EXHIBIT 99.2

Published on February 20, 2020

Exhibit 99.2

Fourth Quarter 2019 Earnings Presentation

Forward Looking Statements 2 When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward - looking statements” within the meaning of Section 27 A of the 1933 Act and Section 21 E of the 1934 Act and, as such, may involve known and unknown risks, uncertainties and assumptions . Statements regarding the following subjects, among others, may be forward - looking : changes in interest rates and the market (i . e . , fair) value of MFA’s MBS, residential whole loans, CRT securities and other assets ; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in its portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows, or in certain circumstances, impairment on certain Legacy Non - Agency MBS purchased at a discount ; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans securing MFA’s Non - Agency MBS and relating to MFA’s residential whole loan portfolio ; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings ; implementation of or changes in government regulations or programs affecting MFA’s business ; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on Non - Agency MBS and residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s Agency MBS, Non - Agency MBS and residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals and whole loan modifications, foreclosures and liquidations ; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board of Directors and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as MFA’s Board of Directors deems relevant ; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes ; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940 , as amended (or the Investment Company Act), including statements regarding the Concept Release issued by the Securities and Exchange Commission (SEC) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage - related interests ; MFA’s ability to continue growing its residential whole loan portfolio which is dependent on, among other things, the supply of loans offered for sale in the market ; expected returns on MFA’s investments in non - performing residential whole loans (NPLs), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e . g . , taxes, insurance, maintenance expenses, etc . on the underlying property) and the amount ultimately realized upon resolution of the asset ; targeted or expected returns on MFA’s investments in recently - originated loans, the performance of which is, similar to MFA’s other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing cost associated with such investments ; risks associated with MFA’s investments in MSR - related assets, including servicing, regulatory and economic risks, risks associated with our investments in loan originators, and risks associated with investing in real estate assets, including changes in business conditions and the general economy . These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the SEC, could cause MFA’s actual results to differ materially from those projected in any forward - looking statements it makes . All forward - looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account all information currently available . Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they are made . New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA . Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

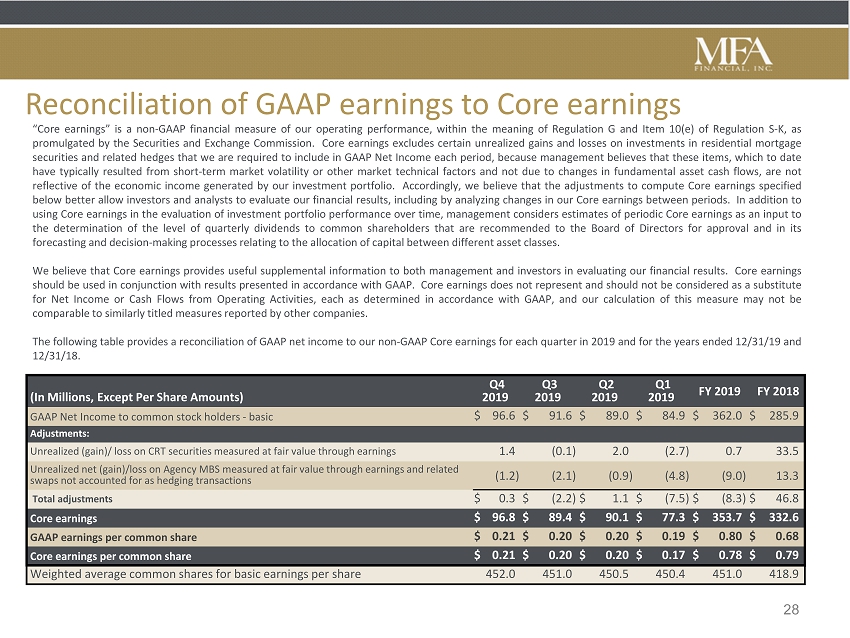

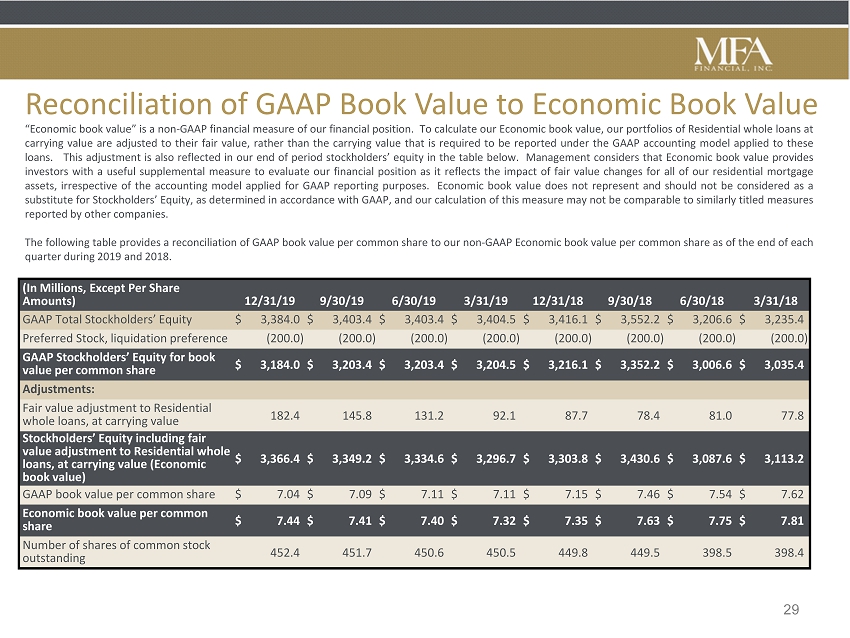

Executive summary • MFA’s GAAP EPS in the fourth quarter of 2019 was $ 0 . 21 , as our whole loan portfolio growth and performance continues to drive our financial results . Core earnings ( 1 ) was also $ 0 . 21 . • For the fourth quarter of 2019 , MFA acquired $ 1 . 7 billion of assets, including $ 1 . 5 billion of whole loans . Our whole loan investment portfolio increased by more than $ 2 . 9 billion in 2019 as our strategy of sourcing from select origination partners continues to generate results . Overall portfolio growth exceeded $ 1 billion for the year 2019 . • Our fourth quarter dividend to common stockholders of $ 0 . 20 was paid on January 31 , 2020 . • GAAP book value decreased slightly to $ 7 . 04 per share at December 31 , 2019 , while Economic book value ( 2 ) was $ 7 . 44 , a small increase for the quarter . • Estimated undistributed taxable income at December 31 , 2019 was $ 0 . 05 per share . 3 (1) Core earnings is a Non - GAAP financial measure of MFA’s operating performance that is calculated by adjusting GAAP net income to exclude the impact of unrealized gains and losses on certain investments in residential mortgage securities and related hedges. Refer to slide 28 for additional information, inc lud ing a reconciliation of GAAP net income to Core earnings. (2) Economic book value is a Non - GAAP financial measure of MFA’s financial position. To calculate Economic book value, our port folios of Residential whole loans at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied t o t hese loans. Refer to slide 29 for additional information, including a reconciliation of GAAP book value to Economic book value.

• Fourth quarter investment activity was our highest of the year, as we purchased approximately $ 1 . 7 billion of assets, including $ 1 . 5 billion of Purchased Performing Loans ( 1 ) . New investments for the year were $ 5 . 3 billion, including $ 4 . 3 billion of residential whole loans . • We continue to pursue new investment structures to strengthen our originator relationships and gain access to loan flow . Additional $ 25 million invested this quarter, bringing total capital contributions to $ 148 million across five loan origination partners . ▪ These investments generated $ 3 . 7 million of interest and dividend income in Q 4 before allocation of profits from these entities . 4 (1) Purchased Performing Loans are comprised of Non - QM loans, Fix and Flip Loans, Single Family Rental Loans and Seasoned Perfor ming Loans. They are included, along with Purchased Credit Impaired Loans, in Residential whole loans held at carrying value on our consolidated balance sheet. Executive summary (cont'd.)

