EXHIBIT 99.2

Published on November 3, 2022

|

Company Update THIRD QUARTER 2022 DRAFT 10/27 Company Update THIRD QUARTER 2022 |

|

2 Q2 202 2 Financial Snapshot Forward looking statements When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions .. These forward - looking statements include information about possible or assumed future results with respect to our business, financial condition, liquidity, results of operations, plans and objectives .. Among the important factors that could cause our actual results to differ materially from those projected in any forward - looking statements we make are : changes in inflation and interest rates and the market (i .. e .. , fair) value of MFA’s residential whole loans, Mortgage - Backed Securities (“ MBS “) , securitized debt and other assets , as well as changes in the value of liabilities accounted for at fair value through earnings, the effectiveness of hedging transactions ; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in MFA’s portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows ; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole loan portfolio ; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings ; implementation of or changes in government regulations or programs affecting MFA’s business ; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals and whole loan modifications, foreclosures and liquidations ; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board of Directors and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of it s qualification as a real estate investment trust (REIT) and such other factors as MFA’s Board deems relevant ; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes ; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940 , as amended (or the “Investment Company Act”), including statements regarding the concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage - related interests ; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent on, among other things, the supply of loans offered for sale in the market ; targeted or expected returns on MFA’s investments in recently - originated loans, the performance of which is, similar to MFA’s other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing cost associated with such investments ; risks associated with the ongoing operation of Lima One Holdings, LLC (including, without limitation, unanticipated expenditures relating to or liabilities arising from its operation (including, among other things, a failure to realize management’s assumptions regarding expected growth in business purpose loan (BPL) origination volumes and credit risks underlying BPLs, including changes in the default rates and management’s assumptions regarding default rates on the BPLs originated by Lima One ) ; expected returns on MFA’s investments in nonperforming residential whole loans (“NPLs”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e .. g .. , taxes, insurance, maintenance expenses, etc .. on the underlying property) and the amount ultimately realized upon resolution of the asset ; risks associated with MFA’s investments in MSR - related assets, including servicing, regulatory and economic risks, risks associated with our investments in loan originators ; and risks associated with investing in real estate assets generally , including changes in business conditions and the general economy ; and other risks, uncertainties and factors described in the annual, quarterly and current reports that MFA files with the SEC .. All forward - looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account all information currently available .. Readers and listeners are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they are made .. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA .. Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .. |

|

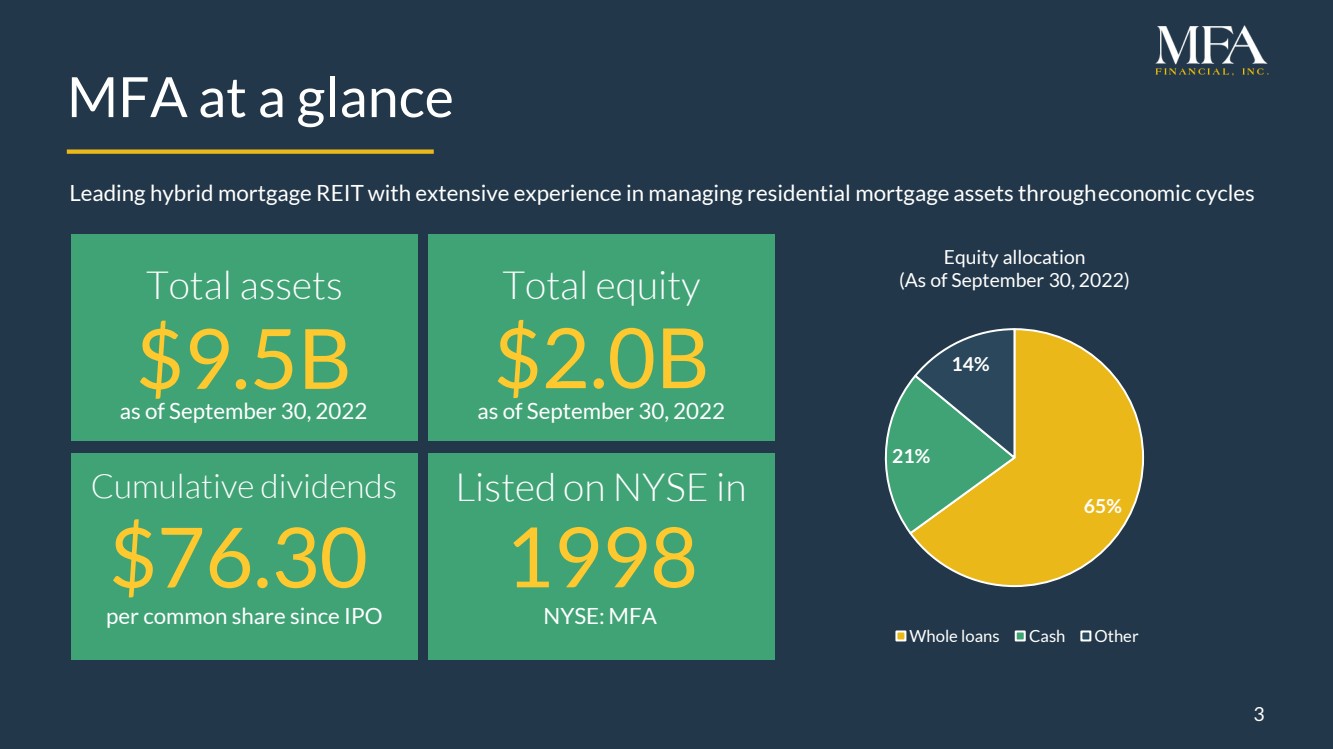

3 MFA at a glance 3 $2.0B Total equity $76.30 Cumulative dividends Leading hybrid mortgage REIT with extensive experience in managing residential mortgage assets through economic cycles $9.5B Total assets p er common share since IPO 1998 Listed on NYSE in a s of September 30, 2022 a s of September 30, 2022 65% 21% 14% Equity allocation (As of September 30, 2022) Whole loans Cash Other NYSE: MFA |

|

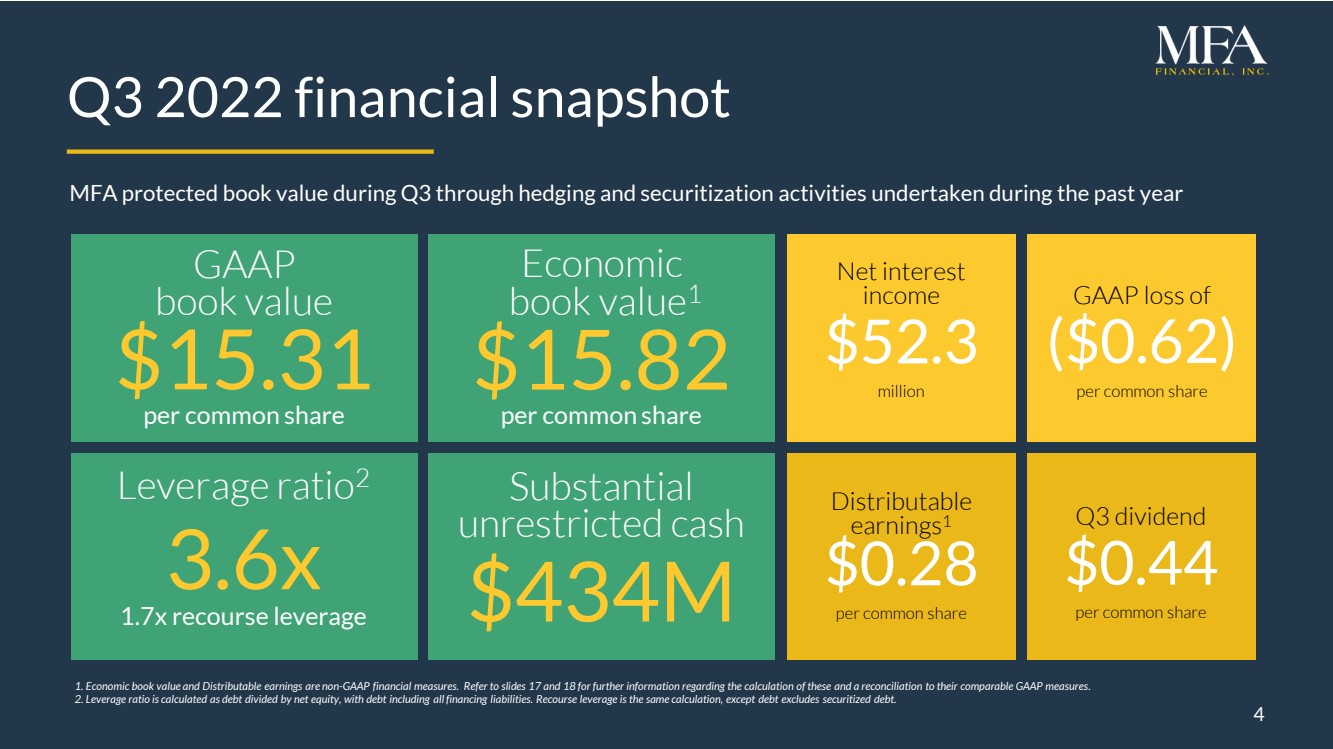

4 Q 3 202 2 f inancial snapshot 1. Economic book value and Distributable e arnings are n on - GAAP financial measures. Refer to slides 17 and 18 for further information regarding the calculation of these and a reconciliation to their comparable GAAP measures .. 2. Leverage ratio is calculated as debt divided by net equity, with d ebt including all financing liabilities .. Recourse leverage is the same calculation, except debt excludes securitized debt. MFA protected book value during Q3 through hedging and securitization activities undertaken during the past year $15.31 $15.82 Net interest income $ 52.3 million GAAP loss of ($0.62) per common share Distributable earnings 1 $0.28 per common share Q3 dividend $ 0.44 per common share GAAP book value Economic book value 1 per common share per common share $434M Substantial unrestricted cash 3.6x 1.7x recourse leverage Leverage ratio 2 4 |

