EXHIBIT 99.2

Published on February 23, 2023

Exhibit 99.2

Company Update THIRD QUARTER 2022 DRAFT 10/27 Company Update FOURTH QUARTER 2022

2 Q2 202 2 Financial Snapshot Forward looking statements When used in this presentation or other written or oral communications, statements that are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions . These forward - looking statements include information about possible or assumed future results with respect to MFA’s business, financial condition, liquidity, results of operations, plans and objectives . Among the important factors that could cause our actual results to differ materially from those projected in any forward - looking statements that we make are : general economic developments and trends and the performance of the housing, real estate, mortgage finance, broader financial markets ; inflation, increases in interest rates and changes in the market (i . e . , fair) value of MFA’s residential whole loans, MBS, securitized debt and other assets, as well as changes in the value of MFA’s liabilities accounted for at fair value through earnings ; the effectiveness of hedging transactions ; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in its portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows ; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole loan portfolio ; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings ; implementation of or changes in government regulations or programs affecting MFA’s business ; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals or whole loan modifications, foreclosures and liquidations ; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board of Directors and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as MFA’s Board of Directors deems relevant ; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes ; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940 , as amended (or the “Investment Company Act”), including statements regarding the concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage - related interests ; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent on, among other things, the supply of loans offered for sale in the market ; targeted or expected returns on our investments in recently - originated mortgage loans, the performance of which is, similar to our other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing costs associated with such investments ; risks associated with the ongoing operation of Lima One Holdings, LLC (including, without limitation, unanticipated expenditures relating to or liabilities arising from its operation (including, among other things, a failure to realize management’s assumptions regarding expected growth in business purpose loan (BPL) origination volumes and credit risks underlying BPLs, including changes in the default rates and management’s assumptions regarding default rates on the BPLs originated by Lima One) ; expected returns on MFA’s investments in nonperforming residential whole loans (“NPLs ”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e . g . , taxes, insurance, maintenance expenses, etc . on the underlying property) and the amount ultimately realized upon resolution of the asset ; risks associated with our investments in MSR - related assets, including servicing, regulatory and economic risks ; risks associated with our investments in loan originators ; risks associated with investing in real estate assets generally, including changes in business conditions and the general economy ; and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that we file with the SEC . These forward - looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account information currently available . Readers and listeners are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they are made . New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA . Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

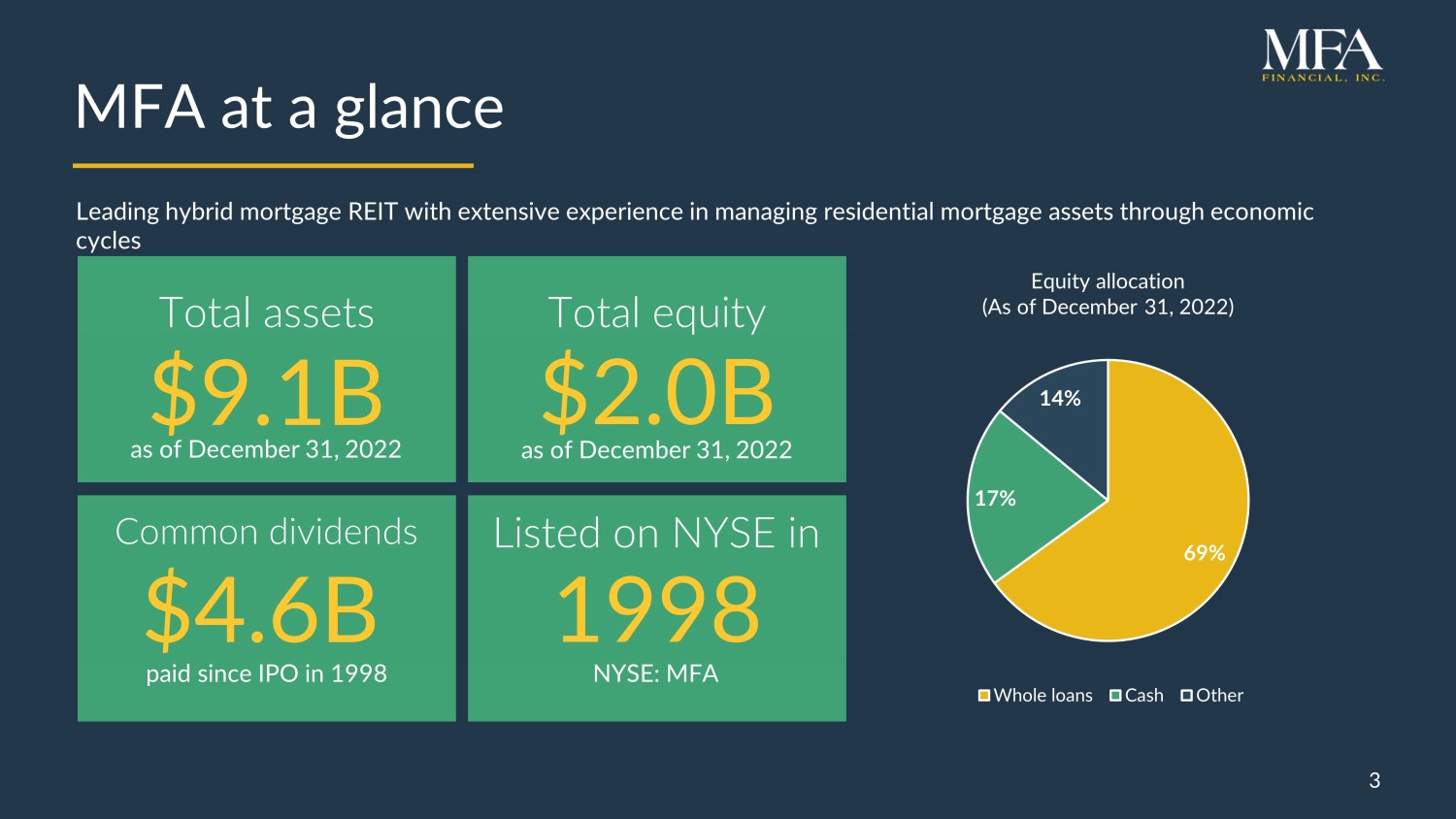

3 MFA at a glance 3 $2.0B Total equity $4.6B Common dividends Leading hybrid mortgage REIT with extensive experience in managing residential mortgage assets through economic cycles $9.1B Total assets p aid since IPO in 1998 1998 Listed on NYSE in a s of December 31, 2022 a s of December 31, 2022 69% 17% 14% Equity allocation (As of December 31, 2022) Whole loans Cash Other NYSE: MFA

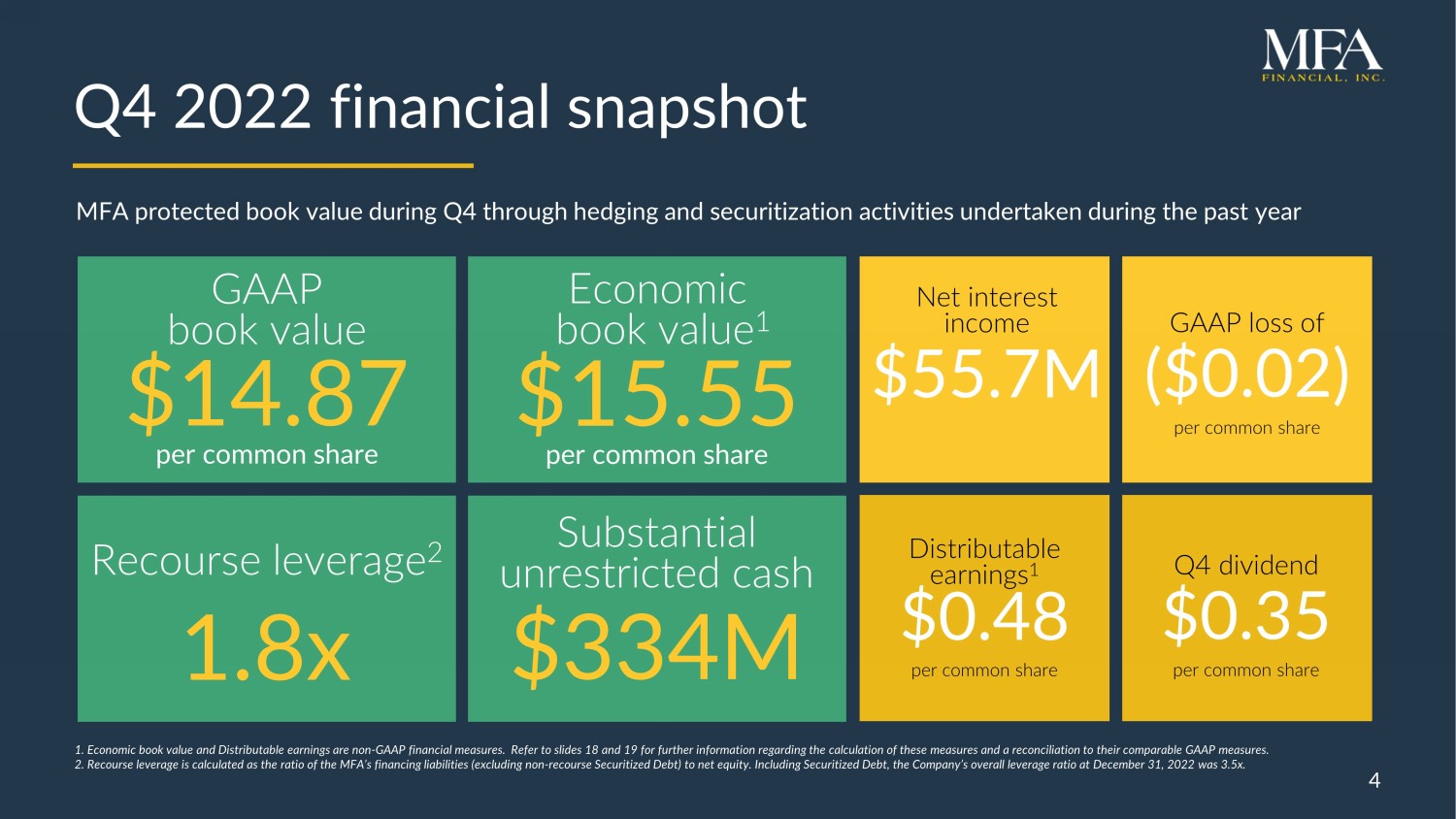

4 Q 4 202 2 f inancial snapshot 1. Economic book value and Distributable e arnings are n on - GAAP financial measures. Refer to slides 18 and 19 for further information regarding the calculation of these measures and a reconciliation to their comparable GAAP measures . 2. Recourse leverage is calculated as the ratio of the MFA’s financing liabilities (excluding non - recourse Securitized Debt) to net equity. Including Securitized Debt , the Company’s overall leverage r atio at December 31, 2022 was 3.5x. MFA protected book value during Q4 through hedging and securitization activities undertaken during the past year $14.87 $15.55 Net interest income $ 55.7M GAAP loss of ($0.02) per common share Distributable earnings 1 $0.48 per common share Q4 dividend $ 0.35 per common share GAAP book value Economic book value 1 per common share per common share $334M Substantial unrestricted cash 1.8x Recourse leverage 2 4

5 Active portfolio management limits changes to cost of funds and book value • Strategic focus on hedging and liability management during 2022 limited the impact of volatile markets in Q4 2022. • Q4 2022 cost of funds (including impact of swaps) was essentially unchanged from Q3 2022 at 3.7%, despite the Fed raising rates 125 bps in the quarter and 200 bps since its September 2022 meeting. • Modest book value decline with GAAP book value down 2.9% and Economic book value down 1.7%. • C ontinued to prioritize liquidity and prudent management of recourse leverage. C losed the year with $ 334M in unrestricted cash and low recourse leverage of 1.8x. • Current LTV 1 of 58% on loan portfolio, which continues to benefit from accumulated home price appreciation and loan amortization. Loan delinquencies trended down during 2022, with overall 60+ day delinquency decreasing more than 300 bps. • Lima One subsidiary continues to solidify its role as a leading originator of business purpose loans (BPL) and deliver a strong volume of high yielding, high quality assets to MFA’s balance sheet. • Record origination volume of $2.3B 2 in 2022, a 42% increase over 2021 volume. • Q4 2022 origination volume of $ 406M 2 with an average coupon of 9.9%. Current origination pipeline has average coupon over 10%. 1. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home V alu e Index (ZHVI) is utilized to estimate updated LTVs. For Transitional loans, the LTV reflects after repaired loan to value. 2. Origination amounts and average coupon are based on the maximum loan amount, which includes amounts initially funded plus any committed, but undrawn amounts .