• Growth of Purchased Performing Loans continues to drive interest income : ▪ Loans held at carrying value produced $ 72 . 3 million of interest income in the fourth quarter of 2019 (versus $ 64 . 2 million in Q 3 2019 and $ 100 . 9 million for all of 2018 ) . ▪ Interest income from residential whole loans represented 47 % of total interest income in the fourth quarter versus 29 % in the fourth quarter of 2018 . • Our leverage ticked up during the quarter from 2 . 8 x to 3 . 0 x as we added $ 1 billion of additional borrowing on whole loans . Despite this being a relatively more expensive source of financing, total interest expense declined in Q 4 vs Q 3 due to lower LIBOR levels following the rate cuts that occurred in Q 3 . • Residential whole loans including REO totaled $ 7 . 9 billion at year end . 5 Executive summary (cont'd.)

• Our asset management team maintains very active oversight of the servicing of delinquent and credit sensitive loans to improve outcomes and expected returns . This team also manages our REO properties, some of which we have converted to rental properties . • Technology initiatives have improved processing and reporting efficiencies, and provide scalability to support future loan portfolio growth . • Including the impact of bond redemptions, the Legacy Non - Agency portfolio generated an unlevered yield in the fourth quarter of 14 . 8 % . Eliminating the impact of these redemptions, the yield on this portfolio would have been 10 . 6 % . • We purchased an additional $ 93 million of MSR - Related Assets in the fourth quarter, growing this portfolio to $ 1 . 2 billion (double the size at the end of 2018 ) . 6 Executive summary (cont'd.)

Investment strategy 7 • Continue to grow investment assets ▪ Purchased Performing Loans are providing recurring (and increasing) portfolio growth ▪ Opportunistic growth in other asset classes if/when available • Optimize Balance Sheet/Capital Structure ▪ Modest increase in leverage (including securitization) to support asset growth ▪ Securitization both diversifies our loan funding and lowers the cost ▪ Produce attractive returns that are comparable to peers, but with relatively less risk due to lower leverage, less interest rate exposure and reduced prepayment sensitivity • Manage existing portfolio ▪ Strategic sales of Legacy Non - Agency MBS and Agency MBS ▪ Diligent management of delinquent loans

• Expand investment opportunities in the form of newly originated whole loans . ▪ Benign rate environment often leads to higher origination volume of non - conventional loan products such as Non - QM mortgages . ▪ Creative approach to partnering with originators gives MFA an edge as competition increases to purchase these assets . • Capital structure optimization should continue to generate savings in funding costs . Market conditions and investment activity 8

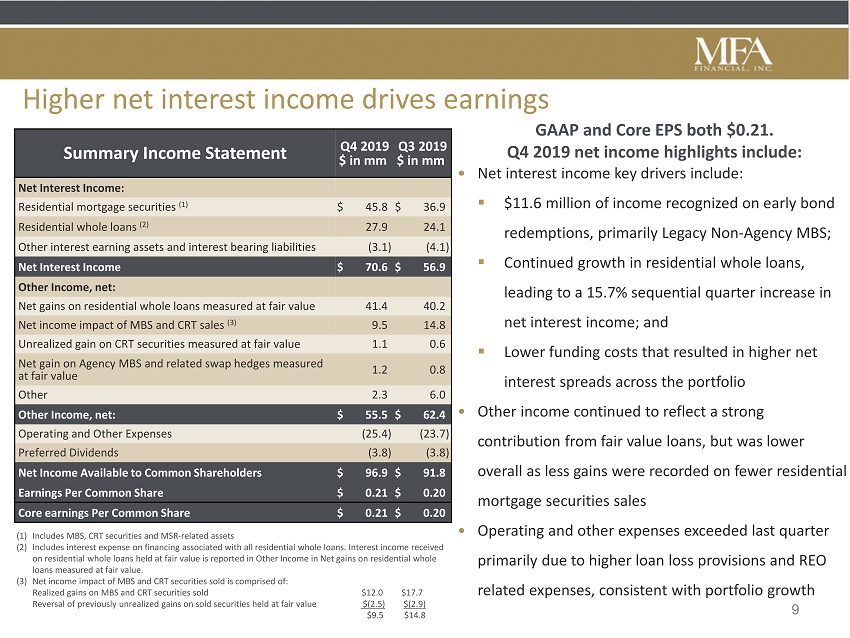

Higher net interest income drives earnings Summary Income Statement Q4 2019 $ in mm Q3 2019 $ in mm Net Interest Income: Residential mortgage securities (1) $ 45.8 $ 36.9 Residential whole loans (2) 27.9 24.1 Other interest earning assets and interest bearing liabilities (3.1 ) (4.1 ) Net Interest Income $ 70.6 $ 56.9 Other Income, net: Net gains on residential whole loans measured at fair value 41.4 40.2 Net income impact of MBS and CRT sales (3) 9.5 14.8 Unrealized gain on CRT securities measured at fair value 1.1 0.6 Net gain on Agency MBS and related swap hedges measured at fair value 1.2 0.8 Other 2.3 6.0 Other Income, net: $ 55.5 $ 62.4 Operating and Other Expenses (25.4 ) (23.7 ) Preferred Dividends (3.8 ) (3.8 ) Net Income Available to Common Shareholders $ 96.9 $ 91.8 Earnings Per Common Share $ 0.21 $ 0.20 Core earnings Per Common Share $ 0.21 $ 0.20 • Net interest income key drivers include: ▪ $11.6 million of income recognized on early bond redemptions, primarily Legacy Non - Agency MBS; ▪ Continued growth in residential whole loans, leading to a 15.7% sequential quarter increase in net interest income; and ▪ Lower funding costs that resulted in higher net interest spreads across the portfolio • Other income continued to reflect a strong contribution from fair value loans, but was lower overall as less gains were recorded on fewer residential mortgage securities sales • Operating and other expenses exceeded last quarter primarily due to higher loan loss provisions and REO related expenses, consistent with portfolio growth 9 (1) Includes MBS, CRT securities and MSR - related assets (2) Includes interest expense on financing associated with all residential whole loans. Interest income received on residential whole loans held at fair value is reported in Other Income in Net gains on residential whole loans measured at fair value. (3) Net income impact of MBS and CRT securities sold is comprised of: Realized gains on MBS and CRT securities sold $12.0 $17.7 Reversal of previously unrealized gains on sold securities held at fair value $(2.5) $(2.9) $9.5 $14.8 GAAP and Core EPS both $0.21. Q4 2019 net income highlights include:

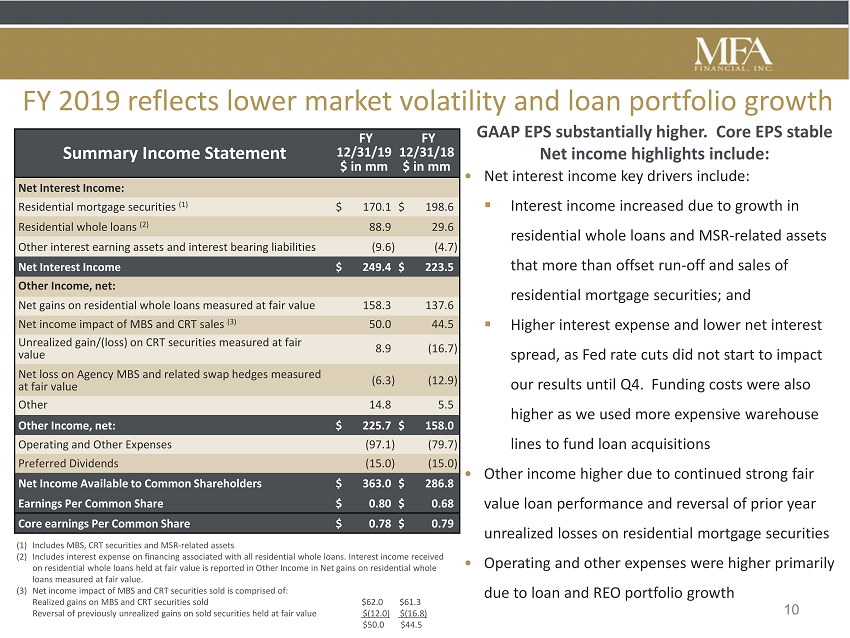

FY 2019 reflects lower market volatility and loan portfolio growth Summary Income Statement FY 12/31/19 $ in mm FY 12/31/18 $ in mm Net Interest Income: Residential mortgage securities (1) $ 170.1 $ 198.6 Residential whole loans (2) 88.9 29.6 Other interest earning assets and interest bearing liabilities (9.6 ) (4.7 ) Net Interest Income $ 249.4 $ 223.5 Other Income, net: Net gains on residential whole loans measured at fair value 158.3 137.6 Net income impact of MBS and CRT sales (3) 50.0 44.5 Unrealized gain/(loss) on CRT securities measured at fair value 8.9 (16.7 ) Net loss on Agency MBS and related swap hedges measured at fair value (6.3 ) (12.9 ) Other 14.8 5.5 Other Income, net: $ 225.7 $ 158.0 Operating and Other Expenses (97.1 ) (79.7 ) Preferred Dividends (15.0 ) (15.0 ) Net Income Available to Common Shareholders $ 363.0 $ 286.8 Earnings Per Common Share $ 0.80 $ 0.68 Core earnings Per Common Share $ 0.78 $ 0.79 • Net interest income key drivers include: ▪ Interest income increased due to growth in residential whole loans and MSR - related assets that more than offset run - off and sales of residential mortgage securities; and ▪ Higher interest expense and lower net interest spread, as Fed rate cuts did not start to impact our results until Q4. Funding costs were also higher as we used more expensive warehouse lines to fund loan acquisitions • Other income higher due to continued strong fair value loan performance and reversal of prior year unrealized losses on residential mortgage securities • Operating and other expenses were higher primarily due to loan and REO portfolio growth 10 (1) Includes MBS, CRT securities and MSR - related assets (2) Includes interest expense on financing associated with all residential whole loans. Interest income received on residential whole loans held at fair value is reported in Other Income in Net gains on residential whole loans measured at fair value. (3) Net income impact of MBS and CRT securities sold is comprised of: Realized gains on MBS and CRT securities sold $62.0 $61.3 Reversal of previously unrealized gains on sold securities held at fair value $(12.0) $(16.8) $50.0 $44.5 GAAP EPS substantially higher. Core EPS stable Net income highlights include:

Impact of Credit Impairment standard (CECL) adoption • We adopted CECL on January 1, 2020. Adoption did not have a material impact on our financial position or book value. Key impacts of adoption on our investments are as follows: ▪ Purchased Performing Loans - “Day 1” transition adjustment of $8.3 million, resulting in an increase in our allowance for credit losses for this portfolio and a corresponding decrease in stockholders’ equity; ▪ Purchased Credit Impaired Loans - initial adoption results in changes in balance sheet presentation, with no impact on stockholders’ equity. Post adoption, income recognition is based on contractual cash flows; ▪ Available for Sale (AFS) securities - no adoption impact on stockholders’ equity. Post adoption, “OTTI” is replaced by “allowance for credit loss” accounting. Income recognition essentially unchanged; and ▪ Loans measured at fair value through earnings - no impact as not included in CECL scope • Subsequent to adoption, impact of CECL accounting on our results is expected to be primarily two - fold: ▪ Expected credit loss estimates on acquired assets reduce GAAP income on the asset acquisition date; and ▪ Changes in the allowance for credit loss for both loans and AFS securities is recorded in periodic GAAP earnings • CECL adoption and ongoing CECL accounting will not impact calculation of Economic book value. 11

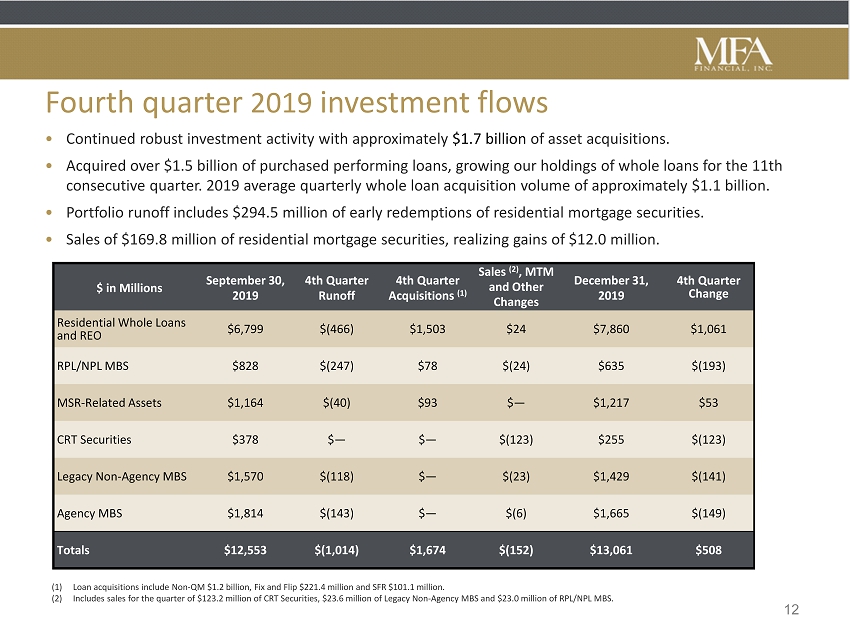

Fourth quarter 2019 investment flows • Continued robust investment activity with approximately $1.7 billion of asset acquisitions. • Acquired over $1.5 billion of purchased performing loans, growing our holdings of whole loans for the 11th consecutive quarter. 2019 average quarterly whole loan acquisition volume of approximately $1.1 billion. • Portfolio runoff includes $294.5 million of early redemptions of residential mortgage securities. • Sales of $169.8 million of residential mortgage securities, realizing gains of $12.0 million. 12 $ in Millions September 30, 2019 4th Quarter Runoff 4th Quarter Acquisitions (1) Sales (2) , MTM and Other Changes December 31, 2019 4th Quarter Change Residential Whole Loans and REO $6,799 $(466) $1,503 $24 $7,860 $1,061 RPL/NPL MBS $828 $(247) $78 $(24) $635 $(193) MSR - Related Assets $1,164 $(40) $93 $ — $1,217 $53 CRT Securities $378 $ — $ — $(123) $255 $(123) Legacy Non - Agency MBS $1,570 $(118) $ — $(23) $1,429 $(141) Agency MBS $1,814 $(143) $ — $(6) $1,665 $(149) Totals $12,553 $(1,014) $1,674 $(152) $13,061 $508 (1) Loan acquisitions include Non - QM $1.2 billion, Fix and Flip $221.4 million and SFR $101.1 million. (2) Includes sales for the quarter of $123.2 million of CRT Securities, $23.6 million of Legacy Non - Agency MBS and $23.0 millio n of RPL/NPL MBS.