|

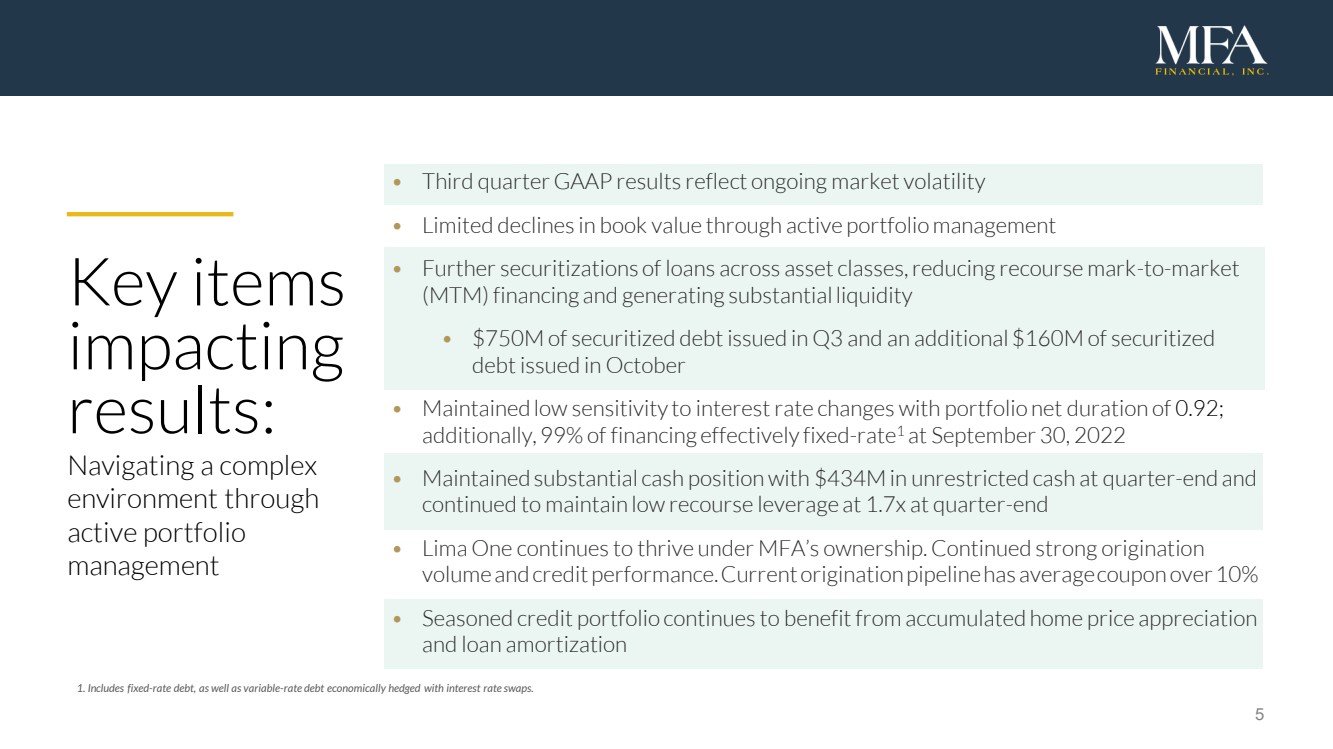

5 Key items impacting results: Navigating a complex environment through active portfolio management 1. Includes fixed - rate debt, as well as variable - rate debt economically hedged with interest rate swaps. • Third quarter GAAP results reflect ongoing market volatility • Limited declines in book value through active portfolio management • Further securitizations of loans across asset classes, reducing recourse mark - to - market (MTM) financing and generating substantial liquidity • $ 750M of securitized debt issued in Q3 and an additional $160M of securitized debt issued in October • Maintained low sensitivity to interest rate changes with portfolio net duration of 0.92; additionally, 99 % of financing effectively fixed - rate 1 at September 30, 2022 • Maintained substantial cash position with $4 34M in unrestricted cash at quarter - end and continued to maintain low recourse leverage at 1.7x at quarter - end • Lima One continues to thrive under MFA’s ownership. Continued strong origination volume and credit performance. Current origination pipeline has average coupon over 10% • Seasoned credit portfolio continues to benefit from accumulated home price appreciation and loan amortization |

|

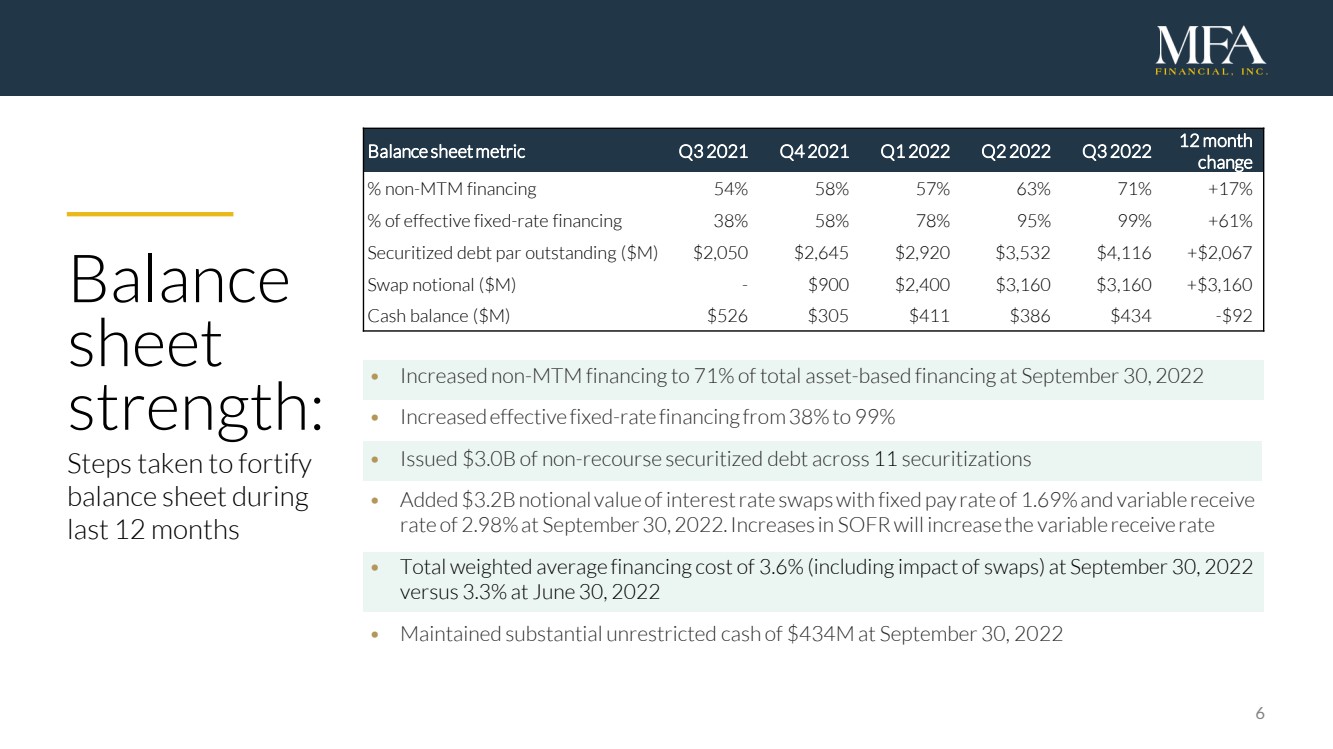

6 Balance sheet strength : Steps taken to fortify balance sheet during last 12 months • Increased non - MTM financing to 71% of total asset - based financing at September 30, 2022 • Increased effective fixed - rate financing from 38% to 99 % • Issued $ 3.0B of non - recourse securitized debt across 11 securitizations • Added $3.2B notional value of interest rate swaps with fixed pay rate of 1.69% and variable receive rate of 2.98% at September 30, 2022. Increases in SOFR will increase the variable receive rate • Total weighted average financing cost of 3.6% (including impact of swaps) at September 30, 2022 versus 3.3% at June 30, 2022 • Maintained substantial unrestricted cash of $434M at September 30, 2022 Balance sheet metric Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 12 month change % non - MTM financing 54% 58% 57% 63% 71% +17% % of effective fixed - rate financing 38% 58% 78% 95% 99% +61% Securitized debt par outstanding ($M) $2,050 $2,645 $2,920 $3,532 $4,116 +$2,067 Swap notional ($M) - $900 $2,400 $3,160 $3,160 +$3,160 Cash balance ($M) $526 $305 $411 $386 $ 434 - $92 |

