EXHIBIT 99.2

Published on May 4, 2022

Exhibit 99.2

First Quarter 2022 Earnings Presentation

Forward looking statements 2 When used in this presentation or other written or oral communications, statements which are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions . These forward - looking statements include information about possible or assumed future results with respect to our business, financial condition, liquidity, results of operations, plans and objectives . Statements regarding the following subjects, among others, may be forward - looking : changes in interest rates and the market (i . e . , fair) value of MFA’s residential whole loans, MBS and other assets ; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in MFA’s portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows ; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole loan portfolio ; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings ; implementation of or changes in government regulations or programs affecting MFA’s business ; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals and whole loan modifications, foreclosures and liquidations ; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as MFA’s Board deems relevant ; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes ; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940 , as amended (or the “Investment Company Act”), including statements regarding the concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage - related interests ; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent on, among other things, the supply of loans offered for sale in the market ; expected returns on MFA’s investments in nonperforming residential whole loans (“NPLs”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e . g . , taxes, insurance, maintenance expenses, etc . on the underlying property) and the amount ultimately realized upon resolution of the asset ; targeted or expected returns on MFA’s investments in recently - originated loans, the performance of which is, similar to MFA’s other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing cost associated with such investments ; risks associated with MFA’s investments in MSR - related assets, including servicing, regulatory and economic risks, risks associated with our investments in loan originators, risks associated with investing in real estate assets, including changes in business conditions and the general economy and risks associated with the integration and ongoing operation of Lima One Holdings, LLC (including, without limitation, unanticipated expenditures relating to or liabilities arising from the transaction and/or the inability to obtain, or delays in obtaining, expected benefits (including expected growth in loan origination volumes) from the transaction) . These and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that MFA files with the SEC, could cause MFA’s actual results to differ materially from those projected in any forward - looking statements it makes . All forward - looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account all information currently available . Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they are made . New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA . Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

2022 first quarter financial results 3 • GAAP loss of $ ( 91 . 1 ) million or $ ( 0 . 86 ) per basic common share • Distributable Earnings 1 of $ 66 . 0 million, or $ 0 . 62 basic per common share • Net interest income of $ 63 . 1 million . Higher loan interest income was largely offset by higher financing costs . Securities net interest income $ 9 . 0 million lower as the prior period included the redemption of an MSR bond . • $ 288 . 4 million of net losses on residential whole loans at fair value, partially offset by $ 158 . 2 million of gains on derivative hedge positions and securitized debt held at fair value • $ 14 . 5 million of origination, servicing and other fee income at Lima One • Paid $ 0 . 11 dividend to common shareholders on April 29 , 2022 • Dramatic rate sell - off impacted book value : • GAAP book value down $ 1 . 28 , or 6 . 7 % , to $ 17 . 84 per common share • Economic book value (EBV) 1 down $ 1 . 77 , or 8 . 6 % , to $ 18 . 81 per common share • Leverage ratio of 3 . 1 x as of March 31 , 2022 . Recourse leverage of 1 . 9 x 1. Distributable Earnings and Economic book value are Non - GAAP measures. Refer to slides 7 and 16 respectively for further inf ormation regarding the calculation of these measures.

2022 first quarter financial results (cont’d) • Acquired $ 1 . 2 billion of loans in the quarter • Tapered asset acquisitions of purchased loans, particularly Non - QM loans • Loan portfolio increased by approximately $ 330 million to $ 8 . 4 billion after portfolio runoff • Q 1 loan acquisitions include over $ 600 million of Non - QM loans and $ 590 million of funded Business Purpose loan originations and draws at Lima One • Completed two Non - QM securitizations during the quarter with UPB of bonds sold of $ 514 million . In April, two securitizations of Business Purpose loans with UPB of bonds sold of $ 463 million . • Cash increased by more than $ 100 million to $ 411 million at quarter end • Continued to take advantage of strong housing market to liquidate REO properties • Sold $ 41 . 5 million of REO properties for a net gain of $ 8 . 7 million • REO portfolio is $ 146 million as of 3 / 31 / 22 • Repurchased 3 . 2 million shares in first quarter at an average price of $ 17 . 15 per share 4