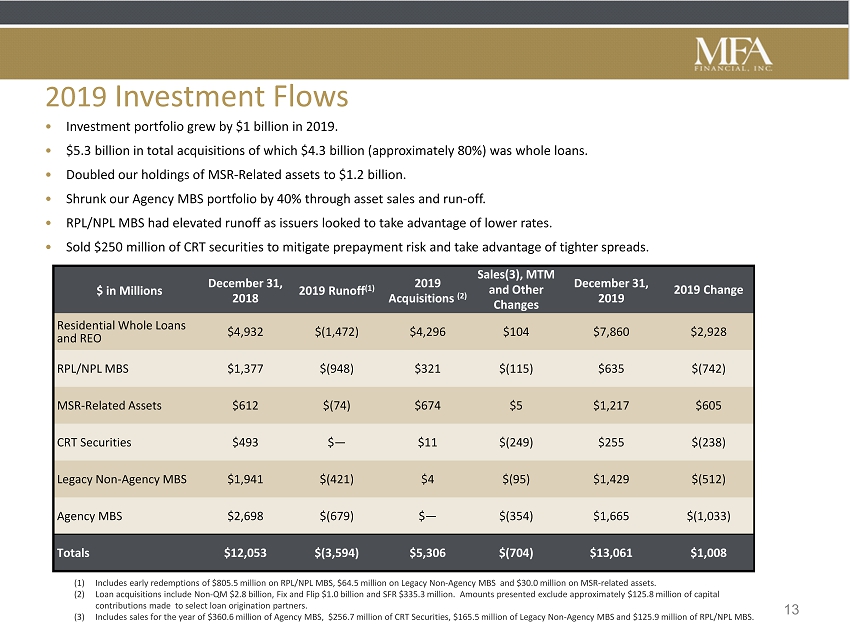

2019 Investment Flows • Investment portfolio grew by $1 billion in 2019. • $5.3 billion in total acquisitions of which $4.3 billion (approximately 80%) was whole loans. • Doubled our holdings of MSR - Related assets to $1.2 billion. • Shrunk our Agency MBS portfolio by 40% through asset sales and run - off. • RPL/NPL MBS had elevated runoff as issuers looked to take advantage of lower rates. • Sold $250 million of CRT securities to mitigate prepayment risk and take advantage of tighter spreads. 13 $ in Millions December 31, 2018 2019 Runoff (1) 2019 Acquisitions (2) Sales(3), MTM and Other Changes December 31, 2019 2019 Change Residential Whole Loans and REO $4,932 $(1,472) $4,296 $104 $7,860 $2,928 RPL/NPL MBS $1,377 $(948) $321 $(115) $635 $(742) MSR - Related Assets $612 $(74) $674 $5 $1,217 $605 CRT Securities $493 $ — $11 $(249) $255 $(238) Legacy Non - Agency MBS $1,941 $(421) $4 $(95) $1,429 $(512) Agency MBS $2,698 $(679) $ — $(354) $1,665 $(1,033) Totals $12,053 $(3,594) $5,306 $(704) $13,061 $1,008 (1) Includes early redemptions of $805.5 million on RPL/NPL MBS, $64.5 million on Legacy Non - Agency MBS and $30.0 million on MS R - related assets. (2) Loan acquisitions include Non - QM $2.8 billion, Fix and Flip $1.0 billion and SFR $335.3 million. Amounts presented exclude approximately $125.8 million of capital contributions made to select loan origination partners. (3) Includes sales for the year of $360.6 million of Agency MBS, $256.7 million of CRT Securities, $165.5 million of Legacy No n - Agency MBS and $125.9 million of RPL/NPL MBS.

Strong portfolio growth since expanding investment strategy to include Non - QM, Fix and Flip and SFR Loans • Residential whole loans are now our largest asset class. • Since expanding our investment universe to include Purchased Performing Loans, our investment portfolio has grown by $3.2 billion since the end of Q3 2017. • Non - QM, Fix and Flip and SFR Loans have grown from $0 since the end of Q3 2017 to $5.2 billion at the end of Q4 2019 and now represent 40% of our investment portfolio. 14 (in millions) Total Investment Portfolio Residential Whole Loans and REO % of Total Investment Portfolio Non - QM, Fix and Flip and SFR Loans % of Residential Whole Loans and REO 9/30/17 $9,878 $1,881 19% $ — — % 6/30/18 $10,160 $3,601 35% $845 23% 12/31/18 $12,053 $4,932 41% $1,995 40% 6/30/19 $12,813 $6,251 49% $ 3,446 55 % 12/31/19 $13,061 $7,860 60% $5,191 66% Change (9/30/17 to 12/31/19) $3,183 $5,979 $5,191

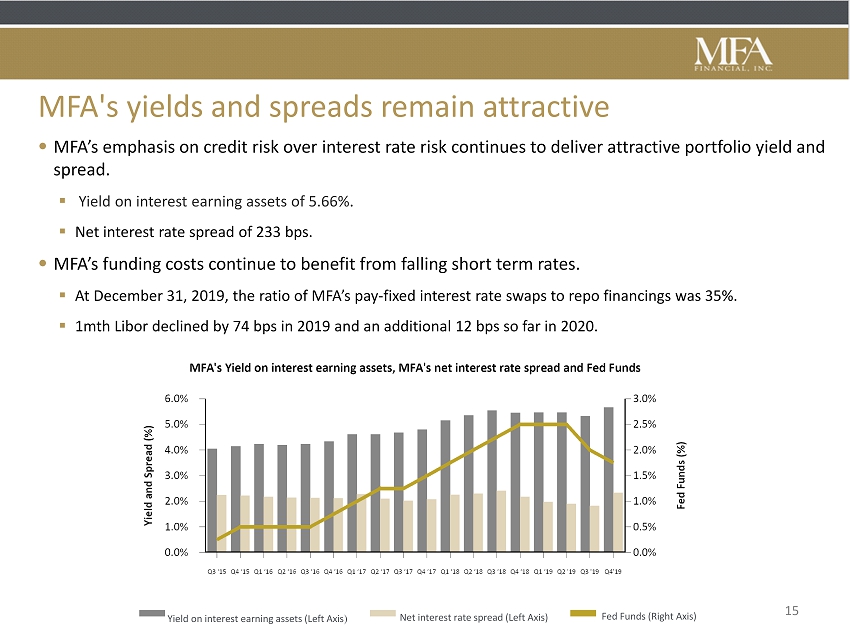

• MFA’s emphasis on credit risk over interest rate risk continues to deliver attractive portfolio yield and spread. ▪ Yield on interest earning assets of 5.66 % . ▪ Net interest rate spread of 233 bps. • MFA’s funding costs continue to benefit from falling short term rates. ▪ At December 31, 2019, the ratio of MFA’s pay - fixed interest rate swaps to repo financings was 35 %. ▪ 1mth Libor declined by 74 bps in 2019 and an additional 1 2 bps so far in 2020. 15 Yield on interest earning assets (Left Axis ) Net interest rate spread (Left Axis) Fed Funds (Right Axis) MFA's yields and spreads remain attractive

