EX-99.2

Published on February 16, 2017

Exhibit 99.2

Fourth Quarter 2016 Earnings Presentation

Forward-looking statements When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as will, believe, expect, anticipate, estimate, plan, continue, intend, should, could, would, may or similar expressions, are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions. Statements regarding the following subjects, among others, may be forward-looking: changes in interest rates and the market value of MFAs MBS; changes in the prepayment rates on the mortgage loans securing MFAs MBS, an increase of which could result in a reduction of the yield on MBS in our portfolio and could require us to reinvest the proceeds received by us as a result of such prepayments in MBS with lower coupons; credit risks underlying MFAs assets, including changes in the default rates and managements assumptions regarding default rates on the mortgage loans securing MFAs Non-Agency MBS and relating to MFAs residential whole loan portfolio; MFAs ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings; implementation of or changes in government regulations or programs affecting MFAs business; MFAs estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on Non-Agency MBS and residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFAs Agency MBS, Non-Agency MBS and residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals and whole loan modification, foreclosure and liquidation; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFAs Board of Directors and will depend on, among other things, MFAs taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as the Board deems relevant; MFAs ability to maintain its qualification as a REIT for federal income tax purposes; MFAs ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended (or the Investment Company Act), including statements regarding the Concept Release issued by the Securities and Exchange Commission (SEC) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage-related interests; MFAs ability to successfully implement its strategy to grow its residential whole loan portfolio; expected returns on our investments in non-performing residential whole loans (NPLs), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e.g., taxes, insurance, maintenance expenses, etc. on the underlying property) and the amount ultimately realized upon resolution of the asset; and risks associated with investing in real estate assets, including changes in business conditions and general economic conditions. These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the SEC, could cause MFAs actual results to differ materially from those projected in any forward-looking statements it makes. All forward-looking statements speak only as of the date on which they are made and are based on beliefs, assumptions and expectations of MFAs future performance, taking into account information currently available. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2

Executive summary In this historically low interest rate environment, we continue to generate attractive returns from residential credit mortgage assets. In the fourth quarter we generated EPS of $0.18. Despite recent interest rate increases, book value per share was little changed at $7.62 versus $7.64 at the end of the third quarter. MFA continued to acquire credit sensitive residential mortgage assets, such as 3 year step-up securities and credit sensitive loans, in response to attractive investment opportunities. 3

Through volatile markets and both interest rate and credit cycles, MFA has generated strong long term returns to investors (1) As of 12/31/16 assuming reinvestment of dividends. 4 Time PeriodAnnualized MFA Shareholder Return (1) Since January 1, 200015.0% 10 Year12.6% 5 Year16.2% 1 Year 28.8%

2017 Investment Strategy Be positioned for less predictable fiscal and monetary policy. 1. Focus on shorter term, less interest rate sensitive assets . 2. Blend mortgage credit exposure with interest rate exposure. Recently, investor expectations of improved economic performance due to the potential for tax cuts or increased infrastructure spending have negatively impacted interest rate sensitive assets while positively impacting credit sensitive assets. 3. Maintain staying power and the ability to invest in distressed, less liquid assets: Permanent equity capital Debt to equity ratio is low enough to accommodate potential declines in asset prices 5

Fourth quarter investment flows Our assets run off due to amortization, paydowns or sale, allowing reinvestment opportunities in changing interest rate and credit environments. $ in Millions 2016RunoffAcquisitionsother changes2016Change performing Loans$1,348 $(40)$98$(1)$1,405$57 Securities (1)$2,523$(319)$455$(4)$2,655$132 Securities$348$$54$3$405$57 (1) 3 year step-up securities are securitized financial instruments that are backed primarily by re-performing and non-performing loans. The majority of these securities are structured such that the coupon increases up to 300 basis points (bps) at 36 months or sooner. 6 September 30,4th Quarter4th QuarterMTM andDecember 31,4th Quarter Re-performing and Non-3 Year Step-up Credit Risk Transfer Legacy Non-Agency MBS$3,386$(200)$$(15)$3,171$(215) Agency MBS$4,022$(248)$$(36)$3,738$(284) Totals$11,627$(807)$607$(53)$11,374$(253)

MFAs yields and spreads remain attractive Earning Assets 4.34% 4.23% 4.19% 4.23% Rate Spread 2.12% 2.13% 2.14% 2.18% Equity Ratio 3.1x 3.1x 3.3x 3.4x 7 FourthThirdSecondFirst QuarterQuarterQuarterQuarter 2016201620162016 Yield on Interest Net Interest Debt to

