EXHIBIT 99.2

Published on February 23, 2021

Exhibit 99.2

|

Fourth Quarter 2020 Earnings Presentation |

|

Forward looking statements When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements include information about possible or assumed future results with respect to our business, financial condition, liquidity, results of operations, plans and objectives. Statements regarding the following subjects, among others, may be forward-looking: risks related to the ongoing spread of the novel coronavirus and the COVID-19 pandemic, including the pandemic’s effect on the general economy and our business, financial position and results of operations (including, among other potential effects, increased delinquencies and greater than expected losses in our whole loan portfolio); changes in interest rates and the market (i.e., fair) value of MFA’s residential whole loans, MBS and other assets; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in its portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole loan portfolio; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings; implementation of or changes in government regulations or programs affecting MFA’s business; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals and whole loan modifications, foreclosures and liquidations; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as MFA’s Board deems relevant; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended (or the “Investment Company Act”), including statements regarding the concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage-related interests; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent on, among other things, the supply of loans offered for sale in the market; expected returns on MFA’s investments in nonperforming residential whole loans (“NPLs”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e.g., taxes, insurance, maintenance expenses, etc. on the underlying property) and the amount ultimately realized upon resolution of the asset; targeted or expected returns on MFA’s investments in recently-originated loans, the performance of which is, similar to MFA’s other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing cost associated with such investments; risks associated with MFA’s investments in MSR-related assets, including servicing, regulatory and economic risks, risks associated with our investments in loan originators, and risks associated with investing in real estate assets, including changes in business conditions and the general economy. These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the SEC, could cause MFA’s actual results to differ materially from those projected in any forward-looking statements it makes. All forward-looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account all information currently available. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA. Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |

|

Executive summary 2020 fourth quarter financial results and other highlights Investment portfolio and asset based financing composition Non-QM and BPL securitizations Apollo/Athene warrant position repurchased/exercised MFA share repurchase program 8% senior note redemption MFA recognition |

|

2020 fourth quarter financial results GAAP earnings of $0.08 per common share Continued strong contribution from whole loans accounted for at fair value $15.7 million net reversal of provision for credit losses Expenses of $25.3 million recognized on Apollo debt repayment GAAP book value was $4.54, down 1.5%, and Economic book value (EBV) was unchanged compared to September 30 at $4.92 Warrant transactions lowered GAAP book value by $0.18 and EBV by $0.19, or 3.9% Purchased 14.1 million shares under the share repurchase program. $0.03 accretive to GAAP book value and $0.04 accretive to EBV Leverage (debt to equity) was 1.7:1 as of December 31 $0.075 dividend paid to common stockholders on January 29 |

|

Other highlights Net interest income again increased and nearly doubled compared to Q3 Securitizations materially reduce interest expense Apollo/Athene debt paid off in October 8% senior notes redeemed on January 6, 2021 Took advantage of strong housing market to liquidate REO properties Sold 1,000 properties in 2020 for $271 million (2.5 times 2019 proceeds realized) Properties sold for an average of 105.9% of carrying value generating gains on disposal of $15.1 million MFA efforts since June 30 following exit from forbearance have generated meaningful results for shareholders as total shareholder return from June 30 through December 31, 2020 was 62% 5 |

|

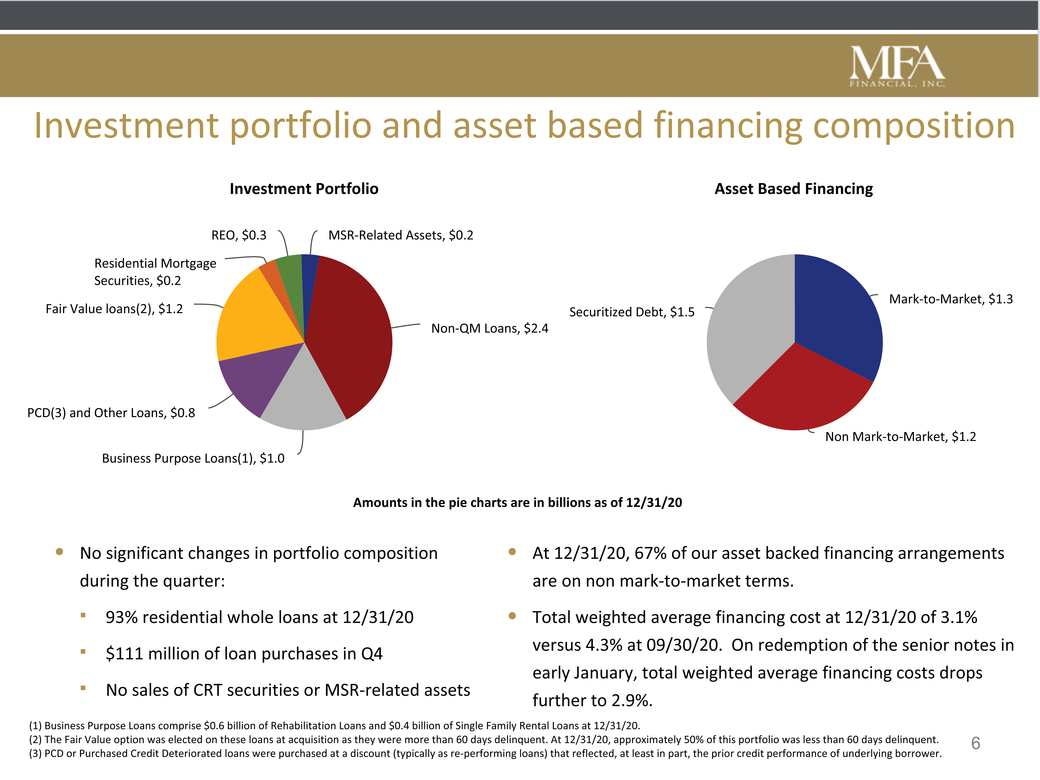

Investment portfolio and asset based financing composition Investment Portfolio Asset Based Financing REO, $0.3 Residential Mortgage Securities, $0.2 Fair Value loans(2), $1.2 PCD(3) and Other Loans, $0.8 Business Purpose Loans(1), $1.0 MSR-Related Assets, $0.2 Non-QM Loans, Securitized Debt, $1.5 Mark-to-Market, $1.3 Non Mark-to-Market, $1.2 $2.4 No significant changes in portfolio composition during the quarter: 93% residential whole loans at 12/31/20 $111 million of loan purchases in Q4 No sales of CRT securities or MSR-related assets At 12/31/20, 67% of our asset backed financing arrangements are on non mark-to-market terms. Total weighted average financing cost at 12/31/20 of 3.1% versus 4.3% at 09/30/20. On redemption of the senior notes in early January, total weighted average financing costs drops further to 2.9%. Business Purpose Loans comprise $0.6 billion of Rehabilitation Loans and $0.4 billion of Single Family Rental Loans at 12/31/20. The Fair Value option was elected on these loans at acquisition as they were more than 60 days delinquent. At 12/31/20, approximately 50% of this portfolio was less than 60 days delinquent.6 PCD or Purchased Credit Deteriorated loans were purchased at a discount (typically as re-performing loans) that reflected, at least in part, the prior credit performance of underlying borrower. |