|

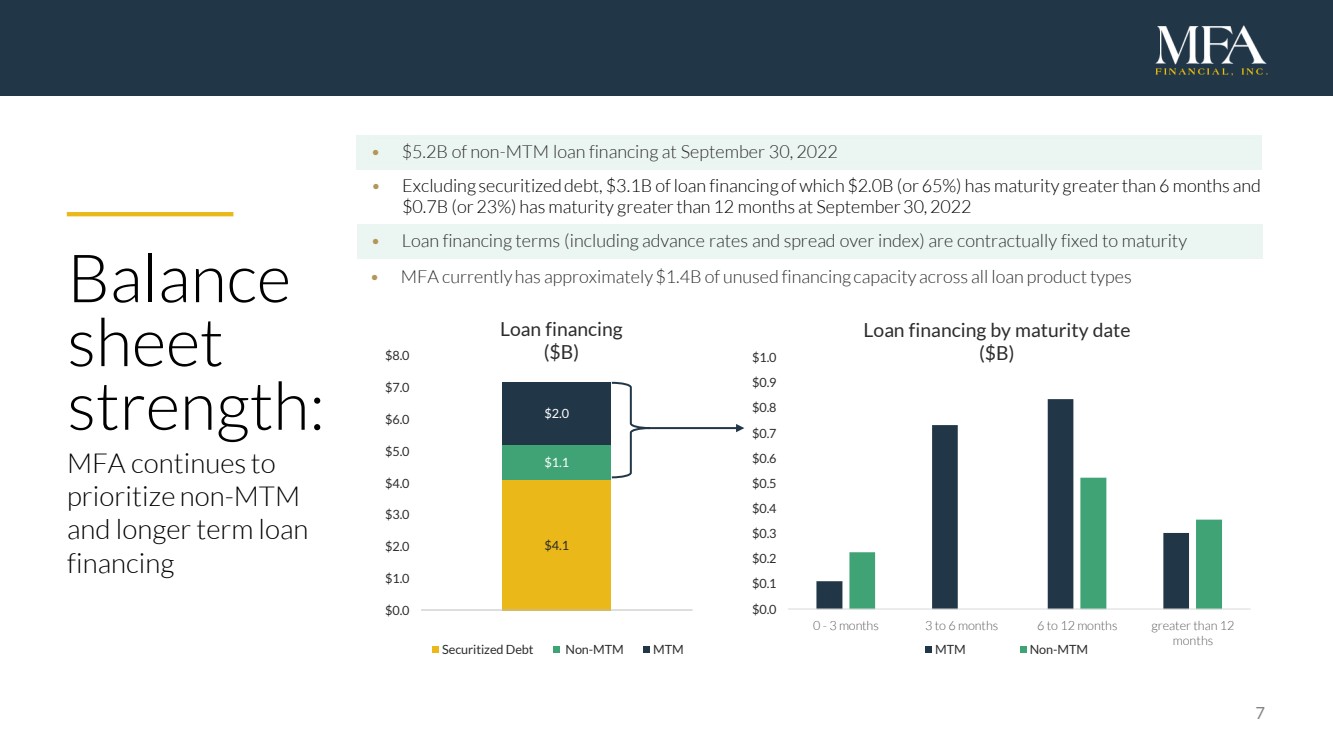

$4.1 $1.1 $2.0 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 1 Loan financing ($ B) Securitized Debt Non-MTM MTM $0.0 $0.1 $0.2 $0.3 $0.4 $0.5 $0.6 $0.7 $0.8 $0.9 $1.0 0 - 3 months 3 to 6 months 6 to 12 months greater than 12 months Loan financing by maturity date ($B) MTM Non-MTM 7 Balance sheet strength : MFA continues to prioritize non - MTM and longer term loan financing • Excluding securitized debt, $3.1B of loan financing of which $2.0B (or 65%) has maturity greater than 6 months and $ 0.7B (or 23%) has maturity greater than 12 months at September 30, 2022 • $5.2B of non - MTM loan financing at September 30, 2022 • Loan financing terms (including advance rates and spread over index) are contractually fixed to maturity • MFA currently has approximately $ 1.4B of unused financing capacity across all loan product types |

|

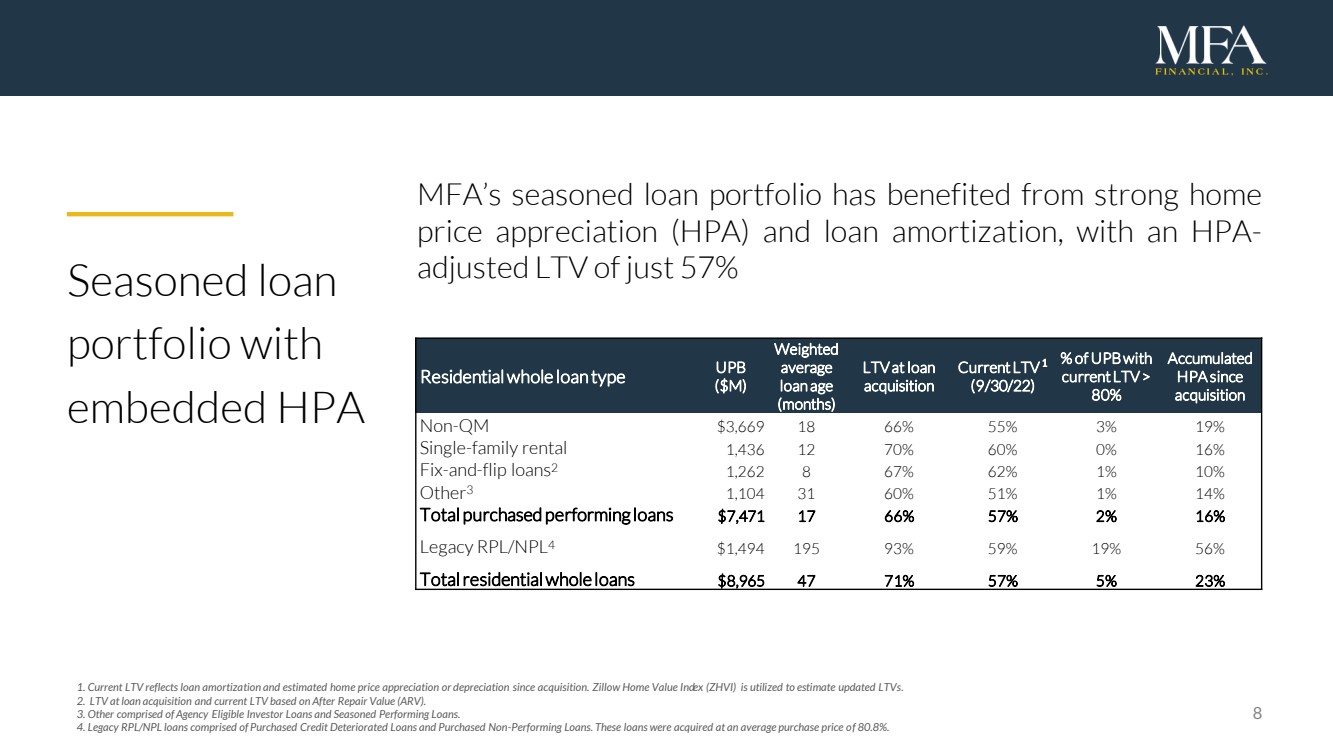

Seasoned loan portfolio with embedded HPA 8 1. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home Value Ind ex (ZHVI) is utilized to estimate updated LTVs .. 2. LTV at loan acquisition and current LTV based on After Repair Value (ARV). 3. Other comprised of Agency Eligible Investor Loans and Seasoned Performing Loans. 4. Legacy RPL/NPL loans comprised of Purchased Credit Deteriorated Loans and Purchased Non - Performing Loans. These loans were acquired at an average purchase price o f 80.8%. MFA’s seasoned loan portfolio has benefited from strong home price appreciation (HPA) and loan amortization, with an HPA - adjusted LTV of just 57 % Residential whole loan type UPB ($M) Weighted average loan age (months) LTV at loan acquisition Current LTV 1 (9/30/22) % of UPB with current LTV > 80% Accumulated HPA since acquisition Non - QM $3,669 18 66% 55% 3% 19% Single - family rental 1,436 12 70% 60% 0% 16% Fix - and - flip loans 2 1,262 8 67% 62% 1% 10% Other 3 1,104 31 60% 51% 1% 14% Total purchased performing loans $7,471 17 66% 57% 2% 16% Legacy RPL/NPL 4 $1,494 195 93% 59% 19% 56% Total residential whole l oans $8,965 47 71% 57% 5% 23% |

|

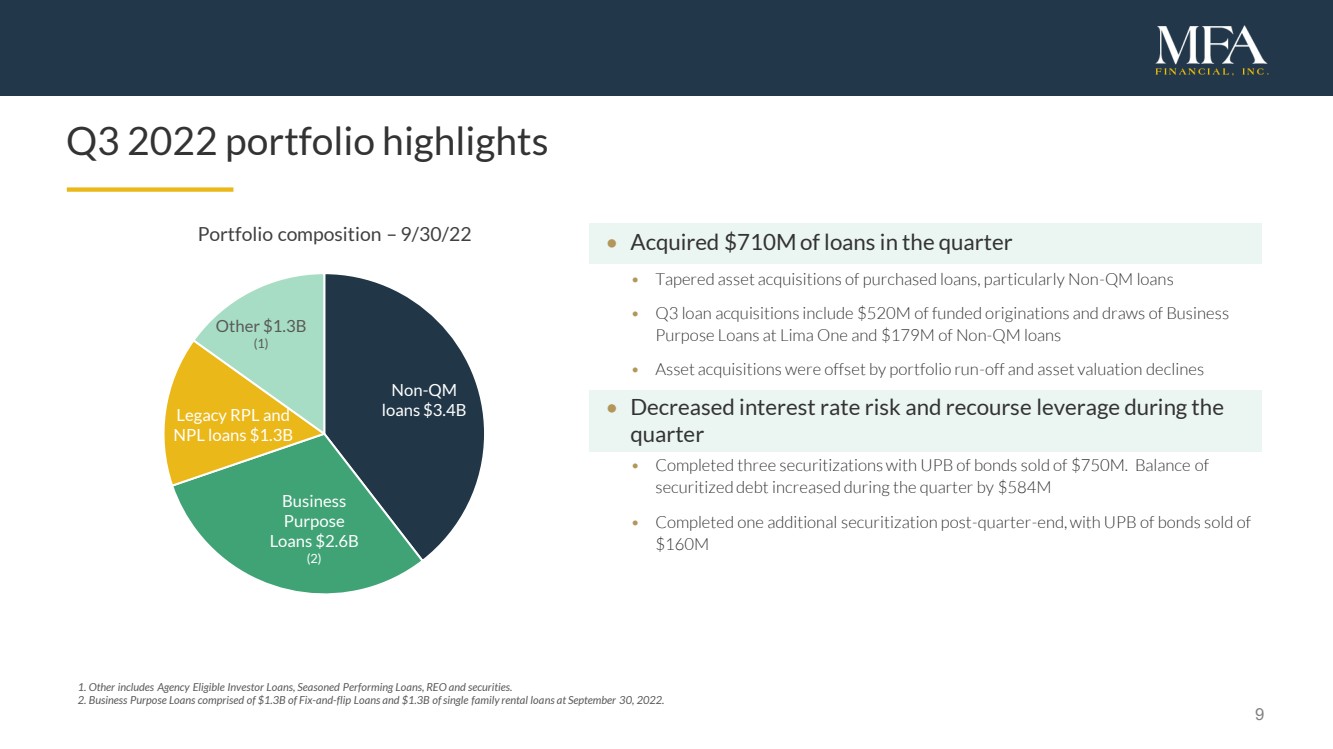

9 Q 3 2022 p ortfolio highlights • Acquired $ 710M of loans in the quarter • Tapered asset acquisitions of purchased loans, particularly Non - QM loans • Q 3 loan acquisitions include $ 520M of funded originations and draws of Business Purpose L oans at Lima One and $ 179M of Non - QM loans • Asset acquisitions were offset by portfolio run - off and asset valuation declines • Decreased interest rate risk and recourse leverage during the quarter • Completed three securitizations with UPB of bonds sold of $ 750M .. Balance of securitized debt increased during the quarter by $ 584M • C ompleted one additional securitization post - quarter - end , with UPB of bonds sold of $ 160M Portfolio composition – 9/30/22 1. Other includes Agency Eligible Investor Loans, Seasoned Performing Loans, REO and securities. 2. Business Purpose Loans comprised of $ 1.3B of Fix - and - flip Loans and $ 1.3B of single family rental loans at September 30, 2022. Non - QM loans $3.4B Business Purpose Loans $2.6B (2) Legacy RPL and NPL loans $1.3 B Other $1.3B (1) |

