ARMs (12 months or less MTR) $1,197 2.81% 0.9 Agency ARMs (12-120 MTR) $2,936 3.45% 2.2 Agency 15 Year Fixed Rate $2,561 3.14% 4.1 Cash $504 0.0 TOTAL ASSETS $12,278 2.1 Hedging Instruments Notional Amount Duration Swaps (Less than 3 years) $1,479 -1.1 Swaps (3-6 years) $1,000 -4.1 Swaps (6-10 years) $1,600 -6.5 TBA Short Positions $350 -4.9 TOTAL $4,429 -4.0 Net Duration 0.65 Dollars in millions, data as of 9/30/13 *Non-Agency market value includes approximately $106 million in aggregate of MBS underlying Linked Transactions for GAAP financial reporting purposes |

|

|

Improving Credit: Declining LTVs on our Non-Agency Portfolio 10 Average Portfolio LTV has dropped by over 20 points since the beginning of 2012 This decreases likelihood of default, increases prepayment rates, and decreases expected severities Source: CoreLogic, RBS MFAs Non-Agency Portfolio as of September 30, 2013 |

|

|

Improving Credit: Home Price Appreciation Drives LTVs Down 11 10.8% of portfolio 5.6% of portfolio 4.8% of portfolio 3.1% of portfolio 2.2% of portfolio MFA Portfolio Top 5 California County Concentrations County % of MFA Non-Agency Portfolio 12 Month Home Price Appreciation Los Angeles 10.8% + 24.1% Orange 5.6% + 22.4% San Diego 4.8% + 22.6% Santa Clara 3.1% + 18.7% Alameda 2.2% + 27.9% 45.4% of the underlying loans in the Non-Agency portfolio are in California Source: CoreLogic, 1010 data HPA=Home Price Appreciation HPI Data as of August 2013 12 Month HPA >20% 16-20% 11-15% 6-10% 0-5% No Data |

|

|

Improving Credit: Home Price Appreciation Drives LTVs Down 12 0.9% of portfolio 0.6% of portfolio 0.4% of portfolio 1.1% of portfolio 1.2% of portfolio MFA Portfolio Top 5 Florida County Concentrations County % of MFA Non-Agency Portfolio 12 Month Home Price Appreciation Miami-Dade 1.2% + 13.7% Broward 1.1% + 14.8% Palm Beach 0.9% + 15.0% Orange 0.6% + 15.7% Hillsborough 0.4% + 14.1% Florida makes up MFAs second largest Non-Agency geographic concentration with 8.0% of the portfolio Source: CoreLogic, 1010 data HPA=Home Price Appreciation HPI Data as of August 2013 12 Month HPA >20% 16-20% 11-15% 6-10% 0-5% No Data |

|

|

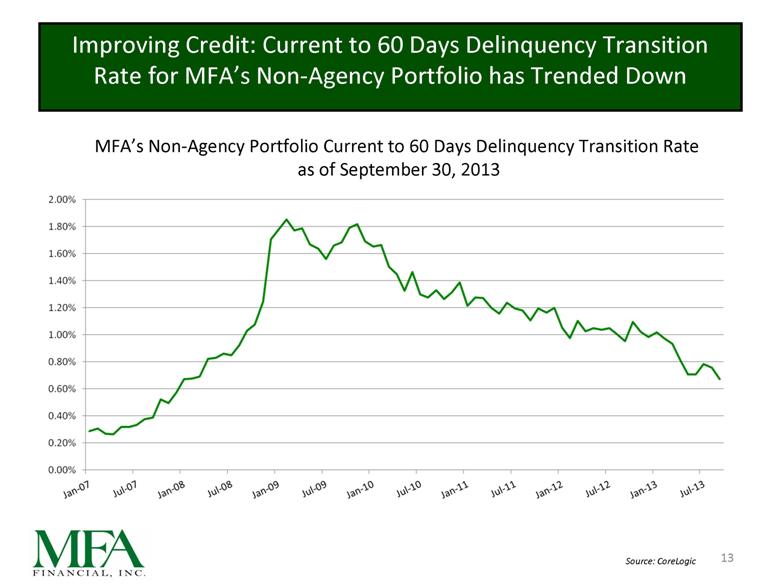

Improving Credit: Current to 60 Days Delinquency Transition Rate for MFAs Non-Agency Portfolio has Trended Down 13 Source: CoreLogic MFAs Non-Agency Portfolio Current to 60 Days Delinquency Transition Rate as of September 30, 2013 |

|

|

Non-Agency Portfolio as of September 30, 2013 Current Face $5,865.7 We maintain a substantial credit reserve of $1.1 Billion. Credit assumption changes would impact earnings over time. Dollars in Millions 14 Improving Credit: Yet Substantial Credit Reserves |

|

|

Annex 1 Reconciliations of Non-GAAP Financial Measures Core Earnings per common share for the three months ended September 30, 2013 is non-GAAP financial measure, as the calculation of net income used in determining this measure excludes gain on sales of MBS and U.S. Treasury securities, net, changes in fair value of MBS underlying our Linked Transactions, unrealized losses on TBA short positions and impairment of resecuritization related costs. MFAs management excludes these items as it believes that they are not reflective of the underlying performance of our portfolio or the way the portfolio is managed by the company. A reconciliation of the GAAP items discussed above to their non-GAAP measures for the three months ended September 30, 2013, are as follows: A reconciliation of the GAAP items discussed above to their non-GAAP measures for the three months ended each of March 31 and June 30, 2013, may be found in MFAs press releases dated May 1, 2013, and August 1, 2013, respectively. 15 Three Months Ended September 30, 2013 (In Thousands, Except Per Share Amounts) Reconciliation Basic and Diluted EPS GAAP Net Income Available to Common Stock and Participating Securities $ 67,578 Less: Dividends and Dividend Equivalent Rights on Participating Securities (230) GAAP Net Income Allocable to Common Stockholders $ 67,348 $ 0.19 Non-GAAP Adjustments: Changes in Net Unrealized Gains on Linked Transactions $ 290 Gain on Sales of MBS and U.S. Treasury Securities, net (13,680) Unrealized losses on short TBA positions 8,724 Impairment of resecuritization related costs 2,031 Total Adjustments to Arrive at Core Earnings $ (2,635) $ (0.01) Core Earnings $ 64,713 $ 0.18 Weighted Average Common Shares Outstanding - Basic and Diluted 363,918 |

|

|

[LOGO] |