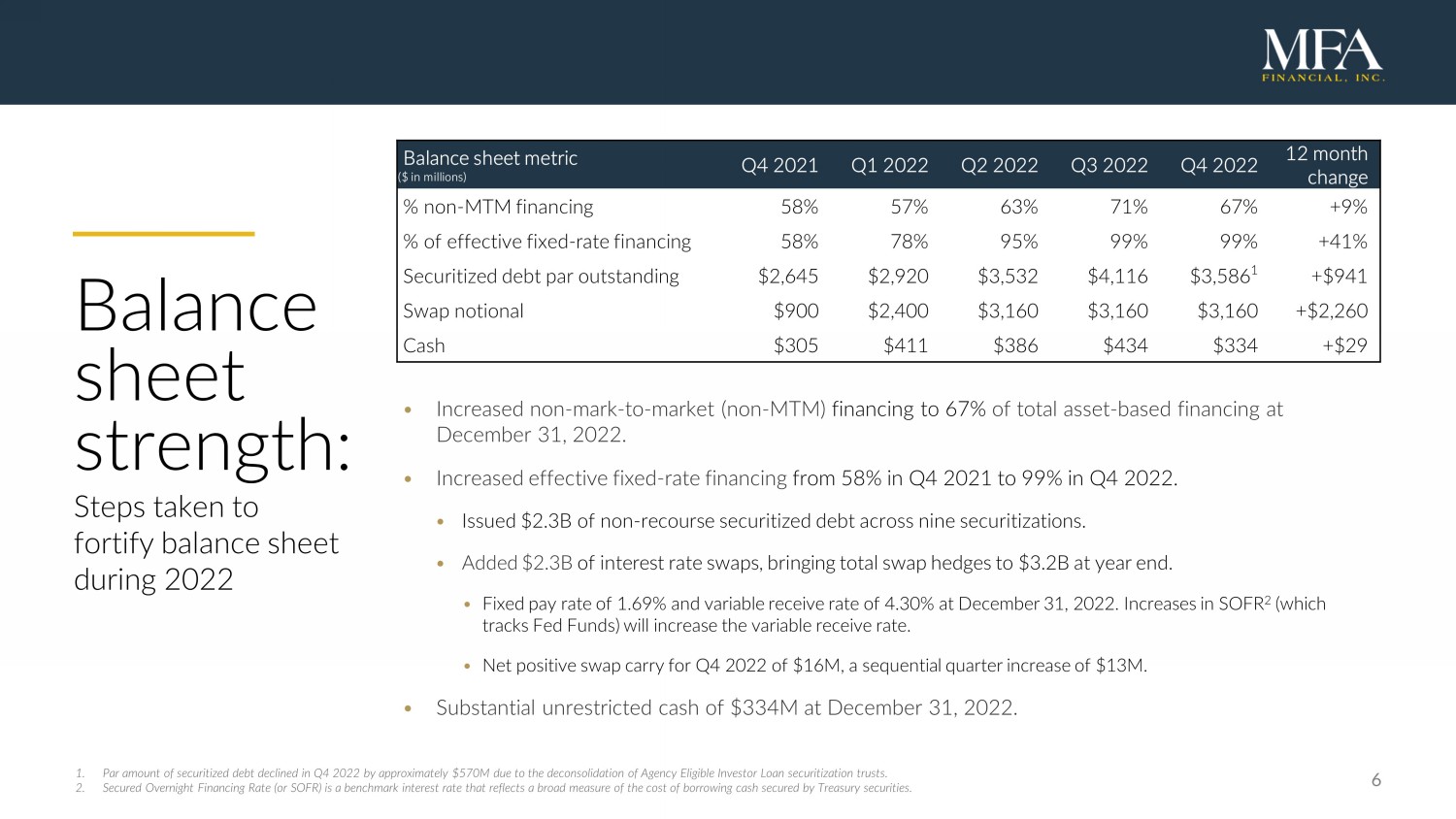

6 Balance sheet strength : Steps taken to fortify balance sheet during 2022 Balance sheet metric ($ in millions) Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 12 month change % non - MTM financing 58% 57% 63% 71% 67% +9% % of effective fixed - rate financing 58% 78% 95% 99% 99% +41% Securitized debt par outstanding $2,645 $2,920 $3,532 $4,116 $3,586 1 +$941 Swap notional $900 $2,400 $3,160 $3,160 $3,160 +$2,260 Cash $305 $411 $386 $434 $334 +$29 • Increased non - mark - to - market (non - MTM) financing to 67% of total asset - based financing at December 31, 2022. • Increased effective fixed - rate financing from 58% in Q4 2021 to 99 % in Q4 2022. • Issued $2.3B of non - recourse securitized debt across nine securitizations. • Added $2.3B of interest rate swaps, bringing total swap hedges to $3.2B at year end. • F ixed pay rate of 1.69% and variable receive rate of 4.30% at December 31, 2022. Increases in SOFR 2 (which tracks Fed Funds) will increase the variable receive rate. • Net positive swap carry for Q4 2022 of $16M, a sequential quarter increase of $13M. • S ubstantial unrestricted cash of $334M at December 31, 2022. 1. Par amount of securitized debt declined in Q4 2022 by approximately $570M due to the deconsolidation of Agency Eligible Investor Loan securitization trusts. 2. Secured Overnight Financing Rate (or SOFR) is a benchmark interest rate that reflects a broad measure of the cost of borrowin g c ash secured by Treasury securities.

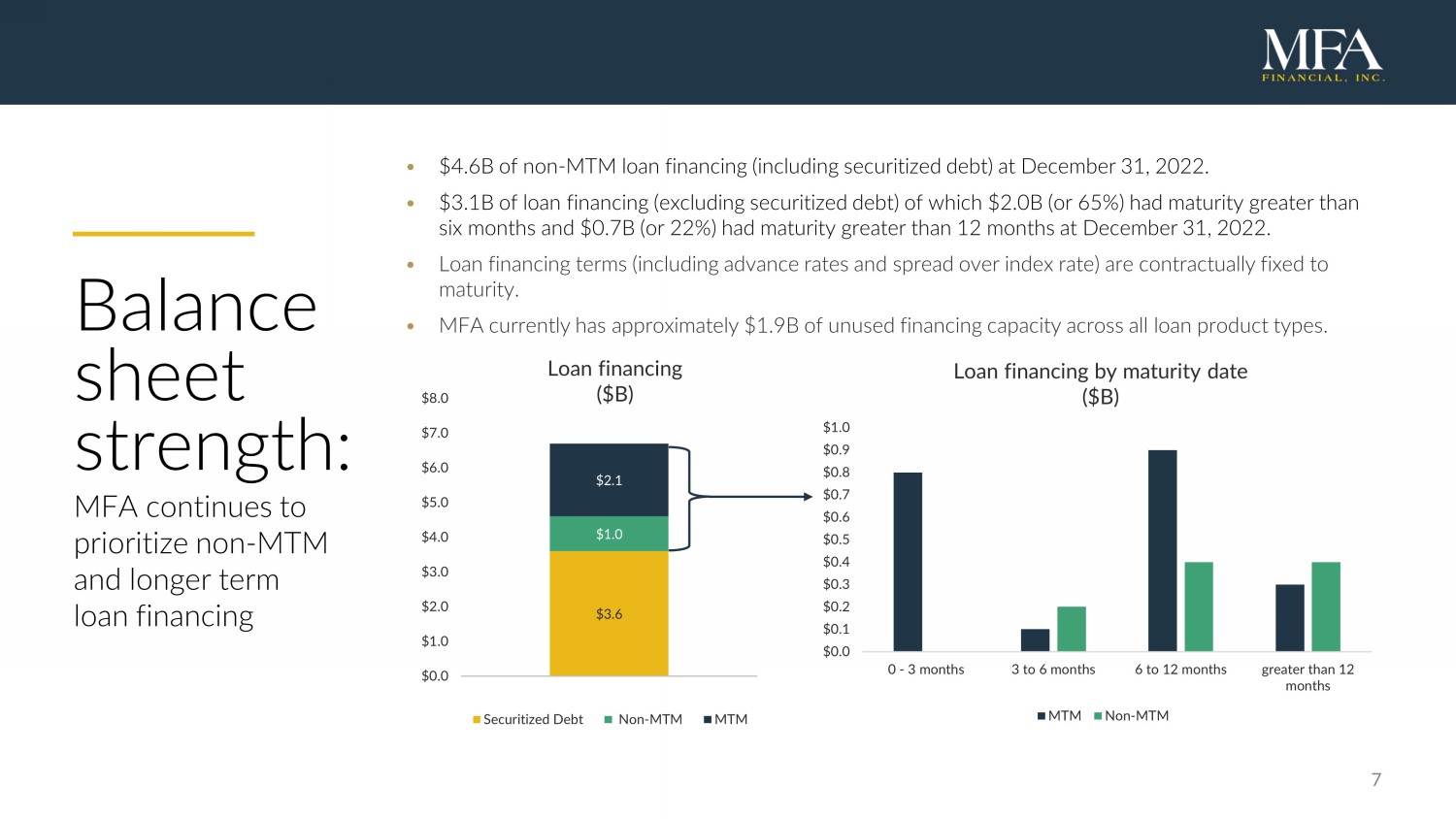

$3.6 $1.0 $2.1 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 1 Loan financing ($ B) Securitized Debt Non-MTM MTM 7 Balance sheet strength : MFA continues to prioritize non - MTM and longer term loan financing • $4.6B of non - MTM loan financing (including securitized debt) at December 31, 2022. • $3.1B of loan financing (excluding securitized debt) of which $2.0B (or 65%) had maturity greater than six months and $0.7B (or 22%) had maturity greater than 12 months at December 31, 2022 . • Loan financing terms (including advance rates and spread over index rate) are contractually fixed to maturity . • MFA currently has approximately $1.9B of unused financing capacity across all loan product types. $0.0 $0.1 $0.2 $0.3 $0.4 $0.5 $0.6 $0.7 $0.8 $0.9 $1.0 0 - 3 months 3 to 6 months 6 to 12 months greater than 12 months Loan financing by maturity date ($B) MTM Non-MTM

