EXHIBIT 99.2

Published on May 4, 2023

|

Company Update FIRST QUARTER 2023 |

|

2

Q2 2022 Financial Snapshot

Forward-looking statements

When used in this presentation or other written or oral communications, statements that are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,”

“intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the S |

|

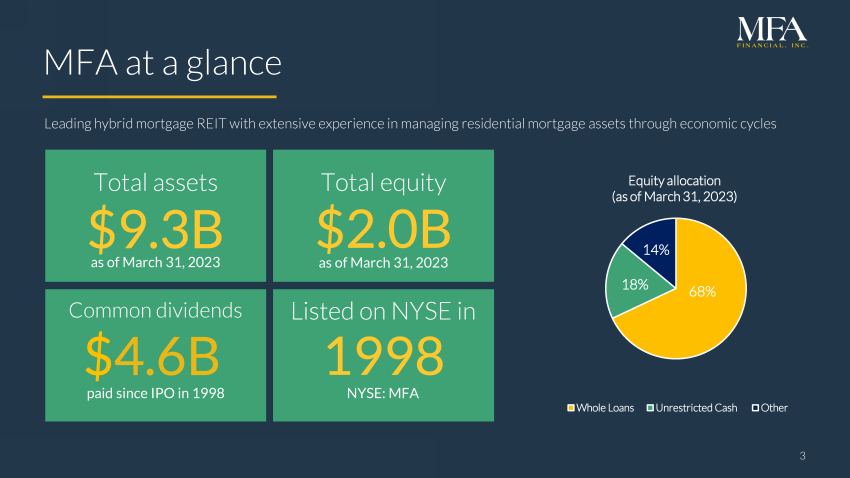

3 MFA at a glance $2.0B Total equity $4.6B Common dividends Leading hybrid mortgage REIT with extensive experience in managing residential mortgage assets through economic cycles $9.3B Total assets paid since IPO in 1998 1998 Listed on NYSE in as of March 31, 2023 as of March 31, 2023 NYSE: MFA 68% 18% 14% Equity allocation (as of March 31, 2023) Whole Loans Unrestricted Cash Other |

|

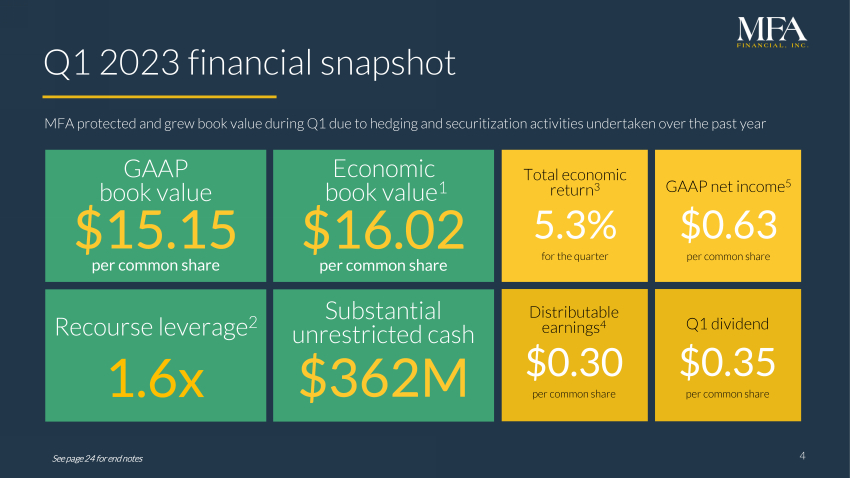

4 Q1 2023 financial snapshot MFA protected and grew book value during Q1 due to hedging and securitization activities undertaken over the past year $15.15 $16.02 GAAP net income5 $0.63 per common share Distributable earnings4 $0.30 per common share Q1 dividend $0.35 per common share GAAP book value Economic book value1 per common share per common share $362M Substantial unrestricted cash 1.6x Recourse leverage2 4 Total economic return3 5.3% for the quarter See page 24 for end notes |

|

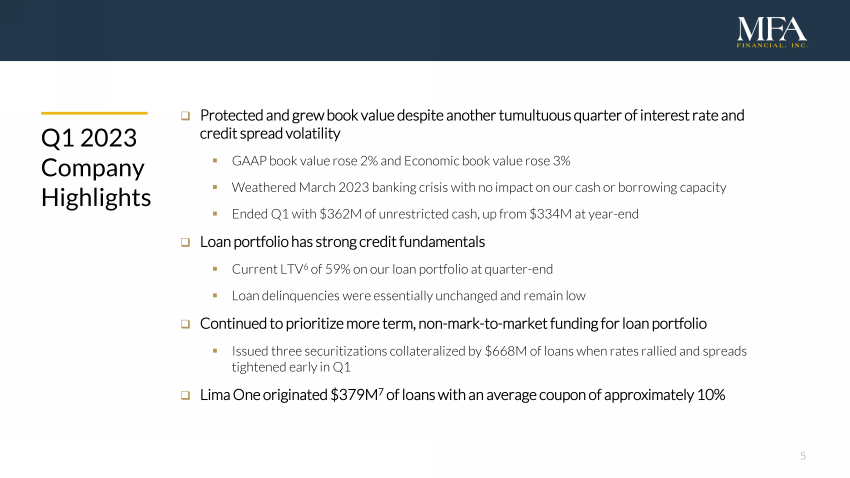

5 Q1 2023 Company Highlights Protected and grew book value despite another tumultuous quarter of interest rate and credit spread volatility GAAP book value rose 2% and Economic book value rose 3% Weathered March 2023 banking crisis with no impact on our cash or borrowing capacity Ended Q1 with $362M of unrestricted cash, up from $334M at year-end Loan portfolio has strong credit fundamentals Current LTV6 of 59% on our loan portfolio at quarter-end Loan delinquencies were essentially unchanged and remain low Continued to prioritize more term, non-mark-to-market funding for loan portfolio Issued three securitizations collateralized by $668M of loans when rates rallied and spreads tightened early in Q1 Lima One originated $379M7 of loans with an average coupon of approximately 10% |