|

Non-QM and BPL securitizations MFRA 2020-NQM2 ($570 mil) closed October 28, 2020 $405.4 million AAA’s sold at 1.34% yield Bonds sold represent 93.8% of UPB Blended cost of debt sold of 1.64% MFRA 2020-NQM3 ($381 mil) closed December 11, 2020 $264.5 mil AAA’s sold at 0.98% yield Bonds sold represent 94.2% of UPB Blended cost of debt sold of 1.30% MFRA 2021-INV1 ($217 mil) closed February 4, 2021 $149.0 mil AAA’s sold at 0.83% yield Bonds sold represent 91.0% of UPB Blended cost of debt sold of 1.06% 7 |

|

Apollo/Athene warrant position repurchased/exercised No warrants outstanding as of December 31, 2020 Apollo/Athene own 12.3 million shares (approximately 2.7%) Total dilution attributable to warrant package of less than 4% MFA repurchased 47.5% of warrants on December 10, 2020 17.6 million warrants purchased for $33.7 million Book value dilution of $0.07 per share or 1.6% Apollo/Athene exercised balance of warrant position on December 28, 2020 Combination of cash exercise and cashless (net share) exercise Payment to MFA of $6.5 million and issuance of 12.3 million shares Book value dilution of $0.11 per share or 2.3% 8 |

|

MFA share repurchase program MFA Board of Directors authorized $250 million share repurchase program 10b-18 program permits share repurchase during “open window” periods $50.7 million of common stock repurchases during the fourth quarter 14.1 million shares at an average price of $3.61 (including commissions) $0.03 per common share accretive to GAAP book value $0.04 per common share accretive to Economic book value $33.7millionApollo/Athenewarrantpurchasesincludedundershare repurchase program Permitted to purchase an additional $165.7 million of common stock at December 31, 2020 |

|

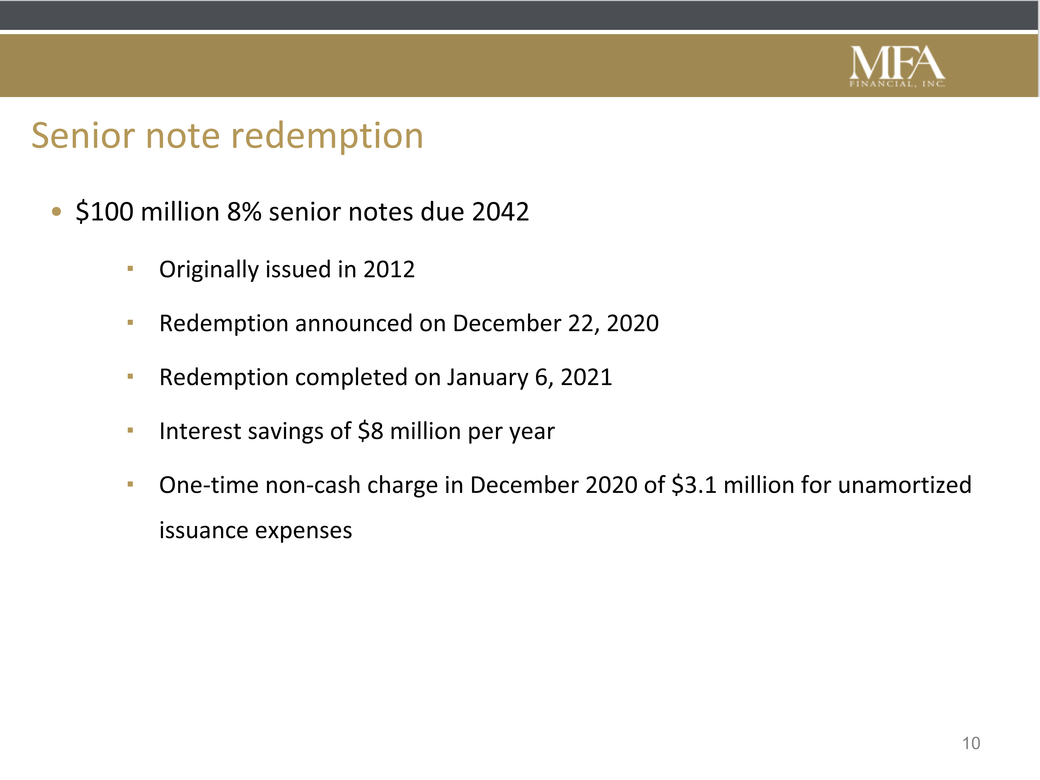

Senior note redemption $100 million 8% senior notes due 2042 Originally issued in 2012 Redemption announced on December 22, 2020 Redemption completed on January 6, 2021 Interest savings of $8 million per year One-time non-cash charge in December 2020 of $3.1 million for unamortized issuance expenses |

|

MFA recognition MFA Financial included in 2021 Bloomberg Gender Equality Index Second consecutive year of inclusion for MFA One of 380 global public companies in 11 sectors across 44 countries and regions Attestation of MFA’s commitment to and support of gender equality MFA Financial certified as a “Great Place to Work” (January 2021) Certified by Great Place to Work Institute, Inc. Based on employee validation through engagement survey ImportantaffirmationofMFA’scultureparticularlyintoday’sworldofvirtual recruitment MFA joins other financial services companies with this certification in NYC including Blackrock, American Express, Goldman Sachs, KKR, Blackstone and Neuberger Berman |