|

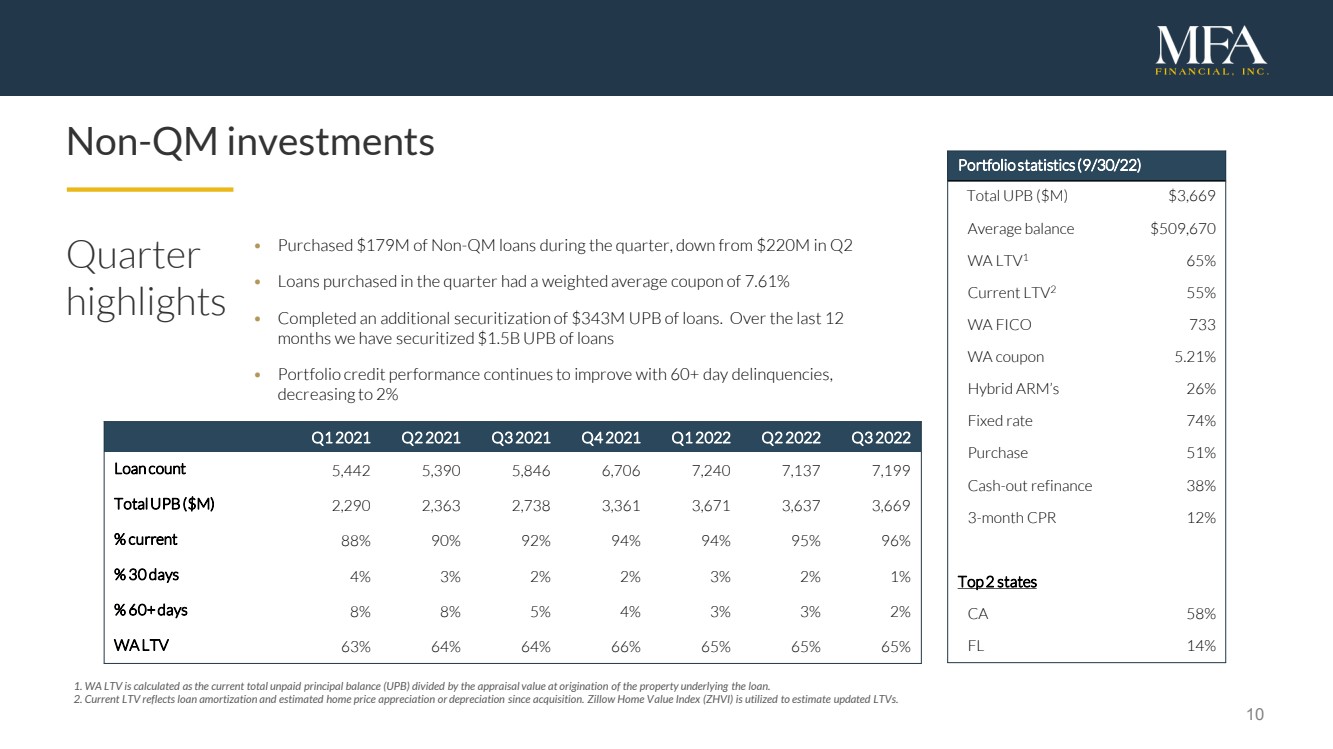

10 Non - QM investments Portfolio s tatistics ( 9 /30/22 ) Total UPB ( $M ) $ 3,6 69 Average b alance $ 509, 670 WA LTV 1 65% Current LTV 2 55% WA FICO 73 3 WA c oupon 5. 21 % Hybrid ARM’s 2 6 % Fixed r ate 7 4 % Purchase 51% Cash - o ut r efinance 38% 3 - m onth CPR 12 % Top 2 s tates CA 5 8 % FL 14% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Loan c ount 5,442 5,390 5,846 6,706 7,240 7,137 7,199 Total UPB ( $M ) 2,290 2,363 2,738 3,361 3,671 3,637 3,669 % c urrent 88% 90% 92% 94% 94% 95% 96% % 30 d ays 4% 3% 2% 2% 3% 2% 1% % 60+ d ays 8% 8% 5% 4% 3% 3% 2% WA LTV 63% 64% 64% 66% 65% 65% 65% • Purchased $ 179M of Non - QM loans during the quarter , down from $220M in Q2 • Loans purchased in the quarter had a weighted average coupon of 7.61% • Complet ed an additional securitization of $343M UPB of loans. Over the last 12 months we have securitized $1.5B UPB of loans • Portfolio credit performance continues to improve with 60+ day delinquencies , decreasing to 2% Quarter highlights 1. WA LTV is calculated as the current total unpaid principal balance (UPB) divided by the appraisal value at origination of the property underlying the loan. 2. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home V alu e Index (ZHVI) is utilized to estimate updated LTVs. |

|

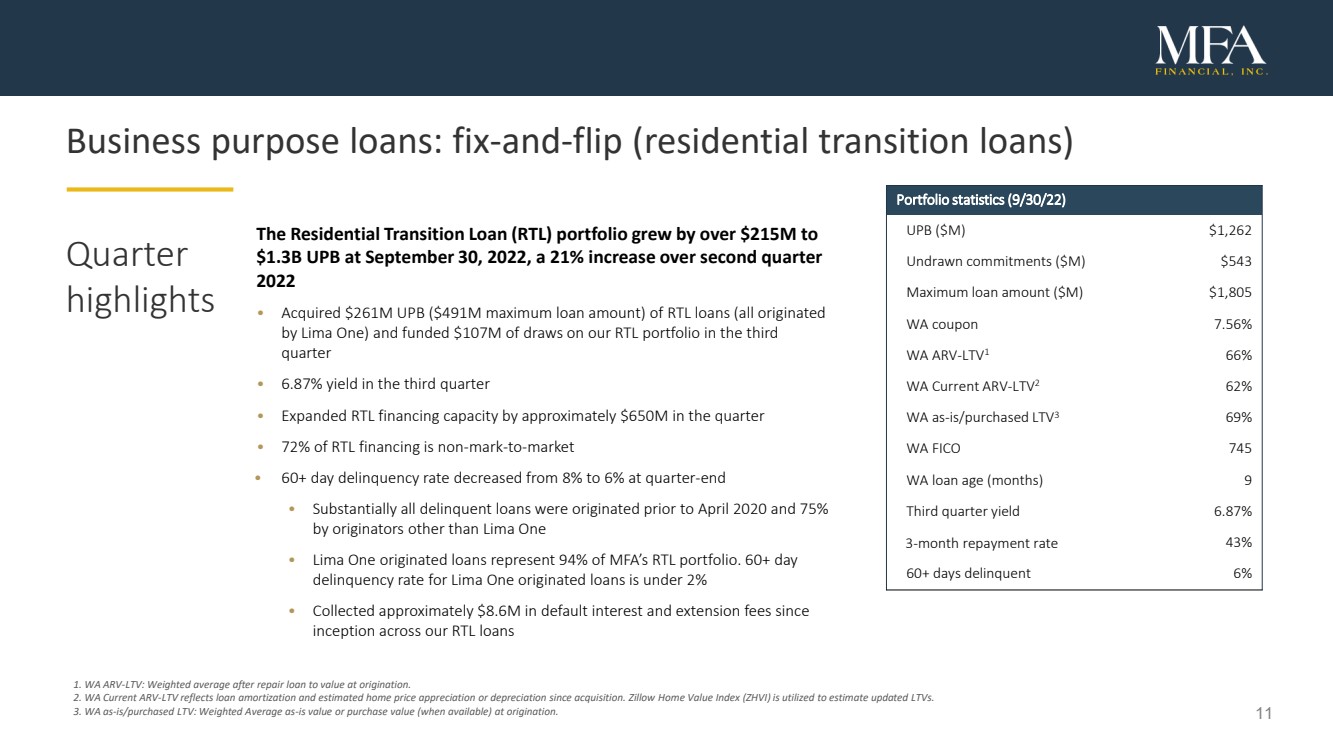

11 Business purpose loans: fix - and - flip (residential transition loans) Portfolio s tatistics ( 9 /30/22 ) UPB ($M) $1,262 Undrawn commitments ($M) $543 Maximum loan a mount ($M) $ 1,805 WA passthrough rate 7.56% WA ARV - LTV 1 66% WA Current ARV - LTV 2 62% WA as - is/purchased LTV 3 69% WA FICO 745 WA loan age (months) 9 Third quarter yield 6.87% 3 - month repayment rate 43% 60+ days delinquent 6 % Quarter highlights 1 .. WA ARV - LTV : Weighted average after repair loan to value at origination. 2. WA Current ARV - LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. 3. WA as - is/purchased LTV: Weighted Average as - is value or purchase value (when available) at origination. The Residential Transition Loan (RTL) portfolio grew by over $215M to $ 1.3B UPB at September 30, 2022, a 21% increase over second quarter 2022 • Acquired $261M UPB ($ 491M maximum loan amount) of RTL loans (all originated by Lima One) and funded $107M of draws on our RTL portfolio in the third quarter • 6.87% yield in the third quarter • Expanded RTL financing capacity by approximately $650M in the quarter • 72% of RTL financing is non - mark - to - market • 60+ day delinquency rate decreased from 8% to 6% at quarter - end • Substantially all delinquent loans were originated prior to April 2020 and 75% by originators other than Lima One • Lima One originated loans represent 94% of MFA’s RTL portfolio. 60 + day delinquency rate for Lima One originated loans is under 2 % • Collected approximately $8.6M in default interest and extension fees since inception across our RTL loans |