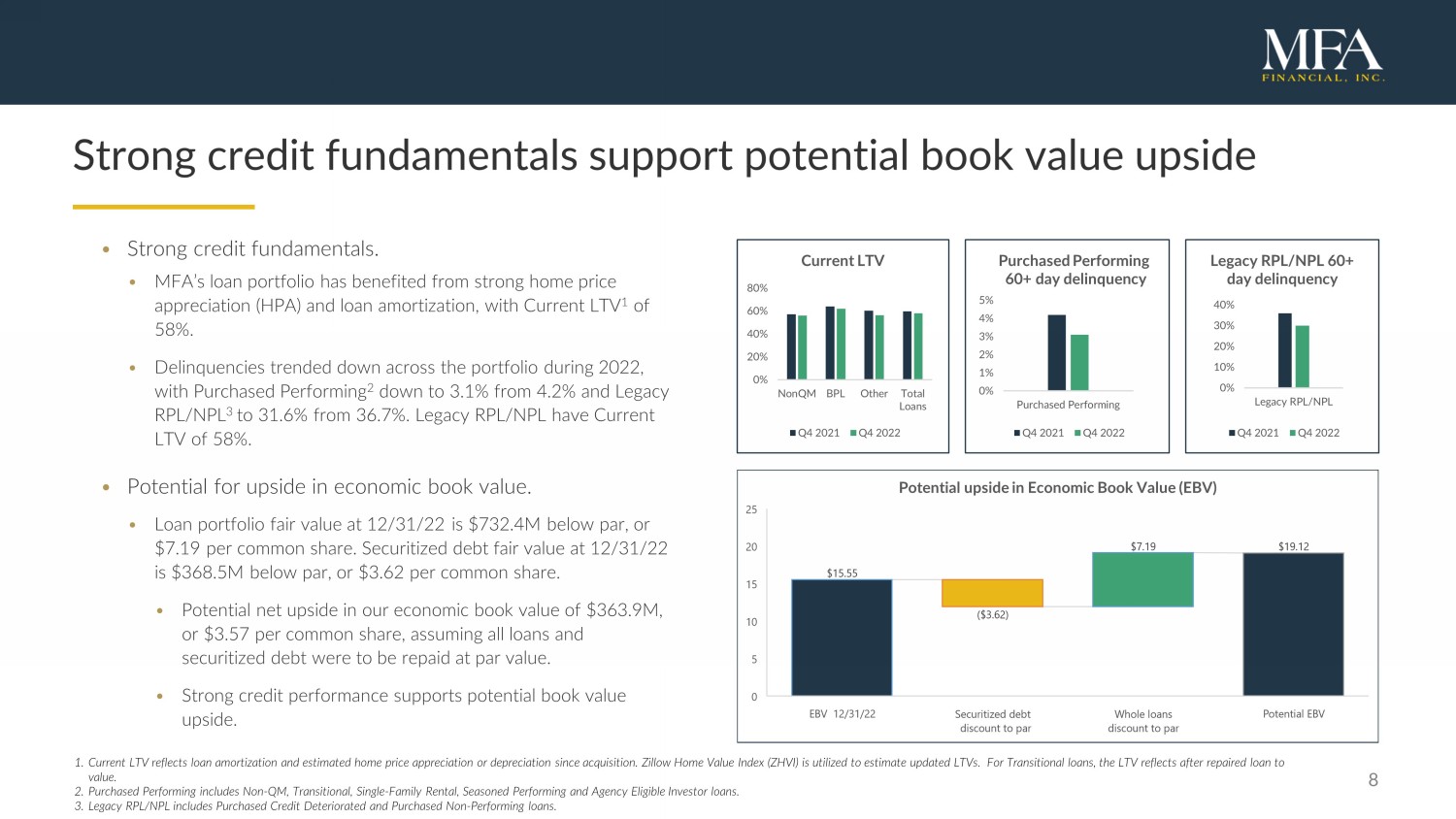

8 0% 10% 20% 30% 40% Legacy RPL/NPL Legacy RPL/NPL 60+ day delinquency Q4 2021 Q4 2022 • Strong credit fundamentals. • MFA’s loan portfolio has benefited from strong home price appreciation (HPA) and loan amortization, with Current LTV 1 of 58%. • Delinquencies trended down across the portfolio during 2022, with Purchased Performing 2 down to 3.1% from 4.2% and Legacy RPL/NPL 3 to 31.6% from 36.7%. Legacy RPL/NPL have Current LTV of 58%. • Potential for upside in economic book value. • L oan portfolio fair value at 12/31/22 is $732.4M below par, or $7.19 per common share. Securitized debt fair value at 12/31/22 is $368.5M below par, or $3.62 per common share. • P otential net upside in our economic book value of $ 363.9M, or $3.57 per common share, assuming all loans and securitized debt were to be repaid at par value. • Strong credit performance supports potential book value upside. 1. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home V alu e Index (ZHVI) is utilized to estimate updated LTVs. For Transitional loans, the LTV reflects after repaired loan to value. 2. Purchased Performing includes Non - QM, Transitional, Single - Family Rental, Seasoned Performing and Agency Eligible Investor loans . 3. Legacy RPL/NPL includes Purchased Credit Deteriorated and Purchased Non - Performing loans. 0% 1% 2% 3% 4% 5% Purchased Performing Purchased Performing 60+ day delinquency Q4 2021 Q4 2022 Strong credit fundamentals support potential book value upside 0% 20% 40% 60% 80% NonQM BPL Other Total Loans Current LTV Q4 2021 Q4 2022

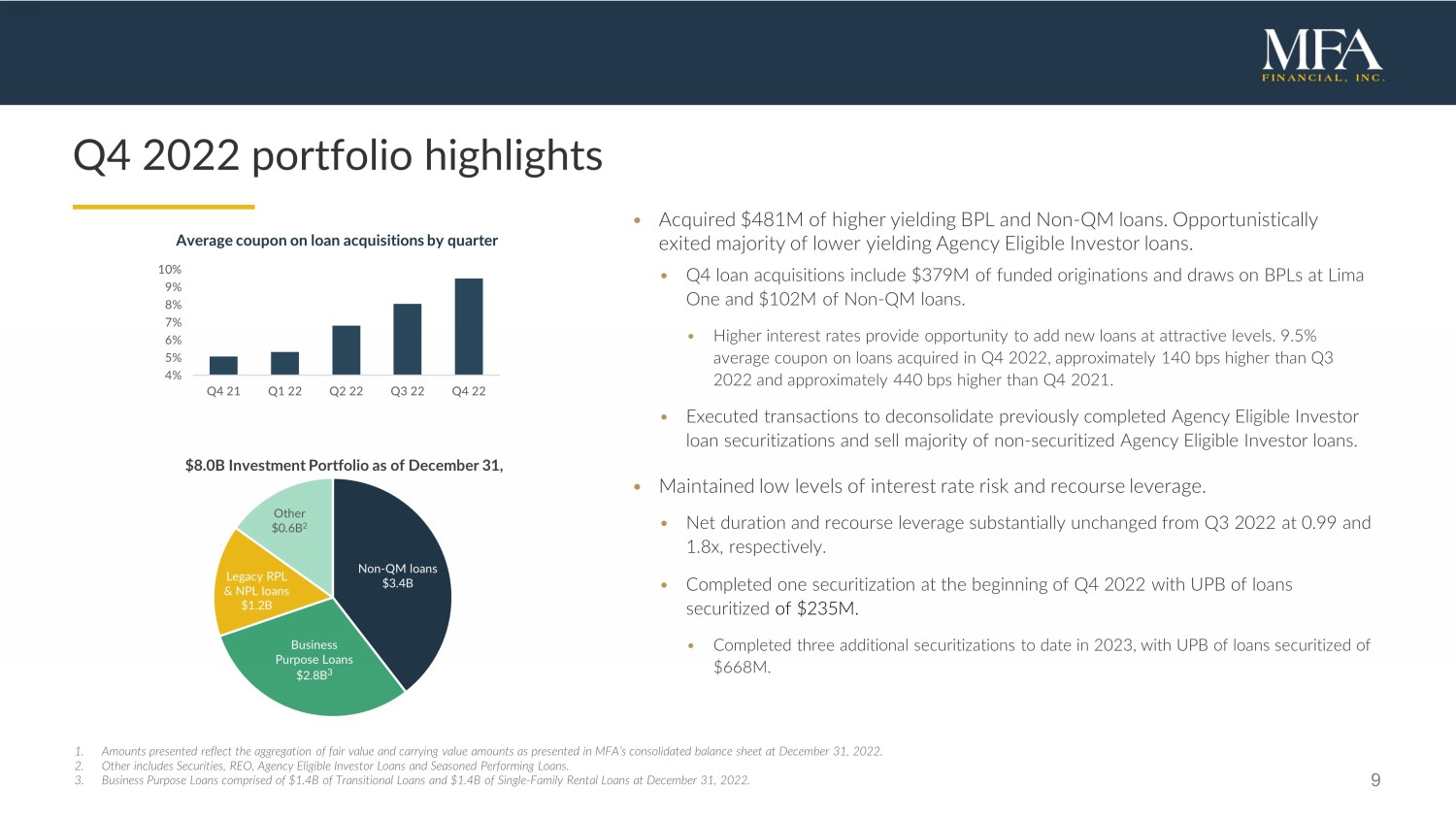

9 Q 4 2022 p ortfolio highlights $8.0B Investment Portfolio as of December 31, 2022 1 Non - QM loans $3.4B Business Purpose Loans $2.8B 3 Legacy RPL & NPL loans $1.2B Other $0.6B 2 • Acquired $481M of higher yielding BPL and Non - QM loans. Opportunistically exited majority of lower yielding Agency Eligible Investor loans. • Q4 loan acquisitions include $379M of funded originations and draws on BPLs at Lima One and $102M of Non - QM loans. • Higher interest rates provide opportunity to add new loans at attractive levels . 9.5% average coupon on loans acquired in Q4 2022, approximately 140 bps higher than Q3 2022 and approximately 440 bps higher than Q4 2021. • Executed transactions to deconsolidate previously completed Agency Eligible Investor loan securitizations and sell majority of non - securitized Agency Eligible Investor loans. • Maintained low levels of interest rate risk and recourse leverage. • Net duration and recourse leverage substantially unchanged from Q3 2022 at 0.99 and 1.8x, respectively. • Completed one securitization at the beginning of Q4 2022 with UPB of loans securitized of $ 235M . • C ompleted three additional securitization s to date in 2023 , with UPB of loans securitized of $ 668M . 4% 5% 6% 7% 8% 9% 10% Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Average coupon on loan acquisitions by quarter 1. Amounts presented reflect the aggregation of fair value and carrying value amounts as presented in MFA’s consolidated balance sh eet at December 31, 2022. 2. Other includes Securities, REO, Agency Eligible Investor Loans and Seasoned Performing Loans. 3. Business Purpose Loans comprised of $1.4B of Transitional Loans and $1.4B of Single - Family R ental L oans at December 31, 2022.