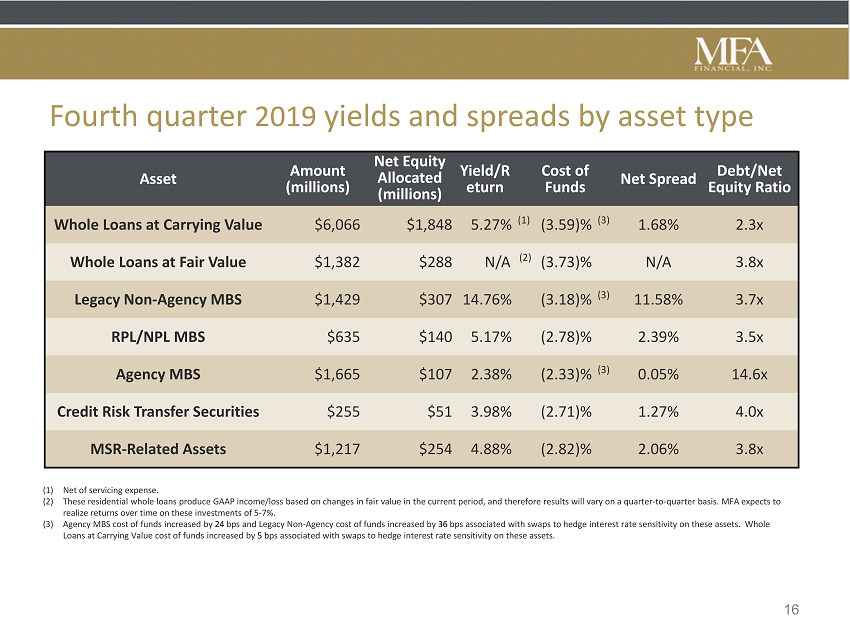

Fourth quarter 2019 yields and spreads by asset type 16 Asset Amount (millions) Net Equity Allocated (millions) Yield/R eturn Cost of Funds Net Spread Debt/Net Equity Ratio Whole Loans at Carrying Value $6,066 $1,848 5.27 % (1) (3.59 )% (3) 1.68% 2.3x Whole Loans at Fair Value $1,382 $288 N/A (2) (3.73 )% N/A 3.8x Legacy Non - Agency MBS $1,429 $307 14.76 % (3.18 )% (3) 11.58% 3.7x RPL/NPL MBS $635 $140 5.17 % (2.78 )% 2.39% 3.5x Agency MBS $1,665 $107 2.38 % (2.33 )% (3) 0.05% 14.6x Credit Risk Transfer Securities $255 $51 3.98 % (2.71 )% 1.27% 4.0x MSR - Related Assets $1,217 $254 4.88 % (2.82 )% 2.06% 3.8x (1) Net of servicing expense. (2) These residential whole loans produce GAAP income/loss based on changes in fair value in the current period, and therefore re sul ts will vary on a quarter - to - quarter basis. MFA expects to realize returns over time on these investments of 5 - 7%. (3) Agency MBS cost of funds increased by 24 bps and Legacy Non - Agency cost of funds increased by 36 bps associated with swaps to hedge interest rate sensitivity on these assets. Whole Loans at Carrying Value cost of funds increased by 5 b ps associated with swaps to hedge interest rate sensitivity on these assets.

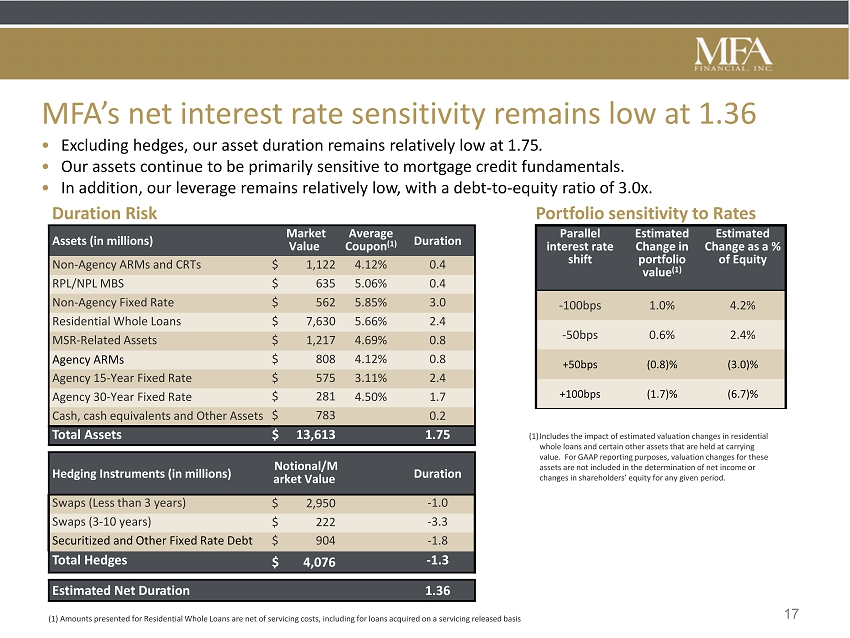

MFA’s net interest rate sensitivity remains low at 1.36 17 Assets (in millions) Market Value Average Coupon (1) Duration Non - Agency ARMs and CRTs $ 1,122 4.12% 0.4 RPL/NPL MBS $ 635 5.06% 0.4 Non - Agency Fixed Rate $ 562 5.85% 3.0 Residential Whole Loans $ 7,630 5.66% 2.4 MSR - Related Assets $ 1,217 4.69% 0.8 Agency ARMs $ 808 4.12% 0.8 Agency 15 - Year Fixed Rate $ 575 3.11% 2.4 Agency 30 - Year Fixed Rate $ 281 4.50% 1. 7 Cash, cash equivalents and Other Assets $ 783 0.2 Total Assets $ 13,613 1.75 Hedging Instruments (in millions) Notional/M arket Value Duration Swaps (Less than 3 years) $ 2,950 - 1.0 Swaps (3 - 10 years) $ 222 - 3.3 Securitized and Other Fixed Rate Debt $ 904 - 1.8 Total Hedges $ 4,076 - 1.3 Estimated Net Duration 1.36 • Excluding hedges, our asset duration remains relatively low at 1.75 . • Our assets continue to be primarily sensitive to mortgage credit fundamentals. • In addition, our leverage remains relatively low, with a debt - to - equity ratio of 3.0x. Duration Risk Parallel interest rate shift Estimated Change in portfolio value (1) Estimated Change as a % of Equity - 100bps 1.0% 4.2% - 50bps 0.6% 2.4% +50bps (0.8)% (3.0)% +100bps (1.7)% (6.7)% Portfolio sensitivity to Rates (1) Includes the impact of estimated valuation changes in residential whole loans and certain other assets that are held at carrying value. For GAAP reporting purposes, valuation changes for these assets are not included in the determination of net income or changes in shareholders’ equity for any given period. (1) Amounts presented for Residential Whole Loans are net of servicing costs, including for loans acquired on a servicing rel eas ed basis

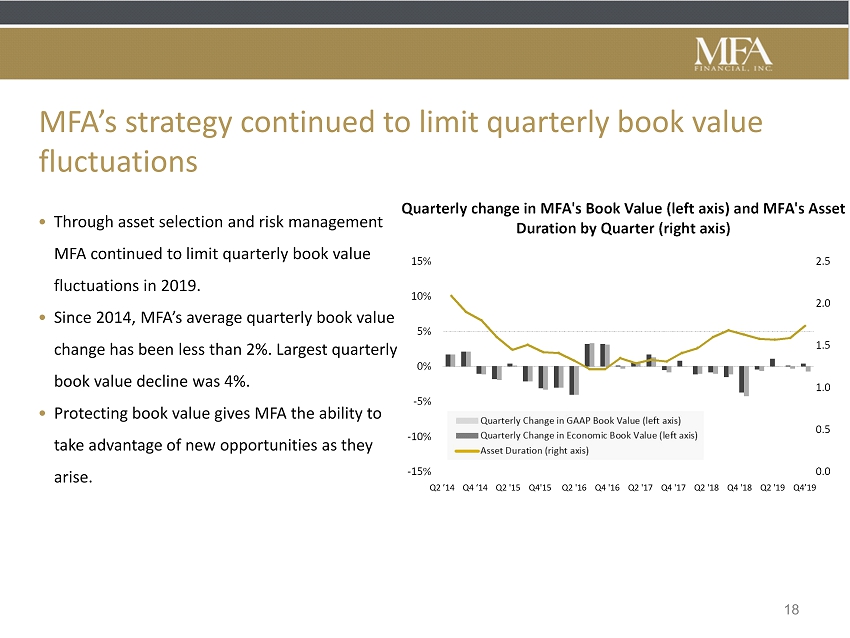

MFA’s strategy continued to limit quarterly book value fluctuations 18 • Through asset selection and risk management MFA continued to limit quarterly book value fluctuations in 2019. • Since 2014, MFA’s average quarterly book value change has been less than 2%. Largest quarterly book value decline was 4%. • Protecting book value gives MFA the ability to take advantage of new opportunities as they arise. Q2 ’14 Q4 ‘14 Q2 '15 Q4'15 Q2 '16 Q4 '16 Q2 '17 Q4 '17 Q2 '18 Q4 '18 Q2 '19 Q4’19