|

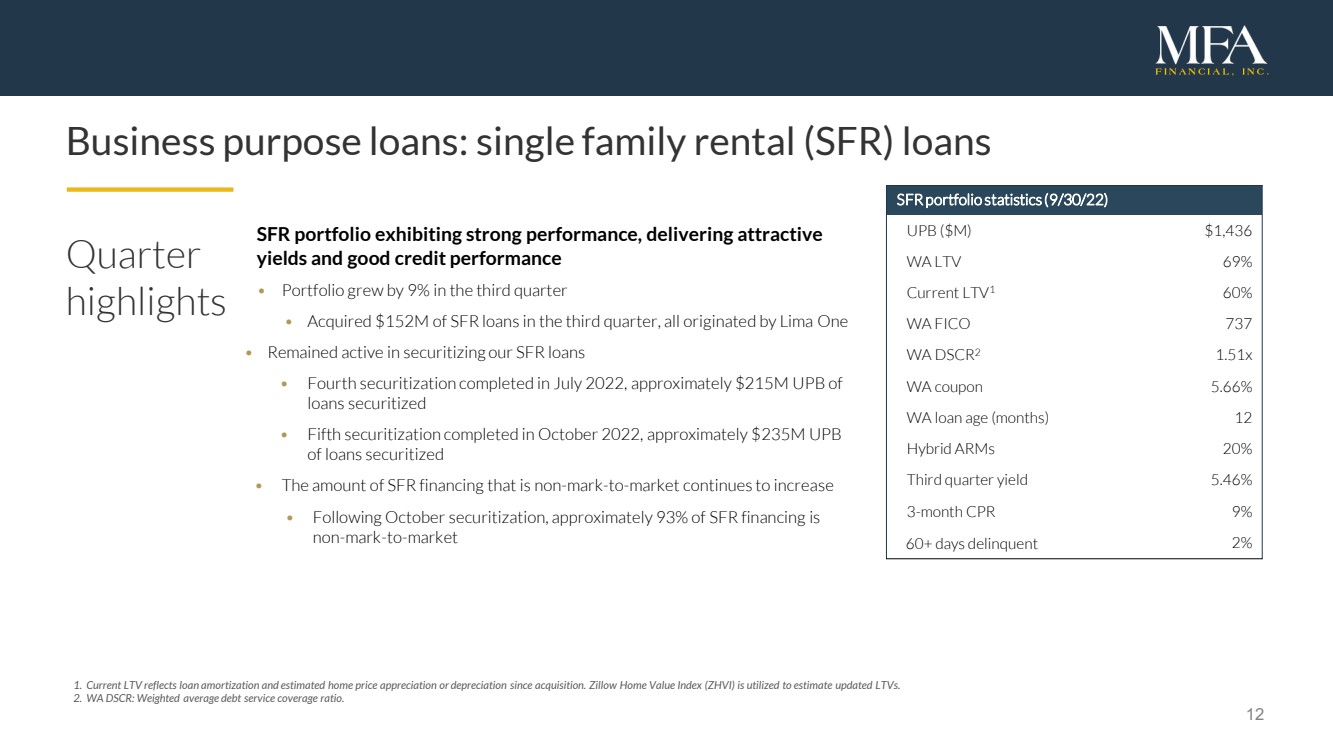

12 Business purpose loans: single family rental (SFR) loans SFR p ortfolio s tatistics ( 9 /30/22 ) UPB ($M) $ 1,436 WA LTV 69% Current LTV 1 60% WA FICO 737 WA DSCR 2 1.51x WA coupon 5.66% WA loan a ge (months) 12 Hybrid ARMs 20% Third quarter yield 5.46% 3 - month CPR 9% 60+ days delinquent 2% Quarter highlights 1. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. 2. WA DSCR: Weighted average debt service coverage ratio. SFR portfolio exhibiting strong performance, delivering attractive yields and good credit performance • Portfolio grew by 9% in the third quarter • Acquired $ 152M of SFR loans in the third quarter, all originated by Lima One • Remained active in securitizing our SFR loans • Fourth securitization completed in July 2022, approximately $215M UPB of loans securitized • Fifth securitization completed in October 2022, approximately $ 235M UPB of loans securitized • The amount of SFR financing that is non - mark - to - market continues to increase • Following October securitization, approximately 93% of SFR financing is non - mark - to - market |

|

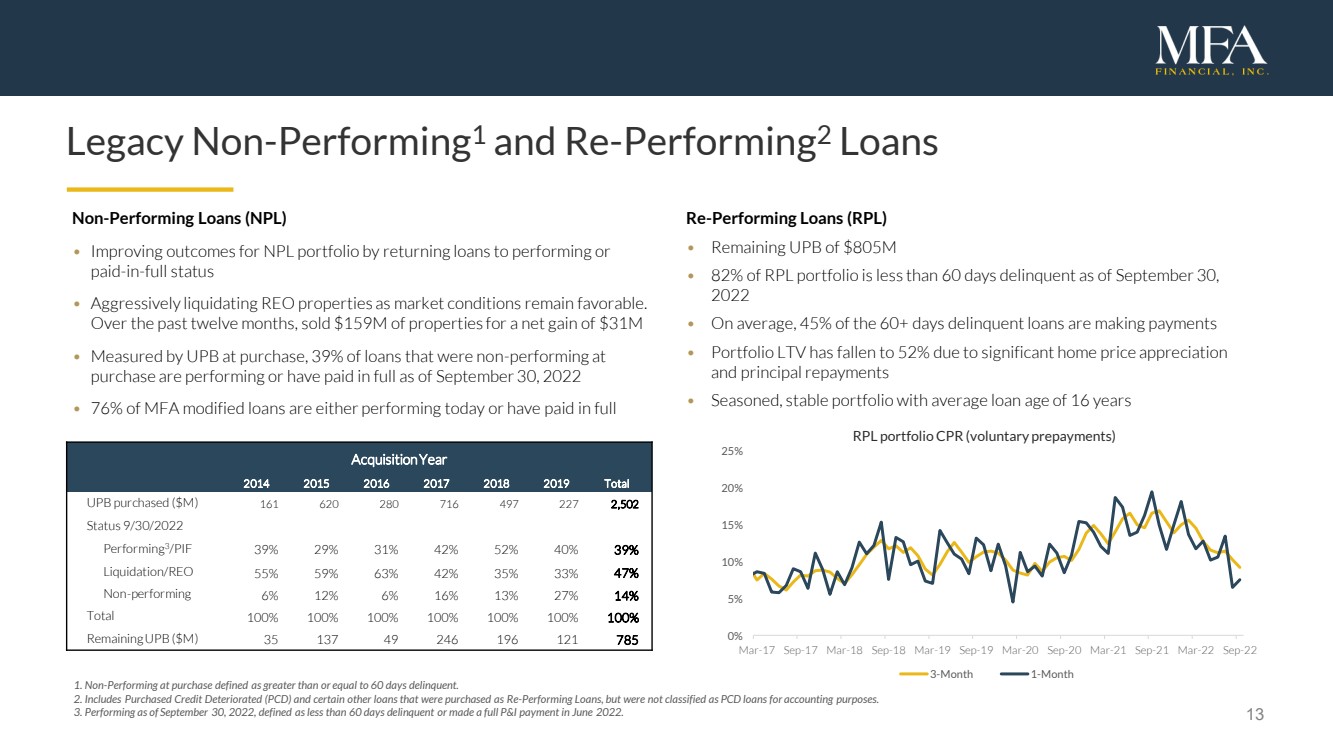

13 Legacy Non - Performing 1 and Re - Performing 2 Loans Non - Performing L oans (NPL) • I mprov ing outcomes for NPL portfolio by returning loans to performing or paid - in - full status • A ggressively liquidating REO properties as market conditions remain favorable. Over the past twelve months , sold $ 159M of properties for a net gain of $ 31M • Measured by UPB at purchase, 39% of loans that were non - performing at purchase are performing or have paid in full as of September 30, 2022 • 76% of MFA modified loans are either performing today or have paid in full Re - Performing Loans (RPL) • Remaining UPB of $ 8 05M • 8 2 % of RPL portfolio is less than 60 days delinquent as of September 30, 2022 • On average, 45 % of the 60+ days delinquent loans are making payments • Portfolio LTV has fallen to 5 2 % due to significant home price appreciation and principal repayments • Seasoned , stable portfolio with average loan age of 16 years 1. Non - P erforming at purchase defined as greater than or equal to 60 days delinquent .. 2. Includes Purchased Credit Deteriorated (PCD) and certain other loans that were purchased as Re - Performing L oans , but were not classified as PCD loans for accounting purposes. 3 .. Performing as of September 30, 2022, defined as less than 60 days delinquent or made a full P&I payment in June 2022 .. Acquisition Year 2014 2015 2016 2017 2018 2019 Total UPB p urchased ($ M ) 161 620 280 716 497 227 2,502 Status 9 /30/2022 Performing 3 /PIF 39% 29% 31% 42% 52% 40% 39% Liquidation/REO 55% 59% 63% 42% 35% 33% 47% Non - p erforming 6% 12% 6% 16% 13% 27% 14% Total 100% 100% 100% 100% 100% 100% 100% Remaining UPB ($ M ) 35 137 49 246 196 121 785 0% 5% 10% 15% 20% 25% Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22 Sep-22 RPL portfolio CPR (voluntary prepayments ) 3-Month 1-Month |