|

6 Grew our investment portfolio by 5.5% to $8.4 billion Lima One funded $364M of new business purpose loans (BPLs) and draws on existing loans Acquired $90M UPB of non-qualified mortgage (Non-QM) loans Acquired $174M of Agency MBS during Q1, bringing that portfolio to over $300M Portfolio runoff was $323M for the quarter Higher interest rates provide the opportunity to add new assets at attractive yields Average coupon on loans acquired in Q1 was 10% Average coupon in Lima One’s origination pipeline remains above 10% Incremental ROE on new investments averages in the mid-teens Q1 2023 Portfolio Highlights 4% 5% 6% 7% 8% 9% 10% Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Non-QM Loans Business Purpose Loans9 Legacy RPL/NPL Other Agency MBS $0.3B $3.5B $3.0B $1.2B $0.5B Investment Portfolio as of March 31, 20238 Average Coupon on Loan Acquisitions |

|

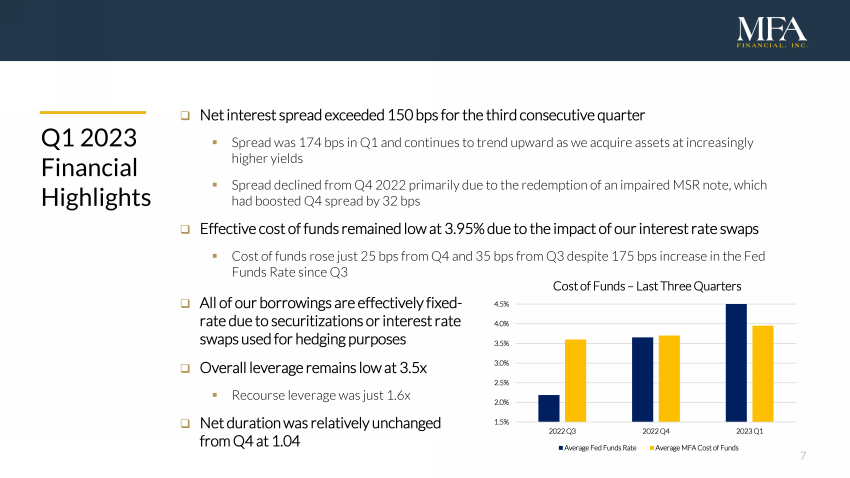

7 All of our borrowings are effectively fixed-rate due to securitizations or interest rate swaps used for hedging purposes Overall leverage remains low at 3.5x Recourse leverage was just 1.6x Net duration was relatively unchanged from Q4 at 1.04 Q1 2023 Financial Highlights Net interest spread exceeded 150 bps for the third consecutive quarter Spread was 174 bps in Q1 and continues to trend upward as we acquire assets at increasingly higher yields Spread declined from Q4 2022 primarily due to the redemption of an impaired MSR note, which had boosted Q4 spread by 32 bps Effective cost of funds remained low at 3.95% due to the impact of our interest rate swaps Cost of funds rose just 25 bps from Q4 and 35 bps from Q3 despite 175 bps increase in the Fed Funds Rate since Q3 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 2022 Q3 2022 Q4 2023 Q1 Cost of Funds – Last Three Quarters Average Fed Funds Rate Average MFA Cost of Funds |

|

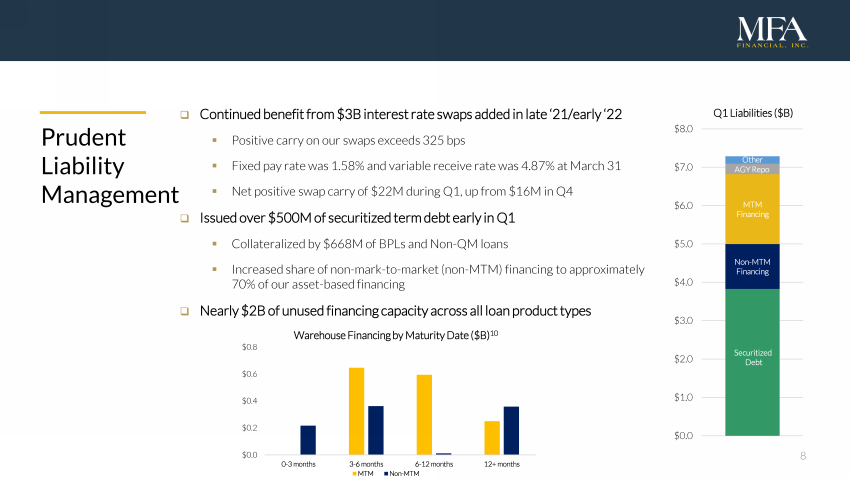

8 Continued benefit from $3B interest rate swaps added in late ‘21/early ‘22 Positive carry on our swaps exceeds 325 bps Fixed pay rate was 1.58% and variable receive rate was 4.87% at March 31 Net positive swap carry of $22M during Q1, up from $16M in Q4 Issued over $500M of securitized term debt early in Q1 Collateralized by $668M of BPLs and Non-QM loans Increased share of non-mark-to-market (non-MTM) financing to approximately 70% of our asset-based financing Nearly $2B of unused financing capacity across all loan product types Prudent Liability Management Securitized Debt Non-MTM Financing MTM Financing AGY Repo Other $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q1 Liabilities ($B) $0.0 $0.2 $0.4 $0.6 $0.8 0-3 months 3-6 months 6-12 months 12+ months Warehouse Financing by Maturity Date ($B)10 MTM Non-MTM |