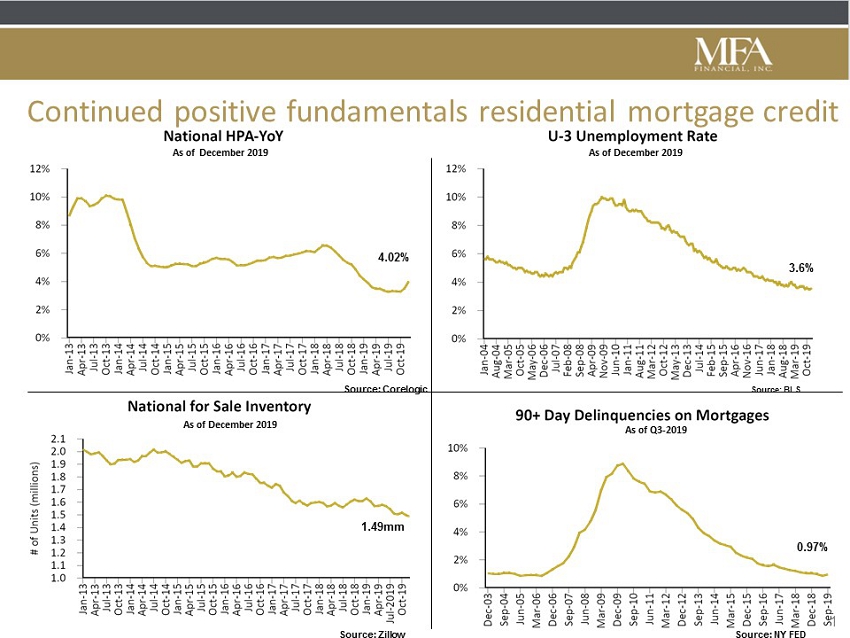

Continued positive fundamentals residential mortgage credit 19 4.02% As of November 2019 As of December 2019 3.6% 0.97% As of Q3 - 2019 As of December 2019 1.49mm Source: Zillow Source: NY FED Source: BLS Source: Corelogic

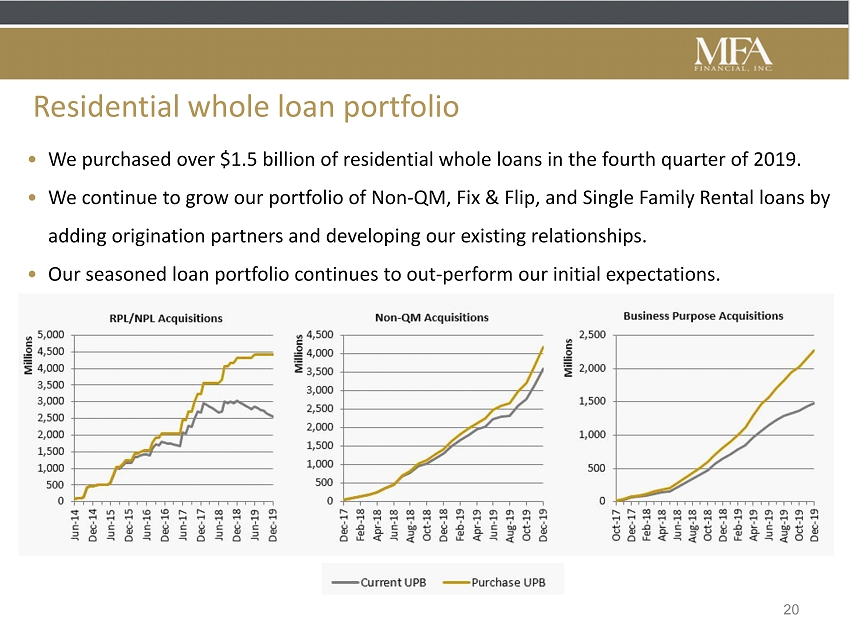

Residential whole loan portfolio 20 • We purchased over $1.5 billion of residential whole loans in the fourth quarter of 2019. • We continue to grow our portfolio of Non - QM, Fix & Flip, and Single Family Rental loans by adding origination partners and developing our existing relationships. • Our seasoned loan portfolio continues to out - perform our initial expectations.

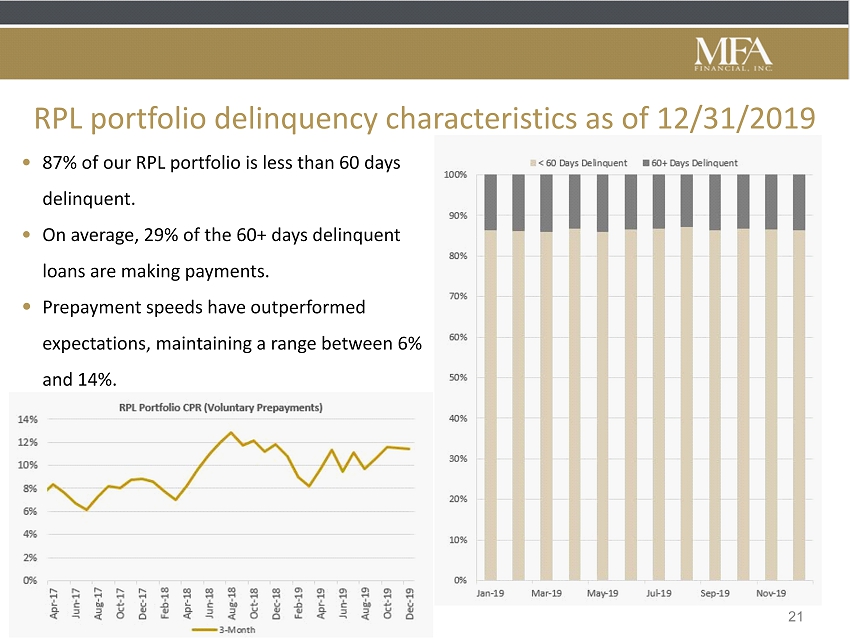

RPL portfolio delinquency characteristics as of 12/31/2019 21 • 87 % of our RPL portfolio is less than 60 days delinquent. • On average, 29% of the 60+ days delinquent loans are making payments. • Prepayment speeds have outperformed expectations, maintaining a range between 6% and 14%.