|

14 Appendix James Casebere , Landscape with Houses ( Dutchess County, NY) #2, 2010 ( detail) |

|

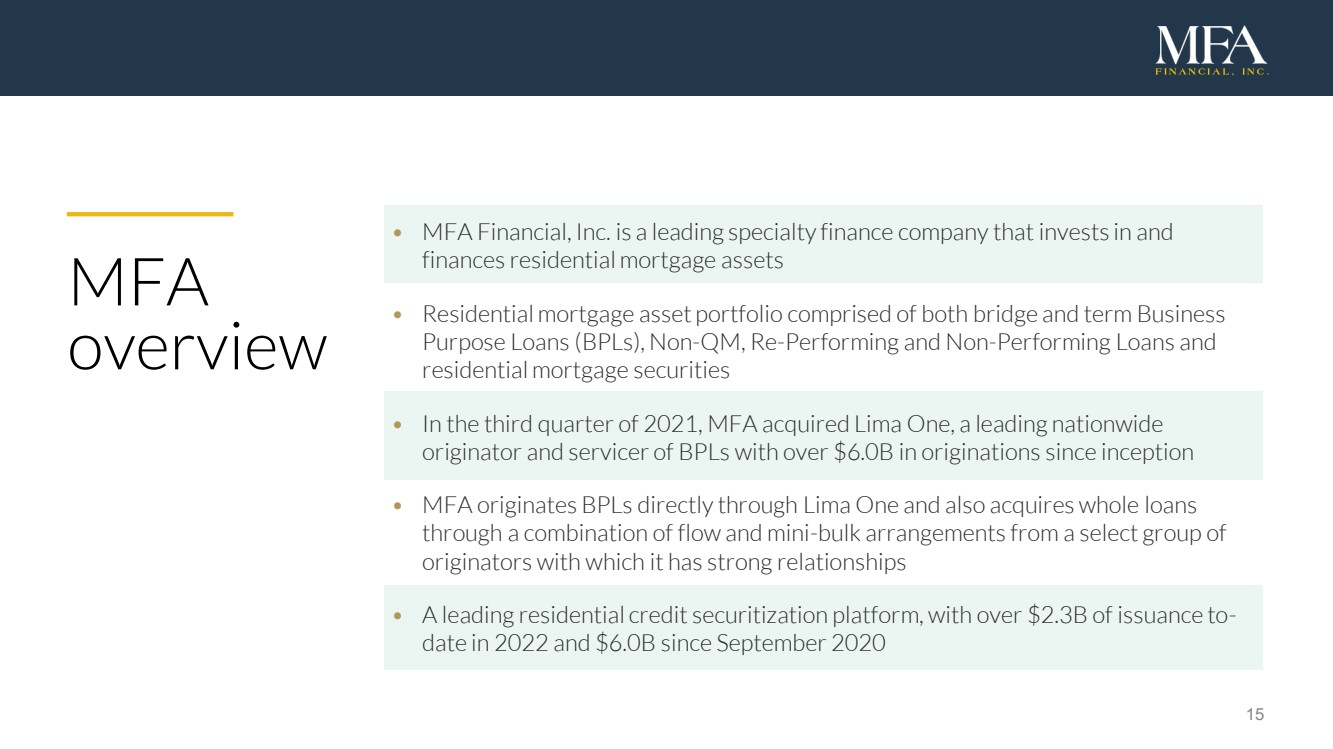

15 MFA overview • MFA Financial, Inc. is a leading specialty finance company that invests in and finances residential mortgage assets • Residential mortgage asset portfolio comprised of both bridge and term Business P urpose Loans (BPLs), Non - QM, Re - Performing and Non - Performing Loans and residential mortgage securities • In the third quarter of 2021, MFA acquired Lima One, a leading nationwide originator and servicer of BPLs with over $6.0B in originations since inception • MFA originates BPLs directly through Lima One and also acquires whole loans through a combination of flow and mini - bulk arrangements from a select group of originators with which it has strong relationships • A leading residential credit securitization platform, with over $2.3B of issuance to - date in 2022 and $6.0B since September 2020 |

|

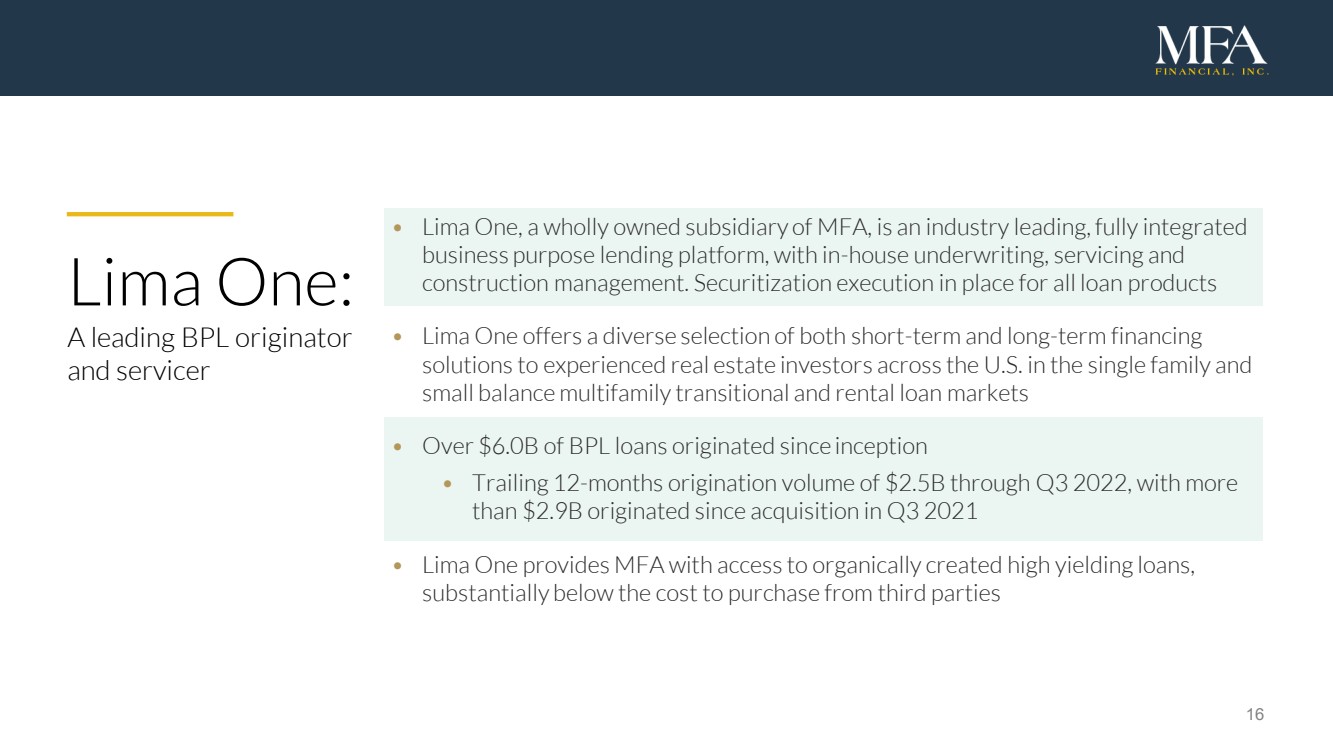

16 • Lima One, a wholly owned subsidiary of MFA, is an industry leading, fully integrated business purpose lending platform, with in - house underwriting, servicing and construction management. Securitization execution in place for all loan products • Lima One offers a diverse selection of both short - term and long - term financing solutions to experienced real estate investors across the U.S. in the single family and small balance multifamily transitional and rental loan markets • Over $6.0B of BPL loans originated since inception • Trailing 12 - months origination volume of $ 2.5B through Q3 2022, with more than $ 2.9B originated since acquisition in Q3 2021 • Lima One provides MFA with access to organically created high yielding loans, substantially below the cost to purchase from third parties Lima One: A leading BPL originator and servicer |