|

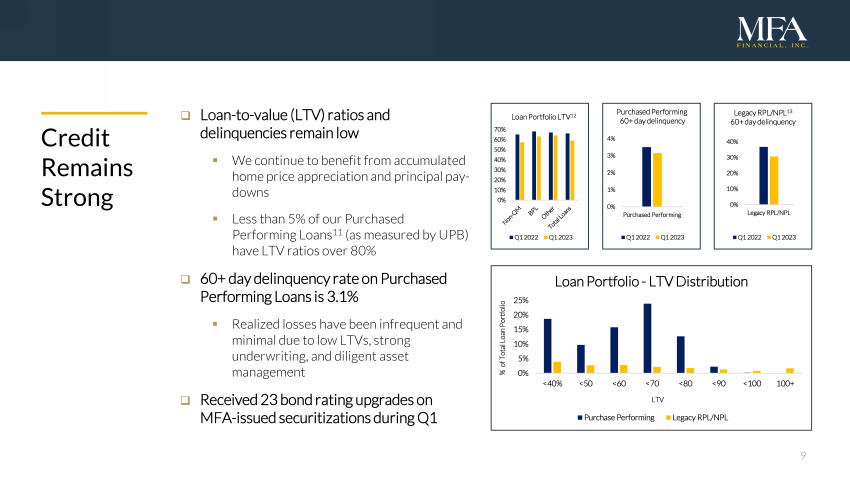

9 Loan-to-value (LTV) ratios and delinquencies remain low We continue to benefit from accumulated home price appreciation and principal pay-downs Less than 5% of our Purchased Performing Loans11 (as measured by UPB) have LTV ratios over 80% Credit Remains Strong 60+ day delinquency rate on Purchased Performing Loans is 3.1% Realized losses have been infrequent and minimal due to low LTVs, strong underwriting, and diligent asset management Received 23 bond rating upgrades on MFA-issued securitizations during Q1 0% 10% 20% 30% 40% Legacy RPL/NPL Legacy RPL/NPL13 60+ day delinquency Q1 2022 Q1 2023 0% 1% 2% 3% 4% Purchased Performing Purchased Performing 60+ day delinquency Q1 2022 Q1 2023 0% 10% 20% 30% 40% 50% 60% 70% Loan Portfolio LTV12 Q1 2022 Q1 2023 0% 5% 10% 15% 20% 25% <40% <50 <60 <70 <80 <90 <100 100+ % of Total Loan Portfolio LTV Loan Portfolio - LTV Distribution Purchase Performing Legacy RPL/NPL |

|

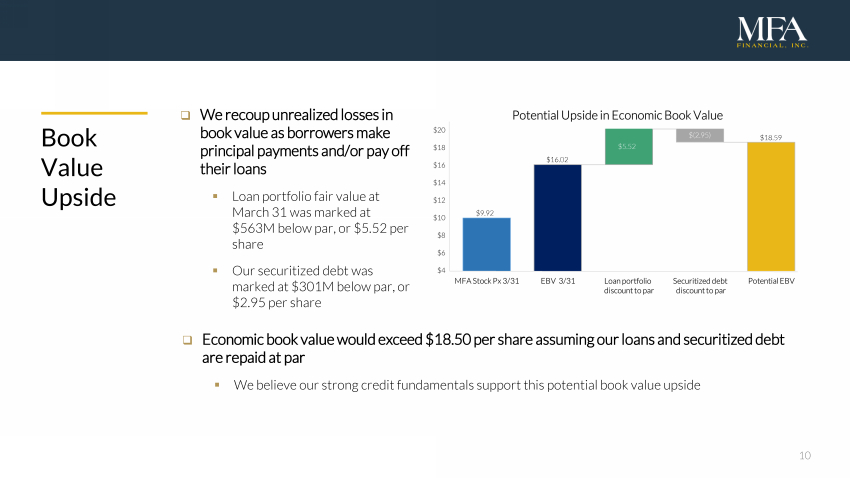

10 Book Value Upside We recoup unrealized losses in book value as borrowers make principal payments and/or pay off their loans Loan portfolio fair value at March 31 was marked at $563M below par, or $5.52 per share Our securitized debt was marked at $301M below par, or $2.95 per share Economic book value would exceed $18.50 per share assuming our loans and securitized debt are repaid at par We believe our strong credit fundamentals support this potential book value upside $9.92 $16.02 $(2.95) $5.52 $18.59 |

|

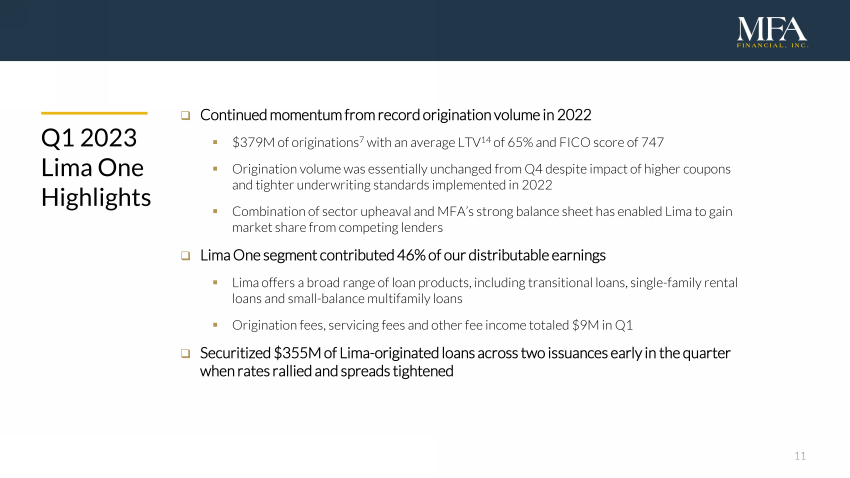

11 Continued momentum from record origination volume in 2022 $379M of originations7 with an average LTV14 of 65% and FICO score of 747 Origination volume was essentially unchanged from Q4 despite impact of higher coupons and tighter underwriting standards implemented in 2022 Combination of sector upheaval and MFA’s strong balance sheet has enabled Lima to gain market share from competing lenders Lima One segment contributed 46% of our distributable earnings Lima offers a broad range of loan products, including transitional loans, single-family rental loans and small-balance multifamily loans Origination fees, servicing fees and other fee income totaled $9M in Q1 Securitized $355M of Lima-originated loans across two issuances early in the quarter when rates rallied and spreads tightened Q1 2023 Lima One Highlights |