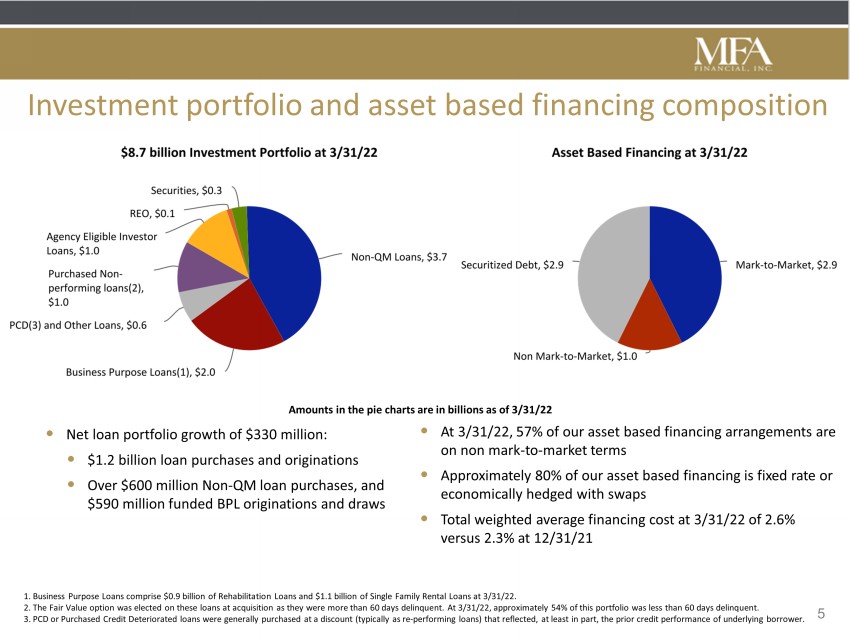

5 • Net loan portfolio growth of $330 million: • $1.2 billion loan purchases and originations • Over $600 million Non - QM loan purchases, and $590 million funded BPL originations and draws • At 3/31/22, 57% of our asset based financing arrangements are on non mark - to - market terms • Approximately 80% of our asset based financing is fixed rate or economically hedged with swaps • Total weighted average financing cost at 3/31/22 of 2.6% versus 2.3% at 12/31/21 Amounts in the pie charts are in billions as of 3/31/22 1. Business Purpose Loans comprise $0.9 billion of Rehabilitation Loans and $1.1 billion of Single Family Rental Loans at 3/3 1/2 2. 2. The Fair Value option was elected on these loans at acquisition as they were more than 60 days delinquent. At 3/31/22, app rox imately 54% of this portfolio was less than 60 days delinquent. 3. PCD or Purchased Credit Deteriorated loans were generally purchased at a discount (typically as re - performing loans) that ref lected, at least in part, the prior credit performance of underlying borrower. Investment portfolio and asset based financing composition 5

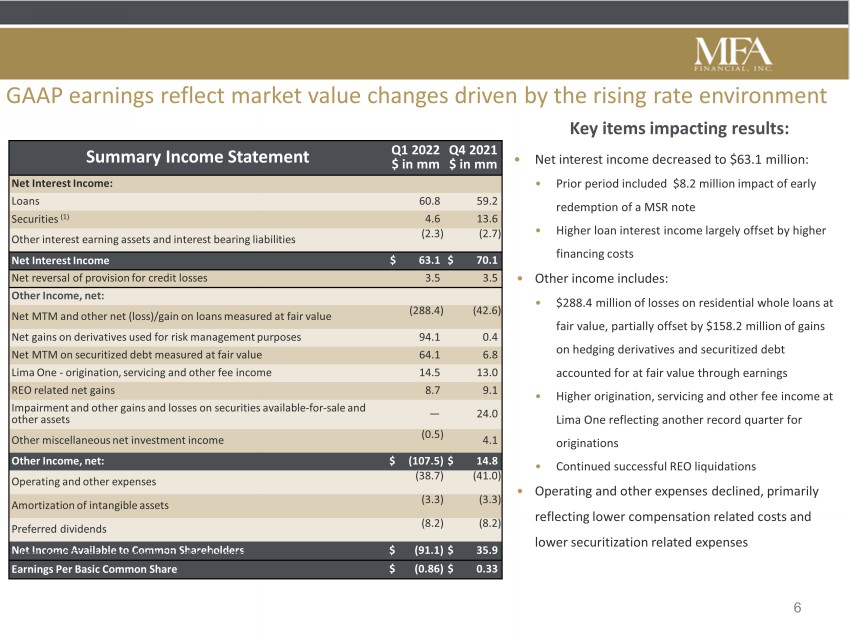

GAAP earnings reflect market value changes driven by the rising rate environment Summary Income Statement Q1 2022 $ in mm Q4 2021 $ in mm Net Interest Income: Loans 60.8 59.2 Securities (1) 4.6 13.6 Other interest earning assets and interest bearing liabilities (2.3) (2.7) Net Interest Income $ 63.1 $ 70.1 Net reversal of provision for credit losses 3.5 3.5 Other Income, net: Net MTM and other net (loss)/gain on loans measured at fair value (288.4) (42.6) Net gains on derivatives used for risk management purposes 94.1 0.4 Net MTM on securitized debt measured at fair value 64.1 6.8 Lima One - origination, servicing and other fee income 14.5 13.0 REO related net gains 8.7 9.1 Impairment and other gains and losses on securities available - for - sale and other assets — 24.0 Other miscellaneous net investment income (0.5) 4.1 Other Income, net: $ (107.5) $ 14.8 Operating and other expenses (38.7) (41.0) Amortization of intangible assets (3.3) (3.3) Preferred dividends (8.2) (8.2) Net Income Available to Common Shareholders $ (91.1) $ 35.9 Earnings Per Basic Common Share $ (0.86) $ 0.33 • Net interest income decreased to $63.1 million: • Prior period included $8.2 million impact of early redemption of a MSR note • Higher loan interest income largely offset by higher financing costs • Other income includes: • $288.4 million of losses on residential whole loans at fair value, partially offset by $158.2 million of gains on hedging derivatives and securitized debt accounted for at fair value through earnings • Higher origination, servicing and other fee income at Lima One reflecting another record quarter for originations • Continued successful REO liquidations • Operating and other expenses declined, primarily reflecting lower compensation related costs and lower securitization related expenses 1. Includes CRT securities and MSR - related assets. Key items impacting results: 6