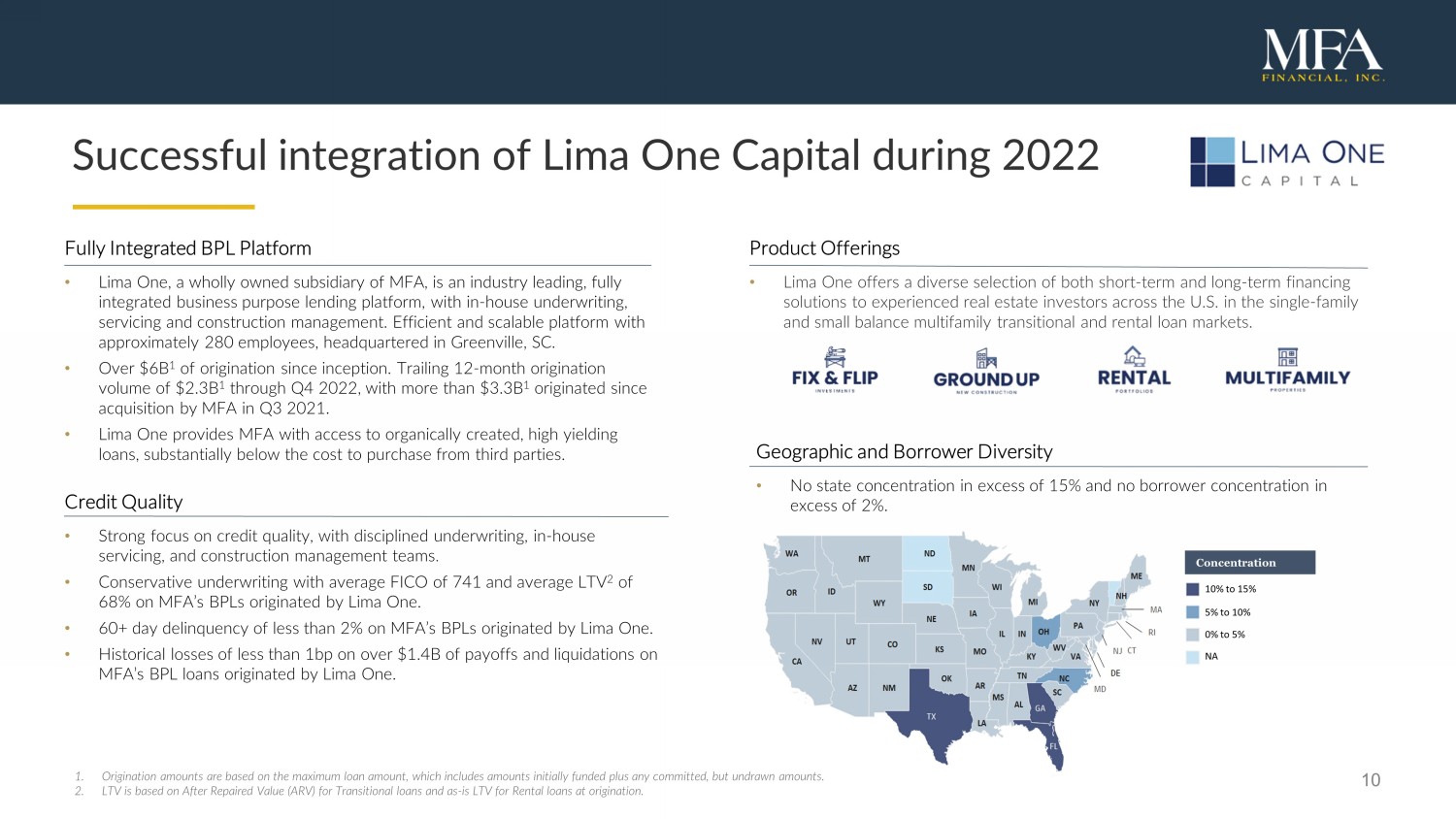

10 Successful integration of Lima One Capital during 2022 Product Offerings • Lima One offers a diverse selection of both short - term and long - term financing solutions to experienced real estate investors across the U.S. in the single - family and small balance multifamily transitional and rental loan markets. Fully Integrated BPL Platform • Lima One, a wholly owned subsidiary of MFA, is an industry leading, fully integrated business purpose lending platform, with in - house underwriting, servicing and construction management. Efficient and scalable platform with approximately 280 employees, headquartered in Greenville, SC. • Over $ 6B 1 of origination since inception. Trailing 12 - month origination volume of $ 2.3B 1 through Q4 2022, with more than $ 3.3B 1 originated since acquisition by MFA in Q3 2021. • Lima One provides MFA with access to organically created, high yielding loans, substantially below the cost to purchase from third parties. Credit Quality • Strong focus on credit quality, with disciplined underwriting, in - house servicing, and construction management teams . • Conservative underwriting with average FICO of 741 and average LTV 2 of 68% on MFA’s BPLs originated by Lima One. • 60+ day delinquency of less than 2% on MFA’s BPLs originated by Lima One. • Historical losses of less than 1bp on over $1.4B of payoffs and liquidations on MFA’s BPL loans originated by Lima One. Geographic and Borrower Diversity • No state concentration in excess of 15% and no borrower concentration in excess of 2 %. Concentration 10% to 15% 5% to 10% 0% to 5% NA 1. Origination amounts are based on the maximum loan amount, which includes amounts initially funded plus any committed, but und raw n amounts. 2. LTV is based on After Repaired Value (ARV) for Transitional loans and as - is LTV for Rental loans at origination.

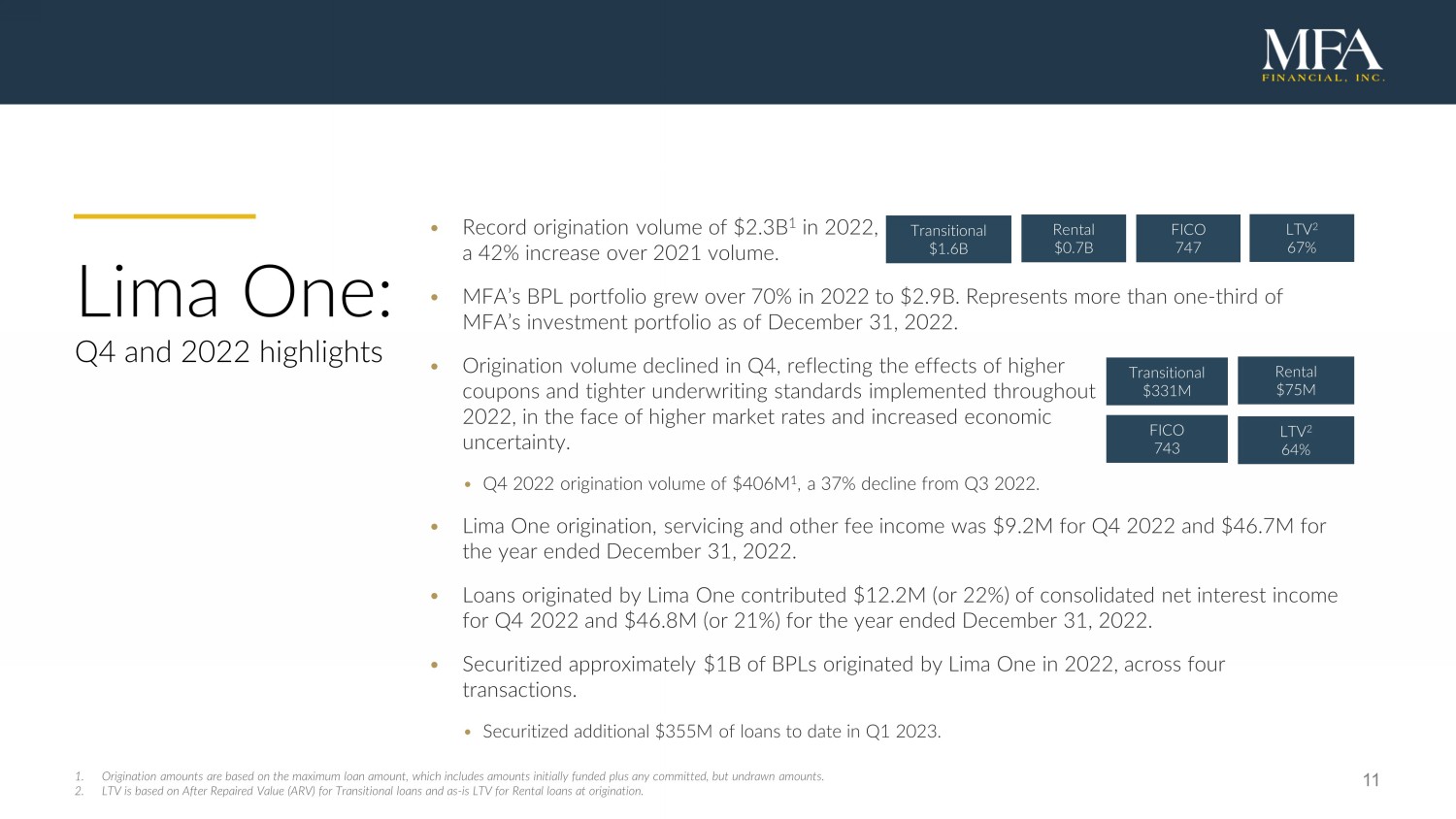

11 Lima One: Q4 and 2022 highlights • Record origination volume of $2.3B 1 in 2022, a 42% increase over 2021 volume. • MFA’s BPL portfolio grew over 70% in 2022 to $2.9B. Represents more than one - third of MFA’s investment portfolio as of December 31, 2022. • Origination volume declined in Q4, reflecting the effects of higher coupons and tighter underwriting standards implemented throughout 2022, in the face of higher market rates and increased economic uncertainty. • Q4 2022 origination volume of $406M 1 , a 37% decline from Q3 2022. • Lima One origination, servicing and other fee income was $9.2M for Q4 2022 and $46.7M for the year ended December 31, 2022. • Loans originated by Lima One contributed $12.2M (or 22%) of consolidated net interest income for Q4 2022 and $ 46.8M (or 21%) for the year ended December 31, 2022. • Securitized approximately $1B of BPLs originated by Lima One in 2022, across four transactions. • Securitized additional $355M of loans to date in Q1 2023. Transitional $1.6B Rental $0.7B FICO 747 LTV 2 67% Transitional $331M Rental $75M FICO 743 LTV 2 64% 1. Origination amounts are based on the maximum loan amount, which includes amounts initially funded plus any committed, but und raw n amounts. 2. LTV is based on After Repaired Value (ARV) for Transitional loans and as - is LTV for Rental loans at origination.