|

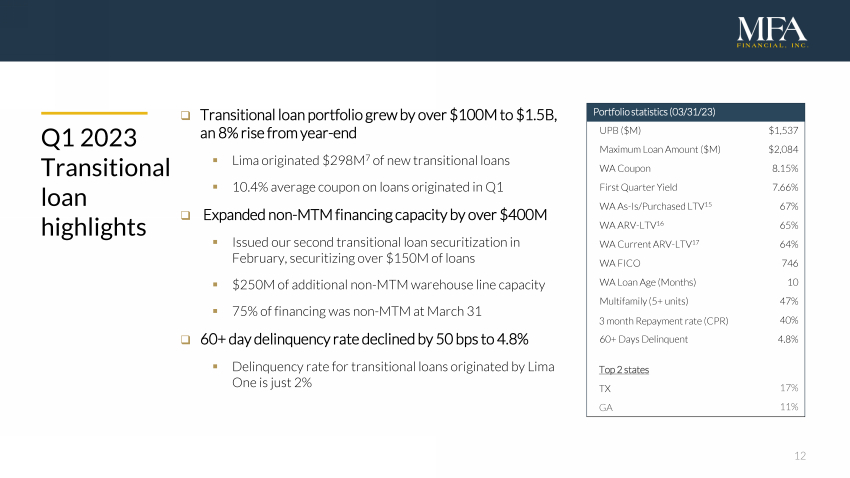

12 Portfolio statistics (03/31/23) UPB ($M) $1,537 Maximum Loan Amount ($M) $2,084 WA Coupon 8.15% First Quarter Yield 7.66% WA As-Is/Purchased LTV15 67% WA ARV-LTV16 65% WA Current ARV-LTV17 64% WA FICO 746 WA Loan Age (Months) 10 Multifamily (5+ units) 47% 3 month Repayment rate (CPR) 40% 60+ Days Delinquent 4.8% Top 2 states TX 17% GA 11% Q1 2023 Transitional loan highlights Transitional loan portfolio grew by over $100M to $1.5B, an 8% rise from year-end Lima originated $298M7 of new transitional loans 10.4% average coupon on loans originated in Q1 Expanded non-MTM financing capacity by over $400M Issued our second transitional loan securitization in February, securitizing over $150M of loans $250M of additional non-MTM warehouse line capacity 75% of financing was non-MTM at March 31 60+ day delinquency rate declined by 50 bps to 4.8% Delinquency rate for transitional loans originated by Lima One is just 2% |

|

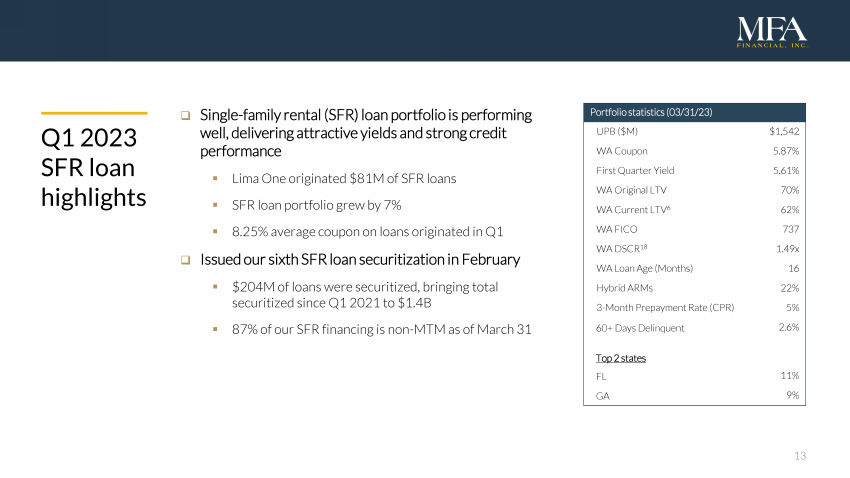

13 Portfolio statistics (03/31/23) UPB ($M) $1,542 WA Coupon 5.87% First Quarter Yield 5.61% WA Original LTV 70% WA Current LTV6 62% WA FICO 737 WA DSCR18 1.49x WA Loan Age (Months) 16 Hybrid ARMs 22% 3-Month Prepayment Rate (CPR) 5% 60+ Days Delinquent 2.6% Top 2 states FL 11% GA 9% Q1 2023 SFR loan highlights Single-family rental (SFR) loan portfolio is performing well, delivering attractive yields and strong credit performance Lima One originated $81M of SFR loans SFR loan portfolio grew by 7% 8.25% average coupon on loans originated in Q1 Issued our sixth SFR loan securitization in February $204M of loans were securitized, bringing total securitized since Q1 2021 to $1.4B 87% of our SFR financing is non-MTM as of March 31 |

|

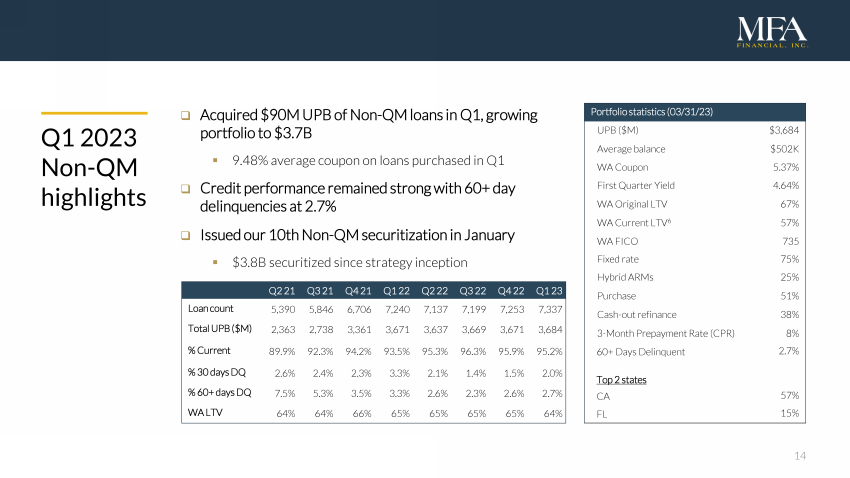

14 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 Loan count 5,390 5,846 6,706 7,240 7,137 7,199 7,253 7,337 Total UPB($M) 2,363 2,738 3,361 3,671 3,637 3,669 3,671 3,684 % Current 89.9% 92.3% 94.2% 93.5% 95.3% 96.3% 95.9% 95.2% % 30 daysDQ 2.6% 2.4% 2.3% 3.3% 2.1% 1.4% 1.5% 2.0% % 60+ daysDQ 7.5% 5.3% 3.5% 3.3% 2.6% 2.3% 2.6% 2.7% WA LTV 64% 64% 66% 65% 65% 65% 65% 64% Q1 2023 Non-QM highlights Acquired $90M UPB of Non-QM loans in Q1, growing portfolio to $3.7B 9.48% average coupon on loans purchased in Q1 Credit performance remained strong with 60+ day delinquencies at 2.7% Issued our 10th Non-QM securitization in January $3.8B securitized since strategy inception Portfolio statistics (03/31/23) UPB ($M) $3,684 Average balance $502K WA Coupon 5.37% First Quarter Yield 4.64% WA Original LTV 67% WA Current LTV6 57% WA FICO 735 Fixed rate 75% Hybrid ARMs 25% Purchase 51% Cash-out refinance 38% 3-Month Prepayment Rate (CPR) 8% 60+ Days Delinquent 2.7% Top 2 states CA 57% FL 15% |