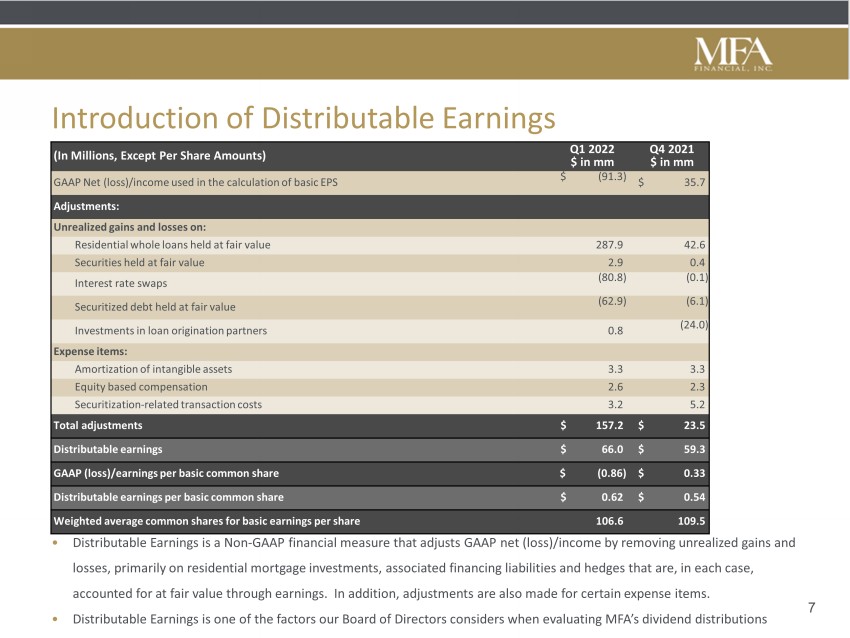

Introduction of Distributable Earnings 7 • Distributable Earnings is a Non - GAAP financial measure that adjusts GAAP net (loss)/income by removing unrealized gains and losses, primarily on residential mortgage investments, associated financing liabilities and hedges that are, in each case, accounted for at fair value through earnings. In addition, adjustments are also made for certain expense items. • Distributable Earnings is one of the factors our Board of Directors considers when evaluating MFA’s dividend distributions (In Millions, Except Per Share Amounts) Q1 2022 $ in mm Q4 2021 $ in mm GAAP Net (loss)/income used in the calculation of basic EPS $ (91.3) $ 35.7 Adjustments: Unrealized gains and losses on: Residential whole loans held at fair value 287.9 42.6 Securities held at fair value 2.9 0.4 Interest rate swaps (80.8) (0.1) Securitized debt held at fair value (62.9) (6.1) Investments in loan origination partners 0.8 (24.0) Expense items: Amortization of intangible assets 3.3 3.3 Equity based compensation 2.6 2.3 Securitization - related transaction costs 3.2 5.2 Total adjustments $ 157.2 $ 23.5 Distributable earnings $ 66.0 $ 59.3 GAAP (loss)/earnings per basic common share $ (0.86) $ 0.33 Distributable earnings per basic common share $ 0.62 $ 0.54 Weighted average common shares for basic earnings per share 106.6 109.5

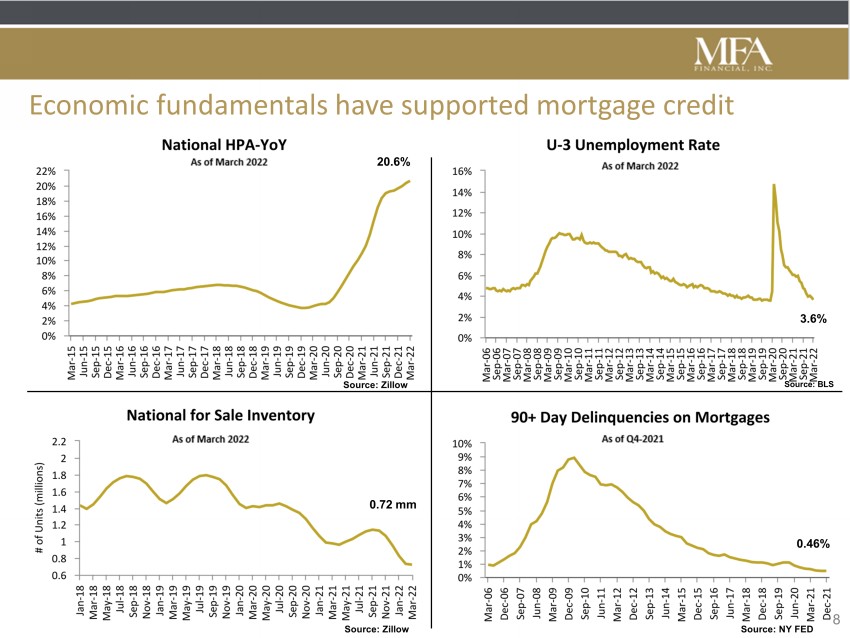

Economic fundamentals have supported mortgage credit 8 20.6% 3.6% 0.46% 0.72 mm Source: Zillow Source: NY FED Source: BLS Source: Zillow