12 Business purpose loans: Transitional loans Q4 2022 highlights 1. WA ARV - LTV: Weighted average after repaired loan to value at origination. 2. WA Current ARV - LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillo w Home V alue I ndex (ZHVI) is utilized to estimate updated LTVs. 3. WA as - is/purchased LTV: Weighted average As - Is value or purchase value (when available) at origination. The Transitional Loan (TL ) portfolio grew by over $170M to $1.4B UPB at December 31, 2022, a 14% increase over Q3 2022. • Lima One originated $ 193M UPB ($ 331M maximum loan amount) of TL loans and funded $ 111M of draws in Q4 2022. • Average coupon on loans acquired in Q4 2022: 10.25 %. • 7.83% yield in Q4 2022. • Expanded financing capacity for TLs by $ 100M in Q4 2022. • 66% of financing at December 31, 2022 is non - mark - to - market. • Completed second securitization of TLs in February 2023. $151M UPB of loans securitized, bringing total securitized UPB to $402M. • 60+ day delinquency rate decreased from 6% to 5% at quarter - end. • Majority of delinquent loans were originated prior to April 2020 and 72% by originators other than Lima One. • Lima One originated loans represent 95% of MFA’s TL portfolio. 60+ day delinquency rate for Lima One originated loans is under 2%. Portfolio s tatistics ( 12/31 /22 ) UPB ($M) $1,432 Maximum Loan Amount ($M) $ 1,985 WA Coupon 7.88% WA ARV - LTV 1 66% WA Current ARV - LTV 2 63% WA As - Is/Purchased LTV 3 68% WA FICO 746 WA Loan Age (Months ) 9 Multifamily (5+ units) 45% Fourth Quarter Yield 7.83% 3 month Repayment rate (CPR) 35% 60+ Days Delinquent 5 % Top 2 states TX 16% GA 12%

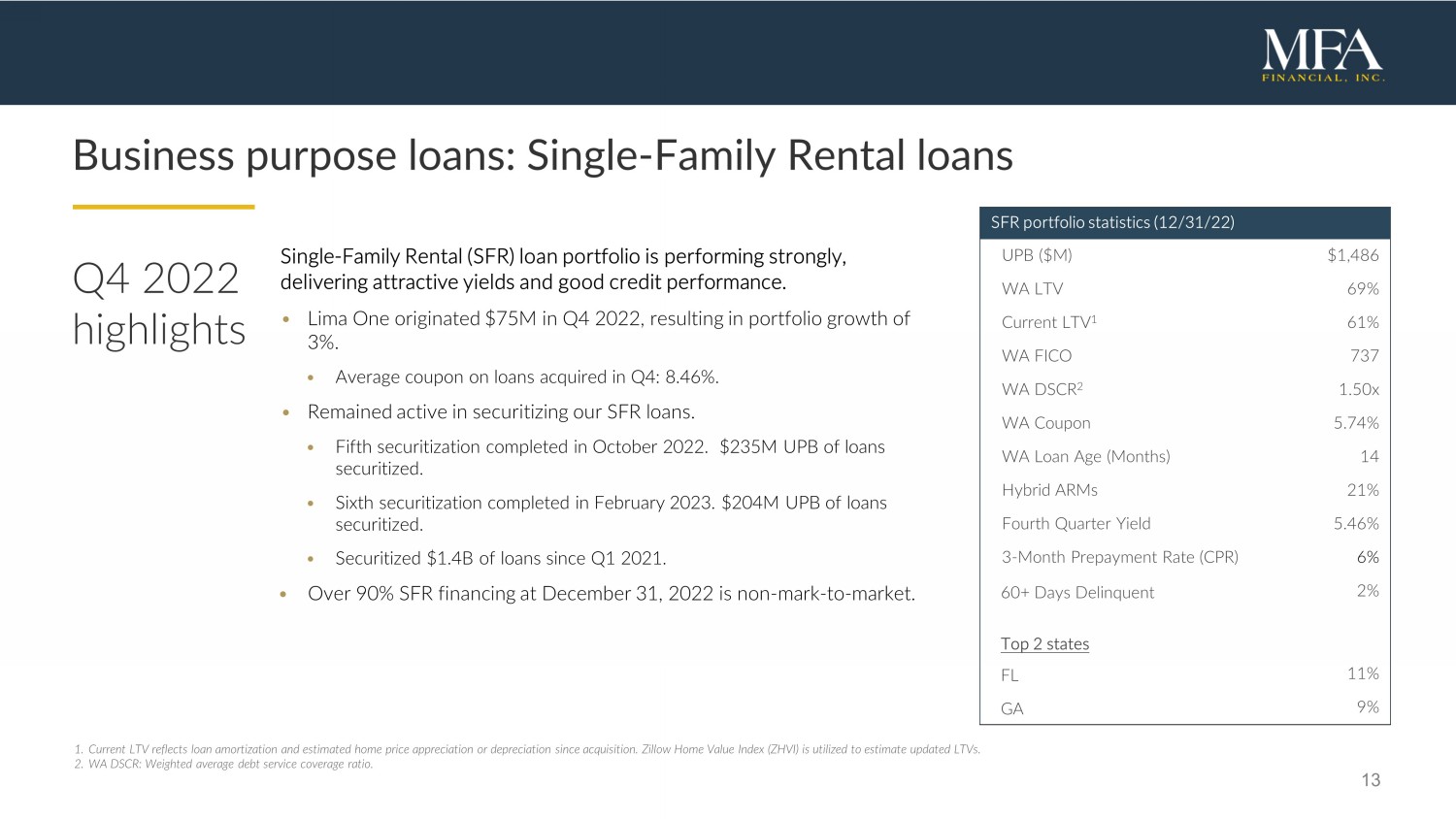

13 Business purpose loans: Single - Family Rental loans Q4 2022 highlights 1. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. 2. WA DSCR: Weighted average debt service coverage ratio. Single - Family Rental (SFR) loan portfolio is performing strongly, delivering attractive yields and good credit performance. • Lima One originated $75M in Q4 2022, resulting in portfolio growth of 3%. • Average coupon on loans acquired in Q4: 8.46 %. • Remained active in securitizing our SFR loans. • Fifth securitization completed in October 2022. $ 235M UPB of loans securitized. • Sixth securitization completed in February 2023. $204M UPB of loans securitized. • Securitized $1.4B of loans since Q1 2021. • Over 90% SFR financing at December 31, 2022 is non - mark - to - market. SFR p ortfolio s tatistics ( 12 /3 1 /22 ) UPB ($M) $ 1,486 WA LTV 69% Current LTV 1 61% WA FICO 737 WA DSCR 2 1.50x WA Coupon 5.74% WA Loan Age (Months ) 14 Hybrid ARMs 21% Fourth Quarter Yield 5.46% 3 - Month Prepayment Rate (CPR) 6% 60+ Days Delinquent 2% Top 2 states FL 11% GA 9%

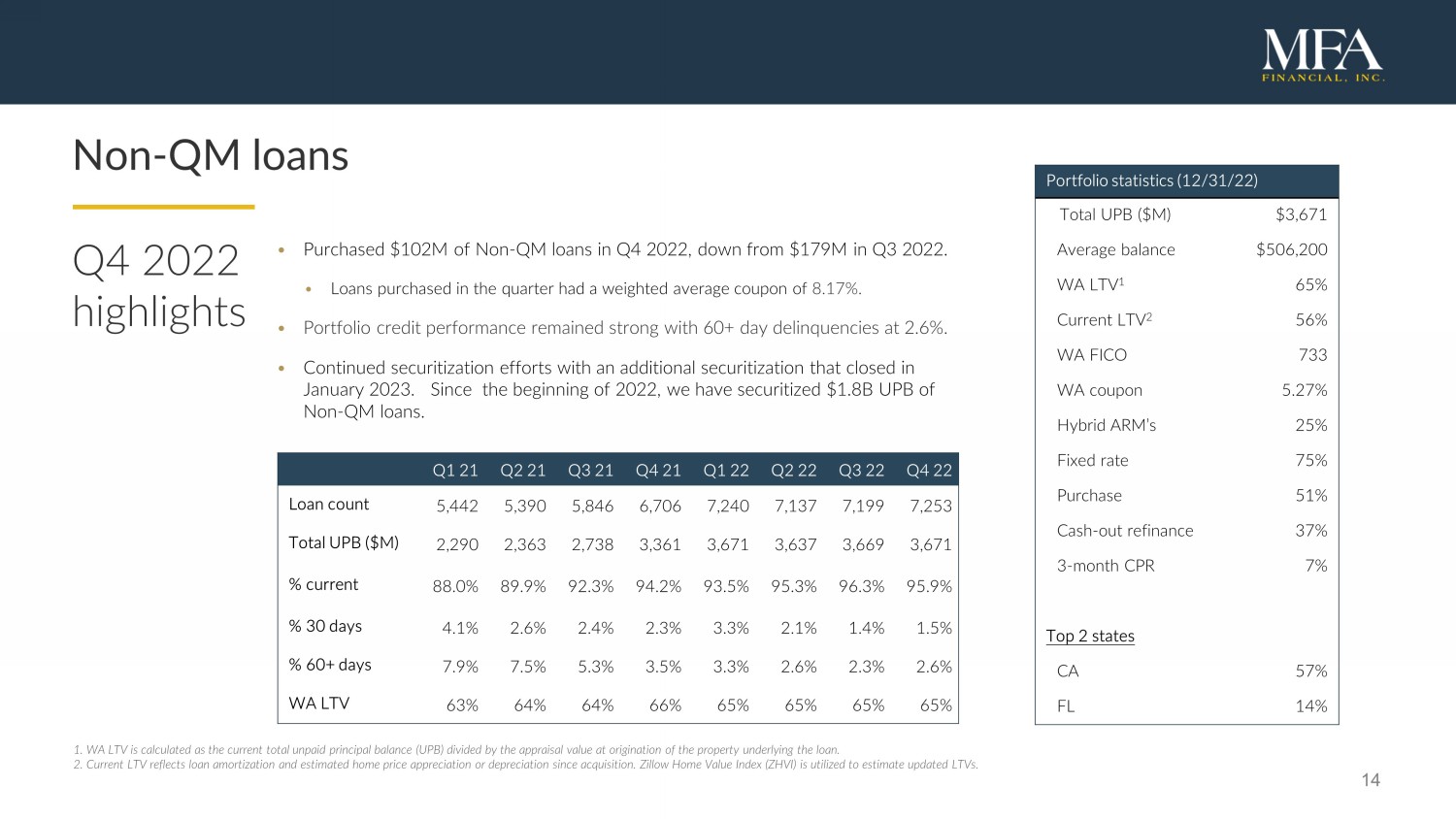

14 Non - QM loans Portfolio s tatistics ( 12 /3 1 /22 ) Total UPB ( $M ) $ 3,6 71 Average b alance $ 50 6 , 200 WA LTV 1 65% Current LTV 2 56% WA FICO 73 3 WA c oupon 5. 27 % Hybrid ARM’s 2 5 % Fixed r ate 7 5 % Purchase 51% Cash - o ut r efinance 3 7 % 3 - m onth CPR 7 % Top 2 s tates CA 5 7 % FL 14% Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Loan c ount 5,442 5,390 5,846 6,706 7,240 7,137 7,199 7,253 Total UP B ( $M ) 2,290 2,363 2,738 3,361 3,671 3,637 3,669 3,671 % c urrent 88.0% 89.9% 92.3% 94.2% 93.5% 95.3% 96.3% 95.9% % 30 d ays 4.1% 2.6% 2.4% 2.3% 3.3% 2.1% 1.4% 1.5% % 60+ d ays 7.9% 7.5% 5.3% 3.5% 3.3% 2.6% 2.3% 2.6% WA LTV 63% 64% 64% 66% 65% 65% 65% 65% • Purchased $ 102M of Non - QM loans in Q4 2022, down from $179M in Q3 2022. • Loans purchased in the quarter had a weighted average coupon of 8.17%. • Portfolio credit performance remained strong with 60+ day delinquencies at 2.6%. • Continued securitization efforts with an additional securitization that closed in January 2023 . Since the beginning of 2022, we have securitized $ 1.8B UPB of Non - QM loans. Q4 2022 highlights 1. WA LTV is calculated as the current total unpaid principal balance (UPB) divided by the appraisal value at origination of the property underlying the loan. 2. Current LTV reflects loan amortization and estimated home price appreciation or depreciation since acquisition. Zillow Home V alu e Index (ZHVI) is utilized to estimate updated LTVs.