|

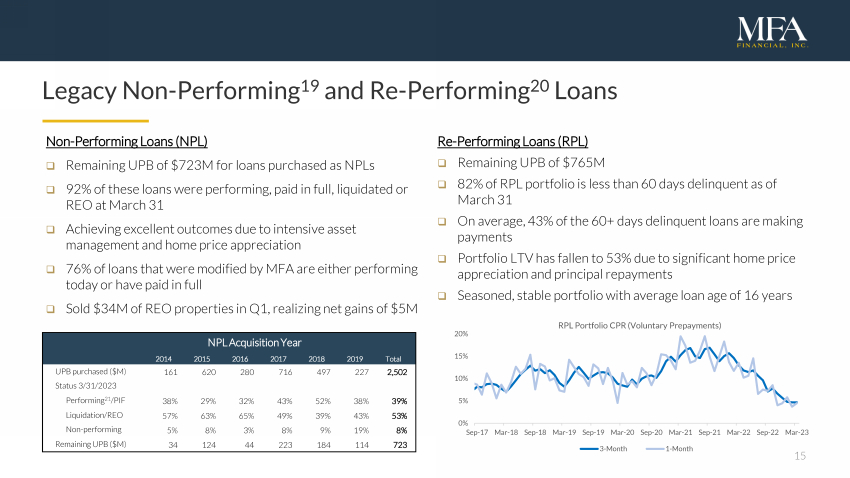

15 Legacy Non-Performing19 and Re-Performing20 Loans Non-Performing Loans (NPL) Remaining UPB of $723M for loans purchased as NPLs 92% of these loans were performing, paid in full, liquidated or REO at March 31 Achieving excellent outcomes due to intensive asset management and home price appreciation 76% of loans that were modified by MFA are either performing today or have paid in full Sold $34M of REO properties in Q1, realizing net gains of $5M Re-Performing Loans (RPL) Remaining UPB of $765M 82% of RPL portfolio is less than 60 days delinquent as of March 31 On average, 43% of the 60+ days delinquent loans are making payments Portfolio LTV has fallen to 53% due to significant home price appreciation and principal repayments Seasoned, stable portfolio with average loan age of 16 years NPL Acquisition Year 2014 2015 2016 2017 2018 2019 Total UPB purchased ($M) 161 620 280 716 497 227 2,502 Status 3/31/2023 Performing21/PIF 38% 29% 32% 43% 52% 38% 39% Liquidation/REO 57% 63% 65% 49% 39% 43% 53% Non-performing 5% 8% 3% 8% 9% 19% 8% Remaining UPB ($M) 34 124 44 223 184 114 723 0% 5% 10% 15% 20% Sep-17 Mar-18 Sep-18 Mar-19 Sep-19 Mar-20 Sep-20 Mar-21 Sep-21 Mar-22 Sep-22 Mar-23 RPL Portfolio CPR (Voluntary Prepayments) 3-Month 1-Month |

|

16 Appendix James Casebere, Landscape with Houses (Dutchess County, NY) #2, 2010 (detail) |

|

17 MFA Financial Overview MFA Financial, Inc. (NYSE: MFA) is a leading specialty finance company that invests in and finances residential mortgage assets MFA owns a diversified portfolio of residential mortgage assets, including transitional and term business purpose loans (BPLs), non-qualified mortgage (Non-QM) loans, re-performing/non-performing loans and residential mortgage-backed securities (RMBS) In 2021, MFA acquired Lima One Capital, a leading nationwide originator and servicer of BPLs with over $7B in originations since its formation MFA originates BPLs directly through Lima One and acquires Non-QM loans through flow and mini-bulk arrangements with a select group of originators with which it holds strong relationships MFA operates a leading residential credit securitization platform, with over $2.3B of issuance in 2022 and $7.3B since inception MFA has deep expertise in residential credit and a long history of investing in new asset classes when compelling opportunities arise |

|

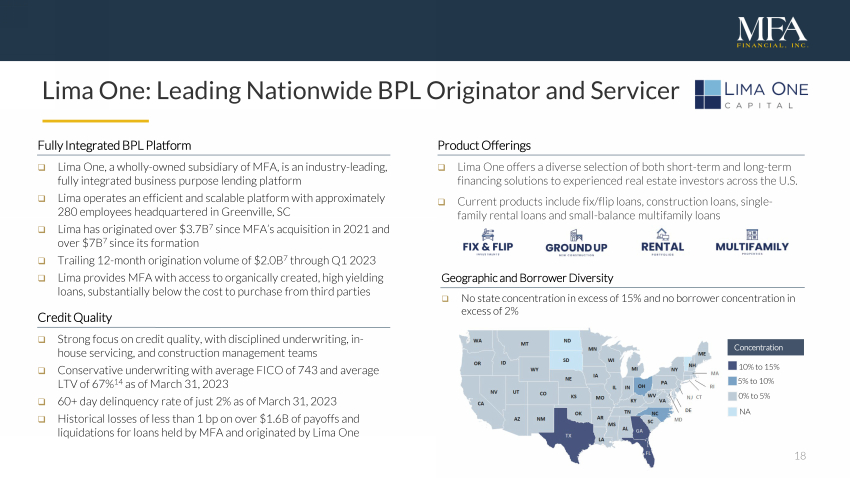

18 Lima One: Leading Nationwide BPL Originator and Servicer Product Offerings Lima One offers a diverse selection of both short-term and long-term financing solutions to experienced real estate investors across the U.S. Current products include fix/flip loans, construction loans, single-family rental loans and small-balance multifamily loans Fully Integrated BPL Platform Lima One, a wholly-owned subsidiary of MFA, is an industry-leading, fully integrated business purpose lending platform Lima operates an efficient and scalable platform with approximately 280 employees headquartered in Greenville, SC Lima has originated over $3.7B7 since MFA’s acquisition in 2021 and over $7B7 since its formation Trailing 12-month origination volume of $2.0B7 through Q1 2023 Lima provides MFA with access to organically created, high yielding loans, substantially below the cost to purchase from third parties Credit Quality Strong focus on credit quality, with disciplined underwriting, in-house servicing, and construction management teams Conservative underwriting with average FICO of 743 and average LTV of 67%14 as of March 31, 2023 60+ day delinquency rate of just 2% as of March 31, 2023 Historical losses of less than 1 bp on over $1.6B of payoffs and liquidations for loans held by MFA and originated by Lima One Geographic and Borrower Diversity No state concentration in excess of 15% and no borrower concentration in excess of 2% Concentration 10% to 15% 5% to 10% 0% to 5% NA |