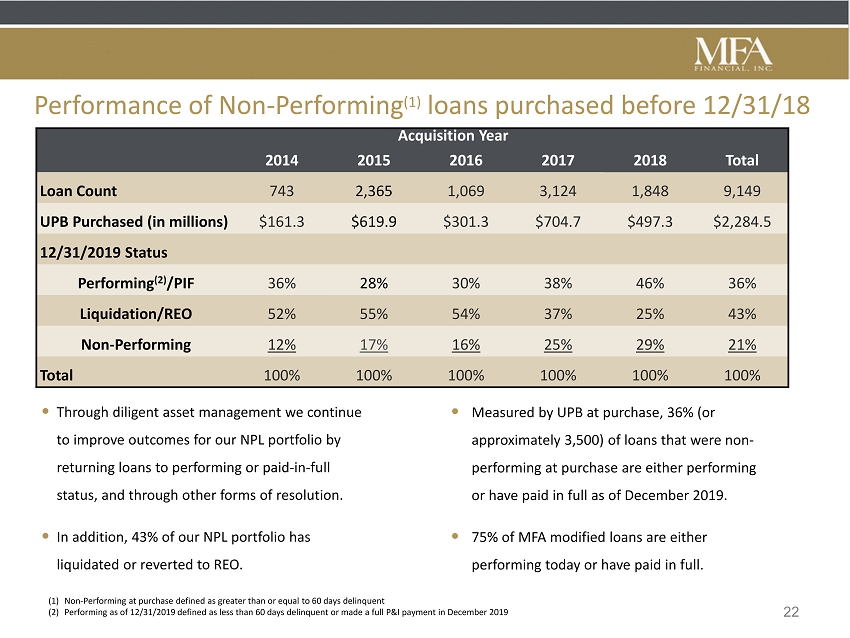

• Measured by UPB at purchase, 36% (or approximately 3,500) of loans that were non - performing at purchase are either performing or have paid in full as of December 2019. • 75% of MFA modified loans are either performing today or have paid in full. Performance of Non - Performing (1) loans purchased before 12/31/18 Acquisition Year 2014 2015 2016 2017 2018 Total Loan Count 743 2,365 1,069 3,124 1,848 9,149 UPB Purchased (in millions) $161.3 $619.9 $301.3 $704.7 $497.3 $2,284.5 12/31/2019 Status Performing (2) /PIF 36% 28% 30% 38% 46% 36% Liquidation/REO 52% 55% 54% 37% 25% 43% Non - Performing 12% 17% 16% 25% 29% 21% Total 100% 100% 100% 100% 100% 100% 22 (1) Non - Performing at purchase defined as greater than or equal to 60 days delinquent (2) Performing as of 12/31/2019 defined as less than 60 days delinquent or made a full P&I payment in December 2019 • Through diligent asset management we continue to improve outcomes for our NPL portfolio by returning loans to performing or paid - in - full status, and through other forms of resolution. • In addition, 43% of our NPL portfolio has liquidated or reverted to REO.

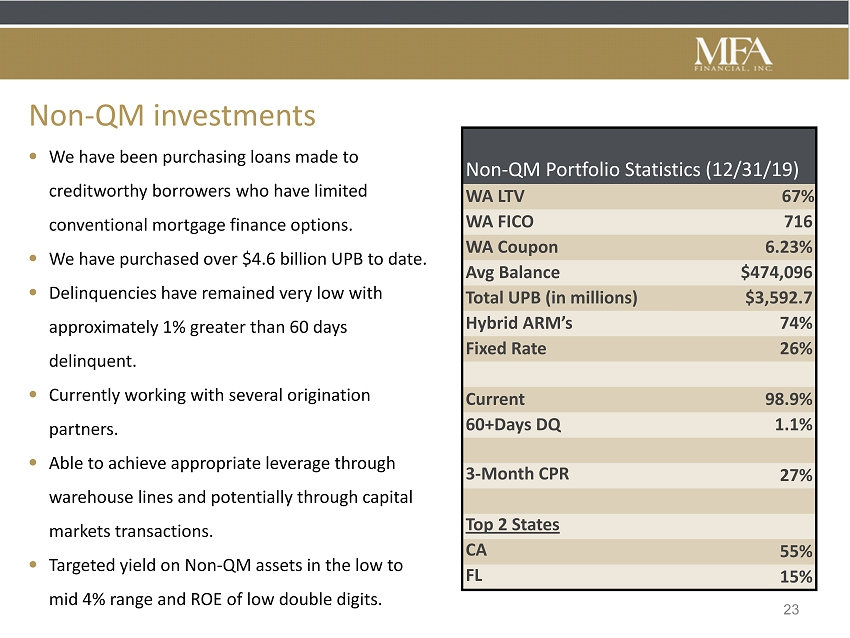

Non - QM investments • We have been purchasing loans made to creditworthy borrowers who have limited conventional mortgage finance options. • We have purchased over $4.6 billion UPB to date. • Delinquencies have remained very low with approximately 1% greater than 60 days delinquent. • Currently working with several origination partners. • Able to achieve appropriate leverage through warehouse lines and potentially through capital markets transactions. • Targeted yield on Non - QM assets in the low to mid 4% range and ROE of low double digits. Non - QM Portfolio Statistics (12/31/19) WA LTV 67 % WA FICO 716 WA Coupon 6.23% Avg Balance $474,096 Total UPB (in millions) $3,592.7 Hybrid ARM’s 74% Fixed Rate 26% Current 98.9% 60+Days DQ 1.1% 3 - Month CPR 27% Top 2 States CA 55% FL 15% 23

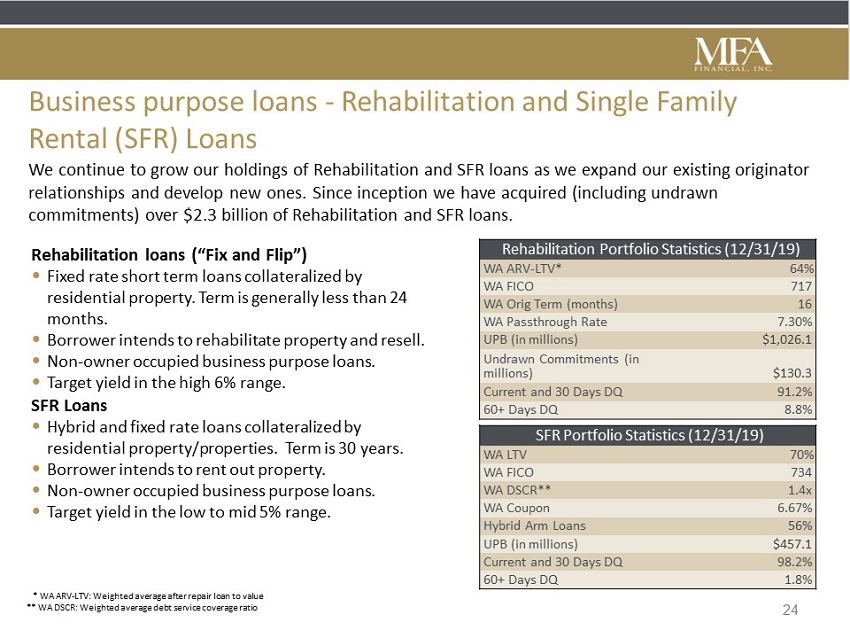

Business purpose loans - Rehabilitation and Single Family Rental (SFR) Loans Rehabilitation loans (“Fix and Flip”) • Fixed rate short term loans collateralized by residential property. Term is generally less than 24 months. • Borrower intends to rehabilitate property and resell. • Non - owner occupied business purpose loans. • Target yield in the high 6 % range . SFR Loans • Hybrid and fixed rate loans collateralized by residential property/properties. Term is 30 years. • Borrower intends to rent out property. • Non - owner occupied business purpose loans. • Target yield in the low to mid 5% range. Rehabilitation Portfolio Statistics (12/31/19) WA ARV - LTV* 64 % WA FICO 71 7 WA Orig Term (months) 16 WA Passthrough Rate 7.30% UPB (in millions) $1,026.1 Undrawn Commitments (in millions) $130.3 Current and 30 Days DQ 91.1% 60+ Days DQ 8.9% We continue to grow our holdings of Rehabilitation and SFR loans as we expand our existing originator relationships and develop new ones. Since inception we have acquired (including undrawn commitments) over $2.3 billion of Rehabilitation and SFR loans. SFR Portfolio Statistics (12/31/19) WA LTV 70 % WA FICO 734 WA DSCR** 1.4x WA Coupon 6.67% Hybrid Arm Loans 56% UPB (in millions) $457.1 Current and 30 Days DQ 98.1% 60+ Days DQ 1.9% 24 * WA ARV - LTV: Weighted average after repair loan to value ** WA DSCR: Weighted average debt service coverage ratio