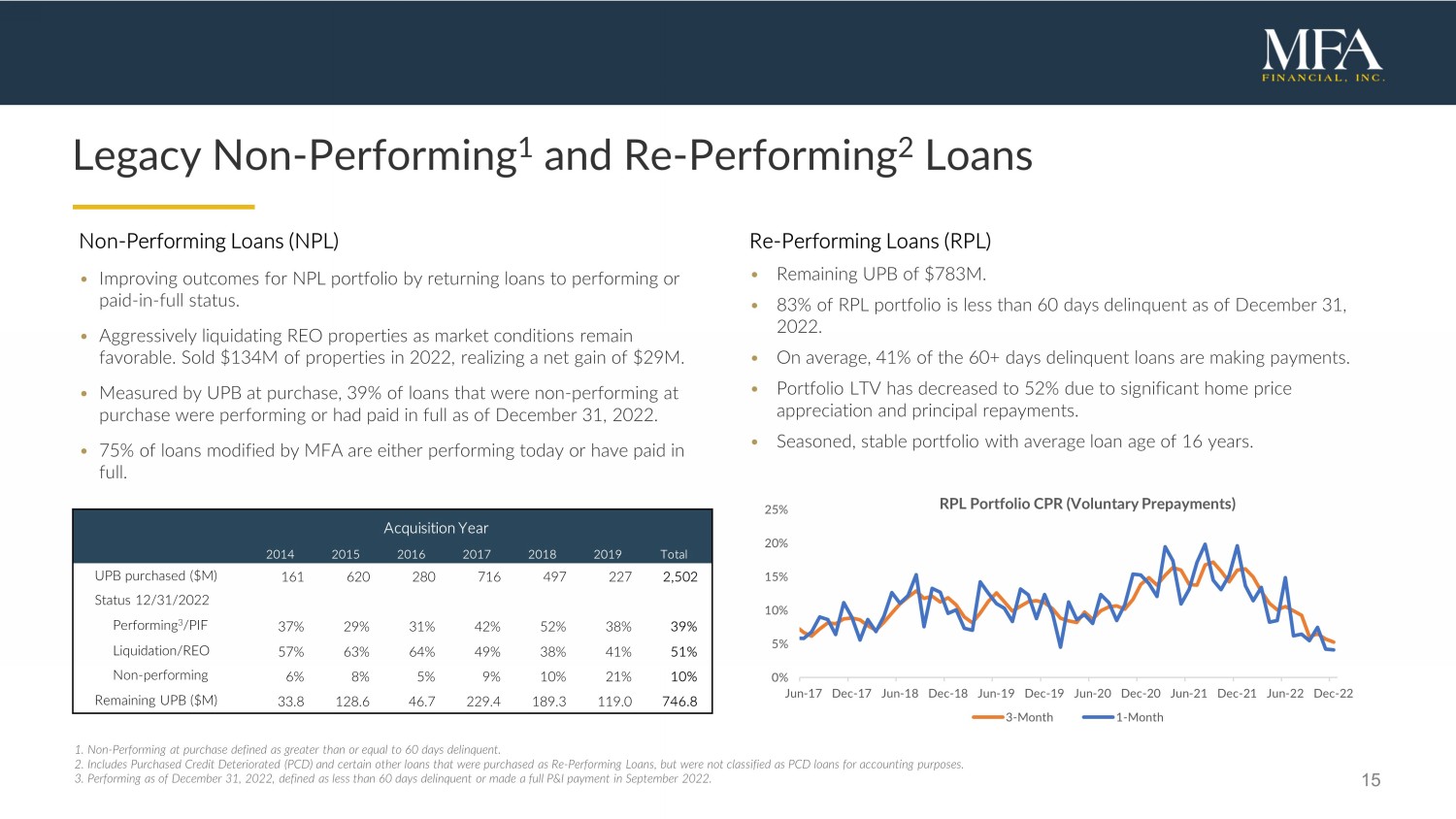

15 Legacy Non - Performing 1 and Re - Performing 2 Loans Non - Performing L oans (NPL) • I mprov ing outcomes for NPL portfolio by returning loans to performing or paid - in - full status . • A ggressively liquidating REO properties as market conditions remain favorable. S old $ 134M of properties in 2022 , realizing a net gain of $ 29M. • Measured by UPB at purchase, 39% of loans that were non - performing at purchase were performing or had paid in full as of December 31, 2022. • 75% of loans modified by MFA are either performing today or have paid in full. Re - Performing Loans (RPL) • Remaining UPB of $ 783M. • 8 3 % of RPL portfolio is less than 60 days delinquent as of December 31, 2022. • On average, 41 % of the 60+ days delinquent loans are making payments . • Portfolio LTV has decreased to 5 2 % due to significant home price appreciation and principal repayments . • Seasoned , stable portfolio with average loan age of 16 years . 1. Non - P erforming at purchase defined as greater than or equal to 60 days delinquent . 2. Includes Purchased Credit Deteriorated (PCD) and certain other loans that were purchased as Re - Performing L oans , but were not classified as PCD loans for accounting purposes. 3 . Performing as of December 31 , 2022, defined as less than 60 days delinquent or made a full P&I payment in September 2022 . Acquisition Year 2014 2015 2016 2017 2018 2019 Total UPB p urchased ($ M ) 161 620 280 716 497 227 2,502 Status 12/31 /2022 Performing 3 /PIF 37% 29% 31% 42% 52% 38% 39% Liquidation/REO 57% 63% 64% 49% 38% 41% 51% Non - p erforming 6% 8% 5 % 9% 10% 21% 10% Remaining UPB ($ M ) 33.8 128.6 46.7 229.4 189.3 119.0 746.8 0% 5% 10% 15% 20% 25% Jun-17 Dec-17 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 RPL Portfolio CPR (Voluntary Prepayments) 3-Month 1-Month

16 Appendix James Casebere , Landscape with Houses ( Dutchess County, NY) #2, 2010 ( detail)

17 MFA overview • MFA Financial, Inc. is a leading specialty finance company that invests in and finances residential mortgage assets. • Residential mortgage asset portfolio comprised of both transitional and term Business P urpose Loans (BPLs), Non - QM, Re - Performing and Non - Performing Loans and residential mortgage securities. • In the third quarter of 2021, MFA acquired Lima One, a leading nationwide originator and servicer of BPLs with over $6.0B in originations since inception. • MFA originates BPLs directly through Lima One and also acquires whole loans through a combination of flow and mini - bulk arrangements from a select group of originators with which it has strong relationships. • A leading residential credit securitization platform, with over $2.3B of issuance in 2022 and $6.5B since September 2020.