|

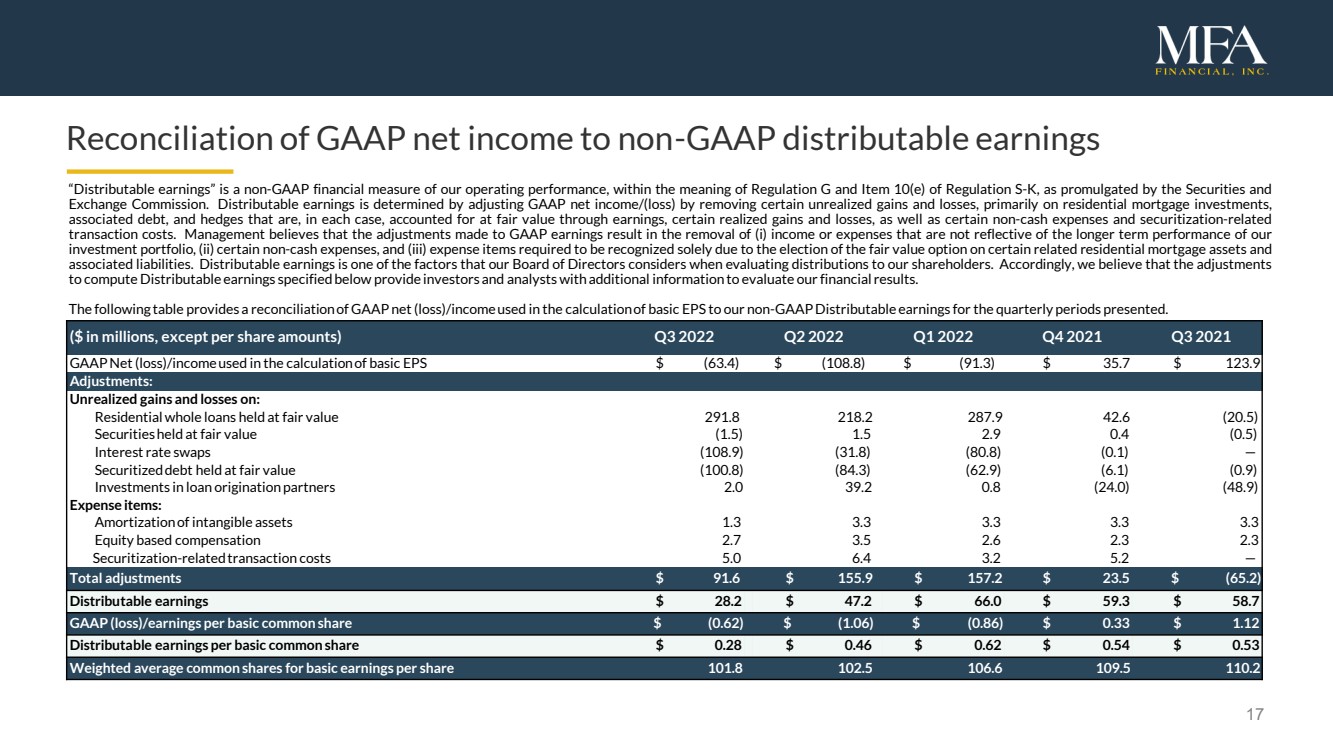

17 Reconciliation of GAAP net income to non - GAAP distributable earnings “Distributable earnings” is a non - GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10 (e) of Regulation S - K, as promulgated by the Securities and Exchange Commission .. Distributable earnings is determined by adjusting GAAP net income/(loss) by removing certain unrealized gains and losses, primarily on residential mortgage investments, associated debt, and hedges that are, in each case, accounted for at fair value through earnings, certain realized gains and losses, as well as certain non - cash expenses and securitization - related transaction costs .. Management believes that the adjustments made to GAAP earnings result in the removal of ( i ) income or expenses that are not reflective of the longer term performance of our investment portfolio, (ii) certain non - cash expenses, and (iii) expense items required to be recognized solely due to the election of the fair value option on certain related residential mortgage assets and associated liabilities .. Distributable earnings is one of the factors that our Board of Directors considers when evaluating distributions to our shareholders .. Accordingly, we believe that the adjustments to compute Distributable earnings specified below provide investors and analysts with additional information to evaluate our financial results .. The following table provides a reconciliation of GAAP net (loss)/income used in the calculation of basic EPS to our non - GAAP Distributable earnings for the quarterly periods presented .. ( $ i n m illions, e xcept p er s hare a mounts) Q 3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP Net (loss)/income used in the calculation of basic EPS $ ( 63.4 ) $ (108.8) $ (91.3) $ 35.7 $ 123.9 Adjustments: Unrealized gains and losses on: Residential whole loans held at fair value 291.8 218.2 287.9 42.6 (20.5) Securities held at fair value ( 1.5 ) 1.5 2.9 0.4 (0.5) Interest rate swaps ( 108 .. 9 ) (31.8) (80.8) (0.1) — Securitized debt held at fair value ( 100 .. 8 ) (84.3) (62.9) (6.1) (0.9) Investments in loan origination partners 2.0 39.2 0.8 (24.0) (48.9) Expense items: Amortization of intangible assets 1.3 3.3 3.3 3.3 3.3 Equity based compensation 2.7 3.5 2.6 2.3 2.3 Securitization - related transaction costs 5.0 6.4 3.2 5.2 — Total adjustments $ 91.6 $ 155.9 $ 157.2 $ 23.5 $ (65.2) Distributable earnings $ 28.2 $ 47.2 $ 66.0 $ 59.3 $ 58.7 GAAP (loss)/earnings per basic common share $ ( 0 .. 62 ) $ (1.06) $ (0.86) $ 0.33 $ 1.12 Distributable earnings per basic common share $ 0.28 $ 0.46 $ 0.62 $ 0.54 $ 0.53 Weighted average common shares for basic earnings per share 10 1 .. 8 102.5 106.6 109.5 110.2 |

|

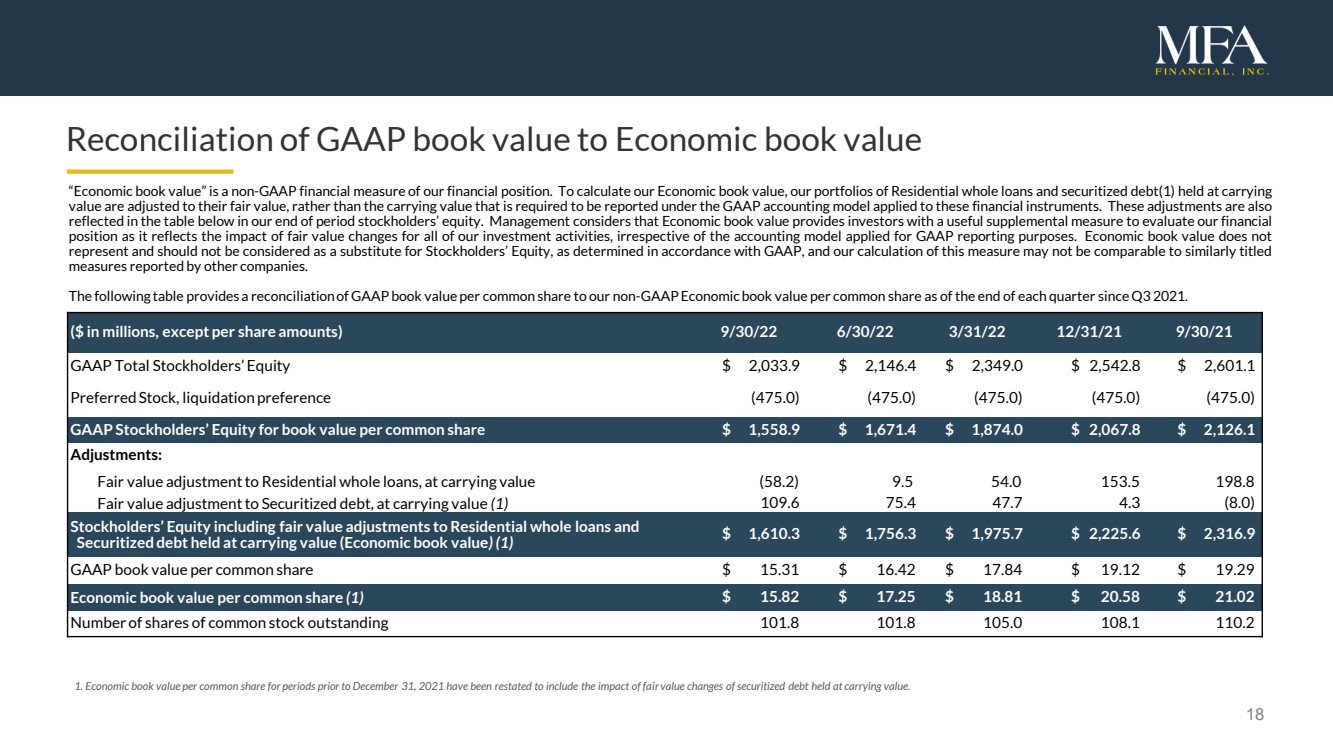

18 Reconciliation of GAAP book value to Economic book value “Economic book value” is a non - GAAP financial measure of our financial position .. To calculate our Economic book value, our portfolios of Residential whole loans and securitized debt( 1 ) held at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these financial instruments .. These adjustments are also reflected in the table below in our end of period stockholders’ equity .. Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our investment activities, irrespective of the accounting model applied for GAAP reporting purposes .. Economic book value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies .. The following table provides a reconciliation of GAAP book value per common share to our non - GAAP Economic book value per common share as of the end of each quarter since Q 3 2021 .. ($ i n millions, except per share amounts) 9 /30/22 6/30/22 3/31/22 12/31/21 9/30/21 GAAP Total Stockholders’ Equity $ 2,033.9 $ 2,146.4 $ 2,349.0 $ 2,542.8 $ 2,601.1 Preferred Stock, liquidation preference (475.0 ) (475.0 ) (475.0 ) (475.0 ) (475.0 ) GAAP Stockholders’ Equity for book value per common share $ 1, 558 .. 9 $ 1,671.4 $ 1,874.0 $ 2,067.8 $ 2,126.1 Adjustments: Fair value adjustment to Residential whole loans, at carrying value (58.2) 9.5 54.0 153.5 198.8 Fair value adjustment to Securitized debt, at carrying value (1) 109.6 75.4 47.7 4.3 (8.0 ) Stockholders’ Equity including fair value adjustments to Residential whole loans and Securitized debt held at carrying value (Economic book value ) (1) $ 1,610.3 $ 1,756.3 $ 1,975.7 $ 2,225.6 $ 2,316.9 GAAP book value per common share $ 15.31 $ 16.42 $ 17.84 $ 19.12 $ 19.29 Economic book value per common share (1) $ 15.82 $ 17.25 $ 18.81 $ 20.58 $ 21.02 Number of shares of common stock outstanding 101.8 101.8 105.0 108.1 110.2 1. Economic book value per common share for periods prior to December 31, 2021 have been restated to include the impact of fa ir value changes of securitized debt held at carrying value. |

|

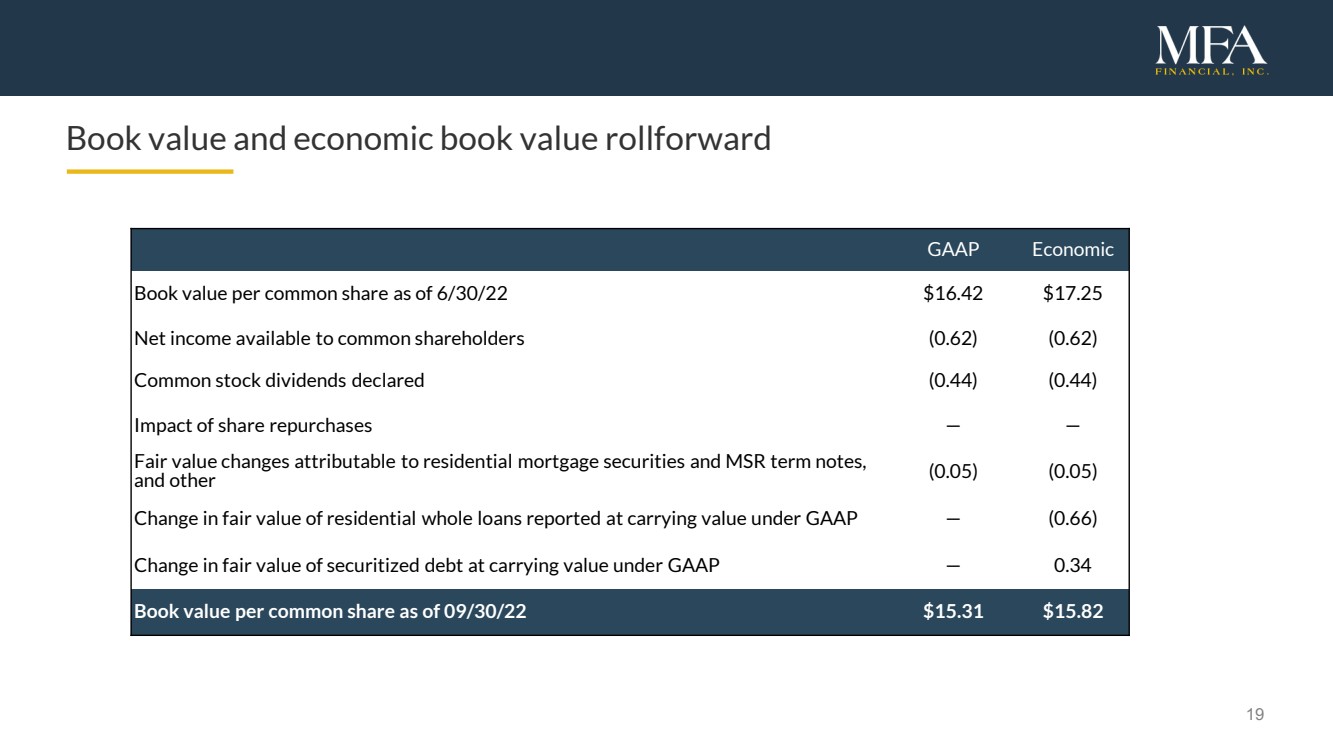

19 Book value and economic book value rollforward GAAP Economic Book value per common share as of 6/30/22 $16.42 $17.25 Net income available to common shareholders (0.62) ( 0 ..6 2 ) Common stock dividends declared (0.44) (0.44) Impact of share repurchases — — Fair value changes attributable to residential mortgage securities and MSR term notes, and other ( 0.0 5) ( 0.0 5) Change in fair value of residential whole loans reported at carrying value under GAAP — ( 0. 66 ) Change in fair value of securitized debt at carrying value under GAAP — 0.34 Book value per common share as of 09/30/22 $ 15 .. 31 $ 15 .. 82 |