Summary 25 • Continued successful execution of our investment strategy, with residential whole loan purchases exceeding $ 1 . 5 billion in Q 4 and $ 4 . 3 billion in 2019 . • Net portfolio growth of $ 1 billion for the year ended December 31 , 2019 . • Acquisitions of P urchased Performing Loans again contributed to interest income expansion and we expect this to continue . • Our investment strategy and portfolio continued to deliver dividend and GAAP book value stability during 2019 . • Total shareholder return of 27 . 5 % for the year ended December 31 , 2019 . • GAAP Economic return ( 1 ) for Q 4 2019 of 2 . 1 % and 9 . 7 % for the full year . 3 . 1 % for Q 4 2019 and 12 . 1 % for the full year when calculated using Economic book value . (1) Economic return is calculated as the change in book value plus dividends for the period, divided by start of period book val ue

Additional Information 26

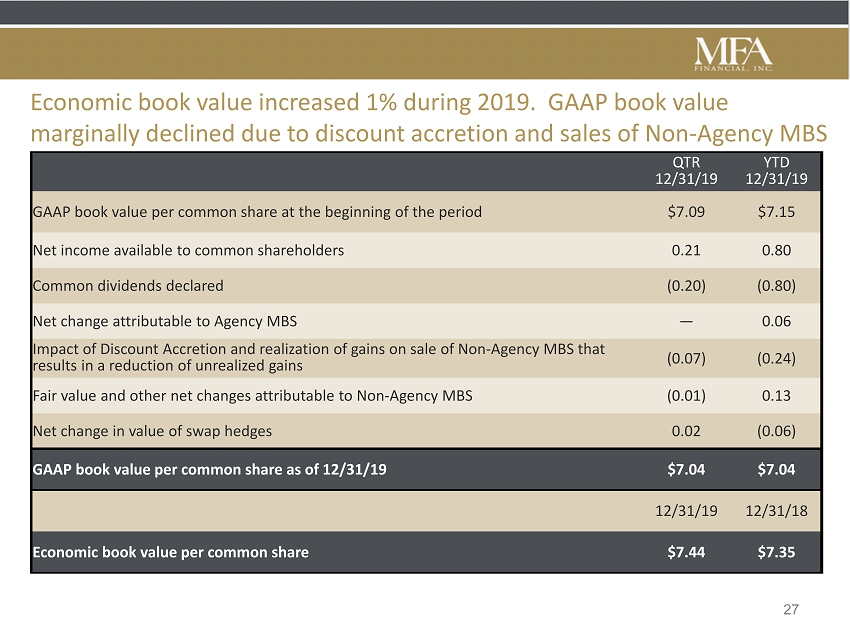

27 QTR 12/31/19 YTD 12/31/19 GAAP book value per common share at the beginning of the period $7.09 $7.15 Net income available to common shareholders 0.21 0.80 Common dividends declared (0.20) (0.80) Net change attributable to Agency MBS — 0.06 Impact of Discount Accretion and realization of gains on sale of Non - Agency MBS that results in a reduction of unrealized gains (0.07) (0.24) Fair value and other net changes attributable to Non - Agency MBS (0.01) 0.13 Net change in value of swap hedges 0.02 (0.06) GAAP book value per common share as of 12/31/19 $7.04 $7.04 12/31/19 12/31/18 Economic book value per common share $7.44 $7.35 Economic book value increased 1% during 2019. GAAP book value marginally declined due to discount accretion and sales of Non - Agency MBS

28 (In Millions, Except Per Share Amounts) Q4 2019 Q3 2019 Q2 2019 Q1 2019 FY 2019 FY 2018 GAAP Net Income to common stock holders - basic $ 96.6 $ 91.6 $ 89.0 $ 84.9 $ 362.0 $ 285.9 Adjustments: Unrealized (gain)/ loss on CRT securities measured at fair value through earnings 1.4 (0.1 ) 2.0 (2.7 ) 0.7 33.5 Unrealized net (gain)/loss on Agency MBS measured at fair value through earnings and related swaps not accounted for as hedging transactions (1.2 ) (2.1 ) (0.9 ) (4.8 ) (9.0 ) 13.3 Total adjustments $ 0.3 $ (2.2 ) $ 1.1 $ (7.5 ) $ (8.3 ) $ 46.8 Core earnings $ 96.8 $ 89.4 $ 90.1 $ 77.3 $ 353.7 $ 332.6 GAAP earnings per common share $ 0.21 $ 0.20 $ 0.20 $ 0.19 $ 0.80 $ 0.68 Core earnings per common share $ 0.21 $ 0.20 $ 0.20 $ 0.17 $ 0.78 $ 0.79 Weighted average common shares for basic earnings per share 452.0 451.0 450.5 450.4 451.0 418.9 Reconciliation of GAAP earnings to Core earnings “Core earnings” is a non - GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10 (e) of Regulation S - K, as promulgated by the Securities and Exchange Commission . Core earnings excludes certain unrealized gains and losses on investments in residential mortgage securities and related hedges that we are required to include in GAAP Net Income each period, because management believes that these items, which to date have typically resulted from short - term market volatility or other market technical factors and not due to changes in fundamental asset cash flows, are not reflective of the economic income generated by our investment portfolio . Accordingly, we believe that the adjustments to compute Core earnings specified below better allow investors and analysts to evaluate our financial results, including by analyzing changes in our Core earnings between periods . In addition to using Core earnings in the evaluation of investment portfolio performance over time, management considers estimates of periodic Core earnings as an input to the determination of the level of quarterly dividends to common shareholders that are recommended to the Board of Directors for approval and in its forecasting and decision - making processes relating to the allocation of capital between different asset classes . We believe that Core earnings provides useful supplemental information to both management and investors in evaluating our financial results . Core earnings should be used in conjunction with results presented in accordance with GAAP . Core earnings does not represent and should not be considered as a substitute for Net Income or Cash Flows from Operating Activities, each as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies . The following table provides a reconciliation of GAAP net income to our non - GAAP Core earnings for each quarter in 2019 and for the years ended 12 / 31 / 19 and 12 / 31 / 18 .

29 Reconciliation of GAAP Book Value to Economic Book Value “Economic book value” is a non - GAAP financial measure of our financial position . To calculate our Economic book value, our portfolios of Residential whole loans at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these loans . This adjustment is also reflected in our end of period stockholders’ equity in the table below . Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our residential mortgage assets, irrespective of the accounting model applied for GAAP reporting purposes . Economic book value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies . The following table provides a reconciliation of GAAP book value per common share to our non - GAAP Economic book value per common share as of the end of each quarter during 2019 and 2018 . (In Millions, Except Per Share Amounts) 12/31/19 9/30/19 6/30/19 3/31/19 12/31/18 9/30/18 6/30/18 3/31/18 GAAP Total Stockholders’ Equity $ 3,384.0 $ 3,403.4 $ 3,403.4 $ 3,404.5 $ 3,416.1 $ 3,552.2 $ 3,206.6 $ 3,235.4 Preferred Stock, liquidation preference (200.0 ) (200.0 ) (200.0 ) (200.0 ) (200.0 ) (200.0 ) (200.0 ) (200.0 ) GAAP Stockholders’ Equity for book value per common share $ 3,184.0 $ 3,203.4 $ 3,203.4 $ 3,204.5 $ 3,216.1 $ 3,352.2 $ 3,006.6 $ 3,035.4 Adjustments: Fair value adjustment to Residential whole loans, at carrying value 182.4 145.8 131.2 92.1 87.7 78.4 81.0 77.8 Stockholders’ Equity including fair value adjustment to Residential whole loans, at carrying value (Economic book value) $ 3,366.4 $ 3,349.2 $ 3,334.6 $ 3,296.7 $ 3,303.8 $ 3,430.6 $ 3,087.6 $ 3,113.2 GAAP book value per common share $ 7.04 $ 7.09 $ 7.11 $ 7.11 $ 7.15 $ 7.46 $ 7.54 $ 7.62 Economic book value per common share $ 7.44 $ 7.41 $ 7.40 $ 7.32 $ 7.35 $ 7.63 $ 7.75 $ 7.81 Number of shares of common stock outstanding 452.4 451.7 450.6 450.5 449.8 449.5 398.5 398.4