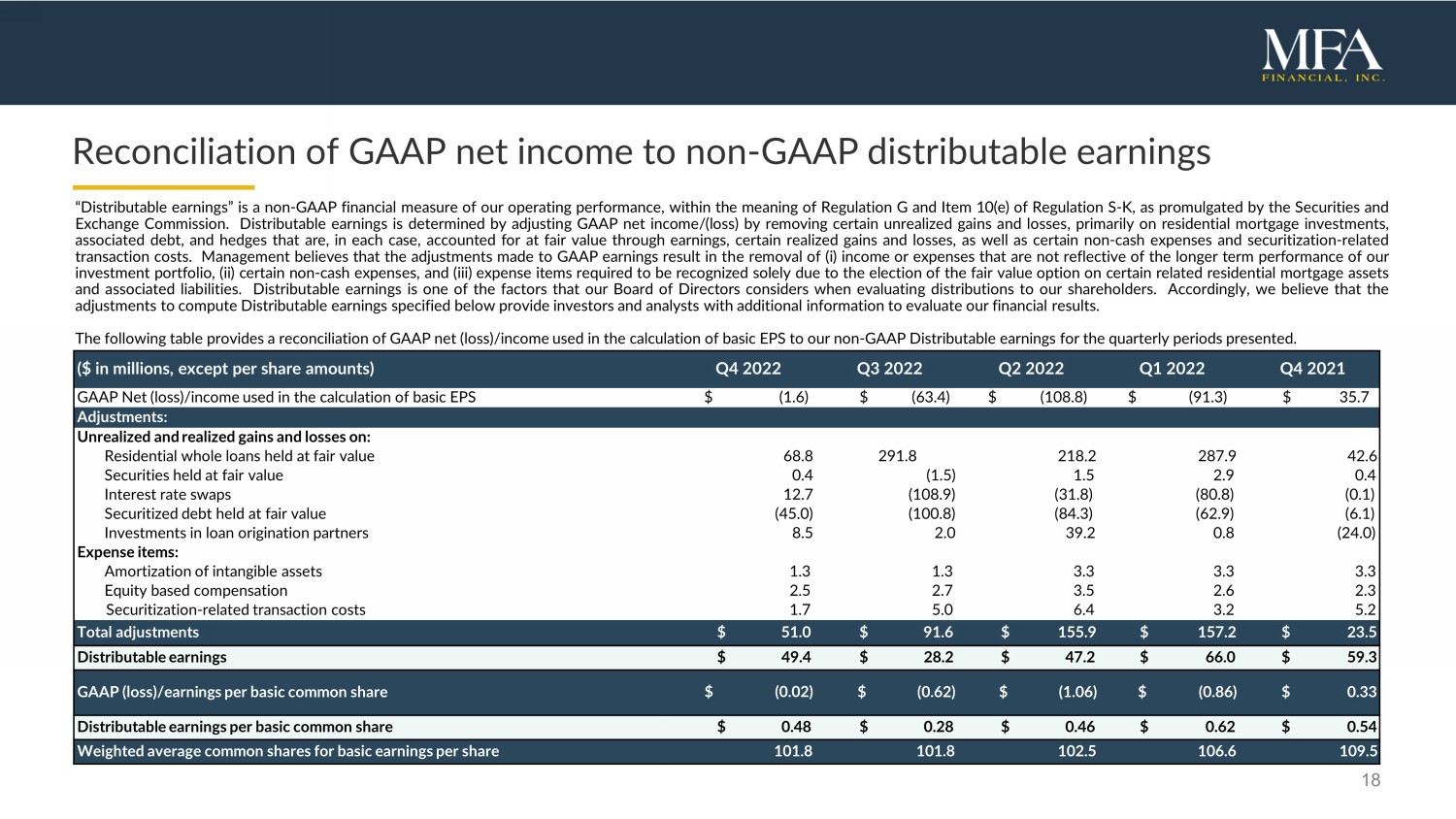

18 Reconciliation of GAAP net income to non - GAAP distributable earnings “Distributable earnings” is a non - GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10 (e) of Regulation S - K, as promulgated by the Securities and Exchange Commission . Distributable earnings is determined by adjusting GAAP net income/(loss) by removing certain unrealized gains and losses, primarily on residential mortgage investments, associated debt, and hedges that are, in each case, accounted for at fair value through earnings, certain realized gains and losses, as well as certain non - cash expenses and securitization - related transaction costs . Management believes that the adjustments made to GAAP earnings result in the removal of ( i ) income or expenses that are not reflective of the longer term performance of our investment portfolio, (ii) certain non - cash expenses, and (iii) expense items required to be recognized solely due to the election of the fair value option on certain related residential mortgage assets and associated liabilities . Distributable earnings is one of the factors that our Board of Directors considers when evaluating distributions to our shareholders . Accordingly, we believe that the adjustments to compute Distributable earnings specified below provide investors and analysts with additional information to evaluate our financial results . The following table provides a reconciliation of GAAP net (loss)/income used in the calculation of basic EPS to our non - GAAP Distributable earnings for the quarterly periods presented . ( $ i n m illions, e xcept p er s hare a mounts) Q 4 2022 Q 3 2022 Q2 2022 Q1 2022 Q 4 2021 GAAP Net (loss)/income used in the calculation of basic EPS $ (1.6) $ ( 63.4 ) $ (108.8) $ (91.3) $ 35.7 Adjustments: Unrealized and realized gains and losses on: Residential whole loans held at fair value 68.8 291.8 218.2 287.9 42.6 Securities held at fair value 0.4 ( 1.5 ) 1.5 2.9 0.4 Interest rate swaps 12.7 ( 108 . 9 ) (31.8) (80.8) (0.1) Securitized debt held at fair value ( 45.0 ) ( 100 . 8 ) (84.3) (62.9) (6.1) Investments in loan origination partners 8.5 2.0 39.2 0.8 (24.0) Expense items: Amortization of intangible assets 1.3 1.3 3.3 3.3 3.3 Equity based compensation 2.5 2.7 3.5 2.6 2.3 Securitization - related transaction costs 1.7 5.0 6.4 3.2 5.2 Total adjustments $ 51.0 $ 91.6 $ 155.9 $ 157.2 $ 23.5 Distributable earnings $ 49.4 $ 28.2 $ 47.2 $ 66.0 $ 59.3 GAAP (loss)/earnings per basic common share $ (0.02) $ ( 0 . 62 ) $ (1.06) $ (0.86) $ 0.33 Distributable earnings per basic common share $ 0.48 $ 0.28 $ 0.46 $ 0.62 $ 0.54 Weighted average common shares for basic earnings per share 10 1 . 8 10 1 . 8 102.5 106.6 109.5

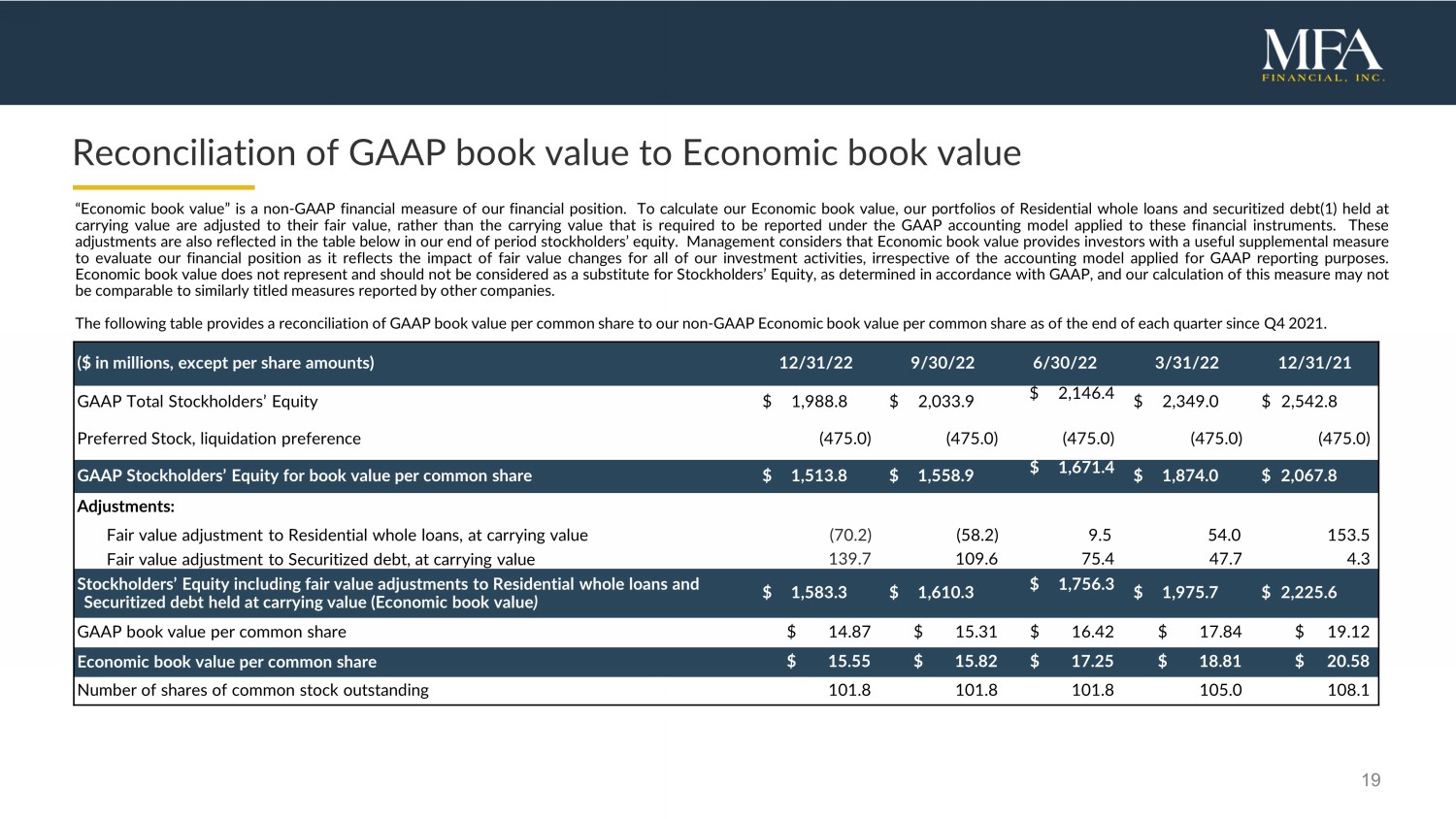

19 Reconciliation of GAAP book value to Economic book value “Economic book value” is a non - GAAP financial measure of our financial position . To calculate our Economic book value, our portfolios of Residential whole loans and securitized debt( 1 ) held at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these financial instruments . These adjustments are also reflected in the table below in our end of period stockholders’ equity . Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our investment activities, irrespective of the accounting model applied for GAAP reporting purposes . Economic book value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies . The following table provides a reconciliation of GAAP book value per common share to our non - GAAP Economic book value per common share as of the end of each quarter since Q 4 2021 . ($ i n millions, except per share amounts) 12 /3 1 /22 9 /30/22 6/30/22 3/31/22 12/31/21 GAAP Total Stockholders’ Equity $ 1,988.8 $ 2,033.9 $ 2,146.4 $ 2,349.0 $ 2,542.8 Preferred Stock, liquidation preference (475.0 ) (475.0 ) (475.0 ) (475.0 ) (475.0 ) GAAP Stockholders’ Equity for book value per common share $ 1, 513.8 $ 1, 558 . 9 $ 1,671.4 $ 1,874.0 $ 2,067.8 Adjustments: Fair value adjustment to Residential whole loans, at carrying value (70.2) (58.2) 9.5 54.0 153.5 Fair value adjustment to Securitized debt, at carrying value 139.7 109.6 75.4 47.7 4.3 Stockholders’ Equity including fair value adjustments to Residential whole loans and Securitized debt held at carrying value (Economic book value ) $ 1,583.3 $ 1,610.3 $ 1,756.3 $ 1,975.7 $ 2,225.6 GAAP book value per common share $ 14.87 $ 15.31 $ 16.42 $ 17.84 $ 19.12 Economic book value per common share $ 15.55 $ 15.82 $ 17.25 $ 18.81 $ 20.58 Number of shares of common stock outstanding 101.8 101.8 101.8 105.0 108.1

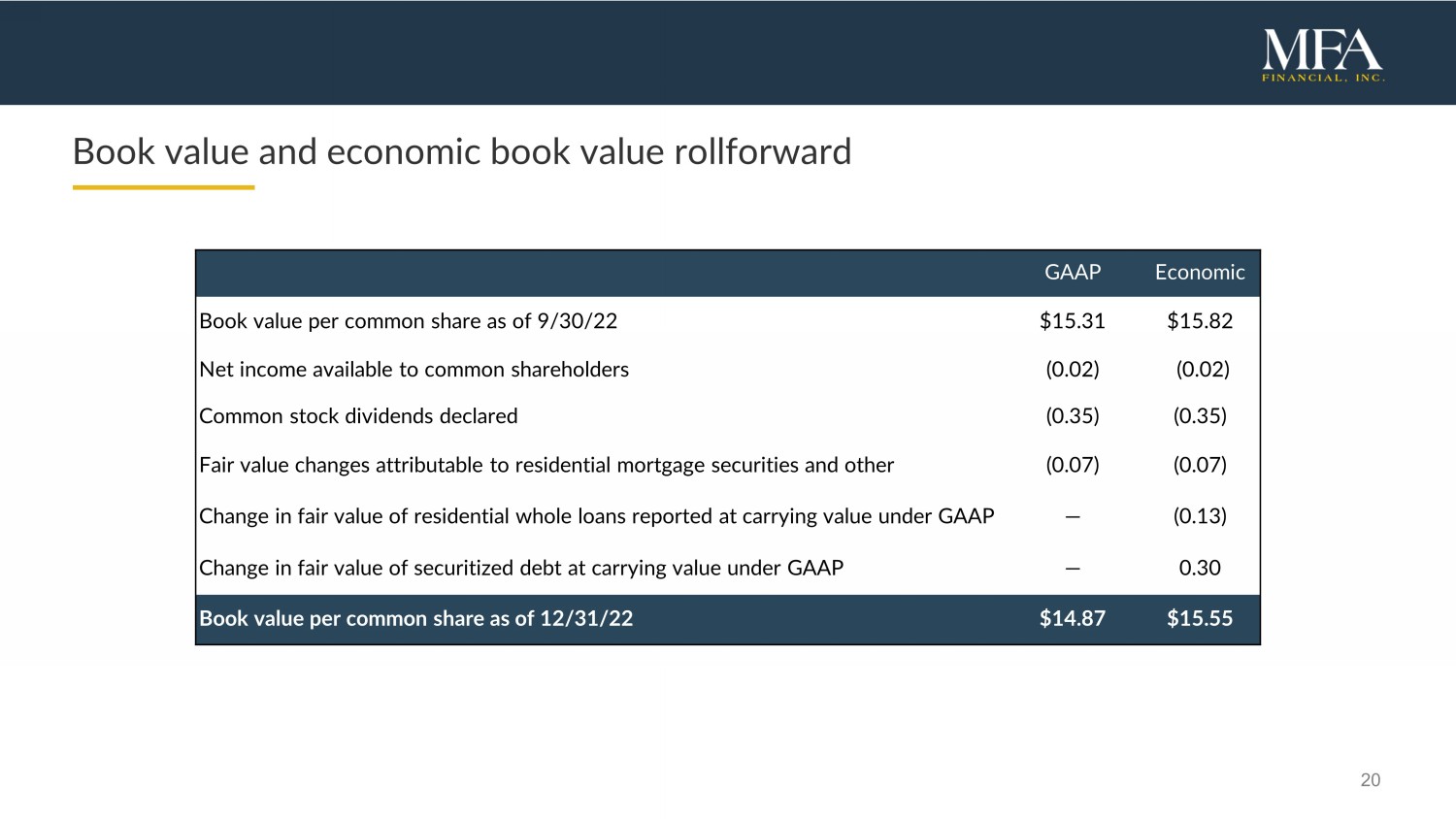

20 Book value and economic book value rollforward GAAP Economic Book value per common share as of 9/30/22 $15.31 $15.82 Net income available to common shareholders (0.02) (0.02) Common stock dividends declared ( 0. 35 ) ( 0. 35 ) Fair value changes attributable to residential mortgage securities and other ( 0.0 7) ( 0.0 7) Change in fair value of residential whole loans reported at carrying value under GAAP — ( 0. 13 ) Change in fair value of securitized debt at carrying value under GAAP — 0.30 Book value per common share as of 12/31/22 $ 14.87 $ 15 . 55