|

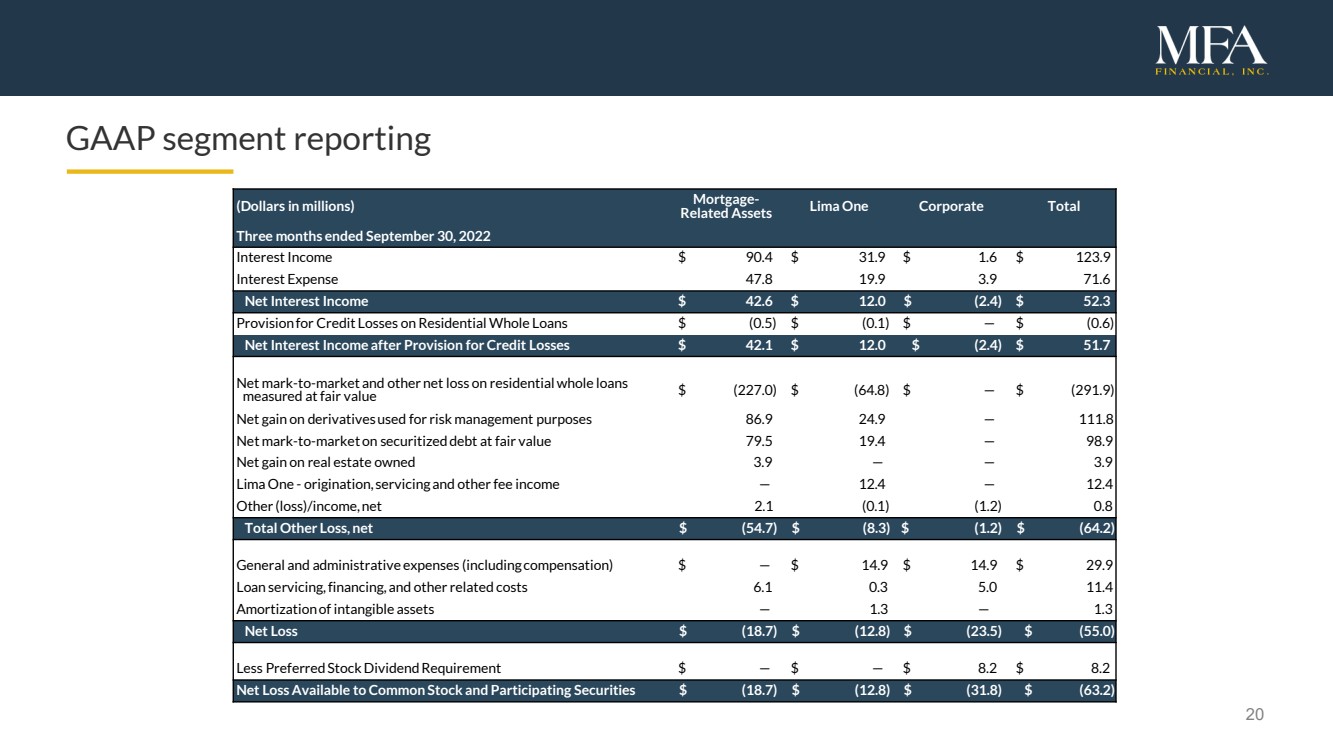

20 GAAP segment reporting (Dollars in m illions) Mortgage - Related Assets Lima One Corporate Total Three months ended September 30, 2022 Interest Income $ 90.4 $ 31.9 $ 1.6 $ 123.9 Interest Expense 47.8 19.9 3.9 71.6 Net Interest Income $ 42.6 $ 12.0 $ ( 2 .. 4 ) $ 52. 3 Provision for Credit Losses on Residential Whole Loans $ ( 0 .. 5 ) $ (0.1) $ — $ ( 0 .. 6 ) Net Interest Income after Provision for Credit Losses $ 4 2.1 $ 12.0 $ ( 2.4 ) $ 51.7 Net mark - to - market and other net loss on residential whole loans measured at fair value $ ( 227.0 ) $ ( 64.8 ) $ — $ ( 291.9 ) Net gain on derivatives used for risk management purposes 86.9 24.9 — 111.8 Net mark - to - market on securitized debt at fair value 79.5 19.4 — 98.9 Net gain on real estate owned 3.9 — — 3.9 Lima One - origination, servicing and other fee income — 12.4 — 1 2 .. 4 Other (loss)/income, net 2.1 ( 0.1 ) (1.2) 0.8 Total Other Loss, net $ ( 5 4.7 ) $ ( 8.3 ) $ (1.2) $ ( 64.2 ) General and administrative expenses (including compensation) $ — $ 14.9 $ 14.9 $ 29. 9 Loan servicing, financing, and other related costs 6. 1 0.3 5.0 1 1 .. 4 Amortization of intangible assets — 1.3 — 1 ..3 Net Loss $ ( 18.7 ) $ ( 12.8 ) $ ( 23.5 ) $ ( 55.0 ) Less Preferred Stock Dividend Requirement $ — $ — $ 8.2 $ 8.2 Net Loss Available to Common Stock and Participating Securities $ ( 18.7 ) $ ( 12.8 ) $ ( 31.8 ) $ ( 63.2 ) |

|

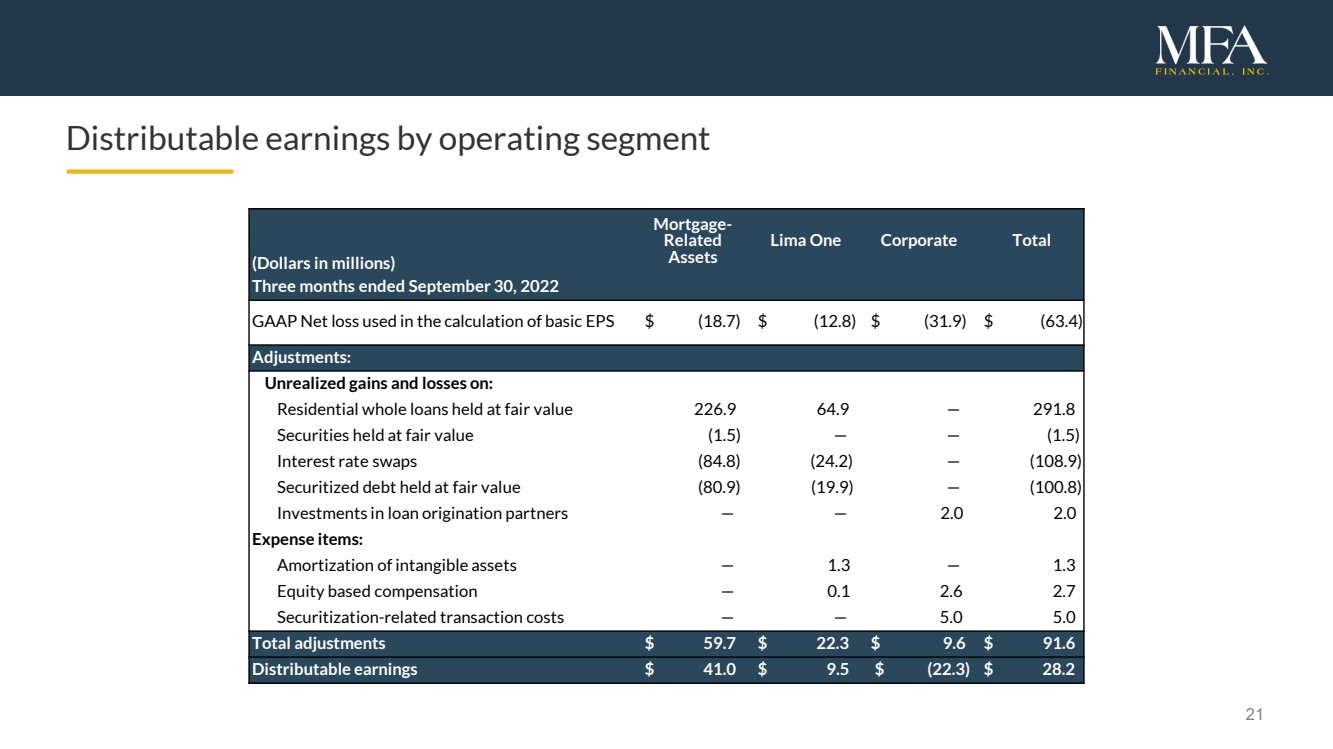

21 Distributable earnings by operating segment (Dollars in m illions ) Mortgage - Related Assets Lima One Corporate Total Three months ended September 30, 2022 GAAP Net loss used in the calculation of basic EPS $ ( 18.7 ) $ ( 12.8 ) $ ( 31.9 ) $ ( 63.4 ) Adjustments: Unrealized gains and losses on: Residential whole loans held at fair value 226.9 64.9 — 291.8 Securities held at fair value ( 1.5 ) — — (1.5) Interest rate swaps ( 84.8 ) ( 2 4.2 ) — ( 108.9 ) Securitized debt held at fair value ( 80.9 ) ( 19. 9 ) — ( 100.8 ) Investments in loan origination partners — — 2.0 2.0 Expense items: Amortization of intangible assets — 1.3 — 1.3 Equity based compensation — 0.1 2.6 2.7 Securitization - related transaction costs — — 5.0 5.0 Total adjustments $ 59.7 $ 22.3 $ 9.6 $ 91.6 Distributable earnings $ 41.0 $ 9.5 $ ( 22.3 ) $ 28.2 |