|

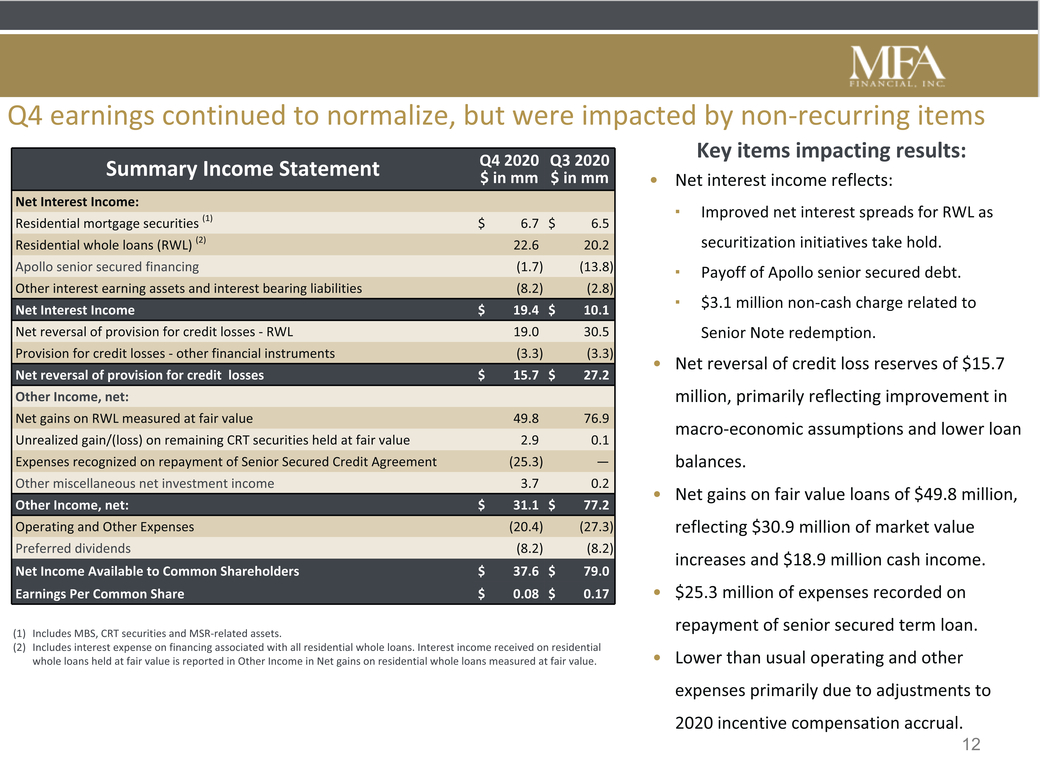

Q4 earnings continued to normalize, but were impacted by non-recurring items Summary Income Statement Q4 2020 Q3 2020 Net Interest Income: Residential mortgage securities (1) $ 6.7 $ 6.5 Residential whole loans (RWL) (2) 22.6 20.2 Apollo senior secured financing (1.7) (13.8) Other interest earning assets and interest bearing liabilities (8.2) (2.8) Net Interest Income $ 19.4 $ 10.1 Net reversal of provision for credit losses - RWL 19.0 30.5 Provision for credit losses - other financial instruments (3.3) (3.3) Net reversal of provision for credit losses $ 15.7 $ 27.2 Other Income, net: Net gains on RWL measured at fair value 49.8 76.9 Unrealized gain/(loss) on remaining CRT securities held at fair value 2.9 0.1 Expenses recognized on repayment of Senior Secured Credit Agreement (25.3) — Other miscellaneous net investment income 3.7 0.2 Other Income, net: $ 31.1 $ 77.2 Operating and Other Expenses (20.4) (27.3) Preferred dividends (8.2) (8.2) Net Income Available to Common Shareholders $ 37.6 $ 79.0 Earnings Per Common Share $ 0.08 $ 0.17 Includes MBS, CRT securities and MSR-related assets. $ in mm $ in mm Net interest income reflects: Improved net interest spreads for RWL as securitization initiatives take hold. Payoff of Apollo senior secured debt. $3.1 million non-cash charge related to Senior Note redemption. Net reversal of credit loss reserves of $15.7 million, primarily reflecting improvement in macro-economic assumptions and lower loan balances. Net gains on fair value loans of $49.8 million, reflecting $30.9 million of market value increases and $18.9 million cash income. $25.3 million of expenses recorded on repayment of senior secured term loan. Includes interest expense on financing associated with all residential whole loans. Interest income received on residential whole loans held at fair value is reported in Other Income in Net gains on residential whole loans measured at fair value. Lower than usual operating and other expenses primarily due to adjustments to 2020 incentive compensation accrual. |

|

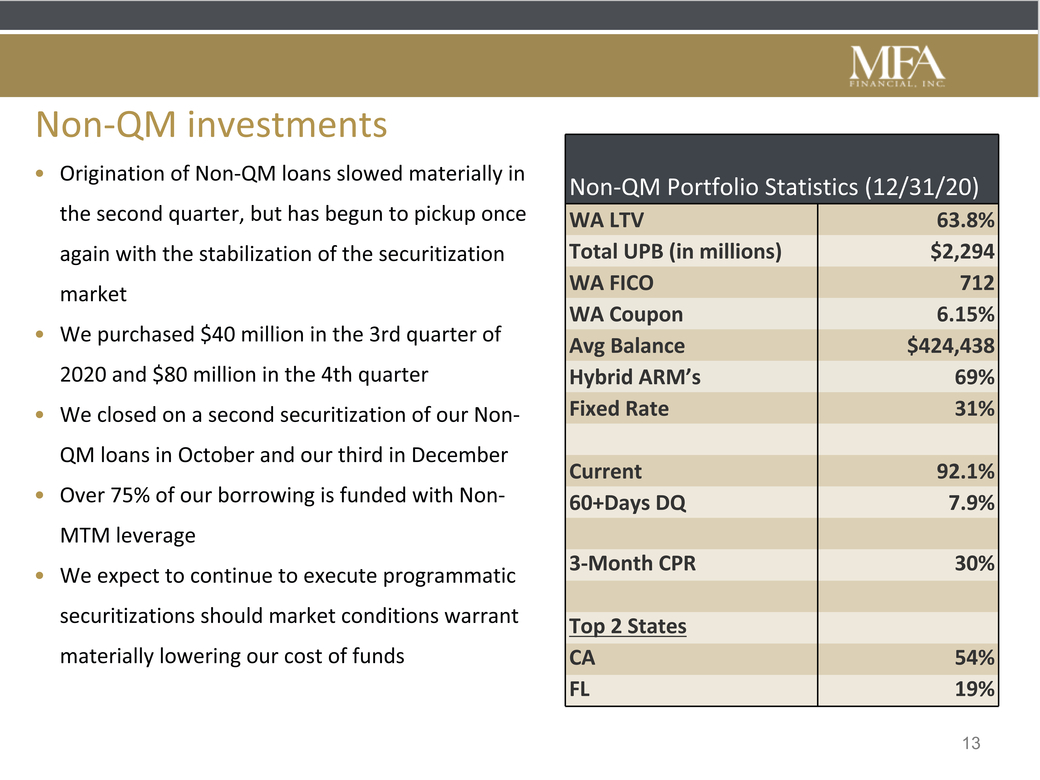

Non-QM Portfolio Statistics (12/31/20) WA LTV 63.8% Total UPB (in millions) $2,294 WA FICO 712 WA Coupon 6.15% Avg Balance $424,438 Hybrid ARM’s 69% Fixed Rate 31% Current 92.1% 60+Days DQ 7.9% 3-Month CPR 30% Top 2 States CA 54% FL 19% Origination of Non-QM loans slowed materially in the second quarter, but has begun to pickup once again with the stabilization of the securitization market We purchased $40 million in the 3rd quarter of 2020 and $80 million in the 4th quarter We closed on a second securitization of our Non-QM loans in October and our third in December Over 75% of our borrowing is funded with Non-MTM leverage We expect to continue to execute programmatic securitizations should market conditions warrant materially lowering our cost of funds |