|

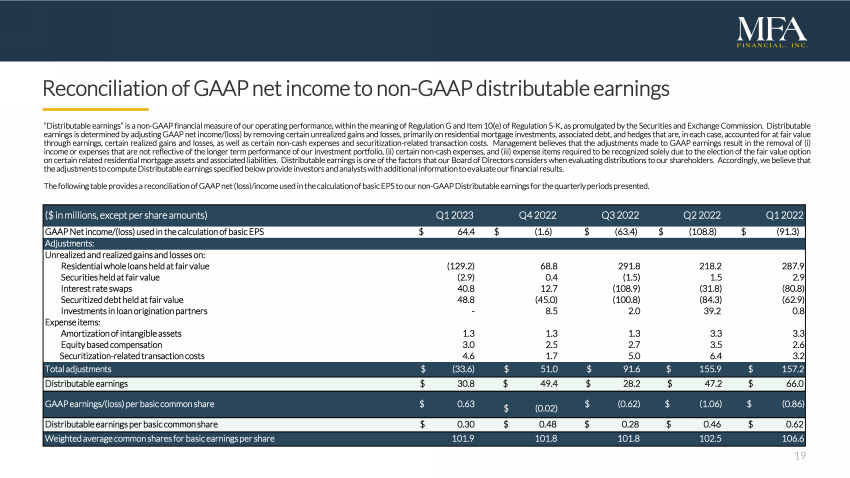

19 Reconciliation of GAAP net income to non-GAAP distributable earnings “Distributable earnings” is a non-GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10(e) of Regulation S-K, as promulgated by the Securities and Exchange Commission. Distributable earnings is determined by adjusting GAAP net income/(loss) by removing certain unrealized gains and losses, primarily on residential mortgage investments, associated debt, and hedges that are, in each case, accounted for at fair value through earnings, certain realized gains and losses, as well as certain non-cash expenses and securitization-related transaction costs. Management believes that the adjustments made to GAAP earnings result in the removal of (i) income or expenses that are not reflective of the longer term performance of our investment portfolio, (ii) certain non-cash expenses, and (iii) expense items required to be recognized solely due to the election of the fair value option on certain related residential mortgage assets and associated liabilities. Distributable earnings is one of the factors that our Board of Directors considers when evaluating distributions to our shareholders. Accordingly, we believe that the adjustments to computeDistributable earnings specified belowprovide investors and analystswith additional information to evaluate ourfinancialresults. The following table provides a reconciliation of GAAP net(loss)/income used in the calculation of basicEPS to our non-GAAP Distributable earnings forthe quarterly periodspresented. ($ in millions, except per share amounts) Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 GAAP Net income/(loss) used in the calculation of basic EPS $ 64.4 $ (1.6) $ (63.4) $ (108.8) $ (91.3) Adjustments: Unrealized and realized gains and losses on: Residential whole loans held at fair value (129.2) 68.8 291.8 218.2 287.9 Securities held at fair value (2.9) 0.4 (1.5) 1.5 2.9 Interest rate swaps 40.8 12.7 (108.9) (31.8) (80.8) Securitized debt held at fair value 48.8 (45.0) (100.8) (84.3) (62.9) Investments in loan origination partners - 8.5 2.0 39.2 0.8 Expense items: Amortization of intangible assets 1.3 1.3 1.3 3.3 3.3 Equity based compensation 3.0 2.5 2.7 3.5 2.6 Securitization-related transaction costs 4.6 1.7 5.0 6.4 3.2 Total adjustments $ (33.6) $ 51.0 $ 91.6 $ 155.9 $ 157.2 Distributable earnings $ 30.8 $ 49.4 $ 28.2 $ 47.2 $ 66.0 GAAP earnings/(loss) per basic common share $ 0.63 $ (0.02) $ (0.62) $ (1.06) $ (0.86) Distributable earnings per basic common share $ 0.30 $ 0.48 $ 0.28 $ 0.46 $ 0.62 Weighted average common shares for basic earnings per share 101.9 101.8 101.8 102.5 106.6 |