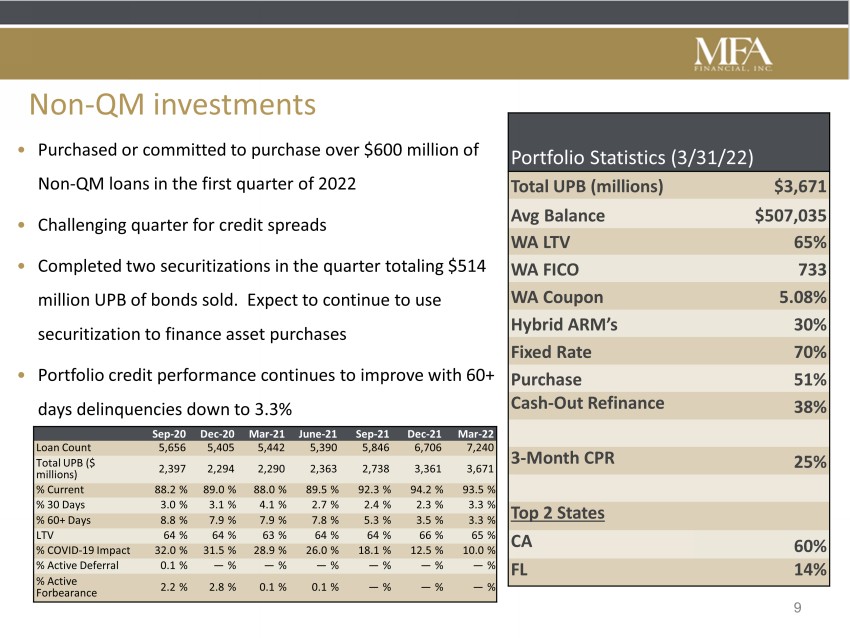

Non - QM investments • Purchased or committed to purchase over $600 million of Non - QM loans in the first quarter of 2022 • Challenging quarter for credit spreads • Completed two securitizations in the quarter totaling $514 million UPB of bonds sold. Expect to continue to use securitization to finance asset purchases • Portfolio credit performance continues to improve with 60+ days delinquencies down to 3.3% Portfolio Statistics (3/31/22) Total UPB (millions) $3,671 Avg Balance $507,035 WA LTV 65% WA FICO 733 WA Coupon 5.08% Hybrid ARM’s 30% Fixed Rate 70% Purchase 51% Cash - Out Refinance 38% 3 - Month CPR 25% Top 2 States CA 60% FL 14% 9 Sep - 20 Dec - 20 Mar - 21 June - 21 Sep - 21 Dec - 21 Mar - 22 Loan Count 5,656 5,405 5,442 5,390 5,846 6,706 7,240 Total UPB ($ millions) 2,397 2,294 2,290 2,363 2,738 3,361 3,671 % Current 88.2 % 89.0 % 88.0 % 89.5 % 92.3 % 94.2 % 93.5 % % 30 Days 3.0 % 3.1 % 4.1 % 2.7 % 2.4 % 2.3 % 3.3 % % 60+ Days 8.8 % 7.9 % 7.9 % 7.8 % 5.3 % 3.5 % 3.3 % LTV 64 % 64 % 63 % 64 % 64 % 66 % 65 % % COVID - 19 Impact 32.0 % 31.5 % 28.9 % 26.0 % 18.1 % 12.5 % 10.0 % % Active Deferral 0.1 % — % — % — % — % — % — % % Active Forbearance 2.2 % 2.8 % 0.1 % 0.1 % — % — % — %

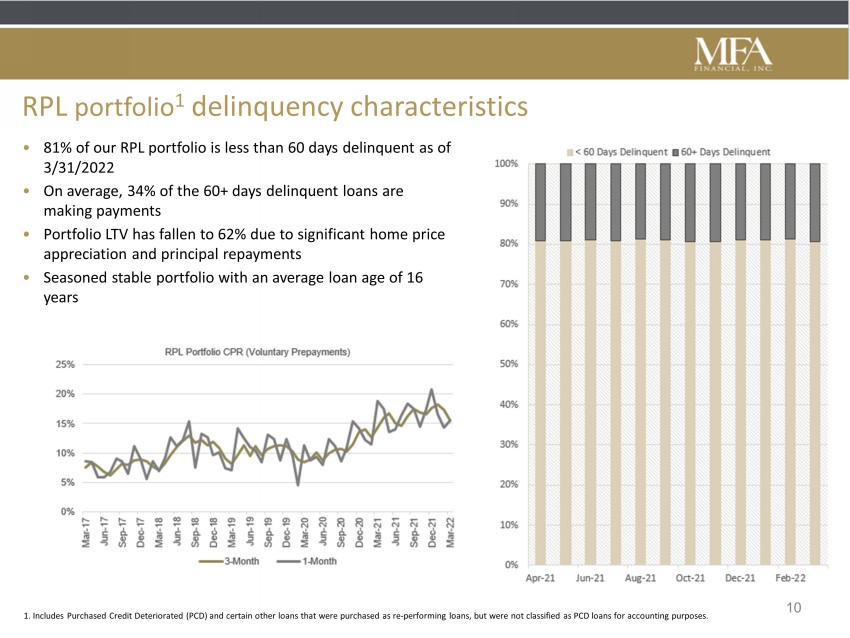

RPL portfolio 1 delinquency characteristics • 81% of our RPL portfolio is less than 60 days delinquent as of 3/31/2022 • On average, 34% of the 60+ days delinquent loans are making payments • Portfolio LTV has fallen to 62% due to significant home price appreciation and principal repayments • Seasoned stable portfolio with an average loan age of 16 years 10 1. Includes Purchased Credit Deteriorated (PCD) and certain other loans that were purchased as re - performing loans, but were not classified as PCD loans for accounting purposes.