Fourth quarter 2016 yields and spreads by asset type (1) Net of 38 bps of servicing costs. (2) These residential whole loans are held at fair value and produce GAAP income/loss based on changes in fair value in the current period, and therefore results will vary on a quarter-to-quarter basis. MFA expects to realize returns over time on these whole loan investments of 5-7%. 8 Debt/Net AssetYield/ReturnCost of FundsNet SpreadEquity Ratio Agency MBS1.92%(1.41)%0.51%7.7x Legacy Non-Agency MBS8.24%(3.01)%5.23%2.3x 3 Year Step-up Securities3.94%(2.16)%1.78%3.6x RPL Whole Loans5.61% (1) (3.02)%2.59%1.4x NPL Whole Loans(2) (3.12)%(2) 1.5x

MFAs interest rate sensitivity remains low, as measured by estimated net duration $ in Millions MTR: Months to reset 9 AssetsMarket ValueAverage CouponDuration Non-Agency ARMs (12 months or less MTR)$2,5383.38%0.4 3 Year Step-up Securities$2,6553.92%0.4 Non-Agency Fixed Rate$1,0385.82%3.0 Residential Whole Loans$1,4364.41%2.7 Agency ARMs (12 months or less MTR)$1,5203.07%0.6 Agency ARMs (13-120 MTR)$7762.93%1.8 Agency 15-Year Fixed Rate$1,4393.06%3.2 Cash, Cash Equivalents and Other Assets$4880.1 TOTAL ASSETS$11,8921.35 Hedging InstrumentsNotional AmountDuration Swaps (Less than 3 years)$1,100-1.2 Swaps (3-10 years)$1,800-3.6 TOTAL HEDGES$2,900-2.7 Estimated Net Duration0.71

MFAs book value changed little as rates rose dramatically in Q4 Over the last few years, MFA has consistently pursued a strategy of maintaining low sensitivity to interest rates. We have achieved this through: Asset selection. Our assets have low duration and very little sensitivity to long-term interest rates. Maintaining net duration below 1.0 by utilizing the appropriate amount of interest rate swap hedges. On 9/30/2016, MFAs low net duration was 0.55 and MFAs asset duration was 1.22. The 10-year UST increased by 85bp to 2.45% in the 4th quarter, the largest quarterly increase in the last sixteen years. The 2-year UST increased by 43bp to 1.20% resulting in a significant steepening of the yield curve. Due to a combination of low net duration and low sensitivity to long term interest rates, MFAs book value was preserved in a volatile quarter. 10

Millions ($) Q3-2013 Q4-2013 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015 Q1-2016 Q2-2016 Q3-2016 Q4-2016 Low sensitivity to prepayment rates Legacy Non-Agency MBS discount accretion has exceeded Agency MBS premium amortization since 2013. MFA's Agency MBS Premium Amortization and Legacy Non-Agency MBS Discount Accretion by quarter $30 $25 $20 $15 $10 $5 $0 Agency MBS Premium AmortizationLegacy Non-Agency MBS Discount Accretion 11

Continued positive fundamentals for residential mortgage credit Fundamental and technical support for residential credit assets and home prices. According to the National Association of Realtors: Total existing-home sales for calendar year 2016 were 5.45 million units, the highest level since 2006. The median existing home price in December 2016 was up 4.0% versus December 2015. Total housing inventory at the end of December 2016 was 1.65 million units, down 10.8% versus November 2016. CoreLogic reports that foreclosure inventory continues to decline. 12

Continued growth in credit sensitive loan portfolio Re-performing and Non-performing Loan Portfolio $ in Millions At todays market prices, Re-performing and Non-performing residential mortgage loans generate higher yields than residential MBS. Residential whole loans are qualifying interests for purposes of REIT qualification and Investment Company Act exemption. Significant expected supply. 13 December 31, 2016 September 30, 2016June 30, 2016March 31, 2016December 31, 2015 $1,405$1,348$1,077$1,024$895

Credit sensitive residential whole loans: Growing asset class for MFA Early results indicate returns to date are consistent with our expectation of 5-7%. Utilizes the same residential mortgage credit expertise we have employed in Legacy Non-Agency MBS since 2008. We believe that our oversight of servicing decisions (loan modifications, short sales, etc.) produces better NPV outcomes. Actively manages its loan portfolio through in-house asset management professionals and utilizes third-party special servicers. 14