|

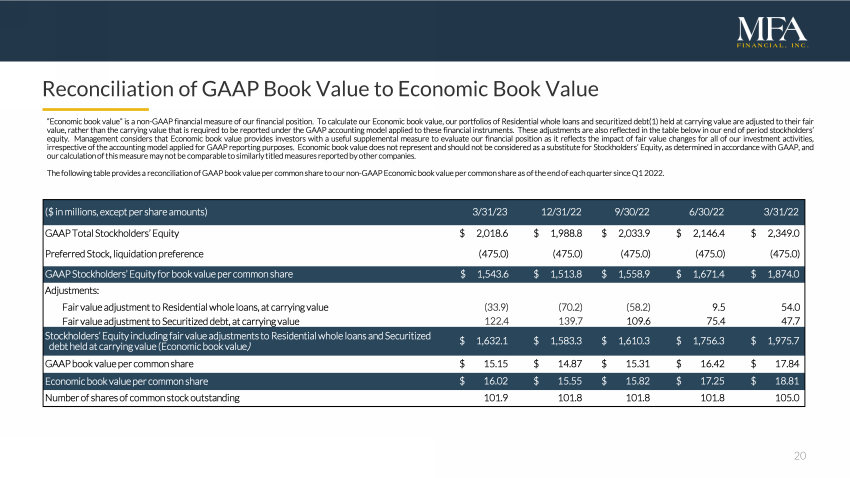

20 Reconciliation of GAAP Book Value to Economic Book Value “Economic book value” is a non-GAAP financial measure of our financial position. To calculate our Economic book value, our portfolios of Residential whole loans and securitized debt(1) held at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these financial instruments. These adjustments are also reflected in the table below in our end of period stockholders’ equity. Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our investment activities, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does notrepresent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation ofthismeasuremay not be comparable to similarly titledmeasures reported by other companies. The following table provides a reconciliation of GAAP book value per common share to our non-GAAP Economic book value per common share as ofthe end of each quarter sinceQ1 2022. ($ in millions, except per share amounts) 3/31/23 12/31/22 9/30/22 6/30/22 3/31/22 GAAP Total Stockholders’ Equity $ 2,018.6 $ 1,988.8 $ 2,033.9 $ 2,146.4 $ 2,349.0 Preferred Stock, liquidation preference (475.0) (475.0) (475.0) (475.0) (475.0) GAAP Stockholders’ Equity for book value per common share $ 1,543.6 $ 1,513.8 $ 1,558.9 $ 1,671.4 $ 1,874.0 Adjustments: Fair value adjustment to Residential whole loans, at carrying value (33.9) (70.2) (58.2) 9.5 54.0 Fair value adjustment to Securitized debt, at carrying value 122.4 139.7 109.6 75.4 47.7 Stockholders’ Equity including fair value adjustments to Residential whole loans and Securitized debt held at carrying value (Economic book value) $ 1,632.1 $ 1,583.3 $ 1,610.3 $ 1,756.3 $ 1,975.7 GAAP book value per common share $ 15.15 $ 14.87 $ 15.31 $ 16.42 $ 17.84 Economic book value per common share $ 16.02 $ 15.55 $ 15.82 $ 17.25 $ 18.81 Number of shares of common stock outstanding 101.9 101.8 101.8 101.8 105.0 |

|

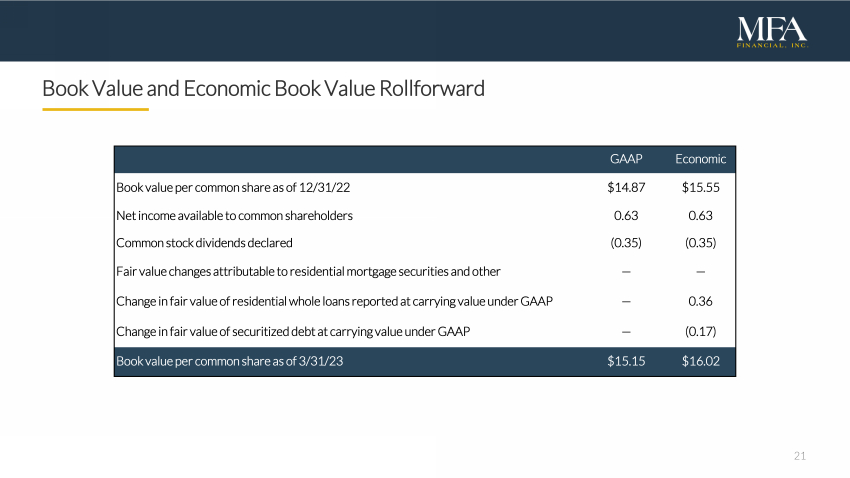

21 Book Value and Economic Book Value Rollforward GAAP Economic Book value per common share as of 12/31/22 $14.87 $15.55 Net income available to common shareholders 0.63 0.63 Common stock dividends declared (0.35) (0.35) Fair value changes attributable to residential mortgage securities and other — — Change in fair value of residential whole loans reported at carrying value under GAAP — 0.36 Change in fair value of securitized debt at carrying value under GAAP — (0.17) Book value per common share as of 3/31/23 $15.15 $16.02 |

|

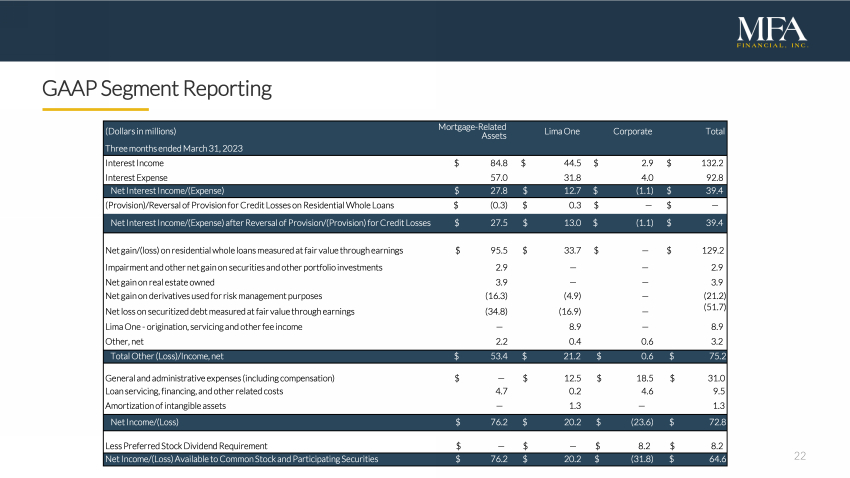

22 GAAP Segment Reporting (Dollars in millions) Mortgage-Related Assets Lima One Corporate Total Three months ended March 31, 2023 Interest Income $ 84.8 $ 44.5 $ 2.9 $ 132.2 Interest Expense 57.0 31.8 4.0 92.8 Net Interest Income/(Expense) $ 27.8 $ 12.7 $ (1.1) $ 39.4 (Provision)/Reversal of Provisionfor Credit Losses on Residential Whole Loans $ (0.3) $ 0.3 $ — $ — Net Interest Income/(Expense) after Reversal of Provision/(Provision)for Credit Losses $ 27.5 $ 13.0 $ (1.1) $ 39.4 Net gain/(loss) on residential whole loans measured at fair value through earnings $ 95.5 $ 33.7 $ — $ 129.2 Impairment and other net gain on securities and other portfolio investments 2.9 — — 2.9 Net gain on real estate owned 3.9 — — 3.9 Net gain on derivatives used for risk management purposes (16.3) (4.9) — (21.2) Net loss on securitized debt measured at fair value through earnings (34.8) (16.9) — (51.7) Lima One - origination, servicing and other fee income — 8.9 — 8.9 Other, net 2.2 0.4 0.6 3.2 Total Other (Loss)/Income, net $ 53.4 $ 21.2 $ 0.6 $ 75.2 General and administrative expenses (including compensation) $ — $ 12.5 $ 18.5 $ 31.0 Loan servicing, financing, and other related costs 4.7 0.2 4.6 9.5 Amortization of intangible assets — 1.3 — 1.3 Net Income/(Loss) $ 76.2 $ 20.2 $ (23.6) $ 72.8 Less Preferred Stock Dividend Requirement $ — $ — $ 8.2 $ 8.2 Net Income/(Loss)Available to Common Stock and Participating Securities $ 76.2 $ 20.2 $ (31.8) $ 64.6 |