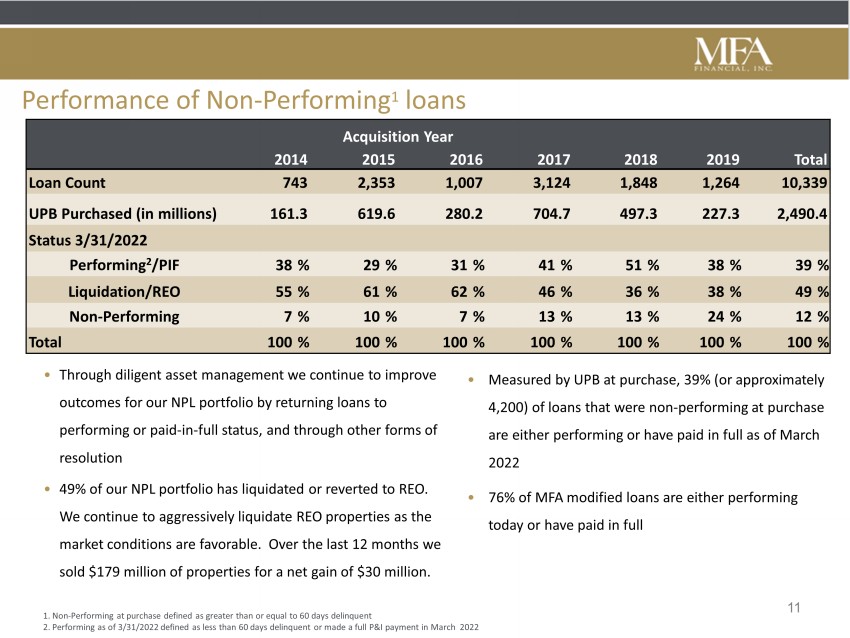

• Measured by UPB at purchase, 39% (or approximately 4,200) of loans that were non - performing at purchase are either performing or have paid in full as of March 2022 • 76% of MFA modified loans are either performing today or have paid in full Performance of Non - Performing 1 loans Acquisition Year 2014 2015 2016 2017 2018 2019 Total Loan Count 743 2,353 1,007 3,124 1,848 1,264 10,339 UPB Purchased (in millions) 161.3 619.6 280.2 704.7 497.3 227.3 2,490.4 Status 3/31/2022 Performing 2 /PIF 38 % 29 % 31 % 41 % 51 % 38 % 39 % Liquidation/REO 55 % 61 % 62 % 46 % 36 % 38 % 49 % Non - Performing 7 % 10 % 7 % 13 % 13 % 24 % 12 % Total 100 % 100 % 100 % 100 % 100 % 100 % 100 % • Through diligent asset management we continue to improve outcomes for our NPL portfolio by returning loans to performing or paid - in - full status, and through other forms of resolution • 49% of our NPL portfolio has liquidated or reverted to REO. We continue to aggressively liquidate REO properties as the market conditions are favorable. Over the last 12 months we sold $179 million of properties for a net gain of $30 million. 1. Non - Performing at purchase defined as greater than or equal to 60 days delinquent 2. Performing as of 3/31/2022 defined as less than 60 days delinquent or made a full P&I payment in March 2022 11

Business purpose loans – Lima One 12 1. Origination amounts are based on the maximum loan amount, which includes amounts initially funded plus any committed, but und rawn amounts. 2. Includes loan origination fair value gains, origination and other fee income, less G&A expenses. • Lima One originated over $660 million 1 in the first quarter, a modest increase from the fourth quarter and a record quarter for the company. Approximately $200 million of originations in April. • Lima One continues to originate high yielding, high quality business purpose loans for MFA’s balance sheet ◦ Has originated over $1.6 billion 1 of BPLs since we closed our acquisition on July 1, 2021 ◦ Current origination pipeline has a weighted average coupon of over 7% ◦ Expect Lima One to originate over $2 billion in 2022 • Adjusted rapidly to rising rates by increasing origination coupons. Weighted average coupon on origination pipeline has increased by over 100bp since the end of last year. • Completed our third single family rental loan securitization and our first fix and flip securitization in April, both consisting of 100% Lima One originated loans ◦ Established securitization programs for both rental and fix and flip loans ◦ Securitized $780 million of Lima One originated loans in the last six months • $ 4 million net contribution 2 from Lima One’s origination and servicing activities in the quarter, representing an annualized return on allocated equity of approximately 10 %

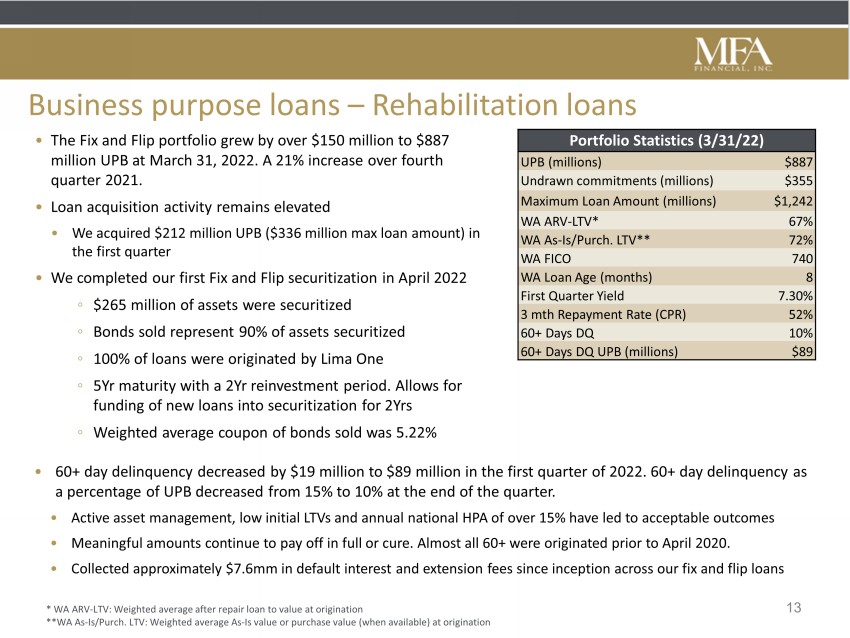

Business purpose loans – Rehabilitation loans • The Fix and Flip portfolio grew by over $150 million to $887 million UPB at March 31, 2022. A 21% increase over fourth quarter 2021. • Loan acquisition activity remains elevated • We acquired $212 million UPB ($336 million max loan amount) in the first quarter • We completed our first Fix and Flip securitization in April 2022 ◦ $265 million of assets were securitized ◦ Bonds sold represent 90% of assets securitized ◦ 100% of loans were originated by Lima One ◦ 5Yr maturity with a 2Yr reinvestment period. Allows for funding of new loans into securitization for 2Yrs ◦ Weighted average coupon of bonds sold was 5.22% Portfolio Statistics (3/31/22) UPB (millions) $887 Undrawn commitments (millions) $355 Maximum Loan Amount (millions) $1,242 WA ARV - LTV* 67% WA As - Is/Purch. LTV** 72% WA FICO 740 WA Loan Age (months) 8 First Quarter Yield 7.30% 3 mth Repayment Rate (CPR) 52% 60+ Days DQ 10% 60+ Days DQ UPB (millions) $89 * WA ARV - LTV: Weighted average after repair loan to value at origination **WA As - Is/Purch. LTV: Weighted average As - Is value or purchase value (when available) at origination 13 • 60+ day delinquency decreased by $19 million to $89 million in the first quarter of 2022. 60+ day delinquency as a percentage of UPB decreased from 15% to 10% at the end of the quarter. • Active asset management, low initial LTVs and annual national HPA of over 15% have led to acceptable outcomes • Meaningful amounts continue to pay off in full or cure. Almost all 60+ were originated prior to April 2020. • Collected approximately $7.6mm in default interest and extension fees since inception across our fix and flip loans