|

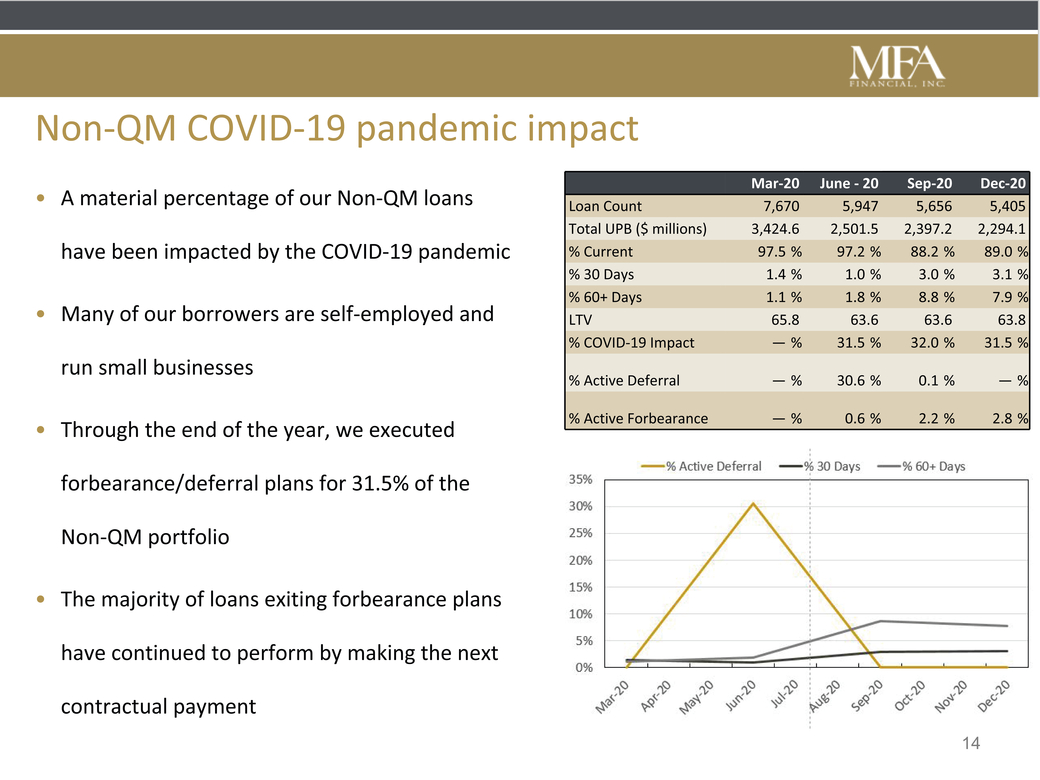

Non-QM COVID-19 pandemic impact Mar-20June - 20 Sep-20 Dec-20 Loan Count 7,670 5,947 5,656 5,405 Total UPB ($ millions) 3,424.6 2,501.5 2,397.2 2,294.1 % Current 97.5 % 97.2 % 88.2 % 89.0 % % 30 Days 1.4 % 1.0 % 3.0 % 3.1 % % 60+ Days 1.1 % 1.8 % 8.8 % 7.9 % LTV 65.8 63.6 63.6 63.8 % COVID-19 Impact — % 31.5 % 32.0 % 31.5 % % Active Deferral — % 30.6 % 0.1 % — % % Active Forbearance — % 0.6 % 2.2 % 2.8 % Many of our borrowers are self-employed and run small businesses Through the end of the year, we executed forbearance/deferral plans for 31.5% of the Non-QM portfolio The majority of loans exiting forbearance plans have continued to perform by making the next contractual payment |

|

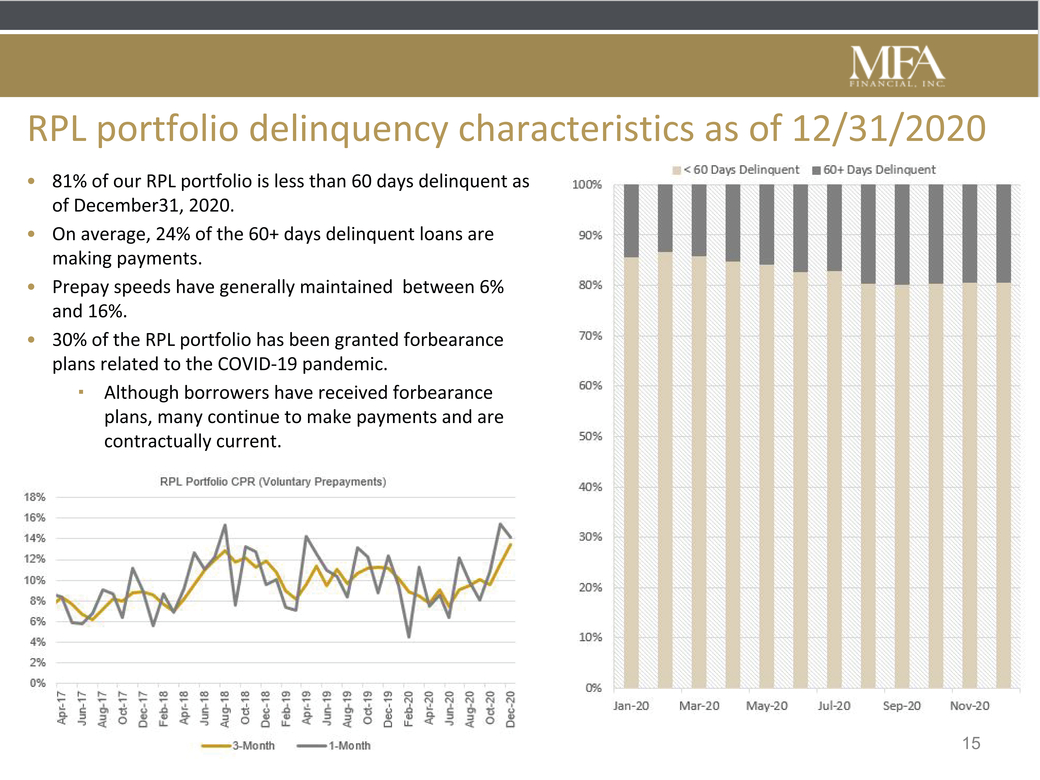

RPL portfolio delinquency characteristics as of 12/31/2020 81% of our RPL portfolio is less than 60 days delinquent as of December31, 2020. On average, 24% of the 60+ days delinquent loans are making payments. Prepay speeds have generally maintained between 6% and 16%. 30% of the RPL portfolio has been granted forbearance plans related to the COVID-19 pandemic. Although borrowers have received forbearance plans, many continue to make payments and are contractually current. 15 |