|

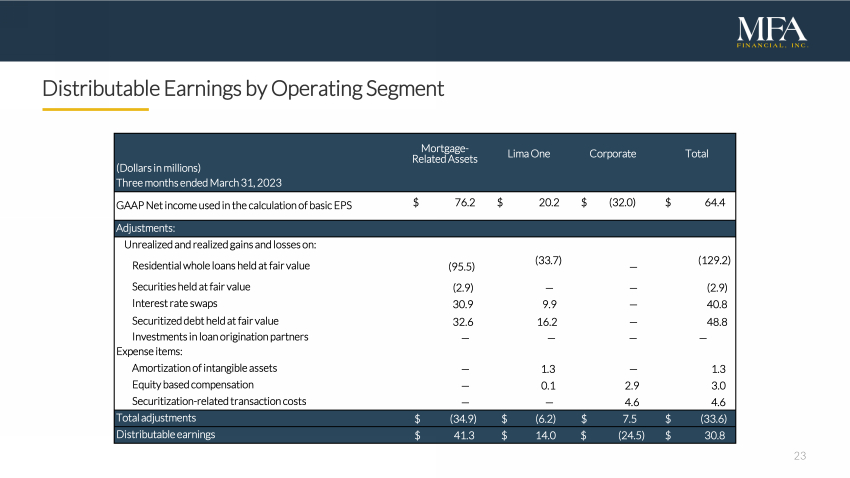

23 Distributable Earnings by Operating Segment (Dollars in millions) Mortgage-Related Assets Lima One Corporate Total Three months ended March 31, 2023 GAAP Net income used in the calculation of basic EPS $ 76.2 $ 20.2 $ (32.0) $ 64.4 Adjustments: Unrealized and realized gains and losses on: Residential whole loans held at fair value (95.5) (33.7) — (129.2) Securities held at fair value (2.9) — — (2.9) Interest rate swaps 30.9 9.9 — 40.8 Securitized debt held at fair value 32.6 16.2 — 48.8 Investments in loan origination partners — — — — Expense items: Amortization of intangible assets — 1.3 — 1.3 Equity based compensation — 0.1 2.9 3.0 Securitization-related transaction costs — — 4.6 4.6 Total adjustments $ (34.9) $ (6.2) $ 7.5 $ (33.6) Distributable earnings $ 41.3 $ 14.0 $ (24.5) $ 30.8 |

|

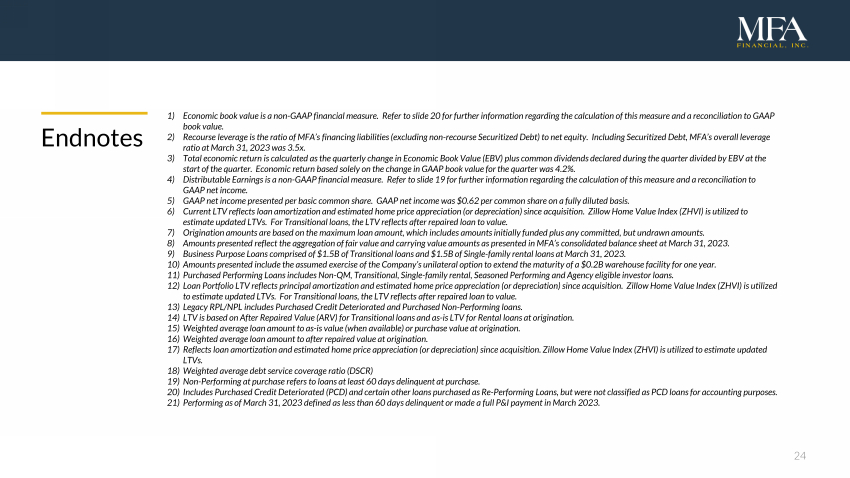

24 Endnotes 1) Economic book value is a non-GAAP financial measure. Refer to slide 20 for further information regarding the calculation of this measure and a reconciliation to GAAP book value. 2) Recourse leverage is the ratio of MFA’s financing liabilities (excluding non-recourse Securitized Debt) to net equity. Including Securitized Debt, MFA’s overall leverage ratio at March 31, 2023 was 3.5x. 3) Total economic return is calculated as the quarterly change in Economic Book Value (EBV) plus common dividends declared during the quarter divided by EBV at the start of the quarter. Economic return based solely on the change in GAAP book value for the quarter was 4.2%. 4) Distributable Earnings is a non-GAAP financial measure. Refer to slide 19 for further information regarding the calculation of this measure and a reconciliation to GAAP net income. 5) GAAP net income presented per basic common share. GAAP net income was $0.62 per common share on a fully diluted basis. 6) Current LTV reflects loan amortization and estimated home price appreciation (or depreciation) since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. For Transitional loans, the LTV reflects after repaired loan to value. 7) Origination amounts are based on the maximum loan amount, which includes amounts initially funded plus any committed, but undrawn amounts. 8) Amounts presented reflect the aggregation of fair value and carrying value amounts as presented in MFA’s consolidated balance sheet at March 31, 2023. 9) Business Purpose Loans comprised of $1.5B of Transitional loans and $1.5B of Single-family rental loans at March 31, 2023. 10) Amounts presented include the assumed exercise of the Company’s unilateral option to extend the maturity of a $0.2B warehouse facility for one year. 11) Purchased Performing Loans includes Non-QM, Transitional, Single-family rental, Seasoned Performing and Agency eligible investor loans. 12) Loan Portfolio LTV reflects principal amortization and estimated home price appreciation (or depreciation) since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. For Transitional loans, the LTV reflects after repaired loan to value. 13) Legacy RPL/NPL includes Purchased Credit Deteriorated and Purchased Non-Performing loans. 14) LTV is based on After Repaired Value (ARV) for Transitional loans and as-is LTV for Rental loans at origination. 15) Weighted average loan amount to as-is value (when available) or purchase value at origination. 16) Weighted average loan amount to after repaired value at origination. 17) Reflects loan amortization and estimated home price appreciation (or depreciation) since acquisition. Zillow Home Value Index (ZHVI) is utilized to estimate updated LTVs. 18) Weighted average debt service coverage ratio (DSCR) 19) Non-Performing at purchase refers to loans at least 60 days delinquent at purchase. 20) Includes Purchased Credit Deteriorated (PCD) and certain other loans purchased as Re-Performing Loans, but were not classified as PCD loans for accounting purposes. 21) Performing as of March 31, 2023 defined as less than 60 days delinquent or made a full P&I payment in March 2023. |