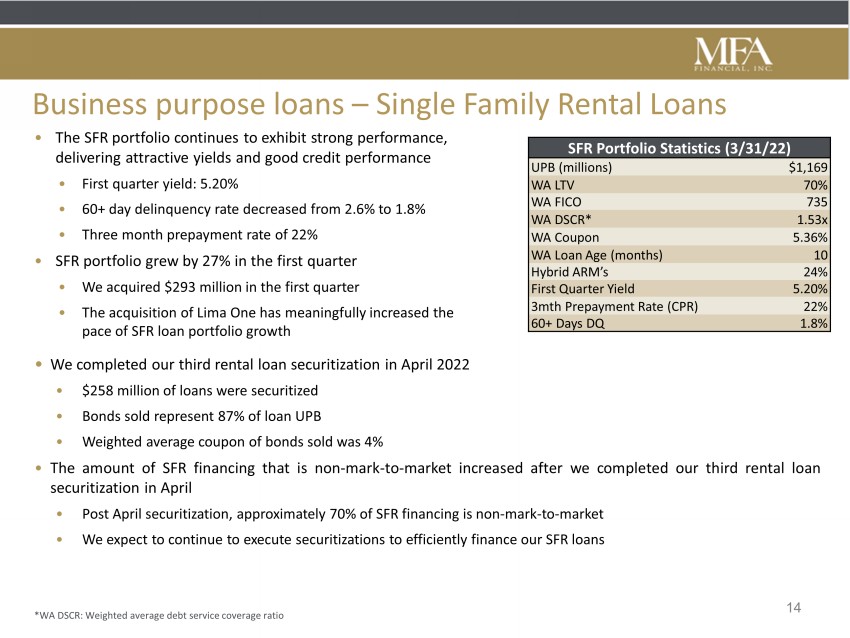

Business purpose loans – Single Family Rental Loans • The SFR portfolio continues to exhibit strong performance, delivering attractive yields and good credit performance • First quarter yield: 5.20% • 60+ day delinquency rate decreased from 2.6% to 1.8% • Three month prepayment rate of 22% • SFR portfolio grew by 27% in the first quarter • We acquired $293 million in the first quarter • The acquisition of Lima One has meaningfully increased the pace of SFR loan portfolio growth SFR Portfolio Statistics (3/31/22) UPB (millions) $1,169 WA LTV 70% WA FICO 735 WA DSCR* 1.53x WA Coupon 5.36% WA Loan Age (months) 10 Hybrid ARM’s 24% First Quarter Yield 5.20% 3mth Prepayment Rate (CPR) 22% 60+ Days DQ 1.8% *WA DSCR: Weighted average debt service coverage ratio 14 • We completed our third rental loan securitization in April 2022 • $ 258 million of loans were securitized • Bonds sold represent 87 % of loan UPB • Weighted average coupon of bonds sold was 4 % • The amount of SFR financing that is non - mark - to - market increased after we completed our third rental loan securitization in April • Post April securitization, approximately 70 % of SFR financing is non - mark - to - market • We expect to continue to execute securitizations to efficiently finance our SFR loans

Summary 15 • First quarter 2022 results reflect the challenging interest rate environment • Increased cash position by over $ 100 million to approximately $ 410 million at quarter - end and continued to maintain relatively low leverage • Completed two securitizations of Non - QM loans during the quarter and two securitizations of Business Purpose loans in April • Third consecutive record quarter for loan originations at Lima One • Continued strong housing market despite affordability issues due to higher rates • Further sequential growth in loan interest income and portfolio

Additional Information

• MFA Board of Directors authorized a new $ 250 million share repurchase program in March 2022 for repurchases through the end of 2023 • Adopted 10 b 5 - 1 plan in March 2022 • 10 b 5 - 1 plan permits share repurchases during closed window periods • Share repurchases in Q 1 2022 of 3 . 2 million shares at an average price of $ 17 . 15 (including commissions) • Subsequent to the end of the quarter through April 29 , 2022 , we repurchased an additional 2 . 8 million shares of common stock at an average price of $ 14 . 48 per share, leaving approximately $ 209 . 7 million of remaining capacity under the existing authorization 17 MFA share repurchase program