|

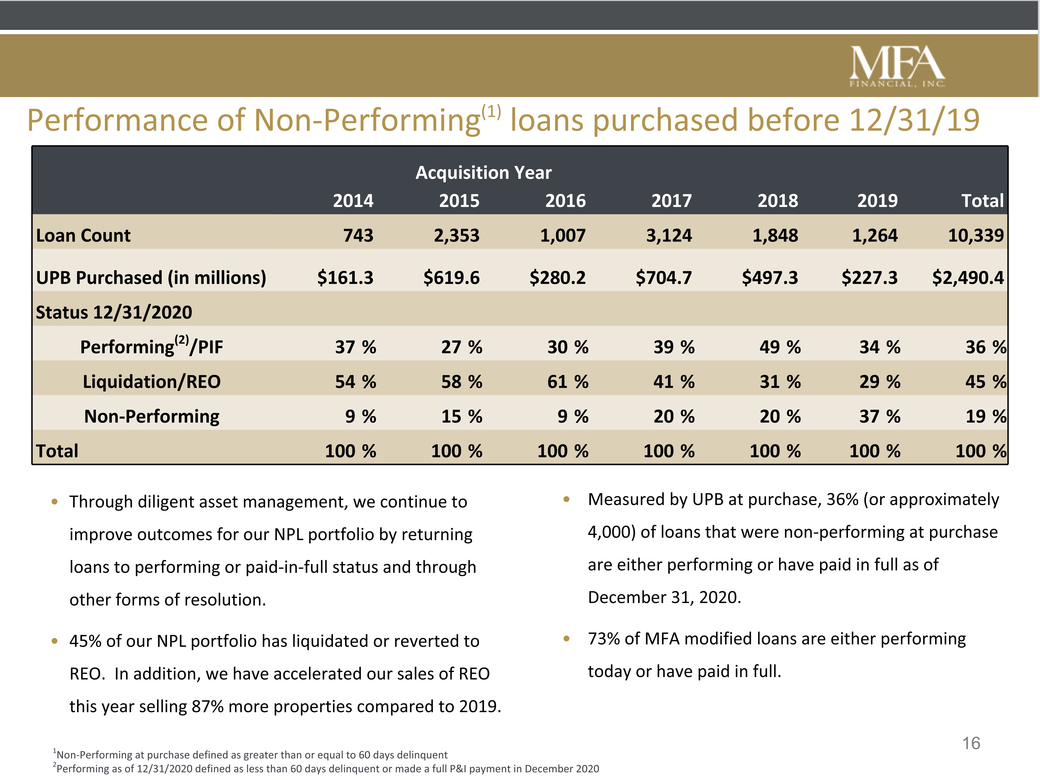

Performance of Non-Performing(1) loans purchased before 12/31/19 Through diligent asset management, we continue to improve outcomes for our NPL portfolio by returning loans to performing or paid-in-full status and through other forms of resolution. 45% of our NPL portfolio has liquidated or reverted to REO. In addition, we have accelerated our sales of REO this year selling 87% more properties compared to 2019. Measured by UPB at purchase, 36% (or approximately 4,000) of loans that were non-performing at purchase are either performing or have paid in full as of December 31, 2020. 73% of MFA modified loans are either performing today or have paid in full. 16 1Non-Performing at purchase defined as greater than or equal to 60 days delinquent 2Performing as of 12/31/2020 defined as less than 60 days delinquent or made a full P&I payment in December 2020 |