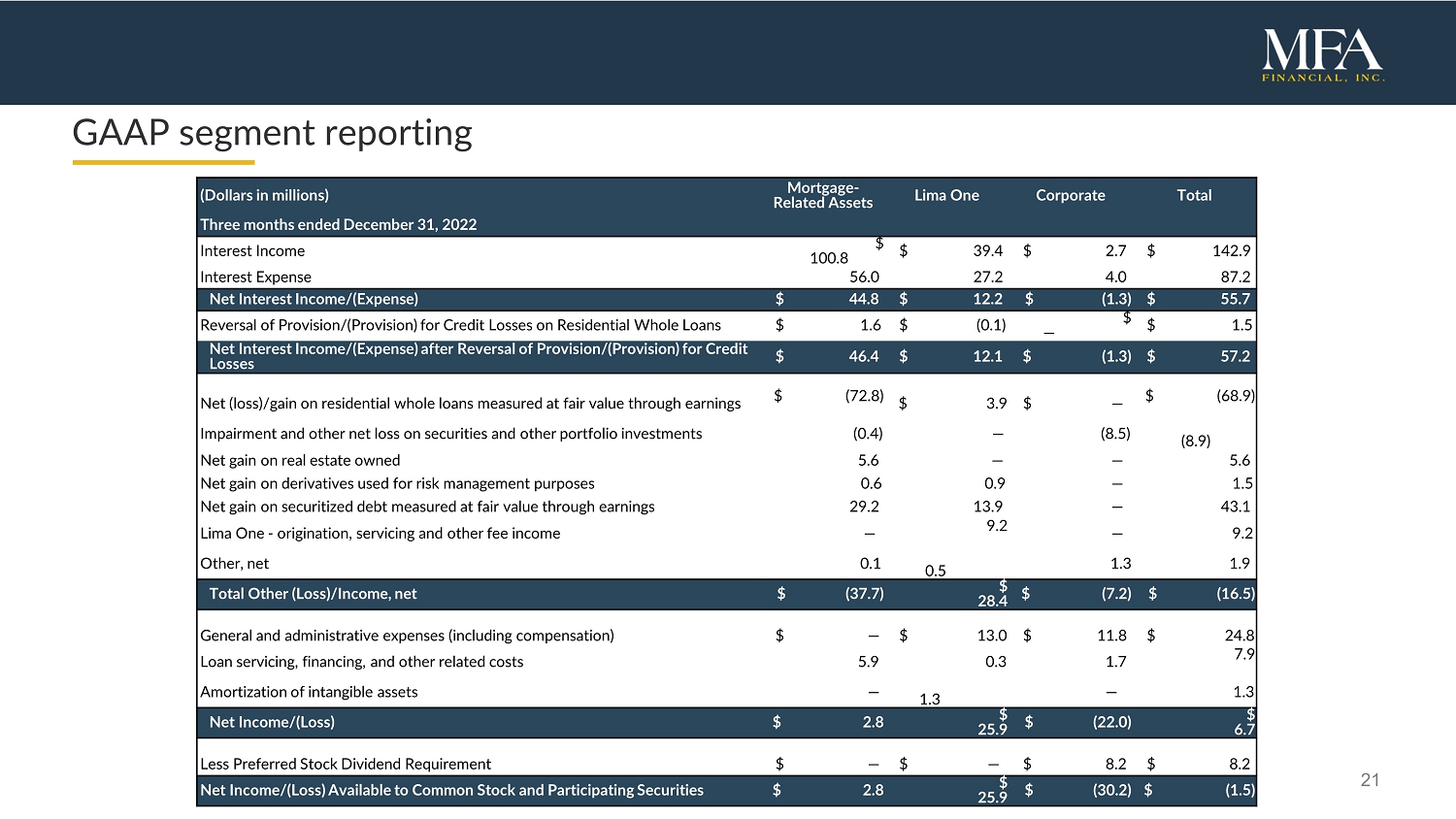

21 GAAP segment reporting (Dollars in m illions) Mortgage - Related Assets Lima One Corporate Total Three months ended December 31, 2022 Interest Income $ 100.8 $ 39.4 $ 2.7 $ 142.9 Interest Expense 56.0 27.2 4 . 0 87.2 Net Interest Income /(Expense) $ 44.8 $ 12.2 $ ( 1.3 ) $ 5 5.7 Reversal of Provision /(Provision) for Credit Losses on Residential Whole Loans $ 1.6 $ (0.1) $ — $ 1.5 Net Interest Income /(Expense) after Reversal of Provision/( Provision ) for Credit Losses $ 4 6.4 $ 12.1 $ ( 1.3 ) $ 57.2 Net (loss)/gain on residential whole loans measured at fair value through earnings $ ( 72.8 ) $ 3.9 $ — $ ( 68.9 ) Impairment and other net loss on securities and other portfolio investments (0.4) — (8.5) (8.9) Net gain on real estate owned 5.6 — — 5.6 Net gain on derivatives used for risk management purposes 0.6 0.9 — 1.5 Net gain on securitized debt measured at fair value through earnings 29.2 13.9 — 43.1 Lima One - origination, servicing and other fee income — 9.2 — 9.2 Other, net 0.1 0. 5 1.3 1.9 Total Other ( Loss )/Income , net $ ( 37.7 ) $ 28.4 $ (7.2) $ ( 16.5 ) General and administrative expenses (including compensation) $ — $ 13.0 $ 11.8 $ 2 4.8 Loan servicing, financing, and other related costs 5.9 0.3 1.7 7.9 Amortization of intangible assets — 1.3 — 1 .3 Net Income/( Loss ) $ 2.8 $ 25.9 $ ( 22.0 ) $ 6.7 Less Preferred Stock Dividend Requirement $ — $ — $ 8.2 $ 8.2

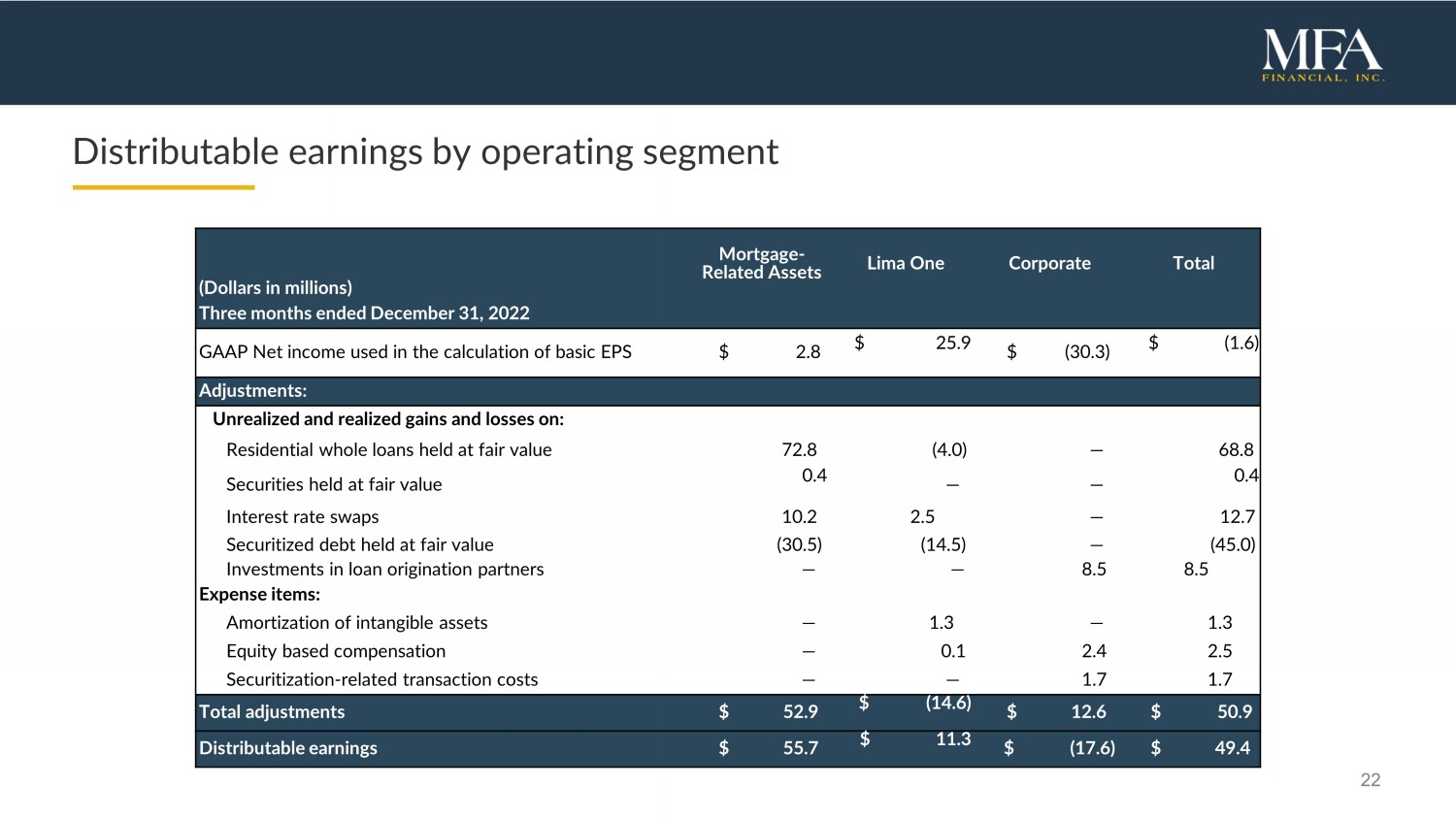

22 Distributable earnings by operating segment (Dollars in m illions ) Mortgage - Related Assets Lima One Corporate Total Three months ended December 3 1 , 2022 GAAP Net income used in the calculation of basic EPS $ 2.8 $ 25.9 $ ( 30.3 ) $ (1.6) Adjustments: Unrealized and realized gains and losses on: Residential whole loans held at fair value 72.8 (4.0) — 68.8 Securities held at fair value 0.4 — — 0.4 Interest rate swaps 10.2 2.5 — 12.7 Securitized debt held at fair value ( 30.5 ) ( 1 4 . 5 ) — ( 45.0 ) Investments in loan origination partners — — 8.5 8.5 Expense items: Amortization of intangible assets — 1.3 — 1.3 Equity based compensation — 0.1 2.4 2.5 Securitization - related transaction costs — — 1.7 1.7 Total adjustments $ 52.9 $ (14.6) $ 12.6 $ 50.9 Distributable earnings $ 55.7 $ 11.3 $ ( 17.6 ) $ 49.4