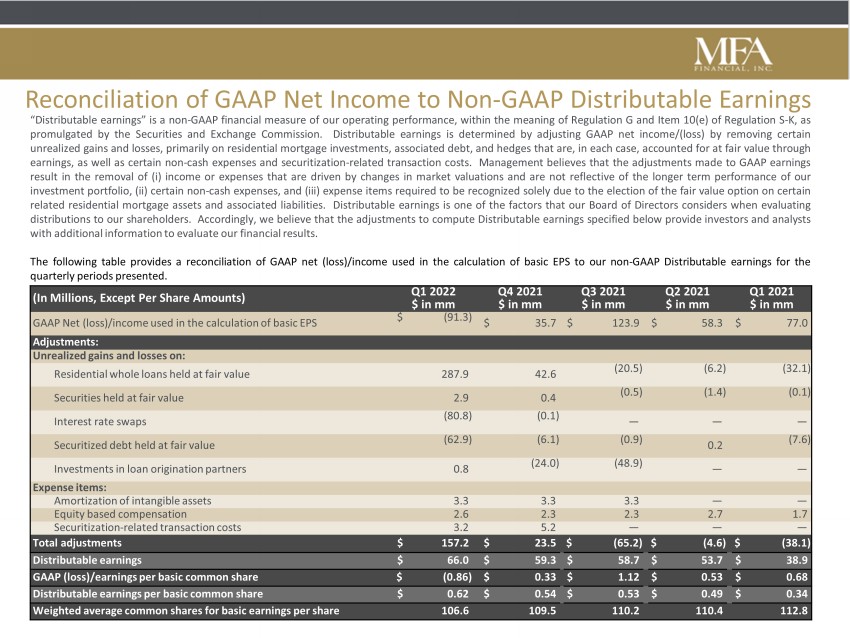

18 Reconciliation of GAAP Net Income to Non - GAAP Distributable Earnings “Distributable earnings” is a non - GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10 (e) of Regulation S - K, as promulgated by the Securities and Exchange Commission . Distributable earnings is determined by adjusting GAAP net income/(loss) by removing certain unrealized gains and losses, primarily on residential mortgage investments, associated debt, and hedges that are, in each case, accounted for at fair value through earnings, as well as certain non - cash expenses and securitization - related transaction costs . Management believes that the adjustments made to GAAP earnings result in the removal of ( i ) income or expenses that are driven by changes in market valuations and are not reflective of the longer term performance of our investment portfolio, (ii) certain non - cash expenses, and (iii) expense items required to be recognized solely due to the election of the fair value option on certain related residential mortgage assets and associated liabilities . Distributable earnings is one of the factors that our Board of Directors considers when evaluating distributions to our shareholders . Accordingly, we believe that the adjustments to compute Distributable earnings specified below provide investors and analysts with additional information to evaluate our financial results . The following table provides a reconciliation of GAAP net (loss)/income used in the calculation of basic EPS to our non - GAAP Distributable earnings for the quarterly periods presented . (In Millions, Except Per Share Amounts) Q1 2022 $ in mm Q4 2021 $ in mm Q3 2021 $ in mm Q2 2021 $ in mm Q1 2021 $ in mm GAAP Net (loss)/income used in the calculation of basic EPS $ (91.3) $ 35.7 $ 123.9 $ 58.3 $ 77.0 Adjustments: Unrealized gains and losses on: Residential whole loans held at fair value 287.9 42.6 (20.5) (6.2) (32.1) Securities held at fair value 2.9 0.4 (0.5) (1.4) (0.1) Interest rate swaps (80.8) (0.1) — — — Securitized debt held at fair value (62.9) (6.1) (0.9) 0.2 (7.6) Investments in loan origination partners 0.8 (24.0) (48.9) — — Expense items: Amortization of intangible assets 3.3 3.3 3.3 — — Equity based compensation 2.6 2.3 2.3 2.7 1.7 Securitization - related transaction costs 3.2 5.2 — — — Total adjustments $ 157.2 $ 23.5 $ (65.2) $ (4.6) $ (38.1) Distributable earnings $ 66.0 $ 59.3 $ 58.7 $ 53.7 $ 38.9 GAAP (loss)/earnings per basic common share $ (0.86) $ 0.33 $ 1.12 $ 0.53 $ 0.68 Distributable earnings per basic common share $ 0.62 $ 0.54 $ 0.53 $ 0.49 $ 0.34 Weighted average common shares for basic earnings per share 106.6 109.5 110.2 110.4 112.8

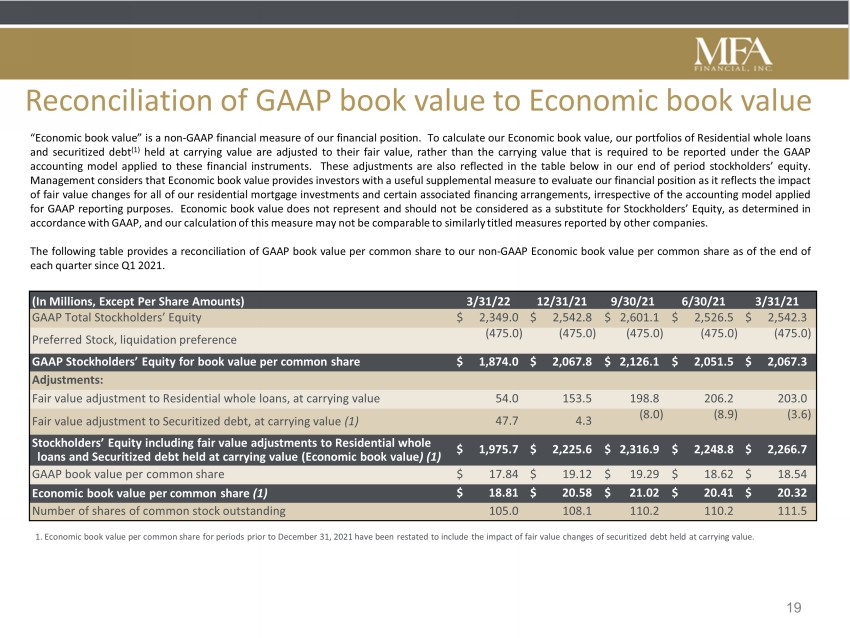

19 Reconciliation of GAAP book value to Economic book value “Economic book value” is a non - GAAP financial measure of our financial position . To calculate our Economic book value, our portfolios of Residential whole loans and securitized debt ( 1 ) held at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these financial instruments . These adjustments are also reflected in the table below in our end of period stockholders’ equity . Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our residential mortgage investments and certain associated financing arrangements, irrespective of the accounting model applied for GAAP reporting purposes . Economic book value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies . The following table provides a reconciliation of GAAP book value per common share to our non - GAAP Economic book value per common share as of the end of each quarter since Q 1 2021 . (In Millions, Except Per Share Amounts) 3/31/22 12/31/21 9/30/21 6/30/21 3/31/21 GAAP Total Stockholders’ Equity $ 2,349.0 $ 2,542.8 $ 2,601.1 $ 2,526.5 $ 2,542.3 Preferred Stock, liquidation preference (475.0) (475.0) (475.0) (475.0) (475.0) GAAP Stockholders’ Equity for book value per common share $ 1,874.0 $ 2,067.8 $ 2,126.1 $ 2,051.5 $ 2,067.3 Adjustments: Fair value adjustment to Residential whole loans, at carrying value 54.0 153.5 198.8 206.2 203.0 Fair value adjustment to Securitized debt, at carrying value (1) 47.7 4.3 (8.0) (8.9) (3.6) Stockholders’ Equity including fair value adjustments to Residential whole loans and Securitized debt held at carrying value (Economic book value ) (1) $ 1,975.7 $ 2,225.6 $ 2,316.9 $ 2,248.8 $ 2,266.7 GAAP book value per common share $ 17.84 $ 19.12 $ 19.29 $ 18.62 $ 18.54 Economic book value per common share (1) $ 18.81 $ 20.58 $ 21.02 $ 20.41 $ 20.32 Number of shares of common stock outstanding 105.0 108.1 110.2 110.2 111.5 1. Economic book value per common share for periods prior to December 31, 2021 have been restated to include the impact of fa ir value changes of securitized debt held at carrying value.