|

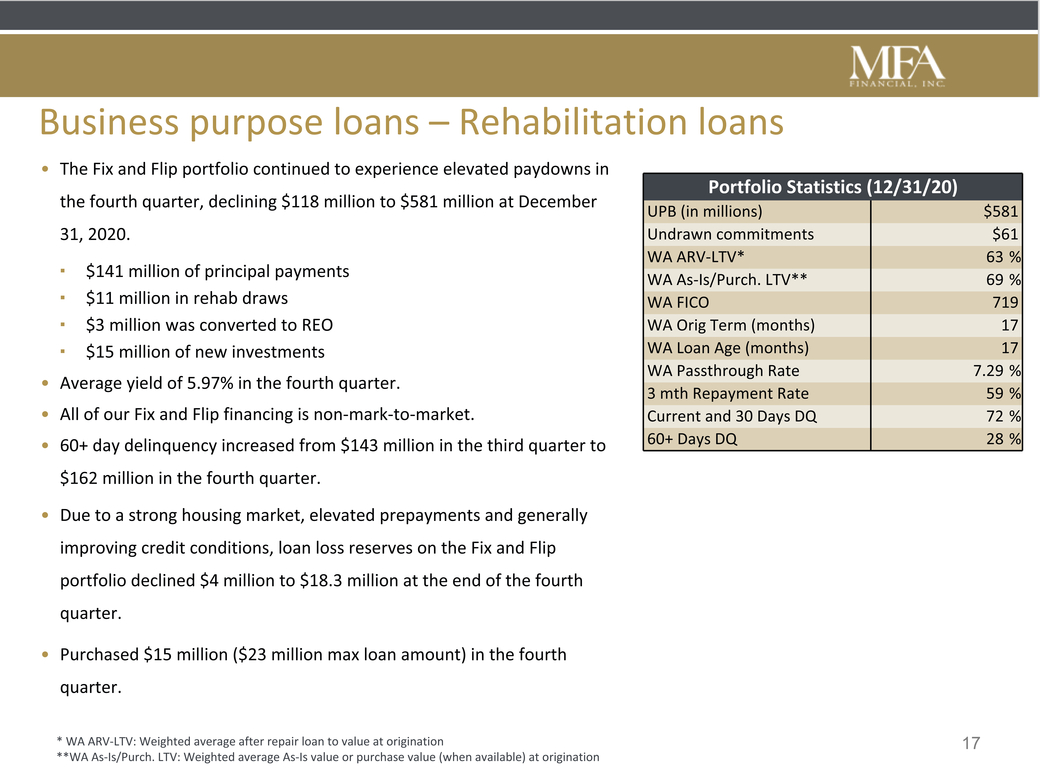

Business purpose loans – Rehabilitation loans Portfolio Statistics (12/31/20) UPB (in millions) $581 Undrawn commitments $61 WA ARV-LTV* 63 % WA As-Is/Purch. LTV** 69 % WA FICO 719 WA Orig Term (months) 17 WA Loan Age (months) 17 WA Passthrough Rate 7.29 % 3 mth Repayment Rate 59 % Current and 30 Days DQ 72 % 60+ Days DQ 28 % $141 million of principal payments $11 million in rehab draws $3 million was converted to REO $15 million of new investments Average yield of 5.97% in the fourth quarter. All of our Fix and Flip financing is non-mark-to-market. 60+ day delinquency increased from $143 million in the third quarter to $162 million in the fourth quarter. Due to a strong housing market, elevated prepayments and generally improving credit conditions, loan loss reserves on the Fix and Flip portfolio declined $4 million to $18.3 million at the end of the fourth quarter. Purchased $15 million ($23 million max loan amount) in the fourth quarter. * WA ARV-LTV: Weighted average after repair loan to value at origination17 **WA As-Is/Purch. LTV: Weighted average As-Is value or purchase value (when available) at origination |

|

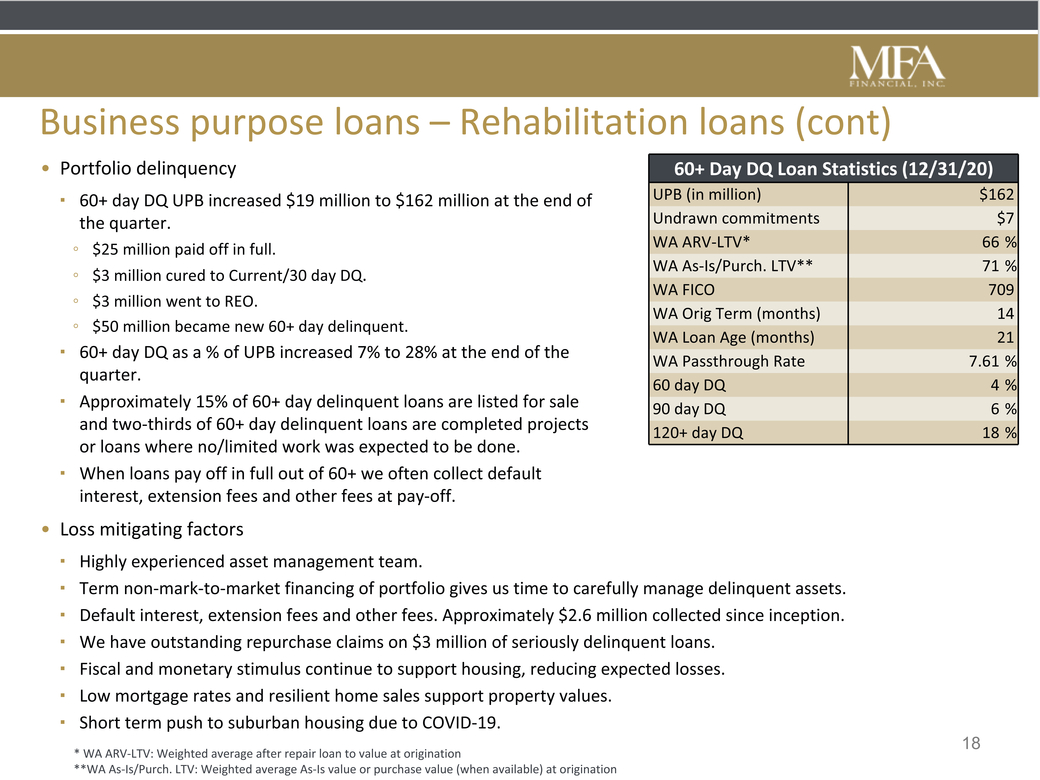

Business purpose loans – Rehabilitation loans (cont) 60+ Day DQ Loan Statistics (12/31/20) UPB (in million) $162 Undrawn commitments $7 WA ARV-LTV* 66 % WA As-Is/Purch. LTV** 71 % WA FICO 709 WA Orig Term (months) 14 WA Loan Age (months) 21 WA Passthrough Rate 7.61 % 60 day DQ 4 % 90 day DQ 6 % 120+ day DQ 18 % 60+ day DQ UPB increased $19 million to $162 million at the end of the quarter. $25 million paid off in full. $3 million cured to Current/30 day DQ. $3 million went to REO. $50 million became new 60+ day delinquent. 60+ day DQ as a % of UPB increased 7% to 28% at the end of the quarter. Approximately 15% of 60+ day delinquent loans are listed for sale and two-thirds of 60+ day delinquent loans are completed projects or loans where no/limited work was expected to be done. When loans pay off in full out of 60+ we often collect default interest, extension fees and other fees at pay-off. Loss mitigating factors Highly experienced asset management team. Term non-mark-to-market financing of portfolio gives us time to carefully manage delinquent assets. Default interest, extension fees and other fees. Approximately $2.6 million collected since inception. We have outstanding repurchase claims on $3 million of seriously delinquent loans. Fiscal and monetary stimulus continue to support housing, reducing expected losses. Low mortgage rates and resilient home sales support property values. Short term push to suburban housing due to COVID-19. 18 * WA ARV-LTV: Weighted average after repair loan to value at origination **WA As-Is/Purch. LTV: Weighted average As-Is value or purchase value (when available) at origination |