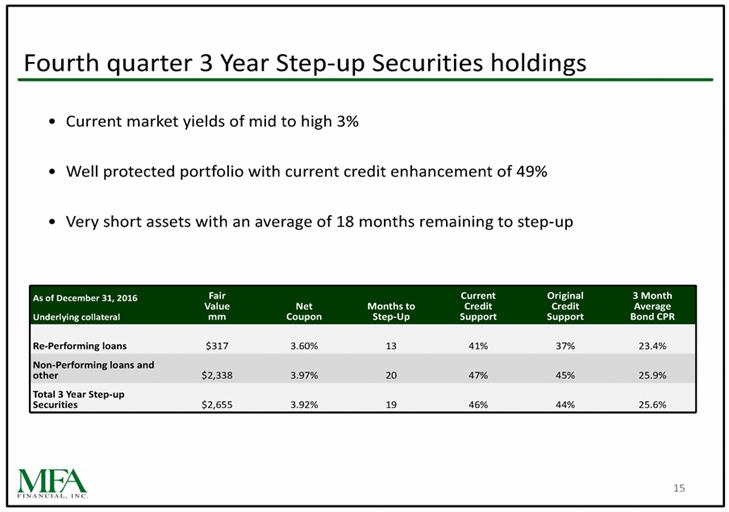

Fourth quarter 3 Year Step-up Securities holdings Current market yields of mid to high 3% Well protected portfolio with current credit enhancement of 49% Very short assets with an average of 18 months remaining to step-up ValueNetMonths toCreditCreditAverage 15 As of December 31, 2016FairCurrentOriginal3 Month Underlying collateralmmCouponStep-UpSupportSupportBond CPR Re-Performing loans$3173.60%1341%37%23.4% Non-Performing loans and other$2,3383.97%2047%45%25.9% Total 3 Year Step-up Securities$2,6553.92%1946%44%25.6%

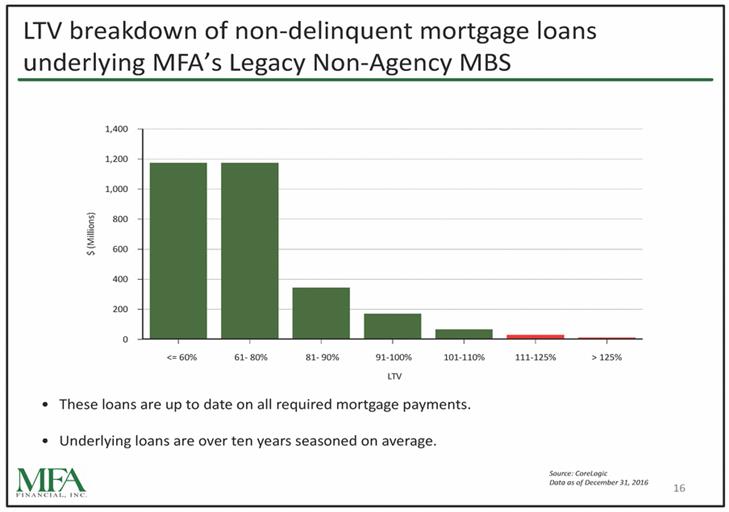

16 $ (Millions) LTV breakdown of non-delinquent mortgage loans underlying MFAs Legacy Non-Agency MBS 1,400 1,200 1,000 800 600 400 200 0 <= 60%61-80%81-90%91-100%101-110%111-125%> 125% LTV These loans are up to date on all required mortgage payments. Underlying loans are over ten years seasoned on average. Source: CoreLogic Data as of December 31, 2016

Summary Wecontinuetoidentifyandacquireattractivecreditsensitiveresidential mortgage assets. We continued to acquire 3 Year Step-Up Securities and credit sensitive mortgage loans during the fourth quarter of 2016. Our credit sensitive assets continue to perform well. MFA is well-positioned for changes in prepayment rates, monetary policy and/ or interest rates. 17

Additional Information 18

Despite recent interest rate increases, book value was largely unchanged for the quarter 19 Book value per common share as of 9/30/16$7.64 Net income available to common shareholders0.18 Common dividend declared during the quarter(0.20) Net change attributable to Agency MBS(0.07) Net change attributable to Non-Agency MBS and CRT securities(0.09) Net change in value of swap hedges0.16 Book value per common share as of 12/31/16$7.62

Fourth Quarter Non-Agency MBS impact on MFA book value Per Share(1) a discount. This income increases amortized cost and lowers unrealized gains(0.05) (1) Does not include impact of swap hedges. 20 Impact Impact of change in market prices$(0.02) Realized gains from asset sales: Reallocation from OCI to Retained Earnings(0.03) Discount Accretion: Primarily income in excess of coupon on Non-Agency MBS purchased at Principal Paydowns0.04 Realized Credit Losses(0.03) Total $(0.09)