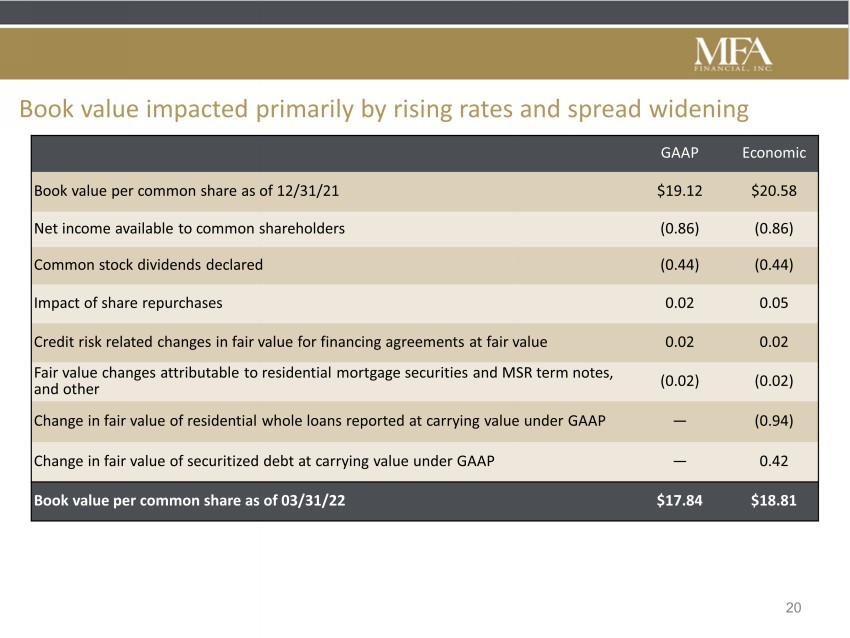

20 GAAP Economic Book value per common share as of 12/31/21 $19.12 $20.58 Net income available to common shareholders (0.86) (0.86) Common stock dividends declared (0.44) (0.44) Impact of share repurchases 0.02 0.05 Credit risk related changes in fair value for financing agreements at fair value 0.02 0.02 Fair value changes attributable to residential mortgage securities and MSR term notes, and other (0.02) (0.02) Change in fair value of residential whole loans reported at carrying value under GAAP — (0.94) Change in fair value of securitized debt at carrying value under GAAP — 0.42 Book value per common share as of 03/31/22 $17.84 $18.81 Book value impacted primarily by rising rates and spread widening

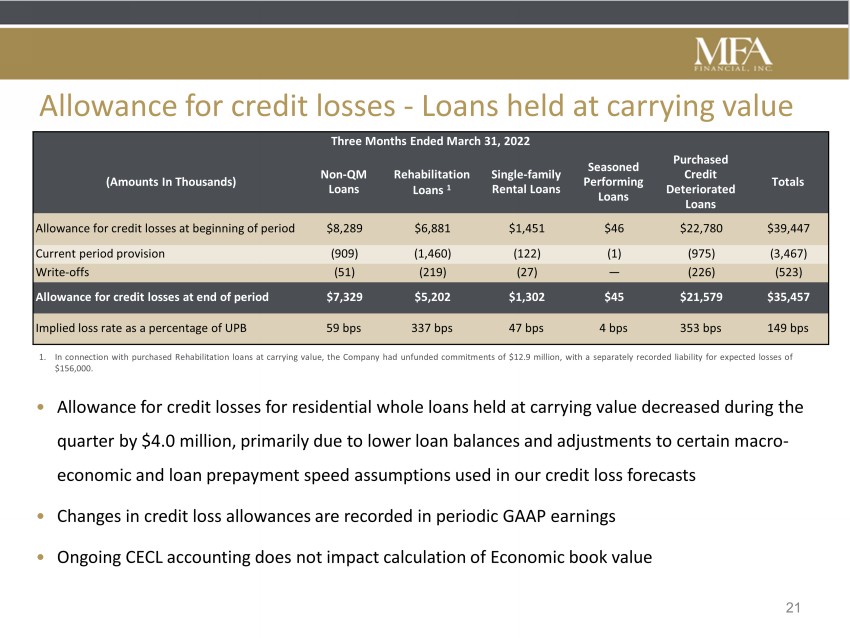

Allowance for credit losses - Loans held at carrying value • Allowance for credit losses for residential whole loans held at carrying value decreased during the quarter by $4.0 million, primarily due to lower loan balances and adjustments to certain macro - economic and loan prepayment speed assumptions used in our credit loss forecasts • Changes in credit loss allowances are recorded in periodic GAAP earnings • Ongoing CECL accounting does not impact calculation of Economic book value 21 Three Months Ended March 31, 2022 (Amounts In Thousands) Non - QM Loans Rehabilitation Loans 1 Single - family Rental Loans Seasoned Performing Loans Purchased Credit Deteriorated Loans Totals Allowance for credit losses at beginning of period $8,289 $6,881 $1,451 $46 $22,780 $39,447 Current period provision (909) (1,460) (122) (1) (975) (3,467) Write - offs (51) (219) (27) — (226) (523) Allowance for credit losses at end of period $7,329 $5,202 $1,302 $45 $21,579 $35,457 Implied loss rate as a percentage of UPB 59 bps 337 bps 47 bps 4 bps 353 bps 149 bps 1. In connection with purchased Rehabilitation loans at carrying value, the Company had unfunded commitments of $ 12 . 9 million, with a separately recorded liability for expected losses of $ 156 , 000 .