|

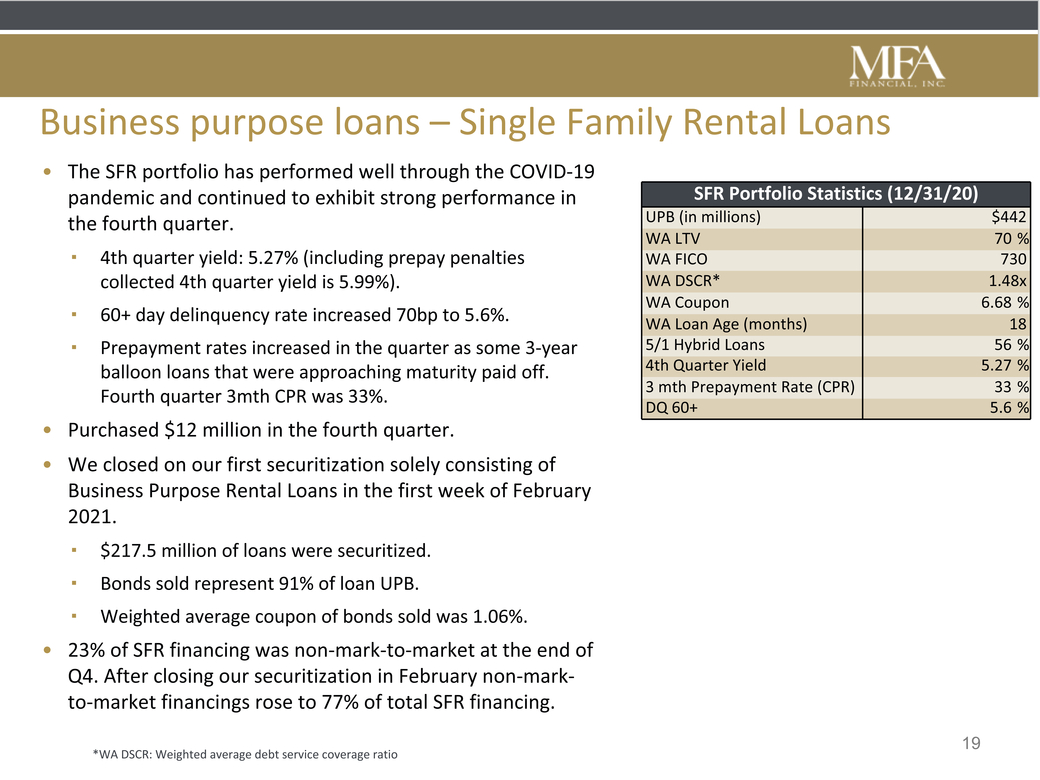

Business purpose loans – Single Family Rental Loans SFR Portfolio Statistics (12/31/20) UPB (in millions) $442 WA LTV 70 % WA FICO 730 WA DSCR* 1.48x WA Coupon 6.68 % WA Loan Age (months) 18 5/1 Hybrid Loans 56 % 4th Quarter Yield 5.27 % 3 mth Prepayment Rate (CPR) 33 % DQ 60+ 5.6 % 4th quarter yield: 5.27% (including prepay penalties collected 4th quarter yield is 5.99%). 60+ day delinquency rate increased 70bp to 5.6%. Prepayment rates increased in the quarter as some 3-year balloon loans that were approaching maturity paid off. Fourth quarter 3mth CPR was 33%. Purchased $12 million in the fourth quarter. We closed on our first securitization solely consisting of Business Purpose Rental Loans in the first week of February 2021. $217.5 million of loans were securitized. Bonds sold represent 91% of loan UPB. Weighted average coupon of bonds sold was 1.06%. 23% of SFR financing was non-mark-to-market at the end of Q4. After closing our securitization in February non-mark-to-market financings rose to 77% of total SFR financing. 19 *WA DSCR: Weighted average debt service coverage ratio |

|

Summary Fourth quarter results and book value primarily reflect stabilizing mortgage markets, resulting in continued recovery of asset vales and lower CECL credit reserves. Successful execution of securitization transactions has generated substantial liquidity and positively impacted our cost of funds. Securitized debt has added benefit of being non-recourse term financing without mark-to-market collateral maintenance. Results were also impacted by certain one-time items, particularly related to repayment of the Apollo/Athene loan as well as the repurchase and exercise of the associated warrants. We enter 2021 with a significantly strengthened balance sheet, substantial liquidity and demonstrated securitization capability across multiple loan products. We anticipate that continued use of loan securitization will further lower financing costs, which should drive earnings and return on equity. |

|

Additional Information |

|

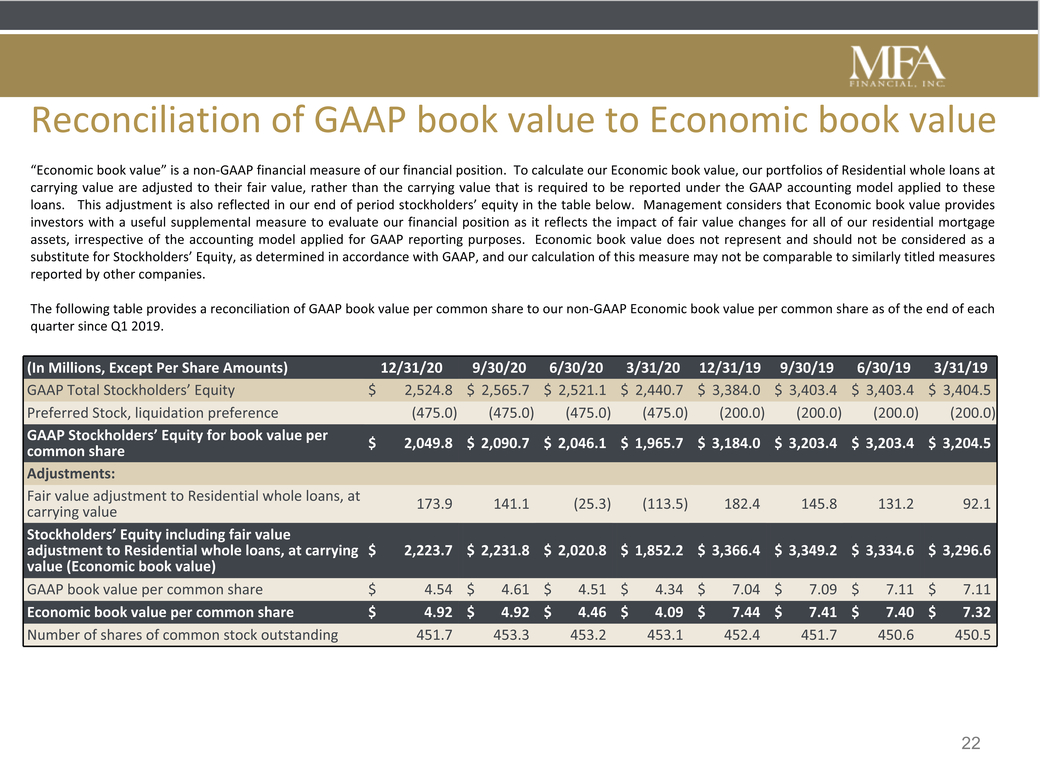

Reconciliation of GAAP book value to Economic book value “Economic book value” is a non-GAAP financial measure of our financial position. To calculate our Economic book value, our portfolios of Residential whole loans at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these loans. This adjustment is also reflected in our end of period stockholders’ equity in the table below. Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our residential mortgage assets, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies. The following table provides a reconciliation of GAAP book value per common share to our non-GAAP Economic book value per common share as of the end of each quarter since Q1 2019. |

|

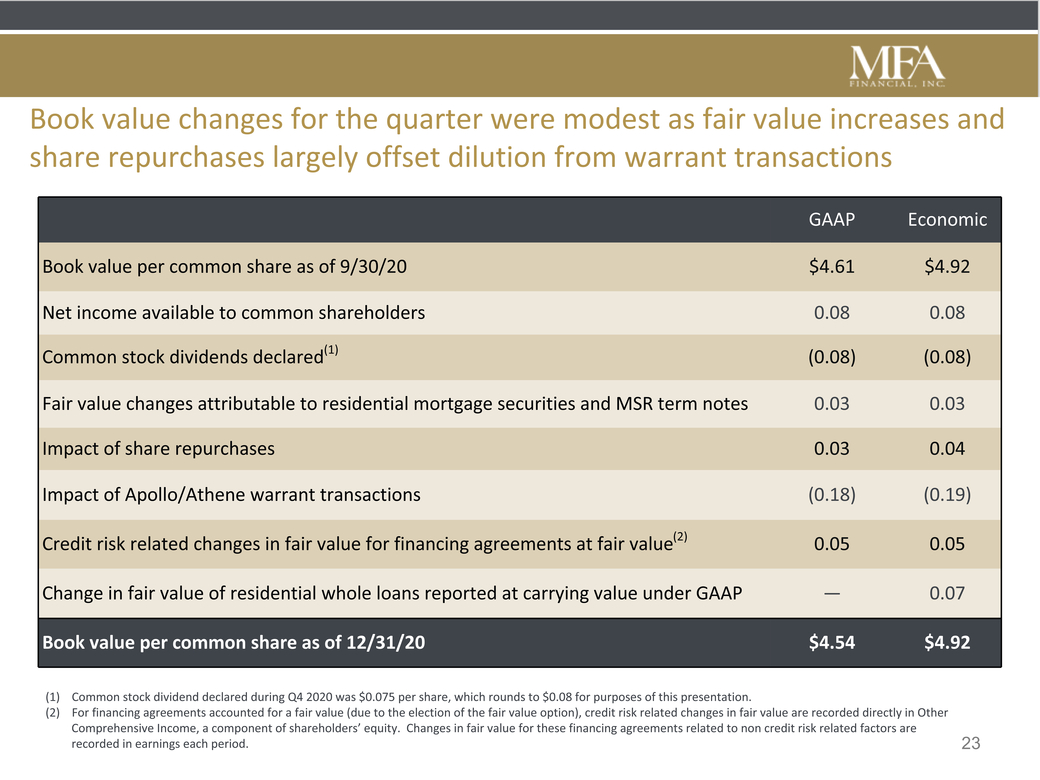

Book value changes for the quarter were modest as fair value increases and share repurchases largely offset dilution from warrant transactions Common stock dividend declared during Q4 2020 was $0.075 per share, which rounds to $0.08 for purposes of this presentation. For financing agreements accounted for a fair value (due to the election of the fair value option), credit risk related changes in fair value are recorded directly in Other Comprehensive Income, a component of shareholders’ equity. Changes in fair value for these financing agreements related to non credit risk related factors are recorded in earnings each period.23 |

|

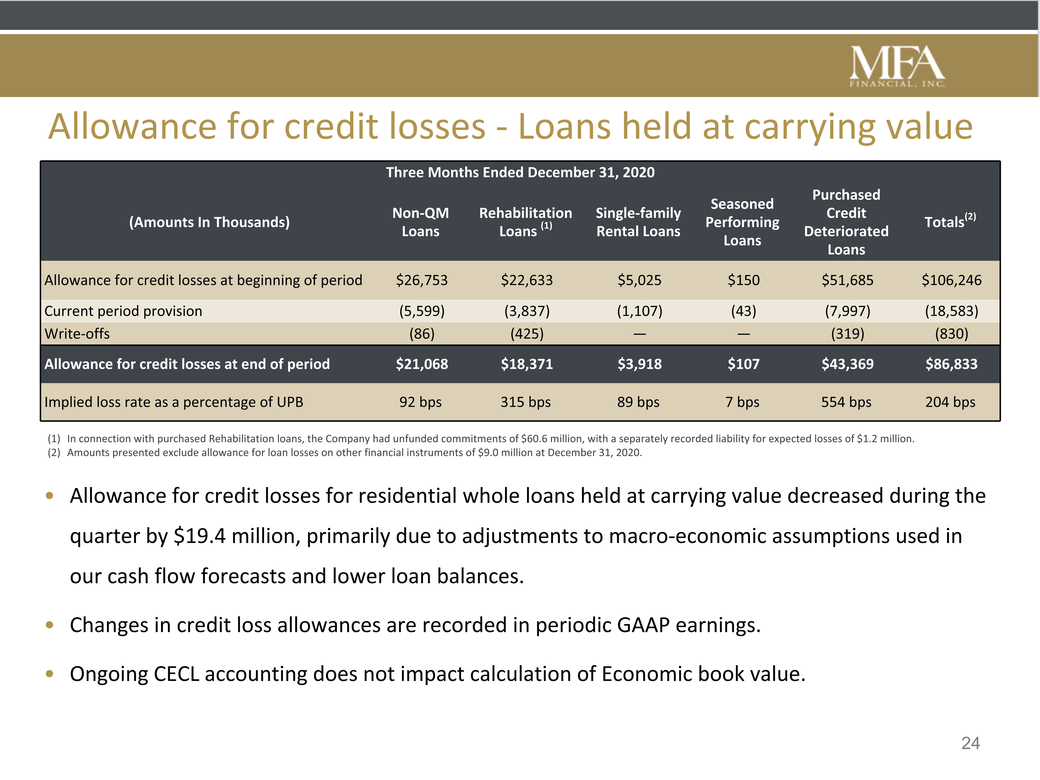

Allowance for credit losses - Loans held at carrying value In connection with purchased Rehabilitation loans, the Company had unfunded commitments of $60.6 million, with a separately recorded liability for expected losses of $1.2 million. Amounts presented exclude allowance for loan losses on other financial instruments of $9.0 million at December 31, 2020. Allowance for credit losses for residential whole loans held at carrying value decreased during the quarter by $19.4 million, primarily due to adjustments to macro-economic assumptions used in our cash flow forecasts and lower loan balances. Changes in credit loss allowances are recorded in periodic GAAP earnings. Ongoing CECL accounting does not impact calculation of Economic book value. 24 |